Authored by Charles Hugh Smith via OfTwoMinds blog,

When we lose small businesses, we lose MORE than tax revenues.

Small businesses receive plenty of lip service but very little appreciation--until they're gone. By then it's too late to do anything but mutter, "you don't know what you've got until it's gone."

Small businesses aren't just sources of tax revenues, they're sources of a wide range of jobs that can't be replaced by Corporate America or the government. Just as importantly, small business owners and entrepreneurs are advocates for the neighborhoods, districts and cities they depend on for customers and suppliers.

The livelihoods of the owners and their employees depend on maintaining the viability of their neighborhood / district / city, which includes public safety and services such as transportation and trash collection, and a minimum density of other private-sector services and amenities which provide residents a safe, appealing atmosphere worth visiting.

59.9 million Americans work at small businesses across the nation. An estimated 47% of Americans shop at small businesses at least twice a week, generating about 45% of the nation's economic activity. According to the most recent available numbers from the U.S. Census, approximately 47% of U.S. employees work for small businesses, compared to 54.5% in 1988.

Small business entrepreneurs are risking everything they have to open and operate a business. They have far more skin in the game than city functionaries tasked with enforcing regulations and collecting business-related fees or their employees, who have the freedom to quit and seek employment elsewhere.

Residents tend to feel powerless to stop the decay of their neighborhood safety, services and amenities. They tried contacting their elected officials or municipal functionaries and were given a meaningless feel-good reply which everyone involved knows is empty.

Small business owners are more willing to apply meaningful pressure because they know the decay follows a sobering slide in which incremental declines pile up and eventually trigger a phase change in which the character of the neighborhood / district / city goes over a cliff no one discerned: petty crime increases, paving the way for more serious crimes to proliferate; customers thin out and then become scarce, and the zeitgeist goes from friendly to wary to unpredictable or even dangerous.

The core characteristic of of neofeudal economy and society is that it's two-tier: there are two tiers of "criminal justice," one of wrist-slaps and vast white-collar crimes ignored for elites and the wealthy, and another far more brutal and Kafkaesque for the rest of us.

In terms of commerce, Big Tech is free to establish monopolies and Finance escapes all the supposed regulatory safeguards, while small business is throttled with endlessly multiplying petty regulations that have little or nothing to do with public safety or employee labor rights. Corporate America has the immense wealth and power to gut any regulations it finds onerous, but small business struggles to pay the soaring costs of compliance and the tripling of junk fees such as business license renewals.

City-provided services degrade but the costs for the privilege of doing business triple.

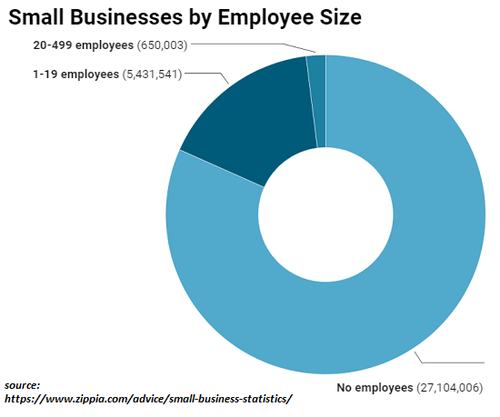

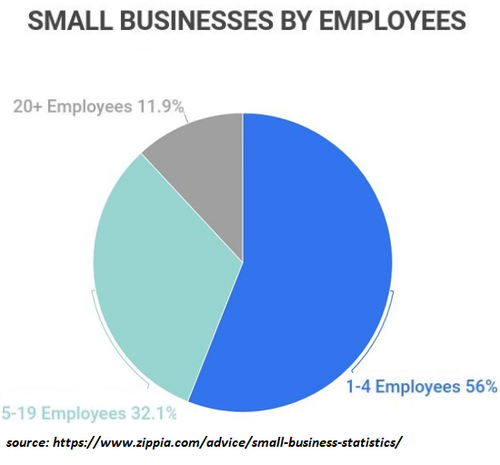

The majority of small businesses are sole proprietors. (see chart below) Many of these are online or at-home enterprises that are invisible to residents walking down the sidewalk. The 5.4 million small businesses with less than 20 employees are visibly consequential to the viability of bricks-and-mortar neighborhood commerce.

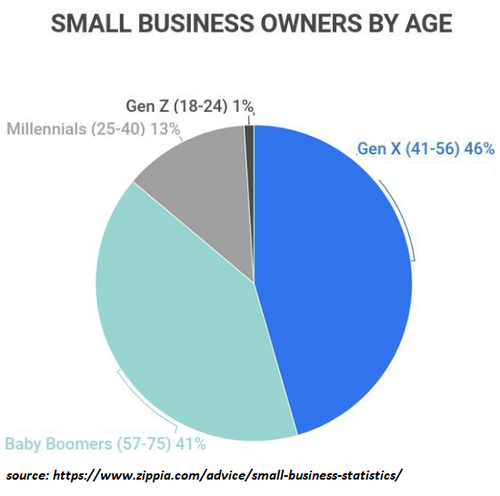

Demographics play a large role in the viability of small businesses. About 40% of all small businesses are owned by Boomers nearing retirement or already past the age of typical retirement. It won't take much in the way of losses or stress to nudge these owners into selling or closing the business.

But if conditions are decaying, who's going to buy a struggling business? The grim reality is "no one." Owners are already working long hours and enduring high levels of stress. This self-exploitation can only go so far before the owners' health and/or finances break down in burnout or losses.

Municipal bureaucracies tend to see small business tax donkeys as something they can count on much like a gushing spring. Should one tax donkey collapse and close a business, another tax donkey will magically appear to pick up the self-exploitation harness and start a new business in the same space.

Local-economy boosters love to cite the flood of new business applications as proof the spring is still gushing, but many of these new enterprises are sole proprietorships with no storefront presence and no employees. Many new businesses that thrived in the post-pandemic boom will soon encounter the headwinds of recession for the first time, and many will find their enterprises blown onto the unforgiving rocks of financial losses.

The phase-change shift in the character and zeitgeist of neighborhoods, districts and cities is difficult to reverse. Once people no longer feel safe, they won't come back. Once the empty storefronts and homeless encampments dominate the landscape, they won't come back. Once services deteriorate and trash accumulates, they won't come back.

Municipal bureaucracies are largely staffed by people who have never experienced what a real recession (such as 1981-2) can do to commerce, tax revenues and small businesses struggling to survive. They're confident that history demonstrates any downturn will be brief and the tax donkeys will appear as usual to fill the empty storefronts, lofts and offices.

But this time will be different. No new tax donkeys will appear to gamble their fortunes and lives on starting a stupidly expensive-to-operate business, pay prevailing wages and benefits and all the taxes, licenses and junk fees municipalities have piled on small business.

When we lose small businesses, we lose more than tax revenues. We lose the engines of employment and the commercial foundation of neighborhoods and districts. When these foundations crumble, those residents who see the slide down the slippery slope of decay sell their homes and get out while the getting's good. Those who remain will regret their inaction.

Tax donkeys don't appear by magic. There has to be an infrastructure in place that allows a real opportunity to scrape out a living despite the high costs and formidable challenges. If the infrastructure and character of a place decay, so does the opportunity, and small businesses melt into air when it's longer worth the struggle.

New Podcast: Its a Waterfall - Risk, Collateral & Productivity (48 min)

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Authored by Charles Hugh Smith via OfTwoMinds blog,

When we lose small businesses, we lose MORE than tax revenues.

Small businesses receive plenty of lip service but very little appreciation–until they’re gone. By then it’s too late to do anything but mutter, “you don’t know what you’ve got until it’s gone.”

Small businesses aren’t just sources of tax revenues, they’re sources of a wide range of jobs that can’t be replaced by Corporate America or the government. Just as importantly, small business owners and entrepreneurs are advocates for the neighborhoods, districts and cities they depend on for customers and suppliers.

The livelihoods of the owners and their employees depend on maintaining the viability of their neighborhood / district / city, which includes public safety and services such as transportation and trash collection, and a minimum density of other private-sector services and amenities which provide residents a safe, appealing atmosphere worth visiting.

59.9 million Americans work at small businesses across the nation. An estimated 47% of Americans shop at small businesses at least twice a week, generating about 45% of the nation’s economic activity. According to the most recent available numbers from the U.S. Census, approximately 47% of U.S. employees work for small businesses, compared to 54.5% in 1988.

Small business entrepreneurs are risking everything they have to open and operate a business. They have far more skin in the game than city functionaries tasked with enforcing regulations and collecting business-related fees or their employees, who have the freedom to quit and seek employment elsewhere.

Residents tend to feel powerless to stop the decay of their neighborhood safety, services and amenities. They tried contacting their elected officials or municipal functionaries and were given a meaningless feel-good reply which everyone involved knows is empty.

Small business owners are more willing to apply meaningful pressure because they know the decay follows a sobering slide in which incremental declines pile up and eventually trigger a phase change in which the character of the neighborhood / district / city goes over a cliff no one discerned: petty crime increases, paving the way for more serious crimes to proliferate; customers thin out and then become scarce, and the zeitgeist goes from friendly to wary to unpredictable or even dangerous.

The core characteristic of of neofeudal economy and society is that it’s two-tier: there are two tiers of “criminal justice,” one of wrist-slaps and vast white-collar crimes ignored for elites and the wealthy, and another far more brutal and Kafkaesque for the rest of us.

In terms of commerce, Big Tech is free to establish monopolies and Finance escapes all the supposed regulatory safeguards, while small business is throttled with endlessly multiplying petty regulations that have little or nothing to do with public safety or employee labor rights. Corporate America has the immense wealth and power to gut any regulations it finds onerous, but small business struggles to pay the soaring costs of compliance and the tripling of junk fees such as business license renewals.

City-provided services degrade but the costs for the privilege of doing business triple.

The majority of small businesses are sole proprietors. (see chart below) Many of these are online or at-home enterprises that are invisible to residents walking down the sidewalk. The 5.4 million small businesses with less than 20 employees are visibly consequential to the viability of bricks-and-mortar neighborhood commerce.

Demographics play a large role in the viability of small businesses. About 40% of all small businesses are owned by Boomers nearing retirement or already past the age of typical retirement. It won’t take much in the way of losses or stress to nudge these owners into selling or closing the business.

But if conditions are decaying, who’s going to buy a struggling business? The grim reality is “no one.” Owners are already working long hours and enduring high levels of stress. This self-exploitation can only go so far before the owners’ health and/or finances break down in burnout or losses.

Municipal bureaucracies tend to see small business tax donkeys as something they can count on much like a gushing spring. Should one tax donkey collapse and close a business, another tax donkey will magically appear to pick up the self-exploitation harness and start a new business in the same space.

Local-economy boosters love to cite the flood of new business applications as proof the spring is still gushing, but many of these new enterprises are sole proprietorships with no storefront presence and no employees. Many new businesses that thrived in the post-pandemic boom will soon encounter the headwinds of recession for the first time, and many will find their enterprises blown onto the unforgiving rocks of financial losses.

The phase-change shift in the character and zeitgeist of neighborhoods, districts and cities is difficult to reverse. Once people no longer feel safe, they won’t come back. Once the empty storefronts and homeless encampments dominate the landscape, they won’t come back. Once services deteriorate and trash accumulates, they won’t come back.

Municipal bureaucracies are largely staffed by people who have never experienced what a real recession (such as 1981-2) can do to commerce, tax revenues and small businesses struggling to survive. They’re confident that history demonstrates any downturn will be brief and the tax donkeys will appear as usual to fill the empty storefronts, lofts and offices.

But this time will be different. No new tax donkeys will appear to gamble their fortunes and lives on starting a stupidly expensive-to-operate business, pay prevailing wages and benefits and all the taxes, licenses and junk fees municipalities have piled on small business.

When we lose small businesses, we lose more than tax revenues. We lose the engines of employment and the commercial foundation of neighborhoods and districts. When these foundations crumble, those residents who see the slide down the slippery slope of decay sell their homes and get out while the getting’s good. Those who remain will regret their inaction.

Tax donkeys don’t appear by magic. There has to be an infrastructure in place that allows a real opportunity to scrape out a living despite the high costs and formidable challenges. If the infrastructure and character of a place decay, so does the opportunity, and small businesses melt into air when it’s longer worth the struggle.

New Podcast: Its a Waterfall – Risk, Collateral & Productivity (48 min)

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Loading…