By Brian McGlinchey via starkrealities.substack.com

As millions of Americans struggle to recover from the latest hurricane, state government officials are issuing stern reminders that criminal penalties loom for anyone who engages in “price gouging.”

“Price gouging” is the pejorative label applied to the charging of substantially higher prices for goods and services that are in high demand and short supply in disaster-stricken areas. Anti-price gouging laws typically apply to things like food, fuel, lodging, medicine, building materials, construction tools and other necessities.

The idea of charging higher prices in the midst of a crisis goes against human impulses about fair play. However, a dispassionate examination of “price gouging” reveals that it actually benefits people in disaster areas — and confirms that, like other forms of price control, anti-price gouging laws make things worse for the people they’re supposed to benefit.

Before diving in, it’s essential to fully appreciate what prices are. They aren’t just numbers on cases of water, hotel signs or gas pumps. Embedded with information, prices transmit important signals to would-be buyers and sellers alike.

Sharply higher prices announce that the demand for a product is suddenly much higher than the supply. At the same time, the higher price performs two enormously beneficial functions:

-

Incentivizing consumers to more deeply consider if they truly need the product right now — and, if so, in what quantity.

-

Incentivizing sellers to go to great lengths to bring more of the product to the market as quickly as possible.

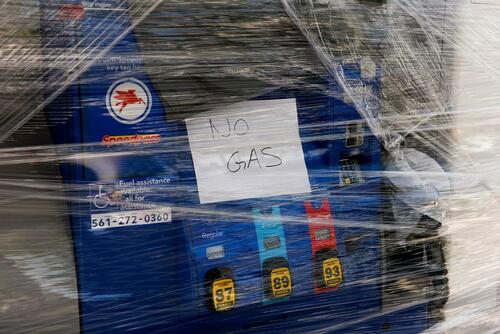

Let’s first consider the effect of crisis-driven price spikes on consumer behavior, using gas prices as an example. When gas prices in a disaster area are allowed to soar alongside surging demand and plummeting supply, consumers are pressured to buy only what they think they really need. If they’re on an evacuation route, they’ll be more inclined to buy only what’s needed to get them out of the disaster area and to a place where gas is in greater supply.

On the other hand, when laws compel gas stations to keep the same price as during normal conditions, customers are prone to top off like they always do. When a station runs out, it will have served fewer people’s needs and left more people with no opportunity to buy gas at any price.

Similarly, consider the market for hotel rooms. When prices spike, a family with two teenagers will be incentivized to share one room rather than indulging in two. Another family may choose to travel a little farther, where the supply of rooms is greater and the price lower. Others will pursue non-hotel substitutes, like staying at the home of a friend or relative.

In each case, the resulting consumer behavior sees price signals organically guiding the market toward a broader and more rational distribution of scarce products, with those products more likely to be obtained by people whose need for them is greatest.

At the same time they’re positively influencing consumers, crisis-driven price surges offer powerful enticements to businesses and entrepreneurs, pushing them to rush products into the disaster area so they can reap outsized rewards.

Sellers have a particular motivation to be among the first to introduce new inventory into the area, before the supply-demand imbalance is neutralized and prices collapse. In that way, larger profit margins foster an urgency among sellers that’s aligned with the urgency of disaster-area buyers.

Even those who can’t afford the higher prices initially asked by the “gougers” benefit from them, as those prices draw new supply into the market that will push prices down to more affordable levels.

“Poor people may not be able to afford the high prices at first, but having empty shelves wouldn’t help poor people either,” said Duke University Professor Michael Munger. “Anti-price-gouging laws keep the shelves empty longer. High prices are better than empty shelves, and high prices come down quickly if we’ll just let producers do their jobs.”

Price signals can even inspire those who aren’t normally in the business of selling a particular product to jump into the market in pursuit of attractive profits.

That’s no classroom hypothetical: After Hurricane Katrina devastated the Gulf Coast and wiped out electricity for more than 2 million people in the region, Kentuckian John Shepperson bought 19 generators, rented a U-Haul truck and drove 600 miles to Mississippi, where he offered them at twice his purchase price.

If you’re flinching at Shepperson’s “price-gouging” markup, consider his time, his long trek that grew increasingly difficult as he proceeded deeper into the disaster zone, and the financial risk he took by buying the generators, renting a truck, and paying for fuel along the way —all with hope but not certainty of reaching buyers.

Shepperson wasn’t acting as a charity. However, his actions show how, in a free market, individuals pursuing their own separate interests are driven to act in a way that benefits other people at the same time it benefits themselves.

Sadly, in a particularly vivid illustration of Robert LeFevre’s observation that “government is a disease masquerading as its own cure,” Shepperson was arrested for violating Mississippi’s anti-price-gouging law and held in a jail for four days. His generators were confiscated and locked away in police storage where — rather than powering the homes of those who’d be happy to pay Shepperson’s asking price — they sat idle.

In more than 30 states, the law embraces that outcome — one where police intervene to prevent willing buyers from paying prices that a government official subjectively determines to be “excessive” or “unconscionable.” To borrow from Thomas Sowell, those who champion such laws — whether they’re legislators or the citizens who cheer them on — are “long on indignation and short on economics.”

The Price Gouging Hotline is activated for #Idalia.

— AG Ashley Moody (@AGAshleyMoody) August 28, 2023

You can report extreme price increases on essential commodities by using our free NO SCAM app, calling 1(866) 9NO-SCAM or visiting https://t.co/T17XitLuGo.https://t.co/ItvNRtFImF pic.twitter.com/1lGJ8nA95c

None of this is to say that higher prices make everyone better off or result in a perfectly fair allocation of scarce resources in precise order of need. “But the question is whether alternative systems of rationing are usually better or worse,” wrote Sowell in his indispensable book, “Basic Economics: A Common Sense Guide to the Economy.”

Anti-price gouging laws impose a first-come, first-served rationing system, one that encourages hoarding and empties shelves faster, while doing nothing to prioritize the distribution of products by urgency of need, or to incentivize a rapid influx of new supply to ease the crisis.

At a superficial level, “price-gouging” may feel wrong. However, those who turn society’s impulsive indignation over the phenomenon into outright criminalization ultimately do a great disservice to their fellow citizens.

Stark Realities undermines official narratives, demolishes conventional wisdom and exposes fundamental myths across the political spectrum. Read more and subscribe at starkrealities.substack.com

By Brian McGlinchey via starkrealities.substack.com

As millions of Americans struggle to recover from the latest hurricane, state government officials are issuing stern reminders that criminal penalties loom for anyone who engages in “price gouging.”

“Price gouging” is the pejorative label applied to the charging of substantially higher prices for goods and services that are in high demand and short supply in disaster-stricken areas. Anti-price gouging laws typically apply to things like food, fuel, lodging, medicine, building materials, construction tools and other necessities.

The idea of charging higher prices in the midst of a crisis goes against human impulses about fair play. However, a dispassionate examination of “price gouging” reveals that it actually benefits people in disaster areas — and confirms that, like other forms of price control, anti-price gouging laws make things worse for the people they’re supposed to benefit.

Before diving in, it’s essential to fully appreciate what prices are. They aren’t just numbers on cases of water, hotel signs or gas pumps. Embedded with information, prices transmit important signals to would-be buyers and sellers alike.

Sharply higher prices announce that the demand for a product is suddenly much higher than the supply. At the same time, the higher price performs two enormously beneficial functions:

-

Incentivizing consumers to more deeply consider if they truly need the product right now — and, if so, in what quantity.

-

Incentivizing sellers to go to great lengths to bring more of the product to the market as quickly as possible.

Let’s first consider the effect of crisis-driven price spikes on consumer behavior, using gas prices as an example. When gas prices in a disaster area are allowed to soar alongside surging demand and plummeting supply, consumers are pressured to buy only what they think they really need. If they’re on an evacuation route, they’ll be more inclined to buy only what’s needed to get them out of the disaster area and to a place where gas is in greater supply.

On the other hand, when laws compel gas stations to keep the same price as during normal conditions, customers are prone to top off like they always do. When a station runs out, it will have served fewer people’s needs and left more people with no opportunity to buy gas at any price.

Similarly, consider the market for hotel rooms. When prices spike, a family with two teenagers will be incentivized to share one room rather than indulging in two. Another family may choose to travel a little farther, where the supply of rooms is greater and the price lower. Others will pursue non-hotel substitutes, like staying at the home of a friend or relative.

In each case, the resulting consumer behavior sees price signals organically guiding the market toward a broader and more rational distribution of scarce products, with those products more likely to be obtained by people whose need for them is greatest.

At the same time they’re positively influencing consumers, crisis-driven price surges offer powerful enticements to businesses and entrepreneurs, pushing them to rush products into the disaster area so they can reap outsized rewards.

Sellers have a particular motivation to be among the first to introduce new inventory into the area, before the supply-demand imbalance is neutralized and prices collapse. In that way, larger profit margins foster an urgency among sellers that’s aligned with the urgency of disaster-area buyers.

Even those who can’t afford the higher prices initially asked by the “gougers” benefit from them, as those prices draw new supply into the market that will push prices down to more affordable levels.

“Poor people may not be able to afford the high prices at first, but having empty shelves wouldn’t help poor people either,” said Duke University Professor Michael Munger. “Anti-price-gouging laws keep the shelves empty longer. High prices are better than empty shelves, and high prices come down quickly if we’ll just let producers do their jobs.”

Price signals can even inspire those who aren’t normally in the business of selling a particular product to jump into the market in pursuit of attractive profits.

That’s no classroom hypothetical: After Hurricane Katrina devastated the Gulf Coast and wiped out electricity for more than 2 million people in the region, Kentuckian John Shepperson bought 19 generators, rented a U-Haul truck and drove 600 miles to Mississippi, where he offered them at twice his purchase price.

If you’re flinching at Shepperson’s “price-gouging” markup, consider his time, his long trek that grew increasingly difficult as he proceeded deeper into the disaster zone, and the financial risk he took by buying the generators, renting a truck, and paying for fuel along the way —all with hope but not certainty of reaching buyers.

Shepperson wasn’t acting as a charity. However, his actions show how, in a free market, individuals pursuing their own separate interests are driven to act in a way that benefits other people at the same time it benefits themselves.

Sadly, in a particularly vivid illustration of Robert LeFevre’s observation that “government is a disease masquerading as its own cure,” Shepperson was arrested for violating Mississippi’s anti-price-gouging law and held in a jail for four days. His generators were confiscated and locked away in police storage where — rather than powering the homes of those who’d be happy to pay Shepperson’s asking price — they sat idle.

In more than 30 states, the law embraces that outcome — one where police intervene to prevent willing buyers from paying prices that a government official subjectively determines to be “excessive” or “unconscionable.” To borrow from Thomas Sowell, those who champion such laws — whether they’re legislators or the citizens who cheer them on — are “long on indignation and short on economics.”

The Price Gouging Hotline is activated for #Idalia.

You can report extreme price increases on essential commodities by using our free NO SCAM app, calling 1(866) 9NO-SCAM or visiting https://t.co/T17XitLuGo.https://t.co/ItvNRtFImF pic.twitter.com/1lGJ8nA95c

— AG Ashley Moody (@AGAshleyMoody) August 28, 2023

None of this is to say that higher prices make everyone better off or result in a perfectly fair allocation of scarce resources in precise order of need. “But the question is whether alternative systems of rationing are usually better or worse,” wrote Sowell in his indispensable book, “Basic Economics: A Common Sense Guide to the Economy.”

Anti-price gouging laws impose a first-come, first-served rationing system, one that encourages hoarding and empties shelves faster, while doing nothing to prioritize the distribution of products by urgency of need, or to incentivize a rapid influx of new supply to ease the crisis.

At a superficial level, “price-gouging” may feel wrong. However, those who turn society’s impulsive indignation over the phenomenon into outright criminalization ultimately do a great disservice to their fellow citizens.

Stark Realities undermines official narratives, demolishes conventional wisdom and exposes fundamental myths across the political spectrum. Read more and subscribe at starkrealities.substack.com

Loading…