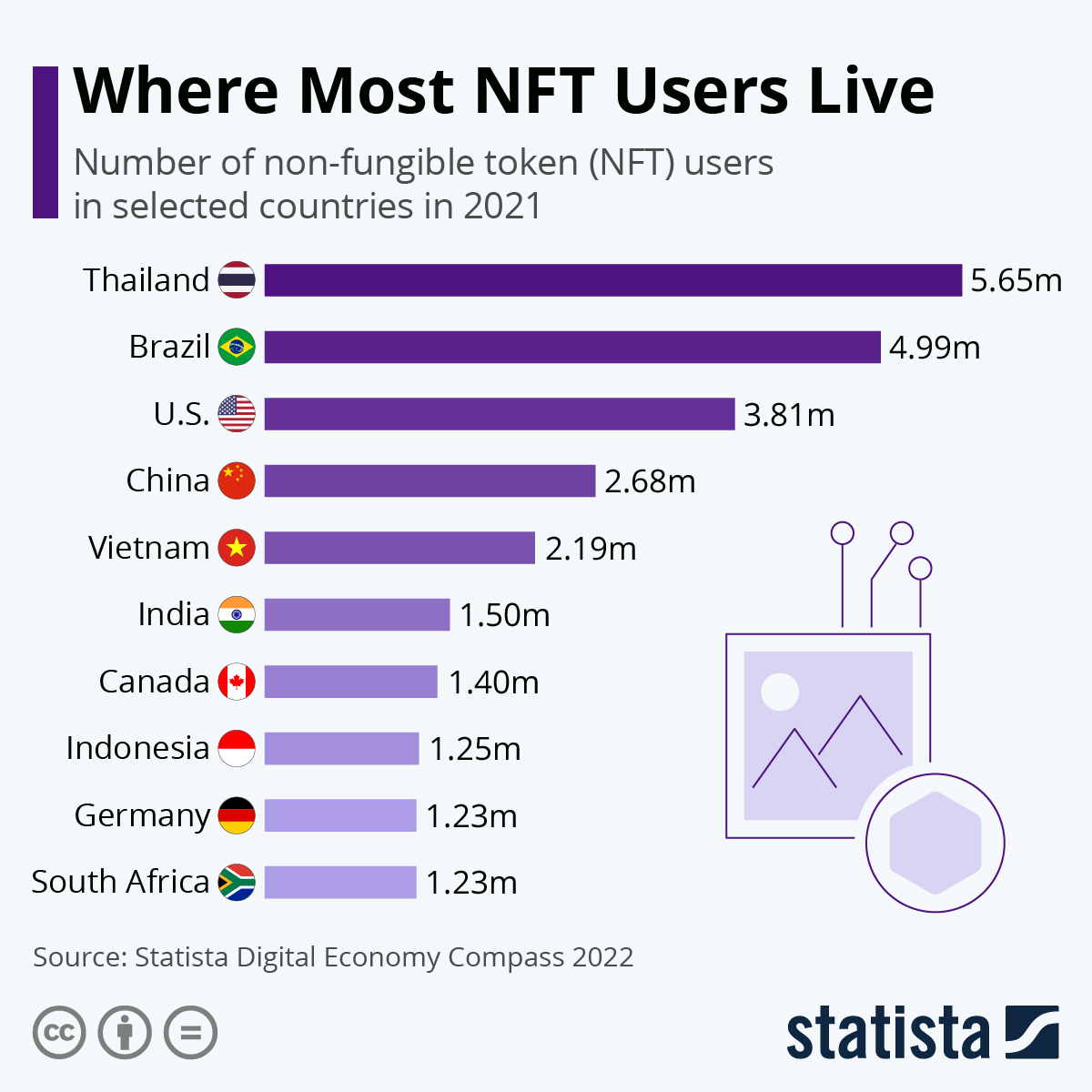

Non-fungible tokens, or NFTs, gained significant traction among certain East and Southeast Asian countries in 2021, including Thailand, China and Vietnam, according to the Statista Digital Economy Compass 2022.

As Statista's Anna Fleck shows in the chart below, Thailand took the lead as the country with the highest number of NFT users in the world in 2021, with a total of 5.65 million users.

This was followed by Brazil with 4.99 million users and the U.S. with 3.81 million.

When taking the countries’ population sizes into account, Thailand was still ahead of other countries in the top 10 of the biggest users, with 8.08 percent of its people owning digital property. This is in stark contrast to Canada, where a 3.67 percent share of the population are collectors, and Brazil with a 2.33 percent share.

You will find more infographics at Statista

According to Forbes, an NFT is defined as a “digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos.” These digital items are popular for being unique, thanks to specific identifying codes, which are attached when they are created or ‘minted’ (published on the blockchain so others can buy them).

By 2021, the NFT market had reportedly grown to more than $41 billion in value, according to a report by the blockchain data company Chainalysis, nearly rivaling the size of the conventional art market, which stood at $50 billion in 2020. However, the NFT market saw a crash last month, as the sale of NFTs fell to a daily average of about 19,000 - a drop of 92 percent since the peak of about 225,000 in September - as reported by the World Street Journal. This is being put down to a general decrease in hype, the fact cryptocurrencies have seen falls in value, fear of scams and rising inflation rates making people less inclined to make risky investments.

The boom in Southeast Asia has been linked to a number of reasons, including the popularity of play-to-earn games such as Axie Infinity by the Vietnamese company Sky Mavis as well as the rising number of artists that are able to showcase their work on social media channels like Discord and Twitter. Users can buy NFTs of virtual land, too, as with the Metaverse Thailand virtual sale in October 2021, when buyers were invited to purchase blocks of land in a virtual downtown Bangkok.

Financial experts, however, warn against over relying on NFTs, as there is little basis for their valuation since they are bought and sold based on speculation and hype. As Chuin Ting Weber, CEO of MoneyOwl, a bionic financial advisor, tells Yahoo News: “NFTs do not have an underlying economic return based on economic activity of companies or countries. Their payoff structure is speculative and volatile: You can win astronomically but you can also lose everything.” For this reason, he suggests users only put into NFTs what they are prepared to lose.

Non-fungible tokens, or NFTs, gained significant traction among certain East and Southeast Asian countries in 2021, including Thailand, China and Vietnam, according to the Statista Digital Economy Compass 2022.

As Statista’s Anna Fleck shows in the chart below, Thailand took the lead as the country with the highest number of NFT users in the world in 2021, with a total of 5.65 million users.

This was followed by Brazil with 4.99 million users and the U.S. with 3.81 million.

When taking the countries’ population sizes into account, Thailand was still ahead of other countries in the top 10 of the biggest users, with 8.08 percent of its people owning digital property. This is in stark contrast to Canada, where a 3.67 percent share of the population are collectors, and Brazil with a 2.33 percent share.

You will find more infographics at Statista

According to Forbes, an NFT is defined as a “digital asset that represents real-world objects like art, music, in-game items and videos. They are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos.” These digital items are popular for being unique, thanks to specific identifying codes, which are attached when they are created or ‘minted’ (published on the blockchain so others can buy them).

By 2021, the NFT market had reportedly grown to more than $41 billion in value, according to a report by the blockchain data company Chainalysis, nearly rivaling the size of the conventional art market, which stood at $50 billion in 2020. However, the NFT market saw a crash last month, as the sale of NFTs fell to a daily average of about 19,000 – a drop of 92 percent since the peak of about 225,000 in September – as reported by the World Street Journal. This is being put down to a general decrease in hype, the fact cryptocurrencies have seen falls in value, fear of scams and rising inflation rates making people less inclined to make risky investments.

The boom in Southeast Asia has been linked to a number of reasons, including the popularity of play-to-earn games such as Axie Infinity by the Vietnamese company Sky Mavis as well as the rising number of artists that are able to showcase their work on social media channels like Discord and Twitter. Users can buy NFTs of virtual land, too, as with the Metaverse Thailand virtual sale in October 2021, when buyers were invited to purchase blocks of land in a virtual downtown Bangkok.

Financial experts, however, warn against over relying on NFTs, as there is little basis for their valuation since they are bought and sold based on speculation and hype. As Chuin Ting Weber, CEO of MoneyOwl, a bionic financial advisor, tells Yahoo News: “NFTs do not have an underlying economic return based on economic activity of companies or countries. Their payoff structure is speculative and volatile: You can win astronomically but you can also lose everything.” For this reason, he suggests users only put into NFTs what they are prepared to lose.