By Marcel Kasumovich, Deputy CIO, Coinbase Asset Management

Passive investing seems to be dominating the crypto markets, evidenced by significant inflows into exchange-traded products (ETPs). But is it? Institutional engagement has skyrocketed, signaling that crypto is entering the US regulatory mainstream. This has led to a thriving landscape for active management, poised for rapid growth. But the signs are subtle. Exploring volumes and market dispersion reveals a thirst for higher risk-adjusted returns central to active management.

We start with trading volumes of ETPs – a familiar theme. They are high. Last month alone, roughly $2 billion changed hands for assets under management of around $60 billion . It represents more than 3% daily turnover, meaning ETP assets are turning over every 30 trading days. Such turnover is indicative of active investing. Investors buy the ETF and sell the futures against it, earning a spread over risk-free rates that, if well managed, has no correlation to Bitcoin.

So, active crypto investing is in vogue, after all. But yield opportunities in crypto markets are just “a trade.” In mature foreign exchange markets, the forward price of a currency reflects interest rate differentials. Yes, you can earn a 5% premium owning the US dollar against the Japanese yen. But the forward value of the US dollar trades at a 5% discount to the yen. That basic no-arbitrage condition doesn’t exist in crypto – yet. Institutional capital is capitalizing on the inefficiency.

As capital arrives to end some inefficiencies, new ones will arise. Investors can be expected to use familiar filters from traditional markets to evaluate potential active opportunities in crypto assets. Trend-like strategies are ideally suited to benefit from crypto adoption, focusing on price-based risk management to capture upside returns with far less downside volatility. Though dominated by Bitcoin and Ethereum today, that opportunity set will also broaden.

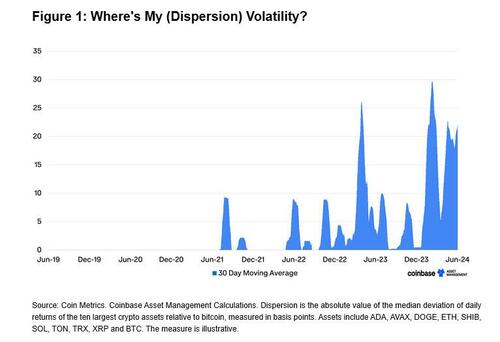

And asset dispersion is central to new active opportunities. Dispersion defines the breadth of active strategies – in all assets, not just crypto. To track dispersion, we create a simple metric defined by the median deviation of the top ten crypto assets relative to Bitcoin (Figure 1). Dispersion is spiking higher for longer – a good sign for new strategies. There was no dispersion when Bitcoin stood alone. It shot up in 2021, and is much higher now. It tells us two things.

- The first is statistical – a classic mean-reversion concept. Our dispersion metric illustrates that sharp spikes higher are associated with equally violent downturns. This can be exciting when looking for statistical anomalies. Outlying positive or negative performance relative to the Bitcoin benchmark leads to fast reversion. It suggests investors can bet against large dispersion, as it is short-lived. And the more dispersion that emerges, the more opportunities there are to harvest.

- The second is fundamental – statistical dispersion can be a filter for identifying where to dig deeper on individual assets. Statistical dispersion metrics are unlikely to be reliable on their own for such a new asset class. Imagine a killer application emerges, taking market share from Bitcoin. Statistical arbitrage tells you to bet against it. The fundamentals may paint a very different picture. They are better together – like peanut butter and chocolate – more symbiotic than competitive.

We can also lean on our Digital Pulse to capture dispersion patterns, studying common fundamental onchain metrics. Today, the range of scores across the top ten assets is from 26 for Cardano to 73 with Litecoin (scale of 0 to 100). Similar to price dispersion, the Digital Pulse draws attention to outlier scores by categories and assets. It may signal a continuation of a trend or a reversion. Most importantly, it’s a tool that lets active investors screen hundreds of assets.

But be careful. Dispersion and disruption come in many forms. Consensus opinion today slots crypto assets as a separate line item from traditional ones. But what if crypto advances within existing corporate structures? The value of disruptive technologies, like the internet before it, may be monetized through conventional means. To that end, MarketVectors created an index of publicly traded companies. And it also shows dispersion, having greatly outperformed Bitcoin recently.

Looks can be deceiving. While passive investing may be surging, there is significant active trading beneath the surface. The recent stalling of Bitcoin inflows reflects fewer attractive low risk yield opportunities, not a saturation of crypto demand. The increasing dispersion among publicly traded companies also suggests that investors are exploring diverse strategies for exposure. Despite appearances, it shows active crypto strategies are quietly and steadily gaining momentum.

By Marcel Kasumovich, Deputy CIO, Coinbase Asset Management

Passive investing seems to be dominating the crypto markets, evidenced by significant inflows into exchange-traded products (ETPs). But is it? Institutional engagement has skyrocketed, signaling that crypto is entering the US regulatory mainstream. This has led to a thriving landscape for active management, poised for rapid growth. But the signs are subtle. Exploring volumes and market dispersion reveals a thirst for higher risk-adjusted returns central to active management.

We start with trading volumes of ETPs – a familiar theme. They are high. Last month alone, roughly $2 billion changed hands for assets under management of around $60 billion . It represents more than 3% daily turnover, meaning ETP assets are turning over every 30 trading days. Such turnover is indicative of active investing. Investors buy the ETF and sell the futures against it, earning a spread over risk-free rates that, if well managed, has no correlation to Bitcoin.

So, active crypto investing is in vogue, after all. But yield opportunities in crypto markets are just “a trade.” In mature foreign exchange markets, the forward price of a currency reflects interest rate differentials. Yes, you can earn a 5% premium owning the US dollar against the Japanese yen. But the forward value of the US dollar trades at a 5% discount to the yen. That basic no-arbitrage condition doesn’t exist in crypto – yet. Institutional capital is capitalizing on the inefficiency.

As capital arrives to end some inefficiencies, new ones will arise. Investors can be expected to use familiar filters from traditional markets to evaluate potential active opportunities in crypto assets. Trend-like strategies are ideally suited to benefit from crypto adoption, focusing on price-based risk management to capture upside returns with far less downside volatility. Though dominated by Bitcoin and Ethereum today, that opportunity set will also broaden.

And asset dispersion is central to new active opportunities. Dispersion defines the breadth of active strategies – in all assets, not just crypto. To track dispersion, we create a simple metric defined by the median deviation of the top ten crypto assets relative to Bitcoin (Figure 1). Dispersion is spiking higher for longer – a good sign for new strategies. There was no dispersion when Bitcoin stood alone. It shot up in 2021, and is much higher now. It tells us two things.

- The first is statistical – a classic mean-reversion concept. Our dispersion metric illustrates that sharp spikes higher are associated with equally violent downturns. This can be exciting when looking for statistical anomalies. Outlying positive or negative performance relative to the Bitcoin benchmark leads to fast reversion. It suggests investors can bet against large dispersion, as it is short-lived. And the more dispersion that emerges, the more opportunities there are to harvest.

- The second is fundamental – statistical dispersion can be a filter for identifying where to dig deeper on individual assets. Statistical dispersion metrics are unlikely to be reliable on their own for such a new asset class. Imagine a killer application emerges, taking market share from Bitcoin. Statistical arbitrage tells you to bet against it. The fundamentals may paint a very different picture. They are better together – like peanut butter and chocolate – more symbiotic than competitive.

We can also lean on our Digital Pulse to capture dispersion patterns, studying common fundamental onchain metrics. Today, the range of scores across the top ten assets is from 26 for Cardano to 73 with Litecoin (scale of 0 to 100). Similar to price dispersion, the Digital Pulse draws attention to outlier scores by categories and assets. It may signal a continuation of a trend or a reversion. Most importantly, it’s a tool that lets active investors screen hundreds of assets.

But be careful. Dispersion and disruption come in many forms. Consensus opinion today slots crypto assets as a separate line item from traditional ones. But what if crypto advances within existing corporate structures? The value of disruptive technologies, like the internet before it, may be monetized through conventional means. To that end, MarketVectors created an index of publicly traded companies. And it also shows dispersion, having greatly outperformed Bitcoin recently.

Looks can be deceiving. While passive investing may be surging, there is significant active trading beneath the surface. The recent stalling of Bitcoin inflows reflects fewer attractive low risk yield opportunities, not a saturation of crypto demand. The increasing dispersion among publicly traded companies also suggests that investors are exploring diverse strategies for exposure. Despite appearances, it shows active crypto strategies are quietly and steadily gaining momentum.

Loading…