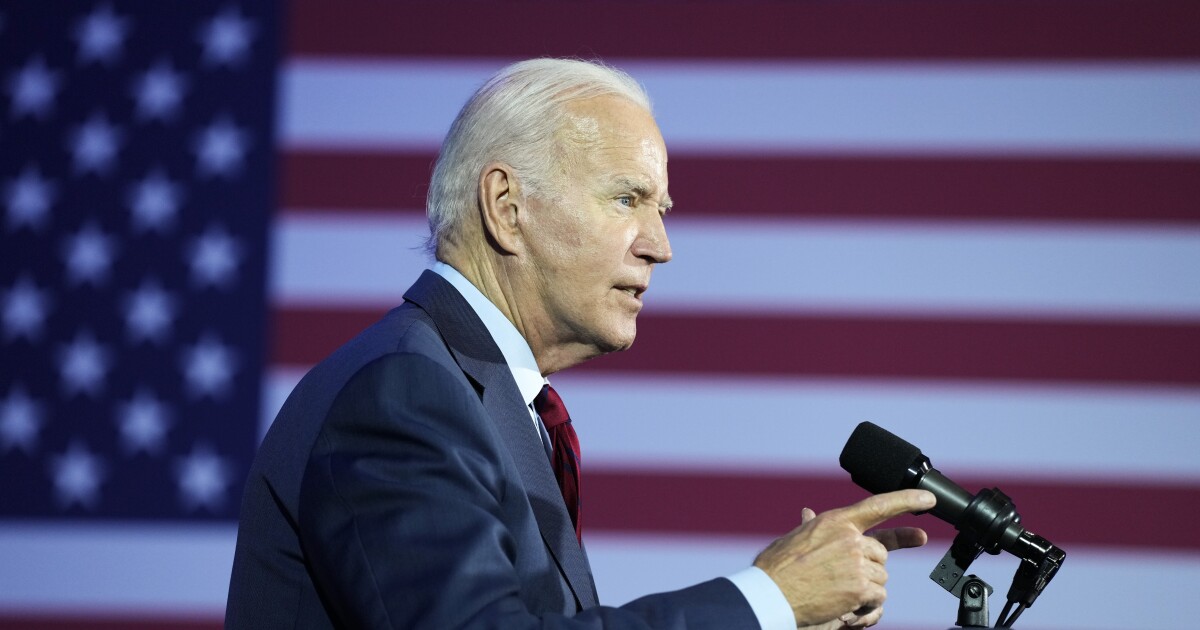

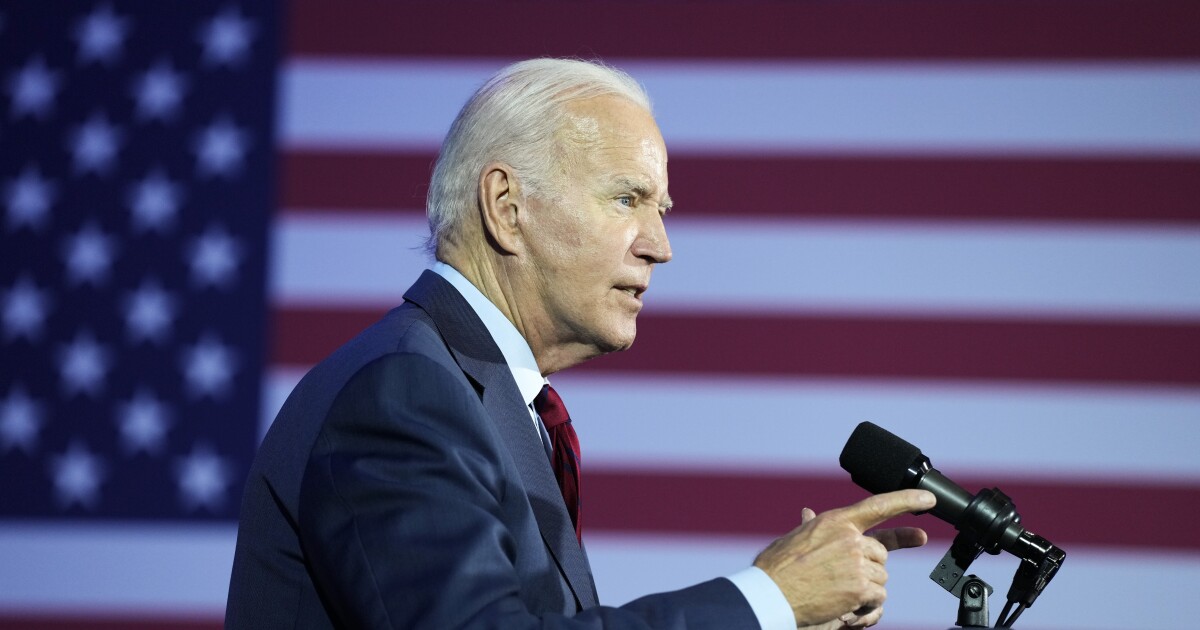

The White House is increasingly turning its attention to the economic accomplishments of President Joe Biden, seeking to embrace the concept of “Bidenomics” as part of the administration’s next campaign strategy.

Biden will appear alongside Vice President Kamala Harris at the White House on Monday to announce more than $40 billion in investments toward high-speed internet infrastructure across the country, kick-starting the second phase of the pair’s “Investing in America” tour. Meanwhile, White House officials are pressing into a new campaign message that heavily focuses on Biden’s economic agenda — hoping to reclaim a policy area that has long been dominated by Republicans.

WILL HURD’S ‘POINTLESS’ ANTI-TRUMP CAMPAIGN ONLY HELPS EX-PRESIDENT, ALLIES AND CRITICS AGREE

“The President came into office with a long-held and fundamentally different economic vision — and he was determined to turn the page on the failed trickle-down policies of the past,” senior Biden advisers wrote in a memo on Monday. “Two years later, there is clear and compelling evidence that Bidenomics is both a winning economic strategy that is delivering results, and an approach that is strongly supported by the vast majority of the American people.”

The memo builds on efforts from the White House to provide talking points that paint the economic narrative as being under the control of Bidenomics, a catchall term referring to the policies implemented by the Biden administration. The strategy comes as Republicans have hammered the president on economic problems, pointing to soaring inflation as a result of the very policies the president claims are helping bring inflation down.

At the root of Bidenomics is the idea that the government must rebuild the economy from the “middle out and bottom-up” — a phrase repeatedly used by Biden on the campaign trail in the 2020 and 2024 cycles.

The White House memo points to the economic growth during the Biden administration, arguing the president has put working-class families in a better position than they were before the COVID-19 pandemic. The memo cited declining inflation rates over the last year, as well as lowering costs of living and prescription drug costs.

One chart compared the number of jobs created under previous administrations to the Biden administration, touting more than 13 million jobs that have been added to the economy since Biden took office.

“Bidenomics has not just created a record number of jobs — it has created good jobs. A recent survey found that job satisfaction is at its highest level in 36 years, as employers are offering better pay, better benefits, and better schedules to attract and retain workers,” the memo states. “The prospect of good jobs is pulling people off the sidelines and into the workforce: the share of working-age Americans in the workforce is now higher than at any time in more than 15 years, and higher than any day under President Trump.”

The memo also points to voter approval of Biden’s economic policies, with 76% of voters expressing support for the president’s signature Bipartisan Infrastructure Law that was passed in 2021. That law authorized up to $108 billion in spending toward public transportation, marking the largest federal investment for public transportation in history.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The revised strategy comes as the economy emerges as a top voter concern ahead of the 2024 election, which has proved to be a crucial cycle for Democrats as they seek to maintain control of the White House and Senate. Only 31% of voters say they approve of Biden’s performance on the matter, according to an Associated Press survey conducted in May.

The memo also follows the release of the Labor Department’s May inflation report that found consumer prices rose by 4% during the past year. That annual rate falls short of the Federal Reserve’s desired 2% rate, but it represents the slowest increase in more than two years as last month’s producer price index decreased to 1.1%, per the Commerce Department.