Submitted by Elliott Middleton

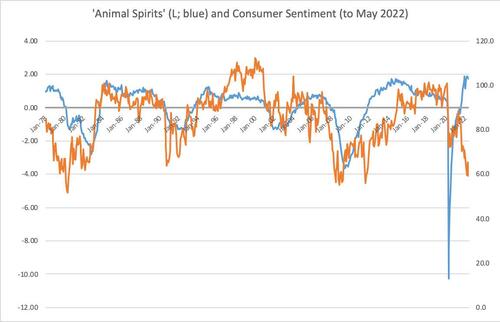

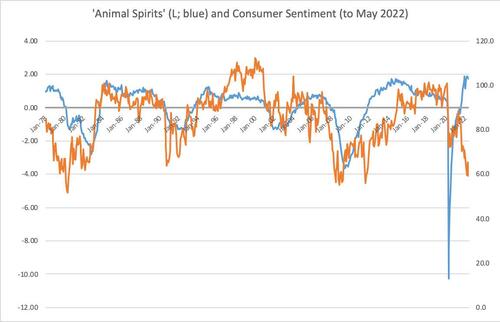

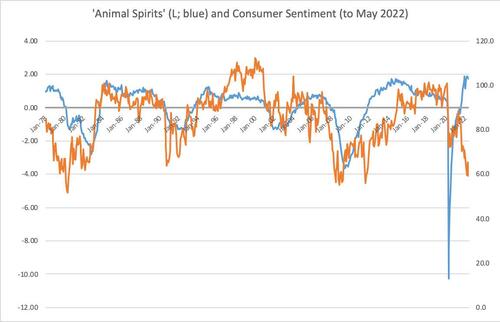

According to the Michigan Consumer Sentiment Series, confidence is at record lows. But a measure of confidence or “animal spirits,” as Keynes called it, that I developed in the 1990s — that was featured on the front page of the Wall Street Journal, February 20, 1998 — is now showing very healthy “animal spirits.” So which one is right?

Only time will tell. Read on to learn more.

In graduate school in the ‘Seventies I became fascinated with the implications of psychology for economics. I had been an English major at Yale as an undergraduate, and found the “psychology” of neoclassical utility theory ridiculous, at least when it came to things like the mood of the markets and consumers. Economics was in the grip of rational expectations theory at this time.

A Stanford economist by the name of Tibor Scitovsky had written a book called The Joyless Economy which explored the implications of adaptation level theory for economics. Our perceptions are always judged in the context of what we have experienced. The legendary Wundt curve showed that the pleasantness of stimuli followed an inverted U-shaped curve with respect to how novel a stimulus is to the subject. Moderate levels of subjective novelty are pleasant; very high levels unpleasant. Scitovsky harped on the then popular theme of the boringness of mass consumption. The importance of subjective novelty is now generally recognized in product design and marketing.

I spent some time on the complicated mathematics of subjective novelty before realizing that, in the majority of instances, some form of moving average of the relevant variable was all you needed to construct a measure of adaptation level, and of current variable value subjective novelty.

I had rediscovered moving averages! Traders feel good when the price is above the moving average, and they start to worry about losses one it veers below.

The next step was to apply this to the macro economy to solve the problem of “animal spirits.” What macro variable did people really care about? Stock prices? No, most people don't own enough stock to worry that much about stock prices. Industrial production? No, only economists are aware of that.

How about the unemployment rate? Given the rather tenuous attachment many people feel they have to their jobs, I thought this was a good candidate variable, sort of a personal unemployment risk indicator. Labor has never had much bargaining power with American business, and in the past few decades what it used to have was decimated.

Elliott Middleton says the main determinant of consumer confidence is the gap between the current unemployment rate of 4.6% and the rate that people consider normal. What's normal, according to Mr. Middleton, a professor at Metropolitan State University in Minneapolis, is a moving average of past unemployment rates, which he puts at about 5.2% now. The 4.6%-to-5.2% gap is what makes people euphoric, he contends, and if that gap closes, if the jobless rate goes above 5%, say, Americans would lose confidence. [https://www.wsj.com/articles/SB887928300124344000]

The recession began in April 2001 with the unemployment rate at 4.4% and adaptation level both at about 4.3%.

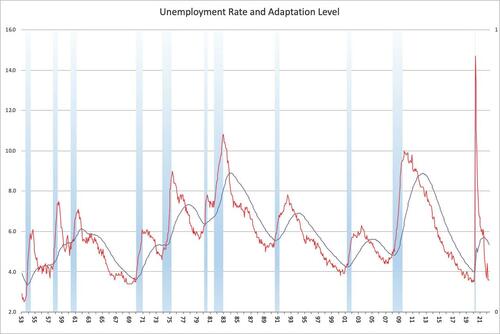

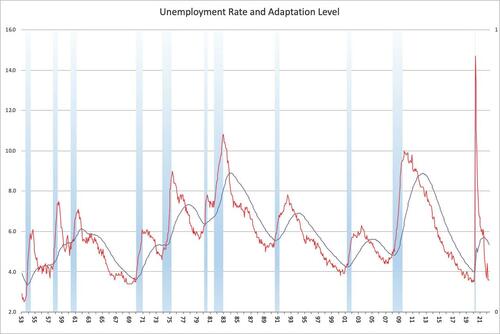

The editor of the European Journal of Economic Psychology had suggested using an exponential moving average whereby more recent observations are weighted more heavily than those more distant in the past; I used an exponential moving average over the past four years. An updated graph of the unemployment rate and adaptation level I proposed in “Adaptation Level and ‘Animal Spirits’” [1] is shown below.

As you can see, whenever the unemployment rate has risen above the adaptation level, a recession has ensued. I am counting the double dip recession in the early 1980s as one instance.

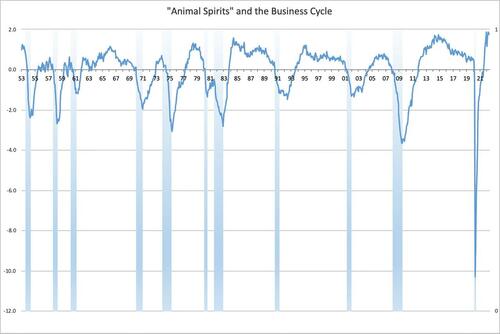

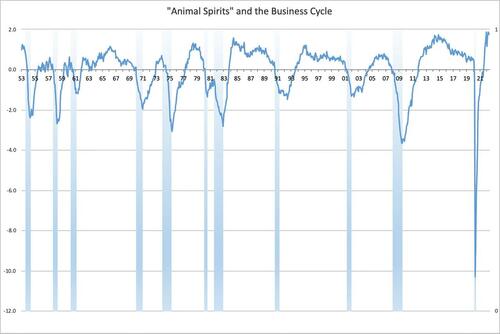

To create an "animal spirits” index I subtracted the unemployment rate from the adaptation level, so if unemployment was below the adaptation level, "animal spirits” would be positive; and conversely if the unemployment rate rose above the adaptation level. I ultimately abandoned attempts to scale this metric by the volatility of unemployment.

Figure 1 also includes the Michigan Sentiment series, showing the current divergence. The two measures track closely, and preliminary causality testing showed causality running from the “animal spirits” metric to the Michigan series.

So what is going on? The labor force participation rate suffered a huge involuntary blow during the pandemic that appears to have contributed to a “great resignation” from the labor force. Other things equal, this lowers the unemployment rate. The massive spike in the unemployment rate to over 14% in 2020, helped to raise the adaptation level, which peaked in the summer of 2021 at 5.7%, and is now at 5.3%, above the unemployment rate of 3.6%.

From the perspective of my model, recession becomes inevitable when the unemployment rate rises above the adaptation level, which is the same as the “animal spirits” index falling below zero. Because confidence is a form of psychological wealth, obeying the neoclassical precept that losses are discounted more steeply then gains, a form of self organized criticality sets in in the psychology of the labor market — as well as in the board rooms where investment decisions are made — and a self-reinforcing downward spiral of consumption and production decisions follows. At some point businesses stop laying off workers; the adaptation level rises to its peak with a lag; and as businesses hire workers back on, the unemployment rate drops below the adaptation level and “animal spirits” (confidence levels) become positive again.

It’s simplistic, but it works, which is why the academic economists have paid it no mind.

The problem facing the policymakers today is keeping the unemployment rate below the adaptation level. If we have a recession, and the unemployment rate jumps two percentage points, it will leap over the adaptation rate, engendering self-organized criticality. Keynes spoke direly about “the state of long-term expectation” as a critical determinant of an economy’s health, of its intrinsic “animal spirits.”

I believe the globalists want the West to give up hope, so we can all be happy owning nothing; that much of current policy is bent on self-destruction. Should the US be lucky enough and wise enough to rebalance national income toward labor with low-tax, hands-off policies for small business, always our greatest job producer, the spurt in domestic demand might be considerable. There are now more job openings than there are unemployed persons!

I believe the firehose of insulting, race-baiting woke propaganda about America emanating from the Democratic Party [CCP/WEF] has the majority of the country profoundly depressed about the prospects for their lives and businesses. This is why the Michigan index is at record lows. These feelings are strongest among small business people who have seen their businesses deemed “non-essential” and subject to termination upon the whim of a bureaucrat. A serious recession now might have very damaging effects on Americans’ long-term expectations.

I’m hoping that Americans are expressing more despair than they are demonstrating economically. Businesses may need to pay them more!

Ultimately, the West must deal with its long-term fiscal position that will involve some sort of bankruptcy negotiation with the rest of the world, that in its turn should also favor a domestic rebalancing to reduce inequalities, but that is another question.

Congress, not just the Fed, has the ability to begin revitalizing the economy with tax reductions on small business and energy production.

And instead of taxing excess profits and giving them to government, which will waste them, why doesn’t Congress require business to share profits with their employees, so they go back into the spending stream and the whole economy grows?

The forecast: the economy will enter recession when the unemployment rate reaches about 4.5%.

However, from psychophysical point of view, “animal spirits” may be stronger than the Michigan index suggests, meaning that appropriate stimulus now might reengage the engine of optimism and forestall the next recession.

[1] Middleton, E., Adaptation level and ‘animal spirits’, JEconPsych, Volume 17, Issue 4, August 1996, Pages 479-498.

Submitted by Elliott Middleton

According to the Michigan Consumer Sentiment Series, confidence is at record lows. But a measure of confidence or “animal spirits,” as Keynes called it, that I developed in the 1990s — that was featured on the front page of the Wall Street Journal, February 20, 1998 — is now showing very healthy “animal spirits.” So which one is right?

Only time will tell. Read on to learn more.

In graduate school in the ‘Seventies I became fascinated with the implications of psychology for economics. I had been an English major at Yale as an undergraduate, and found the “psychology” of neoclassical utility theory ridiculous, at least when it came to things like the mood of the markets and consumers. Economics was in the grip of rational expectations theory at this time.

A Stanford economist by the name of Tibor Scitovsky had written a book called The Joyless Economy which explored the implications of adaptation level theory for economics. Our perceptions are always judged in the context of what we have experienced. The legendary Wundt curve showed that the pleasantness of stimuli followed an inverted U-shaped curve with respect to how novel a stimulus is to the subject. Moderate levels of subjective novelty are pleasant; very high levels unpleasant. Scitovsky harped on the then popular theme of the boringness of mass consumption. The importance of subjective novelty is now generally recognized in product design and marketing.

I spent some time on the complicated mathematics of subjective novelty before realizing that, in the majority of instances, some form of moving average of the relevant variable was all you needed to construct a measure of adaptation level, and of current variable value subjective novelty.

I had rediscovered moving averages! Traders feel good when the price is above the moving average, and they start to worry about losses one it veers below.

The next step was to apply this to the macro economy to solve the problem of “animal spirits.” What macro variable did people really care about? Stock prices? No, most people don’t own enough stock to worry that much about stock prices. Industrial production? No, only economists are aware of that.

How about the unemployment rate? Given the rather tenuous attachment many people feel they have to their jobs, I thought this was a good candidate variable, sort of a personal unemployment risk indicator. Labor has never had much bargaining power with American business, and in the past few decades what it used to have was decimated.

Elliott Middleton says the main determinant of consumer confidence is the gap between the current unemployment rate of 4.6% and the rate that people consider normal. What’s normal, according to Mr. Middleton, a professor at Metropolitan State University in Minneapolis, is a moving average of past unemployment rates, which he puts at about 5.2% now. The 4.6%-to-5.2% gap is what makes people euphoric, he contends, and if that gap closes, if the jobless rate goes above 5%, say, Americans would lose confidence. [https://www.wsj.com/articles/SB887928300124344000]

The recession began in April 2001 with the unemployment rate at 4.4% and adaptation level both at about 4.3%.

The editor of the European Journal of Economic Psychology had suggested using an exponential moving average whereby more recent observations are weighted more heavily than those more distant in the past; I used an exponential moving average over the past four years. An updated graph of the unemployment rate and adaptation level I proposed in “Adaptation Level and ‘Animal Spirits’” [1] is shown below.

As you can see, whenever the unemployment rate has risen above the adaptation level, a recession has ensued. I am counting the double dip recession in the early 1980s as one instance.

To create an “animal spirits” index I subtracted the unemployment rate from the adaptation level, so if unemployment was below the adaptation level, “animal spirits” would be positive; and conversely if the unemployment rate rose above the adaptation level. I ultimately abandoned attempts to scale this metric by the volatility of unemployment.

Figure 1 also includes the Michigan Sentiment series, showing the current divergence. The two measures track closely, and preliminary causality testing showed causality running from the “animal spirits” metric to the Michigan series.

So what is going on? The labor force participation rate suffered a huge involuntary blow during the pandemic that appears to have contributed to a “great resignation” from the labor force. Other things equal, this lowers the unemployment rate. The massive spike in the unemployment rate to over 14% in 2020, helped to raise the adaptation level, which peaked in the summer of 2021 at 5.7%, and is now at 5.3%, above the unemployment rate of 3.6%.

From the perspective of my model, recession becomes inevitable when the unemployment rate rises above the adaptation level, which is the same as the “animal spirits” index falling below zero. Because confidence is a form of psychological wealth, obeying the neoclassical precept that losses are discounted more steeply then gains, a form of self organized criticality sets in in the psychology of the labor market — as well as in the board rooms where investment decisions are made — and a self-reinforcing downward spiral of consumption and production decisions follows. At some point businesses stop laying off workers; the adaptation level rises to its peak with a lag; and as businesses hire workers back on, the unemployment rate drops below the adaptation level and “animal spirits” (confidence levels) become positive again.

It’s simplistic, but it works, which is why the academic economists have paid it no mind.

The problem facing the policymakers today is keeping the unemployment rate below the adaptation level. If we have a recession, and the unemployment rate jumps two percentage points, it will leap over the adaptation rate, engendering self-organized criticality. Keynes spoke direly about “the state of long-term expectation” as a critical determinant of an economy’s health, of its intrinsic “animal spirits.”

I believe the globalists want the West to give up hope, so we can all be happy owning nothing; that much of current policy is bent on self-destruction. Should the US be lucky enough and wise enough to rebalance national income toward labor with low-tax, hands-off policies for small business, always our greatest job producer, the spurt in domestic demand might be considerable. There are now more job openings than there are unemployed persons!

I believe the firehose of insulting, race-baiting woke propaganda about America emanating from the Democratic Party [CCP/WEF] has the majority of the country profoundly depressed about the prospects for their lives and businesses. This is why the Michigan index is at record lows. These feelings are strongest among small business people who have seen their businesses deemed “non-essential” and subject to termination upon the whim of a bureaucrat. A serious recession now might have very damaging effects on Americans’ long-term expectations.

I’m hoping that Americans are expressing more despair than they are demonstrating economically. Businesses may need to pay them more!

Ultimately, the West must deal with its long-term fiscal position that will involve some sort of bankruptcy negotiation with the rest of the world, that in its turn should also favor a domestic rebalancing to reduce inequalities, but that is another question.

Congress, not just the Fed, has the ability to begin revitalizing the economy with tax reductions on small business and energy production.

And instead of taxing excess profits and giving them to government, which will waste them, why doesn’t Congress require business to share profits with their employees, so they go back into the spending stream and the whole economy grows?

The forecast: the economy will enter recession when the unemployment rate reaches about 4.5%.

However, from psychophysical point of view, “animal spirits” may be stronger than the Michigan index suggests, meaning that appropriate stimulus now might reengage the engine of optimism and forestall the next recession.

[1] Middleton, E., Adaptation level and ‘animal spirits’, JEconPsych, Volume 17, Issue 4, August 1996, Pages 479-498.