Authored by Charles Hugh Smith via OfTwoMinds blog,

Simply put, people are moving not just to escape unaffordable housing and high taxes. They're moving to escape fiscally irresponsible, ineffective, unaccountable governance.

Defenders of high state taxes like to point out that surveys find few high-net-worth households move primarily to lower their tax bills. This may be so, but it misses the point: high-income, high-net-worth households don't move away from high tax states if they're getting fair value for their taxes. But if services and infrastructure are crumbling around them even as their taxes keep ratcheting higher, then the benefits of moving become much more compelling.

In other words, if you're getting good value for your high taxes, then high taxes are not sufficient motivation to move. The problem is not high taxes per se, any more than a high cost of living is the reason to move from a world-class city with great amenities: world-class cities with great amenities have always cost more than less desirable locales, even in the 1600s.

The reason blue states are losing population isn't just high taxes; it's a lack of fiscal discipline and accountability, and insanely unaffordable housing costs. Immense floods of tax revenues sluice into the state coffers but the outcomes of all that spending diminish rather than improve. Problems don't seem to get solved even as the permanent "solution"--throw more money at it--fail due to the decay of fiscal discipline and accountability, and the rise of a "stakeholders" mentality where dozens of entrenched interest groups each hold a veto in every decision.

As I've explained before, straightforward government processes like getting a building permit have become Kafkaesque nightmares of delays and soaring costs, partly because every agency benefits from stretching the process out by finding reasons to demand a resubmittal: more delays means more hours of work and more fees.

Nobody benefits from a speedy permit process except the general public, and they have no political power. The same political class gets re-elected despite their poor performance, so there's no incentive to enforce any discipline or accountability. Failure is the New Normal as every "stakeholder" finds reasons to meddle with or nix any plan that might disrupt the self-serving, inefficient, ineffective status quo.

A great many city and county officials are doing their best to solve local problems and improve core services, but there's only so much they can accomplish if the state creates a culture of entrenched-interests dysfunction, skims most of the tax revenues and malinvests public borrowing.

As the excerpts below highlight, most middle-income people leave blue states because they will never be able to afford to own a home. But since middle-income households pay a modest percentage of income and capital gains taxes, the state machinery grinds on even as the priced-out-of-home-ownership middle class moves away.

But when the few who pay most of the income taxes have finally had enough and start leaving, the fiscal consequences quickly accumulate. The Everything Bubble has generated fantastic capital gains for the wealthiest class, and they've paid a disproportionate share of blue state income tax revenues on these gains.

(Note that California taxes long-term capital gains at the same rate as any other income: no long-term capital gains tax break for you, bucko.)

High-income earners fleeing California (by Dan Walters):

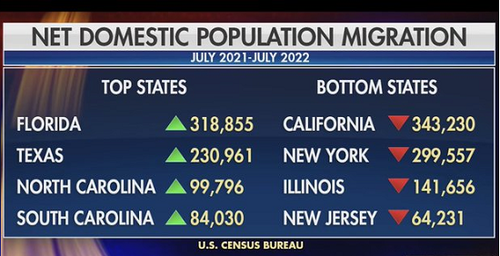

After 170 years of population growth -- occasionally explosive growth -- California is now experiencing population loss for the first time. As foreign immigration and birth rates declined, they no longer offset net losses in state-to-state migration. Since 2010, 7.5 million people have left California while 5.9 million people have come from other states.

"Most people who move across state lines do so for housing, job, or family reasons," Hans Johnson, a demographer for the Public Policy Institute of California, wrote earlier this year. Johnson also notes that those who leave California tend to be poorer and less educated than those who migrate to the state, which is not surprising given that housing and jobs dominate motivations.

There is, however, a less obvious subset of those who leave California -- high-income families seeking relief from the state's notoriously high taxes.

The newspaper found that 39,000 San Franciscans who had filed federal tax returns for 2018 had moved out of the city before filing 2019 returns. Collectively, they took $10.6 billion in income with them while people who moved to the city during that period reported just $3.8 billion in income.

Favored new homes are often in states that levy little or no personal income taxes. No-tax states include Wyoming, Nevada, Washington, Texas and Florida. Utah has a flat 4.85% rate.

Income taxes account for three-quarters of California's general fund revenues and the top 1% of taxpayers generate nearly half of those taxes.

That's just 150,000 taxpayers in a state of 40 million, so even a trickle of departures has a potentially huge impact on the budget.

Why the Middle Class Flees States That Tax the Rich:

A recent survey found that 37 percent of Californians are thinking of leaving the state for this reason alone. California has the highest housing costs among the 48 continental states, and government has much to do with that.

Costs are astronomical, even for government-favored, heavily subsidized affordable housing. The cost of building a subsidized unit of housing in California can be as high as about $700,000 a unit, according to a recent study by the Government Accountability Office.

Fueled by its taxes on high earners and on businesses, California has an enormous budget. Its general fund alone tops $200 billion. You might expect, for that money, top-notch services from government, but the opposite is true. One essential public-sector responsibility that heavily influences quality of life for everyone is basic infrastructure.

California consistently ranks low on that crucial measure, and it's not alone. Other high-tax states like New York also sit near the bottom of rankings for essentials like roads, bridges, and airports, while states with moderate and low taxes like Arizona and Nevada rank near the top. Money alone is clearly not the deciding factor in what kind of quality-of-life a government can help deliver, and residents notice.

Simply put, people are moving not just to escape unaffordable housing and high taxes. They're moving to escape fiscally irresponsible, ineffective, unaccountable governance that always wants more tax revenues while delivering diminishing quality services and infrastructure. There's nothing like a homeless encampment a few yards from your million-dollar cottage to modify one's calculation of the benefits of staying put. Throw in decaying public transportation, library hours being slashed and random crime, and all the supposedly great amenities start losing their luster.

The heavily subsidized lower-income households have every reason to stay. The top 5% who pay most of the taxes and who have more options are reaching the point where all the advantages of moving are starting to outweigh the advantages of staying. Should the trickle of wealth leaving turn into a flood, blue states will no longer be fiscally viable.

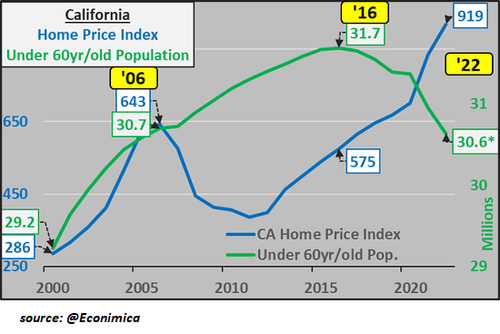

Note the extremely high cost of housing in California even as the primary workforce populace plummets.

The soaring cohort of elderly won't be engines of growth; they'll increasingly be drawing benefits and subsidies from the state coffers. That's not a formula for fiscal solvency.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Authored by Charles Hugh Smith via OfTwoMinds blog,

Simply put, people are moving not just to escape unaffordable housing and high taxes. They’re moving to escape fiscally irresponsible, ineffective, unaccountable governance.

Defenders of high state taxes like to point out that surveys find few high-net-worth households move primarily to lower their tax bills. This may be so, but it misses the point: high-income, high-net-worth households don’t move away from high tax states if they’re getting fair value for their taxes. But if services and infrastructure are crumbling around them even as their taxes keep ratcheting higher, then the benefits of moving become much more compelling.

In other words, if you’re getting good value for your high taxes, then high taxes are not sufficient motivation to move. The problem is not high taxes per se, any more than a high cost of living is the reason to move from a world-class city with great amenities: world-class cities with great amenities have always cost more than less desirable locales, even in the 1600s.

The reason blue states are losing population isn’t just high taxes; it’s a lack of fiscal discipline and accountability, and insanely unaffordable housing costs. Immense floods of tax revenues sluice into the state coffers but the outcomes of all that spending diminish rather than improve. Problems don’t seem to get solved even as the permanent “solution”–throw more money at it–fail due to the decay of fiscal discipline and accountability, and the rise of a “stakeholders” mentality where dozens of entrenched interest groups each hold a veto in every decision.

As I’ve explained before, straightforward government processes like getting a building permit have become Kafkaesque nightmares of delays and soaring costs, partly because every agency benefits from stretching the process out by finding reasons to demand a resubmittal: more delays means more hours of work and more fees.

Nobody benefits from a speedy permit process except the general public, and they have no political power. The same political class gets re-elected despite their poor performance, so there’s no incentive to enforce any discipline or accountability. Failure is the New Normal as every “stakeholder” finds reasons to meddle with or nix any plan that might disrupt the self-serving, inefficient, ineffective status quo.

A great many city and county officials are doing their best to solve local problems and improve core services, but there’s only so much they can accomplish if the state creates a culture of entrenched-interests dysfunction, skims most of the tax revenues and malinvests public borrowing.

As the excerpts below highlight, most middle-income people leave blue states because they will never be able to afford to own a home. But since middle-income households pay a modest percentage of income and capital gains taxes, the state machinery grinds on even as the priced-out-of-home-ownership middle class moves away.

But when the few who pay most of the income taxes have finally had enough and start leaving, the fiscal consequences quickly accumulate. The Everything Bubble has generated fantastic capital gains for the wealthiest class, and they’ve paid a disproportionate share of blue state income tax revenues on these gains.

(Note that California taxes long-term capital gains at the same rate as any other income: no long-term capital gains tax break for you, bucko.)

High-income earners fleeing California (by Dan Walters):

After 170 years of population growth — occasionally explosive growth — California is now experiencing population loss for the first time. As foreign immigration and birth rates declined, they no longer offset net losses in state-to-state migration. Since 2010, 7.5 million people have left California while 5.9 million people have come from other states.

“Most people who move across state lines do so for housing, job, or family reasons,” Hans Johnson, a demographer for the Public Policy Institute of California, wrote earlier this year. Johnson also notes that those who leave California tend to be poorer and less educated than those who migrate to the state, which is not surprising given that housing and jobs dominate motivations.

There is, however, a less obvious subset of those who leave California — high-income families seeking relief from the state’s notoriously high taxes.

The newspaper found that 39,000 San Franciscans who had filed federal tax returns for 2018 had moved out of the city before filing 2019 returns. Collectively, they took $10.6 billion in income with them while people who moved to the city during that period reported just $3.8 billion in income.

Favored new homes are often in states that levy little or no personal income taxes. No-tax states include Wyoming, Nevada, Washington, Texas and Florida. Utah has a flat 4.85% rate.

Income taxes account for three-quarters of California’s general fund revenues and the top 1% of taxpayers generate nearly half of those taxes.

That’s just 150,000 taxpayers in a state of 40 million, so even a trickle of departures has a potentially huge impact on the budget.

Why the Middle Class Flees States That Tax the Rich:

A recent survey found that 37 percent of Californians are thinking of leaving the state for this reason alone. California has the highest housing costs among the 48 continental states, and government has much to do with that.

Costs are astronomical, even for government-favored, heavily subsidized affordable housing. The cost of building a subsidized unit of housing in California can be as high as about $700,000 a unit, according to a recent study by the Government Accountability Office.

Fueled by its taxes on high earners and on businesses, California has an enormous budget. Its general fund alone tops $200 billion. You might expect, for that money, top-notch services from government, but the opposite is true. One essential public-sector responsibility that heavily influences quality of life for everyone is basic infrastructure.

California consistently ranks low on that crucial measure, and it’s not alone. Other high-tax states like New York also sit near the bottom of rankings for essentials like roads, bridges, and airports, while states with moderate and low taxes like Arizona and Nevada rank near the top. Money alone is clearly not the deciding factor in what kind of quality-of-life a government can help deliver, and residents notice.

Simply put, people are moving not just to escape unaffordable housing and high taxes. They’re moving to escape fiscally irresponsible, ineffective, unaccountable governance that always wants more tax revenues while delivering diminishing quality services and infrastructure. There’s nothing like a homeless encampment a few yards from your million-dollar cottage to modify one’s calculation of the benefits of staying put. Throw in decaying public transportation, library hours being slashed and random crime, and all the supposedly great amenities start losing their luster.

The heavily subsidized lower-income households have every reason to stay. The top 5% who pay most of the taxes and who have more options are reaching the point where all the advantages of moving are starting to outweigh the advantages of staying. Should the trickle of wealth leaving turn into a flood, blue states will no longer be fiscally viable.

Note the extremely high cost of housing in California even as the primary workforce populace plummets.

The soaring cohort of elderly won’t be engines of growth; they’ll increasingly be drawing benefits and subsidies from the state coffers. That’s not a formula for fiscal solvency.

* * *

My new book is now available at a 10% discount ($8.95 ebook, $18 print): Self-Reliance in the 21st Century. Read the first chapter for free (PDF)

Loading…