The last six weeks or so have seen an extended bounce in US equities that has led to the usual debate about whether it's a 'dead cat bounce' bear-market rally or that the lows are in for this tightening cycle and The Fed will flip-flop and save the day again.

Notably, having tagged 4,000 last week, the S&P has been under pressure, but the rebound trend remains ahead of tomorrow's FOMC statement and presser...

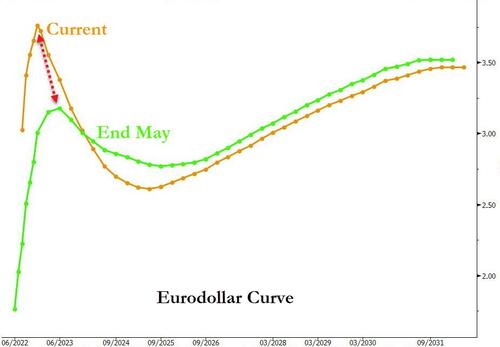

Notably the S&P is trading at the same level it was at around the end of May but as the chart below shows, the expectations for Fed actions have dramatically changed with the 'pivot' having shifted from June 2023 to Dec 2022 and the terminal rate significantly higher (up from 3.18% to around 3.75%). Additionally, the market's expectations for a dovish Fed are significantly more aggressive now than at the end of May (with rates not expected to rise back to this cycle's terminal rate until at least 2031)...this makes sense - the more they hike, the faster the recession occurs and the more they have to cut to save the world...

Will a less hawkish Fed (as opposed to a truly dovish Fed) be enough to satiate the stock market's more voracious appetite for rate-cuts? Is the STIRs and stock market over-excited about The Fed's willingness to flip-flop once again?

Nomura's Charlie McElligott has a few thoughts on the dilemma.

First things first, why have stocks and bonds been bid recently?

In bonds, McElligott notes that the prior / legacy “upside inflation risk” focus instead now having entirely transitioned to the “downside growth (recession) risk."

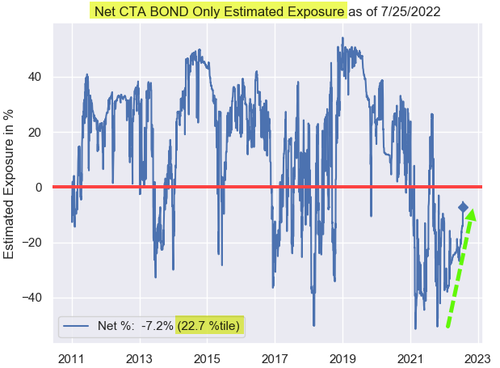

Additionally, we see a major cover of the near-record CTA Trend universe's "Short Bonds / MMs" trade over the past year...

Equities refuse to sell-off on a lot of macro “bad news” and instead, have meaningfully rallied as McElligott notes that the prior “over-hedging” regime has been largely washed-out (i.e. short-covering started this rip-roaring bounce back).

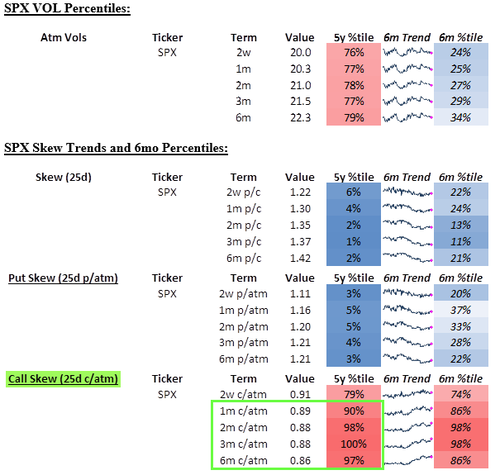

Implied and realized vol (correlation galloping lower) and skew (demand for upside vs negligible for downside) both continue to bleed…which in-turn is supporting systematic Vol allocation strategies to re-allocate in due time.

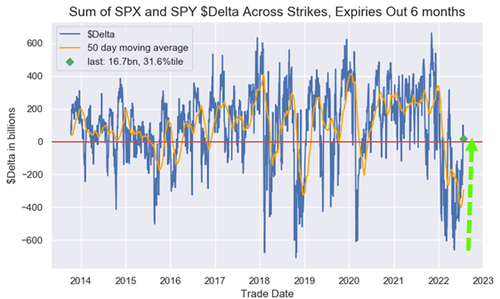

Additionally, US Equities Index / ETF Options positioning shows increasingly “market stabilizing” Dealer Delta and Gamma positioning...

Finally, the FOMO trade - SPX Call Skew stays relentlessly “bid” looking-out medium-term, as traders fear of the “missing the right tail” into this increasingly painful short squeeze driven by under-positioning and overly bearish sentiment which has extended beyond expectations, and despite a rather constant stream of “bad news”.

So equities' gains have largely been 'mechanical' with the narrative overlaid that the market is looking through the recession to an easy Fed sooner rather than later.

So now we have a sense of how we got here (in stocks), McElligott suggests the questions to be asked then become:

1) will markets be satiated simply by a cessation of rate hikes around 1Q23, as opposed to outright cuts being priced; and

2) will the market’s desire for “easy” FCI be satiated by simply the earlier end to QT, as opposed to outright QE?

The Nomura strategist explains he is not buying what the market is selling here:

This current implied timing of the “Fed Pivot,” with messaging / signal seen approaching in coming months (ahead of the actual “policy turn” itself), is where I do not see eye-to-eye with the market…and this comes despite having been pretty early I think and “banging-the-drum” over the course of the year on “recession / contraction” signals being seen, which we’ve been noting across Equities Factor / Risk Premia “recessionary” pro- Duration performance themes, early inversions pricing into STIRs and Yield Curves, and also exhibited via the recent “careening into contraction” trajectory of our Economic Quadrant analysis.

As stated last week, the magnitude and trending velocity of the “sticky inflation” problem is the rub here, as despite the current “peak inflation” potentials (I’ve heard that before), we remain nowhere near a “clear and convincing” directional shift back towards 2% target, which in-turn removes the Fed’s “timing optionality” of a “pivot” until a date which I believe comes much later than most market participants “want” to see.

In other words, how can the Fed possibly begin to signal any sort of approaching “easing” when headline CPI sits at 9.1%, versus “tight” labor markets, with the unemployment rate at 3.6% and NFP’s consistently printing over +400k of job adds a month…while wages are still growing, with Atlanta Fed Wage Growth Tracker at all-time highs of 6.7%...and recent consumer nominal spending data remaining “strong like bull”?

For this reason, I think tomorrow that you’re going to hear a pretty “on message” hawkishness from the Fed statement, where even the usually “balanced” Powell presser may even tilt nonchalantly hawkish as well…acknowledging obvious slowing growth, but rationalizing the Fed’s continued “pumping of the breaks” due to said Labor- and Wage- data remaining so strong, and at the headline inflation highs!

And it is this inability to prematurely “back down” from currently hawkish policy tone which will create a prolongued and uncomfortable “tension” for an Equities market which is instead clamoring for a sped-up resumption of the old “QE” muscle memory, based around this recent confidence in a return to the dreaded “bad is good” regime—where thanks to slowing data indicating “hard landing” recession risks are growing, a “recency bias” / conditioning which has seen central banks not just slash policy rates, but also commence large scale asset purchases, in the event of growth scares and / or “crisis” over the past decade plus period.

As a reminder, the Nomura Econ’s teams house view sees the Fed continuing to hike into Feb ’23, then pausing for approx 6 months thereafter, before actually “commencing” the dovish policy pivot in September ’23 via both cuts and an accelerated end to QT being pulled-forward in September ’23—which is a long ways-away

“Incoming data suggests inflation has become more entrenched relative to the Fed’s expectations.

As a result, we maintain our expectation for the Fed to raise rates by 100bp in July, up from the 75bp hike in June. The updated FOMC statement will likely acknowledge waning growth momentum. However, we believe Chair Powell will remain focused on inflation during the press conference and signal that additional rate increases are likely.

We maintain our expectation of another 50bp hike in September followed by three 25bp hikes in November, December and February – to a terminal rate of 3.75-4.00% – before rate cuts and an end to QT in September 2023.”

The market does not appear to be ready for any 'less than uber-dovish' surprise from The Fed tomorrow (in word or deed).

The last six weeks or so have seen an extended bounce in US equities that has led to the usual debate about whether it’s a ‘dead cat bounce’ bear-market rally or that the lows are in for this tightening cycle and The Fed will flip-flop and save the day again.

Notably, having tagged 4,000 last week, the S&P has been under pressure, but the rebound trend remains ahead of tomorrow’s FOMC statement and presser…

Notably the S&P is trading at the same level it was at around the end of May but as the chart below shows, the expectations for Fed actions have dramatically changed with the ‘pivot’ having shifted from June 2023 to Dec 2022 and the terminal rate significantly higher (up from 3.18% to around 3.75%). Additionally, the market’s expectations for a dovish Fed are significantly more aggressive now than at the end of May (with rates not expected to rise back to this cycle’s terminal rate until at least 2031)…this makes sense – the more they hike, the faster the recession occurs and the more they have to cut to save the world…

Will a less hawkish Fed (as opposed to a truly dovish Fed) be enough to satiate the stock market’s more voracious appetite for rate-cuts? Is the STIRs and stock market over-excited about The Fed’s willingness to flip-flop once again?

Nomura’s Charlie McElligott has a few thoughts on the dilemma.

First things first, why have stocks and bonds been bid recently?

In bonds, McElligott notes that the prior / legacy “upside inflation risk” focus instead now having entirely transitioned to the “downside growth (recession) risk.”

Additionally, we see a major cover of the near-record CTA Trend universe’s “Short Bonds / MMs” trade over the past year…

Equities refuse to sell-off on a lot of macro “bad news” and instead, have meaningfully rallied as McElligott notes that the prior “over-hedging” regime has been largely washed-out (i.e. short-covering started this rip-roaring bounce back).

Implied and realized vol (correlation galloping lower) and skew (demand for upside vs negligible for downside) both continue to bleed…which in-turn is supporting systematic Vol allocation strategies to re-allocate in due time.

Additionally, US Equities Index / ETF Options positioning shows increasingly “market stabilizing” Dealer Delta and Gamma positioning…

Finally, the FOMO trade – SPX Call Skew stays relentlessly “bid” looking-out medium-term, as traders fear of the “missing the right tail” into this increasingly painful short squeeze driven by under-positioning and overly bearish sentiment which has extended beyond expectations, and despite a rather constant stream of “bad news”.

So equities’ gains have largely been ‘mechanical’ with the narrative overlaid that the market is looking through the recession to an easy Fed sooner rather than later.

So now we have a sense of how we got here (in stocks), McElligott suggests the questions to be asked then become:

1) will markets be satiated simply by a cessation of rate hikes around 1Q23, as opposed to outright cuts being priced; and

2) will the market’s desire for “easy” FCI be satiated by simply the earlier end to QT, as opposed to outright QE?

The Nomura strategist explains he is not buying what the market is selling here:

This current implied timing of the “Fed Pivot,” with messaging / signal seen approaching in coming months (ahead of the actual “policy turn” itself), is where I do not see eye-to-eye with the market…and this comes despite having been pretty early I think and “banging-the-drum” over the course of the year on “recession / contraction” signals being seen, which we’ve been noting across Equities Factor / Risk Premia “recessionary” pro- Duration performance themes, early inversions pricing into STIRs and Yield Curves, and also exhibited via the recent “careening into contraction” trajectory of our Economic Quadrant analysis.

As stated last week, the magnitude and trending velocity of the “sticky inflation” problem is the rub here, as despite the current “peak inflation” potentials (I’ve heard that before), we remain nowhere near a “clear and convincing” directional shift back towards 2% target, which in-turn removes the Fed’s “timing optionality” of a “pivot” until a date which I believe comes much later than most market participants “want” to see.

In other words, how can the Fed possibly begin to signal any sort of approaching “easing” when headline CPI sits at 9.1%, versus “tight” labor markets, with the unemployment rate at 3.6% and NFP’s consistently printing over +400k of job adds a month…while wages are still growing, with Atlanta Fed Wage Growth Tracker at all-time highs of 6.7%…and recent consumer nominal spending data remaining “strong like bull”?

For this reason, I think tomorrow that you’re going to hear a pretty “on message” hawkishness from the Fed statement, where even the usually “balanced” Powell presser may even tilt nonchalantly hawkish as well…acknowledging obvious slowing growth, but rationalizing the Fed’s continued “pumping of the breaks” due to said Labor- and Wage- data remaining so strong, and at the headline inflation highs!

And it is this inability to prematurely “back down” from currently hawkish policy tone which will create a prolongued and uncomfortable “tension” for an Equities market which is instead clamoring for a sped-up resumption of the old “QE” muscle memory, based around this recent confidence in a return to the dreaded “bad is good” regime—where thanks to slowing data indicating “hard landing” recession risks are growing, a “recency bias” / conditioning which has seen central banks not just slash policy rates, but also commence large scale asset purchases, in the event of growth scares and / or “crisis” over the past decade plus period.

As a reminder, the Nomura Econ’s teams house view sees the Fed continuing to hike into Feb ’23, then pausing for approx 6 months thereafter, before actually “commencing” the dovish policy pivot in September ’23 via both cuts and an accelerated end to QT being pulled-forward in September ’23—which is a long ways-away

“Incoming data suggests inflation has become more entrenched relative to the Fed’s expectations.

As a result, we maintain our expectation for the Fed to raise rates by 100bp in July, up from the 75bp hike in June. The updated FOMC statement will likely acknowledge waning growth momentum. However, we believe Chair Powell will remain focused on inflation during the press conference and signal that additional rate increases are likely.

We maintain our expectation of another 50bp hike in September followed by three 25bp hikes in November, December and February – to a terminal rate of 3.75-4.00% – before rate cuts and an end to QT in September 2023.”

The market does not appear to be ready for any ‘less than uber-dovish’ surprise from The Fed tomorrow (in word or deed).