By Benjamin Picton, Senior Macro Strategist at Rabobank

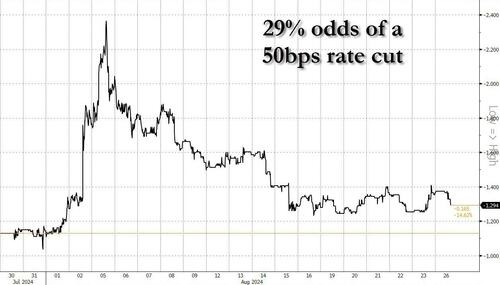

Speaking at the Jackson Hole Symposium on Friday evening, Jerome Powell confirmed the worst kept secret that the Fed is poised to deliver an interest rate cut in September. Powell said that “the time has come for policy to adjust”, but didn’t give any clues as to whether the first move would be the standard 25 basis points, or a supersized 50 basis point cut. Market pricing suggests that traders are unsure on that score. The OIS futures currently have 29bps priced in for September, which is near enough to a coin flip.

Early in his prepared remarks Powell noted that the cooling in the labor market was “unmistakable”. He suggested that the pace of hiring has slowed, the ratio of vacant jobs to unemployment (the Beveridge Curve) has returned to pre-pandemic levels and both hiring and quit rates also resemble the situation that prevailed prior to Covid19. In Powell’s estimation, “it seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

Powell says the economy is still growing at a “solid pace”, but he made it clear that the focus has now shifted from fighting inflation to the other side of the dual mandate: maximum employment. To whit, Powell said that upside risks to inflation have receded, but that the Fed does not “seek or welcome further cooling in labor market conditions.”

With clear signals of imminent easing, asset prices reacted in much the way that you would expect. The S&P500 closed 1.15% higher, the NASDAQ pumped 1.47%, 2-year Treasury yields fell 9bps, 10-year yields were down 5bps and both crude oil and gold prices firmed. The Bloomberg Dollar spot index was down by 0.78% on the day, producing a death cross on the chart as the 50 DMA moved below the 200 DMA.

Our own US Strategist, Philip Marey, recently updated his forecast on the path of Fed policy rates. Philip had previously tipped a cut in September followed by another in December and two more in the first half of 2025. Ahead of Powell’s speech, Philip revised this to bunch his four cuts into consecutive meetings (September, November, December and January) owing to the clear signs of labor market softening and our house view that the United States is trending toward recession, or at least a substantial downturn.

If that’s the case, you might be forgiven for wondering why we are sticking with just four 25bps cuts as our view when most estimates of a neutral nominal rate lay somewhere South of that. The reasoning behind our call is the considerable uncertainty about the political situation in Washington. Under a Trump win scenario the imposition of universal tariffs, tax cuts and strong government spending are likely to induce an inflationary boom that would hamper the Fed in cutting rates further. Under the Harris scenario of targeted tariffs, tax increases and strong government spending, the inflation impetus is likely to be weaker, which opens up the possibility of more cuts than we are currently tipping.

There is also the issue of the Middle East bubbling away in the background putting a cloud over supply-side progress. Israel announced over the weekend that it had launched pre-emptive strikes on up to 40 locations in Southern Lebanon where Hezbollah was believed to be preparing imminent rocket and drone launches. 100 Israeli warplanes were involved in the strikes and Israeli sources claim that the attack thwarted the launch of thousands of projectiles into Israeli territory.

Immediately following the Israeli attack, Hezbollah militants launched approximately 320 projectiles into Israel. An Israeli base just outside Tel Aviv appears to have been the main target. Reports suggest that most of the projectiles were intercepted by Israel’s ‘Iron Dome’ defence system, but Hezbollah leader Nasrallah went on TV late on Sunday to declare the assault a success, rubbish Israel’s claim that they had prevented “thousands” of projectiles being launched and suggest that Israeli sources are hiding the extent of their losses.

Despite the significant exchange of fire between the two belligerents, the events of the weekend may have helped to forestall the threat of regional war, at least in the short term. Hezbollah’s attack on Israel allows it to save face by claiming revenge for the assassination of Fuad Shukr several weeks ago, while the Israeli strike on Hezbollah rocket positions may have prevented civilian casualties that could have demanded a more severe response from Israel later on. At this stage, both sides are signalling limited appetite to escalate further as they remain wary of taking action that could lead to all-out war.

Consequently, markets have not reacted substantially to the news in early trade. However, it would be a mistake to think that the matter is now closed. Nasrallah warned that the events of the weekend were a “preliminary response” and that Hezbollah will “act accordingly” if they assess that the impact of that response was not “satisfactory”. We are also yet to see significant promised action from other members of the ‘Axis of Resistance’: Iran, the Houthis & Hamas. Their desire to extract a price from Israel and its allies is no secret at all.

By Benjamin Picton, Senior Macro Strategist at Rabobank

Speaking at the Jackson Hole Symposium on Friday evening, Jerome Powell confirmed the worst kept secret that the Fed is poised to deliver an interest rate cut in September. Powell said that “the time has come for policy to adjust”, but didn’t give any clues as to whether the first move would be the standard 25 basis points, or a supersized 50 basis point cut. Market pricing suggests that traders are unsure on that score. The OIS futures currently have 29bps priced in for September, which is near enough to a coin flip.

Early in his prepared remarks Powell noted that the cooling in the labor market was “unmistakable”. He suggested that the pace of hiring has slowed, the ratio of vacant jobs to unemployment (the Beveridge Curve) has returned to pre-pandemic levels and both hiring and quit rates also resemble the situation that prevailed prior to Covid19. In Powell’s estimation, “it seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

Powell says the economy is still growing at a “solid pace”, but he made it clear that the focus has now shifted from fighting inflation to the other side of the dual mandate: maximum employment. To whit, Powell said that upside risks to inflation have receded, but that the Fed does not “seek or welcome further cooling in labor market conditions.”

With clear signals of imminent easing, asset prices reacted in much the way that you would expect. The S&P500 closed 1.15% higher, the NASDAQ pumped 1.47%, 2-year Treasury yields fell 9bps, 10-year yields were down 5bps and both crude oil and gold prices firmed. The Bloomberg Dollar spot index was down by 0.78% on the day, producing a death cross on the chart as the 50 DMA moved below the 200 DMA.

Our own US Strategist, Philip Marey, recently updated his forecast on the path of Fed policy rates. Philip had previously tipped a cut in September followed by another in December and two more in the first half of 2025. Ahead of Powell’s speech, Philip revised this to bunch his four cuts into consecutive meetings (September, November, December and January) owing to the clear signs of labor market softening and our house view that the United States is trending toward recession, or at least a substantial downturn.

If that’s the case, you might be forgiven for wondering why we are sticking with just four 25bps cuts as our view when most estimates of a neutral nominal rate lay somewhere South of that. The reasoning behind our call is the considerable uncertainty about the political situation in Washington. Under a Trump win scenario the imposition of universal tariffs, tax cuts and strong government spending are likely to induce an inflationary boom that would hamper the Fed in cutting rates further. Under the Harris scenario of targeted tariffs, tax increases and strong government spending, the inflation impetus is likely to be weaker, which opens up the possibility of more cuts than we are currently tipping.

There is also the issue of the Middle East bubbling away in the background putting a cloud over supply-side progress. Israel announced over the weekend that it had launched pre-emptive strikes on up to 40 locations in Southern Lebanon where Hezbollah was believed to be preparing imminent rocket and drone launches. 100 Israeli warplanes were involved in the strikes and Israeli sources claim that the attack thwarted the launch of thousands of projectiles into Israeli territory.

Immediately following the Israeli attack, Hezbollah militants launched approximately 320 projectiles into Israel. An Israeli base just outside Tel Aviv appears to have been the main target. Reports suggest that most of the projectiles were intercepted by Israel’s ‘Iron Dome’ defence system, but Hezbollah leader Nasrallah went on TV late on Sunday to declare the assault a success, rubbish Israel’s claim that they had prevented “thousands” of projectiles being launched and suggest that Israeli sources are hiding the extent of their losses.

Despite the significant exchange of fire between the two belligerents, the events of the weekend may have helped to forestall the threat of regional war, at least in the short term. Hezbollah’s attack on Israel allows it to save face by claiming revenge for the assassination of Fuad Shukr several weeks ago, while the Israeli strike on Hezbollah rocket positions may have prevented civilian casualties that could have demanded a more severe response from Israel later on. At this stage, both sides are signalling limited appetite to escalate further as they remain wary of taking action that could lead to all-out war.

Consequently, markets have not reacted substantially to the news in early trade. However, it would be a mistake to think that the matter is now closed. Nasrallah warned that the events of the weekend were a “preliminary response” and that Hezbollah will “act accordingly” if they assess that the impact of that response was not “satisfactory”. We are also yet to see significant promised action from other members of the ‘Axis of Resistance’: Iran, the Houthis & Hamas. Their desire to extract a price from Israel and its allies is no secret at all.

Loading…