It was ugly in macro-land today with existing home sales crashing (as home prices hit record highs). But a couple of Regional Fed surveys really laid an egg...

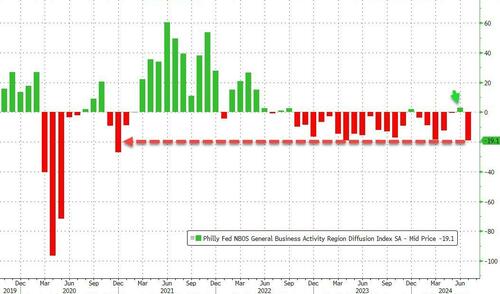

First out of the gate was the Philly Fed Services Activity Survey, which puked in July from two-year highs to near four-year lows...

Source: Bloomberg

The indexes for general activity at the firm level, new orders, and sales/revenues turned negative. The full-time employment index suggested a decline in employment, and prices are rising once again...

-

New orders fell to -7.1 vs 6.7

-

Sales fell to -3.5 vs 14.3

-

Prices paid rose to 30.2 vs 24.4

-

Full-time employment fell to -4.9 vs 14.6

-

Part-time employment fell to 4.0 vs 13.1

Of particular note was that the capital expenditures-equipment fell to 10.8 vs 24.5... not a great sign for the future of AI investment that is still supporting stocks.

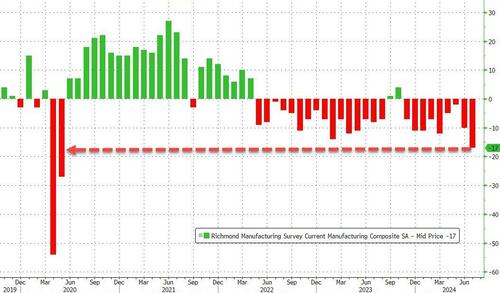

And it's not just Services, The Richmond Fed Manufacturing Survey crashed to -17 (the worst since the peak of the COVID lockdowns)...

Source: Bloomberg

And under the hood, it was even more of a shitshow...

-

Shipments fell to -21

-

New order volume slowed to -23

-

Order backlogs rose to -20

-

Capacity utilization slowed to -13

-

Inventory levels of finished goods increased to 20

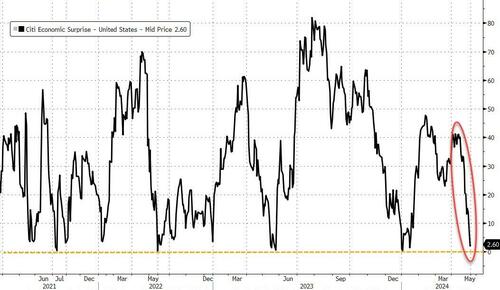

Overall, it's bad news as Bidenomics shits the bed...

Source: Bloomberg

We just cannot wait to hear what Harris has up her sleeve to 'fix' this...

It was ugly in macro-land today with existing home sales crashing (as home prices hit record highs). But a couple of Regional Fed surveys really laid an egg…

First out of the gate was the Philly Fed Services Activity Survey, which puked in July from two-year highs to near four-year lows…

Source: Bloomberg

The indexes for general activity at the firm level, new orders, and sales/revenues turned negative. The full-time employment index suggested a decline in employment, and prices are rising once again…

-

New orders fell to -7.1 vs 6.7

-

Sales fell to -3.5 vs 14.3

-

Prices paid rose to 30.2 vs 24.4

-

Full-time employment fell to -4.9 vs 14.6

-

Part-time employment fell to 4.0 vs 13.1

Of particular note was that the capital expenditures-equipment fell to 10.8 vs 24.5… not a great sign for the future of AI investment that is still supporting stocks.

And it’s not just Services, The Richmond Fed Manufacturing Survey crashed to -17 (the worst since the peak of the COVID lockdowns)…

Source: Bloomberg

And under the hood, it was even more of a shitshow…

-

Shipments fell to -21

-

New order volume slowed to -23

-

Order backlogs rose to -20

-

Capacity utilization slowed to -13

-

Inventory levels of finished goods increased to 20

Overall, it’s bad news as Bidenomics shits the bed…

Source: Bloomberg

We just cannot wait to hear what Harris has up her sleeve to ‘fix’ this…

Loading…