Oil prices are extending gains from yesterday after API's reported big crude and gasoline draws which supported earlier gains from comments by the Saudi oil minister on Tuesday warning oil short-sellers should "watch out" ahead of OPEC+'s ministerial meeting set for the first weekend of June.

"His comments highlighting growing unease (about) the weakness seen during the past month. Some of which has been driven by fresh short selling with the latest Commitment of Traders data showing short sellers have made a comeback. In the week to May 16 the combined gross short in WTI and Brent, held by money managers and Other Reportables reached a near two-year high at 233 million barrels, a 111 million barrel increase in the last five weeks and 40 million barrels higher than the gross short that was registered ahead of the April 2 production cut," Ole Hansen, head of commodity strategy at Saxo Bank, said in a post.

With US equity markets chilled by the reality of debt ceiling impasse, crude's next move is as likely driven by a sizable swing in inventories as by some irksome headline from Washington.

API

-

Crude -6.799mm (+700k exp)

-

Cushing +1.711mm

-

Gasoline -6.398mm (-1.3mm exp) - biggest draw since Sept 2021

-

Distillates -1.771mm (+300k exp)

DOE

-

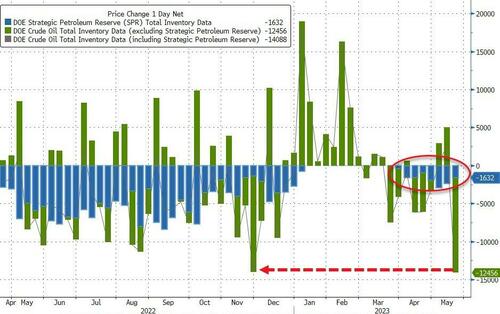

Crude -12.46mm (+700k exp) - biggest draw since Nov '22

-

Cushing +1.762mm

-

Gasoline -2.05mm (-1.3mm exp)

-

Distillates -561k (+300k exp)

The official data confirmed API but was far larger with a 12.5mm barrel crude draw - the biggest draw since Thanksgiving 2022...

Source: Bloomberg

For the 8th straight week, the Biden admin drew down from the SPR (1.6mm barrels)...

Source: Bloomberg

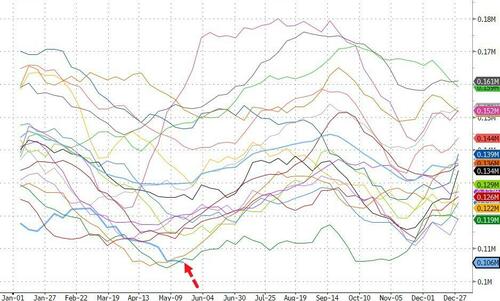

Gasoline stocks are at their lowest since 2014 for this time of year...

Source: Bloomberg

Distillate stocks are at their lowest seasonal level since 2005...

Source: Bloomberg

The drilling rig count has been in free-fall in recent weeks, recording the largest monthly decline since 2020 after plunging by 35 in just the last three weeks. Initially, declines were largely concentrated among gas rigs, but the slump has since spread into crude operators. As Bloomberg reports, US oil production has pinballed between 12.2 million and 12.3 million barrels a day since January, reflecting the stagnation in drilling activity that took hold in late 2022. A continued pullback in activity may result in a similar regression in crude output in the coming months, especially amid apparently waning productivity from shale wells, possibly snuffing out the chance to surpass pre-pandemic highs anytime soon.

Source: Bloomberg

WTI was hovering just above $74 ahead of the official data and extended gains after the print...

Traders betting on the possibility of a recession that would hurt oil demand are increasing “speculative managed money short positions,” McNally, a former White House official, says on daily podcast of Dubai consultancy Gulf Intelligence.

“This is what causes OPEC to want to get out in front of it with proactive cuts”

If necessary, OPEC+ “will come in again” to reduce production quotas further, McNally says.

More on positioning from Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle: Oil prices have felt the pressure of bearish trading positions by non-commercial players, but positive demand signals or additional action by OPEC+ could lead to a price spike. Gaps in US debt-ceiling negotiations and inflation concerns are an overhang on oil demand, but resilient gasoline consumption has supported physical oil markets.

Crude has retreated by about 9% so far this year as China’s lackluster recovery since the lifting of Covid restrictions with funds at their least bullish in decades based on CFTC data.

Oil prices are extending gains from yesterday after API’s reported big crude and gasoline draws which supported earlier gains from comments by the Saudi oil minister on Tuesday warning oil short-sellers should “watch out” ahead of OPEC+’s ministerial meeting set for the first weekend of June.

“His comments highlighting growing unease (about) the weakness seen during the past month. Some of which has been driven by fresh short selling with the latest Commitment of Traders data showing short sellers have made a comeback. In the week to May 16 the combined gross short in WTI and Brent, held by money managers and Other Reportables reached a near two-year high at 233 million barrels, a 111 million barrel increase in the last five weeks and 40 million barrels higher than the gross short that was registered ahead of the April 2 production cut,” Ole Hansen, head of commodity strategy at Saxo Bank, said in a post.

With US equity markets chilled by the reality of debt ceiling impasse, crude’s next move is as likely driven by a sizable swing in inventories as by some irksome headline from Washington.

API

-

Crude -6.799mm (+700k exp)

-

Cushing +1.711mm

-

Gasoline -6.398mm (-1.3mm exp) – biggest draw since Sept 2021

-

Distillates -1.771mm (+300k exp)

DOE

-

Crude -12.46mm (+700k exp) – biggest draw since Nov ’22

-

Cushing +1.762mm

-

Gasoline -2.05mm (-1.3mm exp)

-

Distillates -561k (+300k exp)

The official data confirmed API but was far larger with a 12.5mm barrel crude draw – the biggest draw since Thanksgiving 2022…

Source: Bloomberg

For the 8th straight week, the Biden admin drew down from the SPR (1.6mm barrels)…

Source: Bloomberg

Gasoline stocks are at their lowest since 2014 for this time of year…

Source: Bloomberg

Distillate stocks are at their lowest seasonal level since 2005…

Source: Bloomberg

The drilling rig count has been in free-fall in recent weeks, recording the largest monthly decline since 2020 after plunging by 35 in just the last three weeks. Initially, declines were largely concentrated among gas rigs, but the slump has since spread into crude operators. As Bloomberg reports, US oil production has pinballed between 12.2 million and 12.3 million barrels a day since January, reflecting the stagnation in drilling activity that took hold in late 2022. A continued pullback in activity may result in a similar regression in crude output in the coming months, especially amid apparently waning productivity from shale wells, possibly snuffing out the chance to surpass pre-pandemic highs anytime soon.

Source: Bloomberg

WTI was hovering just above $74 ahead of the official data and extended gains after the print…

Traders betting on the possibility of a recession that would hurt oil demand are increasing “speculative managed money short positions,” McNally, a former White House official, says on daily podcast of Dubai consultancy Gulf Intelligence.

“This is what causes OPEC to want to get out in front of it with proactive cuts”

If necessary, OPEC+ “will come in again” to reduce production quotas further, McNally says.

More on positioning from Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle: Oil prices have felt the pressure of bearish trading positions by non-commercial players, but positive demand signals or additional action by OPEC+ could lead to a price spike. Gaps in US debt-ceiling negotiations and inflation concerns are an overhang on oil demand, but resilient gasoline consumption has supported physical oil markets.

Crude has retreated by about 9% so far this year as China’s lackluster recovery since the lifting of Covid restrictions with funds at their least bullish in decades based on CFTC data.

Loading…