Oil prices extended their recent plunge (to five-month lows) overnight following across-the-board inventory builds reported by API (especially at the Cushing hub). This morning's weak ADP report added more selling pressure (demand anxiety building on China concerns) as supply soars with US oil exports near record highs amid record high domestic crude production flooding the market, overshadowing Saudi Arabia’s pledges that OPEC+ will deliver on its planned production cuts.

Non-OPEC countries are driving oil production growth, with the US, Brazil and Guyana contributing 1.4 million barrels per day, 0.43 million b/d and 0.2 million b/d, respectively. In 2024, the increase in non-OPEC production is likely to be in the range of 2 million b/d, according to ANZ Bank.

Will the official data confirm API's bearish builds?

API

-

Crude +594k (-1.00mm exp)

-

Cushing +4.28mm - biggest build since April 2020

-

Gasoline +2.83mm (+700k exp)

-

Distillates +890k (+1.00mm exp)

DOE

-

Crude -4.63mm (-1.00mm exp) - biggest draw in 3 months

-

Cushing +1.83mm

-

Gasoline +5.42mm (+700k exp)

-

Distillates +1.27mm (+1.00mm exp)

Flipping the script on API's data, the official DOE data shows a large 4.6mm barrel crude draw - the biggest in 3 months. Cushing stocks increased for the seventh straight week and products also saw builds...

Source: Bloomberg

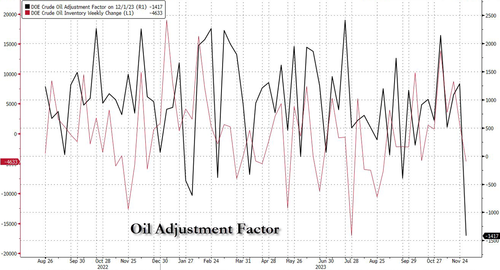

This occurred amid a massive negative 'adjustment'...

Source: Bloomberg

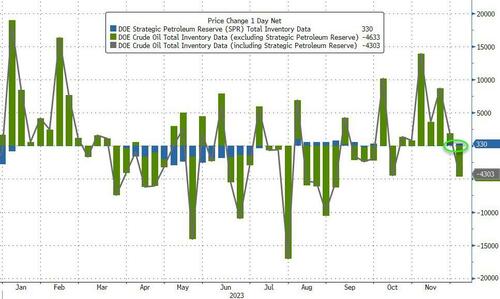

For the second week in a row, the Biden admin added crude to the SPR (+330k barrels)...

Source: Bloomberg

Cushing stocks rose to their highest since August...

Source: Bloomberg

US Crude production actually declined by 100k b/d - the first weekly drop since July...

Source: Bloomberg

WTI was hovering just above $70.50 ahead of the official data and extended losses after (despite the crude draw and production cut)...

If OPEC+ cuts achieve complete compliance, global stockpiles would decline by less than 350k b/d in 1H 2024 and 700k b/d for next year, RBC Capital Markets analysts said in a Dec. 3 note.

“We are re-entering a supply driven market, one that more closely resembles the decade leading into Covid-19 rather than the demand-led market seen in the post-pandemic era. And those types are markets are often fraught with bull traps”

Prices will likely remain volatile and potentially directionless until the market sees clear data points pertaining to the voluntary output cuts, analysts including Michael Tran said.

WTI's at 5-month lows...

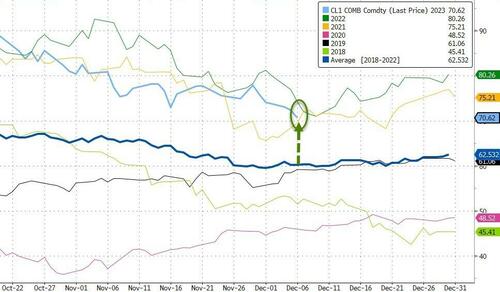

But we do point out that this is around the same price it was at this time of year in 2022 and 2021 (still significantly above the 5 year average)...

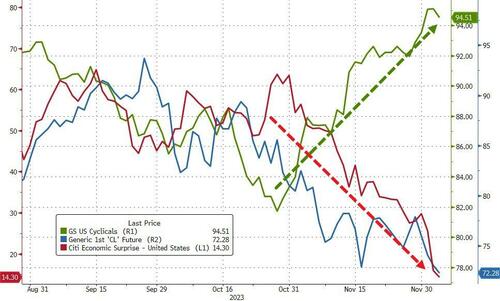

It's also worth noting that oil prices are drastically decoupled from cyclical stocks...

So, who's guessing right on growth?

Oil prices extended their recent plunge (to five-month lows) overnight following across-the-board inventory builds reported by API (especially at the Cushing hub). This morning’s weak ADP report added more selling pressure (demand anxiety building on China concerns) as supply soars with US oil exports near record highs amid record high domestic crude production flooding the market, overshadowing Saudi Arabia’s pledges that OPEC+ will deliver on its planned production cuts.

Non-OPEC countries are driving oil production growth, with the US, Brazil and Guyana contributing 1.4 million barrels per day, 0.43 million b/d and 0.2 million b/d, respectively. In 2024, the increase in non-OPEC production is likely to be in the range of 2 million b/d, according to ANZ Bank.

Will the official data confirm API’s bearish builds?

API

-

Crude +594k (-1.00mm exp)

-

Cushing +4.28mm – biggest build since April 2020

-

Gasoline +2.83mm (+700k exp)

-

Distillates +890k (+1.00mm exp)

DOE

-

Crude -4.63mm (-1.00mm exp) – biggest draw in 3 months

-

Cushing +1.83mm

-

Gasoline +5.42mm (+700k exp)

-

Distillates +1.27mm (+1.00mm exp)

Flipping the script on API’s data, the official DOE data shows a large 4.6mm barrel crude draw – the biggest in 3 months. Cushing stocks increased for the seventh straight week and products also saw builds…

Source: Bloomberg

This occurred amid a massive negative ‘adjustment’…

Source: Bloomberg

For the second week in a row, the Biden admin added crude to the SPR (+330k barrels)…

Source: Bloomberg

Cushing stocks rose to their highest since August…

Source: Bloomberg

US Crude production actually declined by 100k b/d – the first weekly drop since July…

Source: Bloomberg

WTI was hovering just above $70.50 ahead of the official data and extended losses after (despite the crude draw and production cut)…

If OPEC+ cuts achieve complete compliance, global stockpiles would decline by less than 350k b/d in 1H 2024 and 700k b/d for next year, RBC Capital Markets analysts said in a Dec. 3 note.

“We are re-entering a supply driven market, one that more closely resembles the decade leading into Covid-19 rather than the demand-led market seen in the post-pandemic era. And those types are markets are often fraught with bull traps”

Prices will likely remain volatile and potentially directionless until the market sees clear data points pertaining to the voluntary output cuts, analysts including Michael Tran said.

WTI’s at 5-month lows…

But we do point out that this is around the same price it was at this time of year in 2022 and 2021 (still significantly above the 5 year average)…

It’s also worth noting that oil prices are drastically decoupled from cyclical stocks…

So, who’s guessing right on growth?

Loading…