Oil prices are slightly lower this morning, but bouncing back from further weakness overnight that extended from API's report of an unexpected crude inventory build. After a four-day rampage higher by over 6%, a pause ahead of The Fed is somewhat expected and for now, WTI remains supported by technicals (above its 200DMA).

“The latest US inventory data was uninspiring” as traders were looking for signs of broader tightness in the market, Staunovo said. “A Fed hike is fully priced in, and traders will be looking more to the guidance” on potential future rate increases, he said.

If the official data confirms API's build, we could see WTI extend losses today.

API

-

Crude +1.319mm (-2.2mm exp)

-

Cushing -2.34mm

-

Gasoline -1.043mm (-1.7mm exp)

-

Distillates +1.614mm (-600k exp)

DOE

-

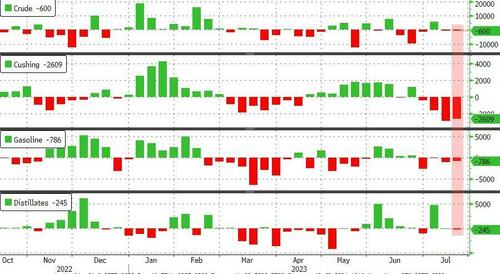

Crude -600k (-2.2mm exp)

-

Cushing -2.6mm

-

Gasoline -786k (-1.7mm exp)

-

Distillates -245k (-600k exp)

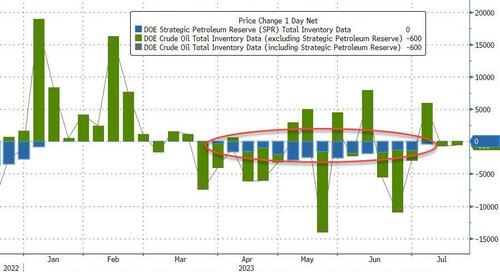

The official data did not confirm API's build, instead seeing a small 600k barrel draw (less than the expected 2.2mm drop). Inventories also dropped at the Cushing hub and in products...

Source: Bloomberg

Before we move on - we have to share the farce that this data has become. The so-called 'adjustment factor' that DOE uses was a record upward adjustment this week...

Source: Bloomberg

For the second week in a row, the Biden admin did not drain the SPR (in fact it was unchanged)...

Source: Bloomberg

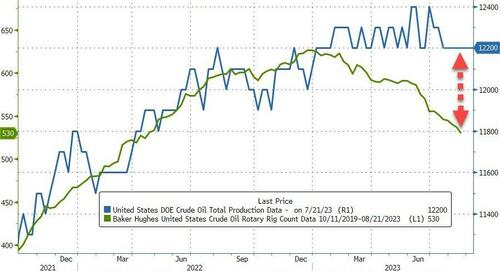

US Crude Production was flat on the week, near cycle highs, and increasingly divergent from the tumbling rig counts...

Source: Bloomberg

WTI was ramping higher - above $79.50 - before the official data and are leaking lower after...

Crude has pushed higher in July as supply cuts from OPEC+ heavyweights Saudi Arabia and Russia take hold. Markets may already be facing a deficit, according to Giovanni Staunovo, a commodities analyst at UBS Group AG.

Oil prices are slightly lower this morning, but bouncing back from further weakness overnight that extended from API’s report of an unexpected crude inventory build. After a four-day rampage higher by over 6%, a pause ahead of The Fed is somewhat expected and for now, WTI remains supported by technicals (above its 200DMA).

“The latest US inventory data was uninspiring” as traders were looking for signs of broader tightness in the market, Staunovo said. “A Fed hike is fully priced in, and traders will be looking more to the guidance” on potential future rate increases, he said.

If the official data confirms API’s build, we could see WTI extend losses today.

API

-

Crude +1.319mm (-2.2mm exp)

-

Cushing -2.34mm

-

Gasoline -1.043mm (-1.7mm exp)

-

Distillates +1.614mm (-600k exp)

DOE

The official data did not confirm API’s build, instead seeing a small 600k barrel draw (less than the expected 2.2mm drop). Inventories also dropped at the Cushing hub and in products…

Source: Bloomberg

Before we move on – we have to share the farce that this data has become. The so-called ‘adjustment factor’ that DOE uses was a record upward adjustment this week…

Source: Bloomberg

For the second week in a row, the Biden admin did not drain the SPR (in fact it was unchanged)…

Source: Bloomberg

US Crude Production was flat on the week, near cycle highs, and increasingly divergent from the tumbling rig counts…

Source: Bloomberg

WTI was ramping higher – above $79.50 – before the official data and are leaking lower after…

Crude has pushed higher in July as supply cuts from OPEC+ heavyweights Saudi Arabia and Russia take hold. Markets may already be facing a deficit, according to Giovanni Staunovo, a commodities analyst at UBS Group AG.

Loading…