By Hideyuki Sano, Bloomberg markets live reporter and strategist

The conventional wisdom in the Japanese market that a cheaper yen benefits exporters and boosts share prices has been turned on its head.

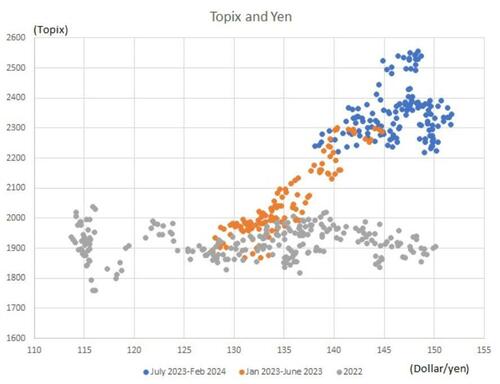

In reality, the yen’s exchange rate is having less and less of a bearing on Japanese stocks. The correlation between the Topix index and the dollar/yen rate since July has been 0.23, a level statisticians would judge as pretty weak. The link between the yen and the Nikkei 225 during the same period is even slightly negative.

The chart below illustrates the point. Blue dots show where the yen and the Topix were each day since July. When Japan’s currency was at 150 against the dollar, the Topix was lower. In 2022 the Topix hardly reacted to the yen’s exchange rate, stuck mostly between 1,800 and 2,000, as shown by the gray dots.

The relations between the dollar/yen and the Topix since 2022.

The loss of connection between the yen and share prices is no surprise given how Japanese exporters have changed. Successful companies such as Sony Group Corp. and Hitachi Ltd. have long ditched their old models of exporting goods manufactured in Japan, making their business more global and diversified.

“Some people say a cheap yen will benefit exporters, but the impact of that is very limited after the hollowing-out of the domestic manufacturing base,” said Seiya Nakajima, visiting professor of international finance at Fukui Prefectural University.

The only period when the Topix appeared to be correlated to the yen is the first half of 2023, (shown by the orange dots), with the index higher when the currency was cheaper.

But the connection appears tenuous: during that period Japanese shares had their own drivers, such as Warren Buffett’s investment in trading firms as well as hopes about corporate governance improvements, suggesting any boost from the yen was secondary.

Hitachi’s earnings before interest, taxes and amortization increased by just ¥200 million ($1.3 million) for each one yen depreciation against the dollar. As for Sony, the net impact of yen moves on its earnings is relatively limited.

For many chip-related companies, the outlook for that sector overseas as well as the global economy has a far-larger impact than the foreign-exchange rate. Against this backdrop, the correlation between the dollar/yen rate and the Topix Electronics Appliance index - the biggest segment of the stock market with a 17% weighting - has decreased since the pandemic.

This isn’t to say that a cheaper yen has no benefit. It still brings currency translation gains for Japanese companies’ earnings on big overseas sales. Automaker shares continue to have a strong correlation with the yen as they export a lot of vehicles. While that weakened in 2022 when chip shortages hobbled their output, the link between Japanese carmakers and the yen came back last year.

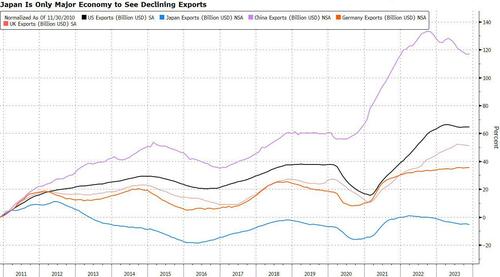

Still, automakers account for just 9% of the Topix. And the perception that Japan’s economy is export-driven also needs a reality check. Japan’s exports have stagnated so much over the past decade in part due to a production shift abroad and the loss of competitiveness. It’s the only major economy that saw exports decline over the last decade.

It’s little wonder, then, investors don’t buy Japanese stocks just because the yen is cheap.

By Hideyuki Sano, Bloomberg markets live reporter and strategist

The conventional wisdom in the Japanese market that a cheaper yen benefits exporters and boosts share prices has been turned on its head.

In reality, the yen’s exchange rate is having less and less of a bearing on Japanese stocks. The correlation between the Topix index and the dollar/yen rate since July has been 0.23, a level statisticians would judge as pretty weak. The link between the yen and the Nikkei 225 during the same period is even slightly negative.

The chart below illustrates the point. Blue dots show where the yen and the Topix were each day since July. When Japan’s currency was at 150 against the dollar, the Topix was lower. In 2022 the Topix hardly reacted to the yen’s exchange rate, stuck mostly between 1,800 and 2,000, as shown by the gray dots.

The relations between the dollar/yen and the Topix since 2022.

The loss of connection between the yen and share prices is no surprise given how Japanese exporters have changed. Successful companies such as Sony Group Corp. and Hitachi Ltd. have long ditched their old models of exporting goods manufactured in Japan, making their business more global and diversified.

“Some people say a cheap yen will benefit exporters, but the impact of that is very limited after the hollowing-out of the domestic manufacturing base,” said Seiya Nakajima, visiting professor of international finance at Fukui Prefectural University.

The only period when the Topix appeared to be correlated to the yen is the first half of 2023, (shown by the orange dots), with the index higher when the currency was cheaper.

But the connection appears tenuous: during that period Japanese shares had their own drivers, such as Warren Buffett’s investment in trading firms as well as hopes about corporate governance improvements, suggesting any boost from the yen was secondary.

Hitachi’s earnings before interest, taxes and amortization increased by just ¥200 million ($1.3 million) for each one yen depreciation against the dollar. As for Sony, the net impact of yen moves on its earnings is relatively limited.

For many chip-related companies, the outlook for that sector overseas as well as the global economy has a far-larger impact than the foreign-exchange rate. Against this backdrop, the correlation between the dollar/yen rate and the Topix Electronics Appliance index – the biggest segment of the stock market with a 17% weighting – has decreased since the pandemic.

This isn’t to say that a cheaper yen has no benefit. It still brings currency translation gains for Japanese companies’ earnings on big overseas sales. Automaker shares continue to have a strong correlation with the yen as they export a lot of vehicles. While that weakened in 2022 when chip shortages hobbled their output, the link between Japanese carmakers and the yen came back last year.

Still, automakers account for just 9% of the Topix. And the perception that Japan’s economy is export-driven also needs a reality check. Japan’s exports have stagnated so much over the past decade in part due to a production shift abroad and the loss of competitiveness. It’s the only major economy that saw exports decline over the last decade.

It’s little wonder, then, investors don’t buy Japanese stocks just because the yen is cheap.

Loading…