With the yen plummeting earlier today, after the BOJ decided to keep its YCC and abandon the yen to its collapsing fate, we said that the BOJ better intervene soon or all hell would break loose:

USDJPY 145.25. BOJ better step in or it's about to get real

— zerohedge (@zerohedge) September 22, 2022

Two hours later, the BOJ has done just that, and after warning earlier in the session of "stealth intervention", it decided to finally put money where its endlessly big mouth is with the first Japanese FX intervention in 24 years that was anything but stealth:

- The Japanese government intervened in the foreign exchange market to prop up the yen, the country’s top currency official Masato Kanda says.

- Kanda, vice finance minister for international affairs, spoke to reporters after the yen climbed sharply against the dollar, erasing most of its decline following the Bank of Japan’s decision to maintain ultra-easy monetary policy

- Kanda says Japan took “bold action” in markets

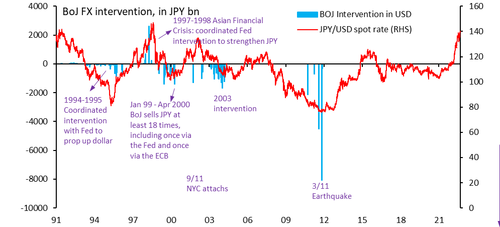

Here a quick primer: in Japan, FX interventions are carried out by the Bank of Japan on behalf of the Ministry of Finance. The last time Japan intervened to sell dollars and buy yen in June 1998 at the height of the Asian currency crisis, while the last time officials stepped into markets to sell yen to weaken the currency was in November 2011.

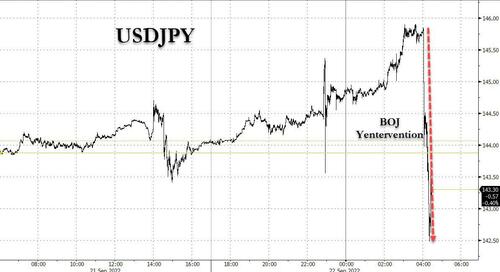

In kneejerk response, the Yen predictably soared, jumping as much as 1.1% as the USDJPY collapsed by a whopping 300 pips from 145.50 to 142.50!

It now appears that the new market level which the BOJ is comfortable with is around 143. However, now that the BOJ has fired its yentervention bazooka, with fundamentals screaming for a far weaker yen for years to come, especially with Kuroda stating that there will be no change in policy for at least two years...

- *BOJ'S KURODA: NO NEED TO CHANGE GUIDANCE FOR 2 OR 3 YEARS

... as the BOJ has no choice but to prop up the YCC while ignoring the collapse in the yen, it is only a matter of time before this BOJ/MOF intervention fizzles, as have all previous attempts to contain the USDJPY through direct currency intervention...

... and the yen resumes its march toward 150, then 200 and so on, on its irreversible way to the scrapheap of MMT-destroyed currencies.

In kneejerk response, we said that while the BOJ panic may prop up the JPY for a few weeks, only a coordinated intervention has any chance of a sustained response.

BOJ intervention which will fail in weeks if not days, has cemented the case for Plaza 2.0

— zerohedge (@zerohedge) September 22, 2022

And sure enough, the Oversea-Chinese Banking Corp. agrees with us, writing that Japan’s intervention to prop up the yen will have more impact if the move is coordinated with other central banks. “The move may still wow markets because they are doing it to buy JPY for the first time in more than 20 years,” says Christopher Wong, a currency strategist at OCBC, adding that "based on historical observation of BOJ intervention, JPY typically moves between 3% and 5% in the direction of intervention and the impact is more pronounced within the first 48 hours.”

But as we also said, “while intervention may slow the pace of JPY depreciation, the move alone is not likely to alter the underlying trend unless USD, UST yields turn lower or the BOJ changes/tweaks its monetary policy. Instead, “at best, their action can help to slow the pace of JPY depreciation.”

An analysis by Bloomberg echoes our skepticism: they write that historically, the yen boost post intervention is likely to endure over a 1-week horizon. However, the effect will diminish soon after -- even with repeated yen buying. A study of 5 distinct historical intervention periods shows:

- USD/JPY dived in the week following intervention, and by an average of 1.7%, with the trade-weighted exchange rate up 2.6%

- But, that was it. The average peak impact occurred after one week

- A month later, the effect had waned, even with follow-up interventions. One-month trade-weighted changes averaged 1.7%. That is, the yen had declined 0.9% on average between 1-week and 1-month

Translation: USDJPY 150 and much more is now guaranteed, even if the time to reach it is delayed by one or two weeks.

With the yen plummeting earlier today, after the BOJ decided to keep its YCC and abandon the yen to its collapsing fate, we said that the BOJ better intervene soon or all hell would break loose:

USDJPY 145.25. BOJ better step in or it’s about to get real

— zerohedge (@zerohedge) September 22, 2022

Two hours later, the BOJ has done just that, and after warning earlier in the session of “stealth intervention”, it decided to finally put money where its endlessly big mouth is with the first Japanese FX intervention in 24 years that was anything but stealth:

- The Japanese government intervened in the foreign exchange market to prop up the yen, the country’s top currency official Masato Kanda says.

- Kanda, vice finance minister for international affairs, spoke to reporters after the yen climbed sharply against the dollar, erasing most of its decline following the Bank of Japan’s decision to maintain ultra-easy monetary policy

- Kanda says Japan took “bold action” in markets

Here a quick primer: in Japan, FX interventions are carried out by the Bank of Japan on behalf of the Ministry of Finance. The last time Japan intervened to sell dollars and buy yen in June 1998 at the height of the Asian currency crisis, while the last time officials stepped into markets to sell yen to weaken the currency was in November 2011.

In kneejerk response, the Yen predictably soared, jumping as much as 1.1% as the USDJPY collapsed by a whopping 300 pips from 145.50 to 142.50!

It now appears that the new market level which the BOJ is comfortable with is around 143. However, now that the BOJ has fired its yentervention bazooka, with fundamentals screaming for a far weaker yen for years to come, especially with Kuroda stating that there will be no change in policy for at least two years…

- *BOJ’S KURODA: NO NEED TO CHANGE GUIDANCE FOR 2 OR 3 YEARS

… as the BOJ has no choice but to prop up the YCC while ignoring the collapse in the yen, it is only a matter of time before this BOJ/MOF intervention fizzles, as have all previous attempts to contain the USDJPY through direct currency intervention…

… and the yen resumes its march toward 150, then 200 and so on, on its irreversible way to the scrapheap of MMT-destroyed currencies.

In kneejerk response, we said that while the BOJ panic may prop up the JPY for a few weeks, only a coordinated intervention has any chance of a sustained response.

BOJ intervention which will fail in weeks if not days, has cemented the case for Plaza 2.0

— zerohedge (@zerohedge) September 22, 2022

And sure enough, the Oversea-Chinese Banking Corp. agrees with us, writing that Japan’s intervention to prop up the yen will have more impact if the move is coordinated with other central banks. “The move may still wow markets because they are doing it to buy JPY for the first time in more than 20 years,” says Christopher Wong, a currency strategist at OCBC, adding that “based on historical observation of BOJ intervention, JPY typically moves between 3% and 5% in the direction of intervention and the impact is more pronounced within the first 48 hours.”

But as we also said, “while intervention may slow the pace of JPY depreciation, the move alone is not likely to alter the underlying trend unless USD, UST yields turn lower or the BOJ changes/tweaks its monetary policy. Instead, “at best, their action can help to slow the pace of JPY depreciation.”

An analysis by Bloomberg echoes our skepticism: they write that historically, the yen boost post intervention is likely to endure over a 1-week horizon. However, the effect will diminish soon after — even with repeated yen buying. A study of 5 distinct historical intervention periods shows:

- USD/JPY dived in the week following intervention, and by an average of 1.7%, with the trade-weighted exchange rate up 2.6%

- But, that was it. The average peak impact occurred after one week

- A month later, the effect had waned, even with follow-up interventions. One-month trade-weighted changes averaged 1.7%. That is, the yen had declined 0.9% on average between 1-week and 1-month

Translation: USDJPY 150 and much more is now guaranteed, even if the time to reach it is delayed by one or two weeks.