By Charlie Zhu and Helen Sun, Bloomberg markets live reporters and strategists

Three things we learned last week:

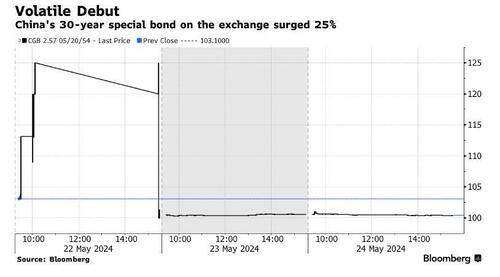

1. China’s first ultra-long special bonds had a dramatic debut in the exchange market, showcasing retail investors’ thirst for higher yields. The 30-year notes were expected to have a lackluster listing on Wednesday. Instead, the price hit limit-up twice in Shanghai, rising as much as 25%, before paring most of the gains toward the end of the day.

True, thin liquidity is a major cause of the unexpected volatility. The exchange market is much more illiquid than the interbank market, where most of the onshore notes are deposited. Still, it reflected households’ thirst for higher returns as products that yield more than 3% with relatively low risks have become rare.

And it’s not just retail investors. In a similar auction of 20-year debt Friday, the bid-to-cover ratio climbed to the highest level since Bloomberg started compiling the data in 2005. This signaled institutional investors are also seeking higher yields by extending duration.

The supply of ultra-long bonds is poised to expand meaningfully in coming months. They’re expected to be among the most actively traded products in the bond market, thanks to demand from both retail and professional investors, economists led by Liu Yu at Huaxi Securities Co. wrote in a note.

2. The huge outflow from deposits has also found its way into some corners of the stock market. A 3.9 trillion yuan ($538 billion) exodus from savings last month and a simultaneous jump in the outstanding value of wealth management products sparked speculation that at least some of the money will go into equities.

That appears to have benefited only some safer shares. The Shanghai Stock Exchange Dividend Index is close to its highest level since 2021, and has risen 15% this year versus a 5% gain in the broader benchmark gauge.

Because the money is behaving in a risk-averse way it might also lead to swift market reversals, limiting any advances when there’s a lack of positive news flow. The onshore benchmark CSI 300 Index fell for the first time in six weeks last week as investors reaped profits.

3. China’s biggest tech companies are rushing to issue convertible bonds to finance their buybacks. Alibaba Group Holding Ltd. sold $4.5 billion of convertible bonds, a record dollar-denominated sale by an Asian company, after JD.com Inc. issued $1.75 billion of similar securities.

The companies are taking advantage of the current low costs of such debt, as well as increases in their share prices, to raise money for the stock repurchases. More tech names including Meituan and Tencent are seen as likely to follow suit.

By Charlie Zhu and Helen Sun, Bloomberg markets live reporters and strategists

Three things we learned last week:

1. China’s first ultra-long special bonds had a dramatic debut in the exchange market, showcasing retail investors’ thirst for higher yields. The 30-year notes were expected to have a lackluster listing on Wednesday. Instead, the price hit limit-up twice in Shanghai, rising as much as 25%, before paring most of the gains toward the end of the day.

True, thin liquidity is a major cause of the unexpected volatility. The exchange market is much more illiquid than the interbank market, where most of the onshore notes are deposited. Still, it reflected households’ thirst for higher returns as products that yield more than 3% with relatively low risks have become rare.

And it’s not just retail investors. In a similar auction of 20-year debt Friday, the bid-to-cover ratio climbed to the highest level since Bloomberg started compiling the data in 2005. This signaled institutional investors are also seeking higher yields by extending duration.

The supply of ultra-long bonds is poised to expand meaningfully in coming months. They’re expected to be among the most actively traded products in the bond market, thanks to demand from both retail and professional investors, economists led by Liu Yu at Huaxi Securities Co. wrote in a note.

2. The huge outflow from deposits has also found its way into some corners of the stock market. A 3.9 trillion yuan ($538 billion) exodus from savings last month and a simultaneous jump in the outstanding value of wealth management products sparked speculation that at least some of the money will go into equities.

That appears to have benefited only some safer shares. The Shanghai Stock Exchange Dividend Index is close to its highest level since 2021, and has risen 15% this year versus a 5% gain in the broader benchmark gauge.

Because the money is behaving in a risk-averse way it might also lead to swift market reversals, limiting any advances when there’s a lack of positive news flow. The onshore benchmark CSI 300 Index fell for the first time in six weeks last week as investors reaped profits.

3. China’s biggest tech companies are rushing to issue convertible bonds to finance their buybacks. Alibaba Group Holding Ltd. sold $4.5 billion of convertible bonds, a record dollar-denominated sale by an Asian company, after JD.com Inc. issued $1.75 billion of similar securities.

The companies are taking advantage of the current low costs of such debt, as well as increases in their share prices, to raise money for the stock repurchases. More tech names including Meituan and Tencent are seen as likely to follow suit.

Loading…