Authored by Simon White, Bloomberg macro strategist,

The widening gap between household employment and payrolls is causing concern the weaker message from the household survey is the more accurate. However, the reality probably lies somewhere in between, and the jobs market is not yet weak enough to justify significantly lower yields.

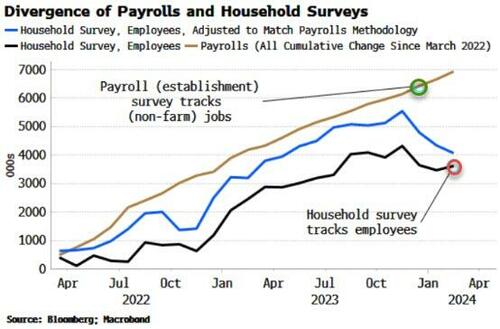

Jobs day has come round again and focus will be on the mounting difference between the number of jobs recorded by the household survey and the establishment survey, i.e. payrolls. The household data is looking increasingly weak, prompting speculation we are on the precipice of a jobs market that’s about to crack.

But there are reasons to think the household survey may be stronger than the data currently suggest, and also that payrolls may be weaker. Overall, that would mean the “true” state of the jobs market is somewhere in between the two surveys, i.e. this is a slowing jobs market, but not one that is going to trigger an imminent recession, nor corner the Federal Reserve into making near-term rate cuts.

1) The household survey may not be properly accounting for increased immigration. A recent Brookings paper posits that the survey may be using too a low an estimate for the civilian population. That would bias employment growth lower, and unemployment rates (both national and state) too high if the estimate of the size the workforce is too low.

2) The BLS adjusts the household data to take account of the differences between the two surveys (orange line in the chart above). This series is also showing weakness, leading to speculation that even payrolls data is inherently soft. But the very jobs taken out of the payrolls survey to make the adjustment (agriculture, the unincorporated self-employed, unpaid family workers in family-owned businesses) are among those that are predisposed to having a bias towards immigrants.

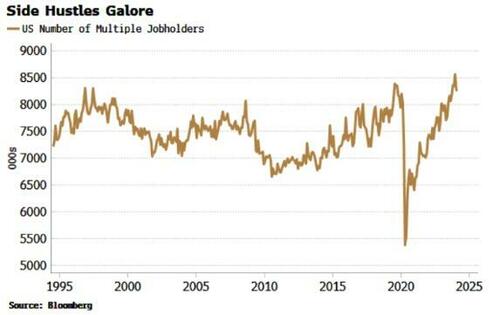

3) On the other hand, payrolls – as it tracks jobs rather than employees as with the household survey – is doing more double counting. The number of multiple job holders is at a 30-year high. Payrolls could thus fall more quickly than household employment when the labor-market decisively turns.

4) The birth-death adjustment for payrolls, to account for new and closed businesses, is making an unusually large contribution to the data, adding 2.8 million jobs since March 2022. That has happened at the same time as survey response rates have dropped notably since the pandemic. It’s conceivable the adjustment is flattering payrolls, and it will eventually be revised away.

Today’s data will shed some light (and probably some heat too), but we would need to see a decisive weakening in both surveys to justify a significant turn lower in yields.

Authored by Simon White, Bloomberg macro strategist,

The widening gap between household employment and payrolls is causing concern the weaker message from the household survey is the more accurate. However, the reality probably lies somewhere in between, and the jobs market is not yet weak enough to justify significantly lower yields.

Jobs day has come round again and focus will be on the mounting difference between the number of jobs recorded by the household survey and the establishment survey, i.e. payrolls. The household data is looking increasingly weak, prompting speculation we are on the precipice of a jobs market that’s about to crack.

But there are reasons to think the household survey may be stronger than the data currently suggest, and also that payrolls may be weaker. Overall, that would mean the “true” state of the jobs market is somewhere in between the two surveys, i.e. this is a slowing jobs market, but not one that is going to trigger an imminent recession, nor corner the Federal Reserve into making near-term rate cuts.

1) The household survey may not be properly accounting for increased immigration. A recent Brookings paper posits that the survey may be using too a low an estimate for the civilian population. That would bias employment growth lower, and unemployment rates (both national and state) too high if the estimate of the size the workforce is too low.

2) The BLS adjusts the household data to take account of the differences between the two surveys (orange line in the chart above). This series is also showing weakness, leading to speculation that even payrolls data is inherently soft. But the very jobs taken out of the payrolls survey to make the adjustment (agriculture, the unincorporated self-employed, unpaid family workers in family-owned businesses) are among those that are predisposed to having a bias towards immigrants.

3) On the other hand, payrolls – as it tracks jobs rather than employees as with the household survey – is doing more double counting. The number of multiple job holders is at a 30-year high. Payrolls could thus fall more quickly than household employment when the labor-market decisively turns.

4) The birth-death adjustment for payrolls, to account for new and closed businesses, is making an unusually large contribution to the data, adding 2.8 million jobs since March 2022. That has happened at the same time as survey response rates have dropped notably since the pandemic. It’s conceivable the adjustment is flattering payrolls, and it will eventually be revised away.

Today’s data will shed some light (and probably some heat too), but we would need to see a decisive weakening in both surveys to justify a significant turn lower in yields.

Loading…