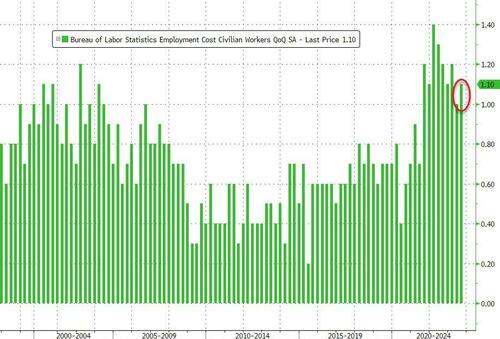

US employment costs unexpectedly accelerated in the third quarter, heightening concerns that a strong labor market risks keeping inflation above the Fed’s target.

The employment cost index, a broad gauge of wages and benefits, increased 1.1% in the July-to-September period (above the 1.0% rise expected) after rising 1% in the second quarter.

Source: Bloomberg

Compared with a year earlier, the ECI was up 4.3%, the smallest annual advance since the end of 2021. Still, that’s well above the typical pace seen in the years before the pandemic.

Source: Bloomberg

While wage growth picked up slightly within private industry, salaries at state and local governments surged.

Source: Bloomberg

We already knew this was happening...

Why oh why is wage/price inflation so sticky?

— zerohedge (@zerohedge) October 27, 2023

Well, it's not because of private workers: here wages and salaries rose just 3.9%, the lowest in 2.5 years.

It's all government workers, where wage growth was 7.8%, just shy of a record high! pic.twitter.com/v46KyqekMg

Bear in mind that while there are a number of other earnings metrics published more frequently - including average hourly earnings figures from the monthly jobs report - economists tend to prefer the ECI because it’s not distorted by shifts in the composition of employment among occupations or industries.

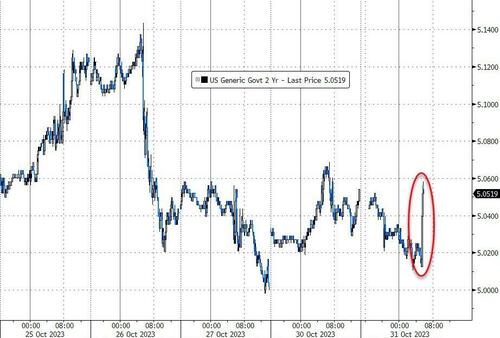

This prompted a spike higher across the yield curve with the short-end affected most...

Source: Bloomberg

Bidenomics and the Re-Inflation Reduction Act is buggering up The Fed's cunning plan.

US employment costs unexpectedly accelerated in the third quarter, heightening concerns that a strong labor market risks keeping inflation above the Fed’s target.

The employment cost index, a broad gauge of wages and benefits, increased 1.1% in the July-to-September period (above the 1.0% rise expected) after rising 1% in the second quarter.

Source: Bloomberg

Compared with a year earlier, the ECI was up 4.3%, the smallest annual advance since the end of 2021. Still, that’s well above the typical pace seen in the years before the pandemic.

Source: Bloomberg

While wage growth picked up slightly within private industry, salaries at state and local governments surged.

Source: Bloomberg

We already knew this was happening…

Why oh why is wage/price inflation so sticky?

Well, it’s not because of private workers: here wages and salaries rose just 3.9%, the lowest in 2.5 years.

It’s all government workers, where wage growth was 7.8%, just shy of a record high! pic.twitter.com/v46KyqekMg

— zerohedge (@zerohedge) October 27, 2023

Bear in mind that while there are a number of other earnings metrics published more frequently – including average hourly earnings figures from the monthly jobs report – economists tend to prefer the ECI because it’s not distorted by shifts in the composition of employment among occupations or industries.

This prompted a spike higher across the yield curve with the short-end affected most…

Source: Bloomberg

Bidenomics and the Re-Inflation Reduction Act is buggering up The Fed’s cunning plan.

Loading…