While we previously shared a detailed FOMC preview, below we excerpt from the Fed preview by Bloomberg Markets Live reporter and strategist Ven Ram, who breaks down his analysis in three parts: i) what traders are watching from the Fed today, ii) what the FOMC statement may look like, and iii) the Fed's dot plot options.

Starting at the top, here is...

What Traders Are Watching From The Fed Today

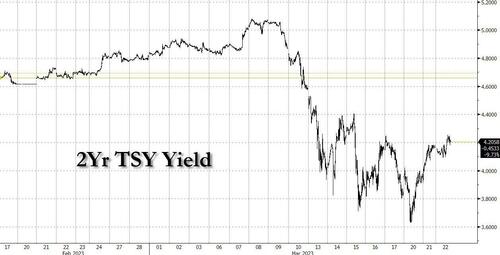

Treasury two-year yields have bobbed almost 150 basis points in their range since the Federal Reserve met last month, enough to give any roller-coaster ride a run for its money. They are still looking for a definitive direction, and today’s Fed decision holds the key.

Decision & dissent:

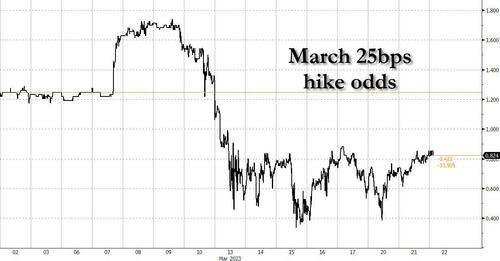

- As of the close on Tuesday, overnight indexed swaps were factoring in slightly more than a 80% chance of a 25-basis point increase. While the tail risk of the Fed standing pat isn’t insignificant for the first time in the current cycle, given that we haven’t had any media leaks yet from the Fed’s trusted sources to steer the markets away from pricing a hike, we should perhaps expect the central bank to follow through

- And like the European Central Bank, Chair Jerome Powell may be inclined to think there is no trade-off between financial and price stability

- The Fed entered its traditional quiet period just as the crisis at Silicon Valley Bank was boiling over, so we don’t quite know if all policymakers will be on the same page when it comes to Wednesday’s decision. Still, there are clues from the Fed’s December dot plot, which showed that two of 19 members had penciled in a top rate of 5%. The question then is what those two think in light of the crisis

- Should the Fed, however, hold, long-dated Treasuries will rally big

Dot plot:

- The FOMC will likely envision 50 more basis points of tightening over and above Wednesday’s move to primarily drive home two points: a) that the Fed believes that the financial landscape isn’t as broken as the markets reckon; and b) the Fed isn’t shifting its focus away from inflation

Summary of Economic Projections:

- Given the adverse impact of the tumult in the banking sector, it’s likely that the Fed will revise its growth forecast for this year lower, possibly by a notch to 0.4% from 0.5%, while leaving the estimate for the jobless rate at 4.6%

- Bloomberg Economics expects that core PCE inflation will be revised higher to 3.7% from 3.5% and to 2.7% for next year from 2.5% now

Powell’s Pyrotechnics:

- Should the Fed go through with the hike, Chair Jerome Powell will doubtless face a barrage of questions on whether:

- The FOMC is hiking rates into a hard landing. His likely response: The Fed sees the economy losing momentum, but given the tightness of the labor market, the FOMC hopes any blip will be transitory

- What he makes of the market pricing on rate cuts down the line. Powell may say that inflation remains the Fed’s central focus and he doesn’t expect the current tumult in the banking landscape to spill over into the wider economy in light of the backstop that has already been put in place and other measures taken to shore up confidence.

Here’s What the Fed Statement May Look

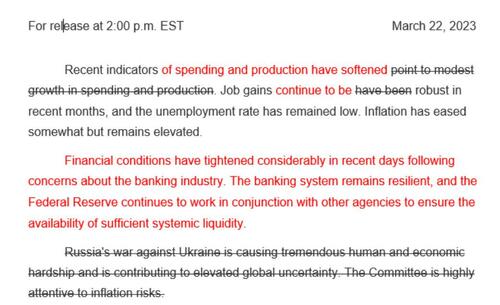

The Fed faces the unenviable prospect of having to craft a policy statement at a time when it is still coming to grips with a banking crisis and its fallout on the wider economy. In light of the recent market tumult, revisions to the statement will be the most extensive in a long while.

The top:

- There are two ways the Fed could go about changing its preamble. It may start off with its time-tested boilerplate on recent macroeconomic inputs — that is, spending, production and the jobs market — before moving on to acknowledge the recent stress in the banking sector.

- The second way would be to acknowledge the latter right off the bat, at the very top. This choice may suggest that the Fed is placing greater weight on financial stability and what that implies for the broader economy.

Rate increase:

- Though it’s a close call, the Fed may opt to raise rates by 25 basis points to signal that it is still intent on battling inflation and also that it views the recent market stress as temporary:

- As reminder, JPMorgan disagrees with Ram here and as we noted last night, the bank's economist Michael Feroli expects the Fed's forward guidance to drop the phrase “ongoing increases…will be appropriate” and substitute language which will indicate that the bias is toward further tightening

Dissent:

- It is possible that the Fed may acknowledge that there two-way risks in the economy. However, the markets may interpret such a clause to mean that the Fed is willing to cut rates, so the FOMC may open a Pandora’s box in doing so

- FOMC members Lisa Cook and Austan Goolsbee are dovish in their leanings, and either or both of them may vote in favor of a pause

What About The Dot Plot

The Fed’s dot plot could broadly go one of three ways today:

Option I: Cop-out

- The Fed could simply not do a dot plot, a reprisal of what happened in March 2020. However, that would end up alarming the markets, and seems unlikely.

Option II: The Dovish Choice

- This is one where Fed policymakers stick to the same dot plot as the one they unveiled in December — that is, one that shows the Fed funds rate topping at 5.125%. That would mean one more 25- basis point increase assuming the Fed raises rates by a similar margin today

- In the light of recent inflation and jobs market data, that would be dovish — but one that acknowledges the recent tightening in financial conditions

Option III: Dovish & Hawkish Simultaneously

- In this scenario, the median of policymakers will pencil in a top rate of 5.375%. In effect they would reckon that the Fed has more work to do on inflation in light of recent macroeconomic data

- While it may look hawkish given the market jitters, there is perhaps little question that the dot plot would have been even more ambitious were it not for the tumult in the banking industry

While we previously shared a detailed FOMC preview, below we excerpt from the Fed preview by Bloomberg Markets Live reporter and strategist Ven Ram, who breaks down his analysis in three parts: i) what traders are watching from the Fed today, ii) what the FOMC statement may look like, and iii) the Fed’s dot plot options.

Starting at the top, here is…

What Traders Are Watching From The Fed Today

Treasury two-year yields have bobbed almost 150 basis points in their range since the Federal Reserve met last month, enough to give any roller-coaster ride a run for its money. They are still looking for a definitive direction, and today’s Fed decision holds the key.

Decision & dissent:

- As of the close on Tuesday, overnight indexed swaps were factoring in slightly more than a 80% chance of a 25-basis point increase. While the tail risk of the Fed standing pat isn’t insignificant for the first time in the current cycle, given that we haven’t had any media leaks yet from the Fed’s trusted sources to steer the markets away from pricing a hike, we should perhaps expect the central bank to follow through

- And like the European Central Bank, Chair Jerome Powell may be inclined to think there is no trade-off between financial and price stability

- The Fed entered its traditional quiet period just as the crisis at Silicon Valley Bank was boiling over, so we don’t quite know if all policymakers will be on the same page when it comes to Wednesday’s decision. Still, there are clues from the Fed’s December dot plot, which showed that two of 19 members had penciled in a top rate of 5%. The question then is what those two think in light of the crisis

- Should the Fed, however, hold, long-dated Treasuries will rally big

Dot plot:

- The FOMC will likely envision 50 more basis points of tightening over and above Wednesday’s move to primarily drive home two points: a) that the Fed believes that the financial landscape isn’t as broken as the markets reckon; and b) the Fed isn’t shifting its focus away from inflation

Summary of Economic Projections:

- Given the adverse impact of the tumult in the banking sector, it’s likely that the Fed will revise its growth forecast for this year lower, possibly by a notch to 0.4% from 0.5%, while leaving the estimate for the jobless rate at 4.6%

- Bloomberg Economics expects that core PCE inflation will be revised higher to 3.7% from 3.5% and to 2.7% for next year from 2.5% now

Powell’s Pyrotechnics:

- Should the Fed go through with the hike, Chair Jerome Powell will doubtless face a barrage of questions on whether:

- The FOMC is hiking rates into a hard landing. His likely response: The Fed sees the economy losing momentum, but given the tightness of the labor market, the FOMC hopes any blip will be transitory

- What he makes of the market pricing on rate cuts down the line. Powell may say that inflation remains the Fed’s central focus and he doesn’t expect the current tumult in the banking landscape to spill over into the wider economy in light of the backstop that has already been put in place and other measures taken to shore up confidence.

Here’s What the Fed Statement May Look

The Fed faces the unenviable prospect of having to craft a policy statement at a time when it is still coming to grips with a banking crisis and its fallout on the wider economy. In light of the recent market tumult, revisions to the statement will be the most extensive in a long while.

The top:

- There are two ways the Fed could go about changing its preamble. It may start off with its time-tested boilerplate on recent macroeconomic inputs — that is, spending, production and the jobs market — before moving on to acknowledge the recent stress in the banking sector.

- The second way would be to acknowledge the latter right off the bat, at the very top. This choice may suggest that the Fed is placing greater weight on financial stability and what that implies for the broader economy.

Rate increase:

- Though it’s a close call, the Fed may opt to raise rates by 25 basis points to signal that it is still intent on battling inflation and also that it views the recent market stress as temporary:

- As reminder, JPMorgan disagrees with Ram here and as we noted last night, the bank’s economist Michael Feroli expects the Fed’s forward guidance to drop the phrase “ongoing increases…will be appropriate” and substitute language which will indicate that the bias is toward further tightening

Dissent:

- It is possible that the Fed may acknowledge that there two-way risks in the economy. However, the markets may interpret such a clause to mean that the Fed is willing to cut rates, so the FOMC may open a Pandora’s box in doing so

- FOMC members Lisa Cook and Austan Goolsbee are dovish in their leanings, and either or both of them may vote in favor of a pause

What About The Dot Plot

The Fed’s dot plot could broadly go one of three ways today:

Option I: Cop-out

- The Fed could simply not do a dot plot, a reprisal of what happened in March 2020. However, that would end up alarming the markets, and seems unlikely.

Option II: The Dovish Choice

- This is one where Fed policymakers stick to the same dot plot as the one they unveiled in December — that is, one that shows the Fed funds rate topping at 5.125%. That would mean one more 25- basis point increase assuming the Fed raises rates by a similar margin today

- In the light of recent inflation and jobs market data, that would be dovish — but one that acknowledges the recent tightening in financial conditions

Option III: Dovish & Hawkish Simultaneously

- In this scenario, the median of policymakers will pencil in a top rate of 5.375%. In effect they would reckon that the Fed has more work to do on inflation in light of recent macroeconomic data

- While it may look hawkish given the market jitters, there is perhaps little question that the dot plot would have been even more ambitious were it not for the tumult in the banking industry

Loading…