BofA Chief Investment Strategist Michael Hartnett (whose latest weekly note we will dissect shortly) has a favorite saying for when critical phase (to avoid the most hated word in the world "paradigm") shifts take place in the market, one which may be the only word a trader in this day and age needs (or rather hopes for): "Markets stop panicking when central banks start panicking."

So in what may be the best news to shellshocked bulls after the worst September and worst Q3 in generations, in a harrowing year for markets, and on a Friday which is set to reverse much of yesterday's historic intraday reversal, the 5th biggest on record, central banks are starting to panic more with every passing day. First it was the BOJ, then the BOE and now, for the second week in a row, it's Switzerland's turn.

Recall that three weeks ago after the (first) panicked pivot by the BOE, when global markets were in freefall, we said that markets desperately needed some words of encouragement from the Fed, or failing that - and with the dollar soaring to new all time highs every day - the Fed had to make some pre-emptive announcement on USD Fx swap lines, if only to reassure global markets that amid this historic, US dollar short squeeze, at least someone can and will print as many as are needed to avoid systemic collapse.

Fed has to issue FX swap line press release before open

— zerohedge (@zerohedge) September 26, 2022

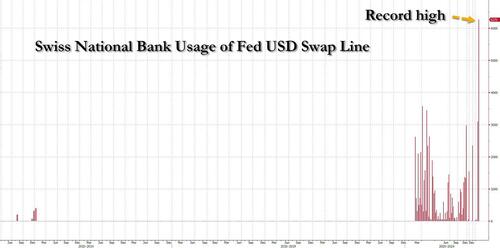

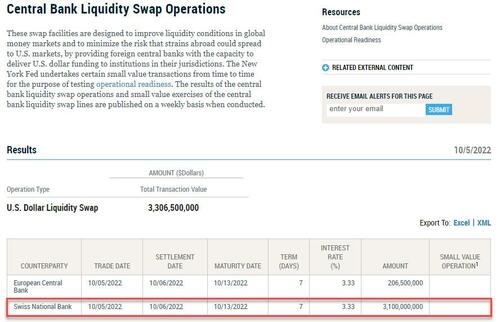

So fast forward two weeks to October 5, when there still hasn't been any formal announcement from the Fed, but every so quietly - and just as we expected - the Fed shuttled $3.1 billion to the Swiss National Bank to cover an emergency dollar shortfall.

Remarkably, this was the first time the Fed sent dollars to the SNB this year, and the first time the Fed used the swap line in size (besides a token amount to the ECB every now and then)!

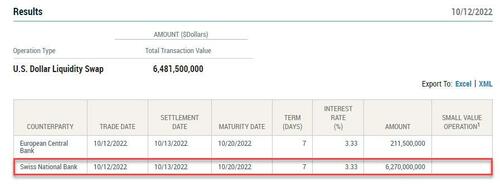

But it certainly won't be the last time - as we have warned, expect far wider use of Fed swap line usage as the world chokes on the global dollar shortage - and sure enough overnight the Fed announced that as of Thursday it doubled the size of its USD swap with the world's most pristine economy and its central bank, the Swiss National Bank, sending some $6.27 billion to avoid an emergency funding crunch.

Remarkably, this was only the second time the Fed sent dollars to the SNB this year, and was also the largest single USD swap transfer in history!

The next logical question obviously is: why does Switzerland have a financial institution needing a record $6.3 billion in cheap (3.33%) overnight funding for the second week in a row. We don't know the answer, but have a pretty good idea of who the culprit may be courtesy of Goldman which earlier this week issued the following note:

And speaking of the coming crisis, recall what we said at the start of September: the coming Fed pivot will have nothing to do with whether the Fed hits or doesn't hit its inflation target, and everything to do with the devastation unleashed by the soaring dollar (a record margin call to the tune of some $20 trillion) on the rest of the world.

And speaking of the coming crisis, recall what we said at the start of September: the coming Fed pivot will have nothing to do with whether the Fed hits or doesn't hit its inflation target, and everything to do with the devastation unleashed by the soaring dollar (a record margin call to the tune of some $20 trillion) on the rest of the world.

BBG dollar index 1300, back over covid panic highs, and new record as dollar margin call sweeps emerging markets. Pivot will not come from "inflation target is hit" but from devastation across ROW pic.twitter.com/C3h15bko0B

— zerohedge (@zerohedge) September 1, 2022

Today, none other than Bob Michele, the outspoken chief investment officer of J.P. Morgan Asset Management, told everyone that we were right: as paraphrased by Bloomberg, Bob said "the relentless dollar could forge a path to the next market upheaval."

Michele has been in de-risking mode, sitting on a pile of cash which is near the highest level he has held in 10 years. And he is long the dollar. While a market crisis sparked by the greenback is not his base case, it’s a tail risk that he is monitoring closely.

Here’s how it could happen: Foreigners have snapped up dollar-denominated assets for higher yields, safety, and a brighter earnings outlook than most markets. A big chunk of those purchases are hedged back into local currencies such as the euro and the yen through the derivatives market, and it involves shorting the dollar. When the contracts roll, investors have to pay up if the dollar moves higher. That means they may have to sell assets elsewhere to cover the loss.

“I get concerned that a much stronger dollar will create a lot of pressure, particularly in hedging US dollar assets back to local currencies,” Michele said in an interview. “When the central bank steps on the brakes, something goes through the windshield. The cost of financing has gone up and it will create tension in the system."

The market probably saw some of that pressure already: as we noted at the time, investment-grade credit spreads spiked close to 20 basis points toward the end of September. That’s coincidental with a lot of currency hedges rolling over at the end of the third quarter, he said -- and it may be just “the tip of an iceberg.”

So far so good: and where we agree especially with Michele is what he thinks happens next: as Bloomberg writes, "the central bank will be so committed to combating inflation that it will keep raising rates and won’t pause or reverse course unless something really bad happens to markets or the economy, or both. If policy makers pause in response to market functionality, there has to be such a shock to the system that it creates potential insolvencies. And a rising dollar might do just that."

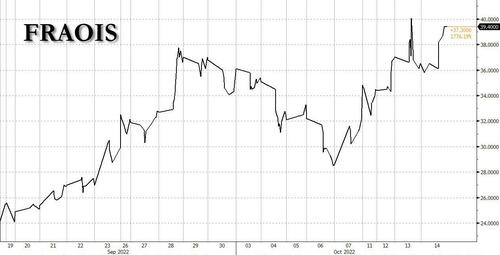

And the fact that the Fed is already quietly shuttling billions of dollars to various central banks to plug dollar overnight funding holes, confirms that the rising dollar has already done just that. One look at the meltup in FRA-OIS is enough confirmation.

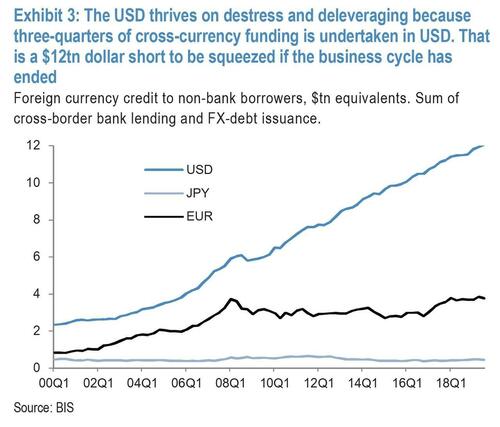

As for what happens next, we suggest that you i) quietly panic if you are still short USD, which so many since at last check (which was March 2020) JPMorgan calculated that the global dollar short was $12 trillion, some 60% of US GDP, a number which has conservatively grown to about $20 trillion as of today...

... and ii) keep a very close eye on this particular hotel.

BofA Chief Investment Strategist Michael Hartnett (whose latest weekly note we will dissect shortly) has a favorite saying for when critical phase (to avoid the most hated word in the world “paradigm”) shifts take place in the market, one which may be the only word a trader in this day and age needs (or rather hopes for): “Markets stop panicking when central banks start panicking.”

So in what may be the best news to shellshocked bulls after the worst September and worst Q3 in generations, in a harrowing year for markets, and on a Friday which is set to reverse much of yesterday’s historic intraday reversal, the 5th biggest on record, central banks are starting to panic more with every passing day. First it was the BOJ, then the BOE and now, for the second week in a row, it’s Switzerland’s turn.

Recall that three weeks ago after the (first) panicked pivot by the BOE, when global markets were in freefall, we said that markets desperately needed some words of encouragement from the Fed, or failing that – and with the dollar soaring to new all time highs every day – the Fed had to make some pre-emptive announcement on USD Fx swap lines, if only to reassure global markets that amid this historic, US dollar short squeeze, at least someone can and will print as many as are needed to avoid systemic collapse.

Fed has to issue FX swap line press release before open

— zerohedge (@zerohedge) September 26, 2022

So fast forward two weeks to October 5, when there still hasn’t been any formal announcement from the Fed, but ever so quietly the Fed shuttled $3.1 billion to the Swiss National Bank to cover an emergency dollar shortfall, as we first reported a few days ago.

Remarkably, this was the first time the Fed sent dollars to the SNB this year, and the first time the Fed used the swap line in size (besides a token amount to the ECB every now and then)!

But it certainly won’t be the last time – as we have warned, expect far wider use of Fed swap line usage as the world chokes on the global dollar shortage – and sure enough overnight the Fed announced that as of Thursday it doubled the size of its USD swap with the world’s most pristine economy and its central bank, the Swiss National Bank, sending some $6.27 billion to avoid an emergency funding crunch.

Remarkably, this was only the second time the Fed sent dollars to the SNB this year, and was also the largest single USD swap transfer in history!

The next logical question obviously is: why does Switzerland have a financial institution needing a record $6.3 billion in cheap (3.33%) overnight funding for the second week in a row. We don’t know the answer, but have a pretty good idea of who the culprit may be courtesy of Goldman which earlier this week issued the following note:

And speaking of the coming crisis, recall what we said at the start of September: the coming Fed pivot will have nothing to do with whether the Fed hits or doesn’t hit its inflation target, and everything to do with the devastation unleashed by the soaring dollar (a record margin call to the tune of some $20 trillion) on the rest of the world.

And speaking of the coming crisis, recall what we said at the start of September: the coming Fed pivot will have nothing to do with whether the Fed hits or doesn’t hit its inflation target, and everything to do with the devastation unleashed by the soaring dollar (a record margin call to the tune of some $20 trillion) on the rest of the world.

BBG dollar index 1300, back over covid panic highs, and new record as dollar margin call sweeps emerging markets. Pivot will not come from “inflation target is hit” but from devastation across ROW pic.twitter.com/C3h15bko0B

— zerohedge (@zerohedge) September 1, 2022

Today, none other than Bob Michele, the outspoken chief investment officer of J.P. Morgan Asset Management, told everyone that we were right: as paraphrased by Bloomberg, Bob said “the relentless dollar could forge a path to the next market upheaval.”

Michele has been in de-risking mode, sitting on a pile of cash which is near the highest level he has held in 10 years. And he is long the dollar. While a market crisis sparked by the greenback is not his base case, it’s a tail risk that he is monitoring closely.

Here’s how it could happen: Foreigners have snapped up dollar-denominated assets for higher yields, safety, and a brighter earnings outlook than most markets. A big chunk of those purchases are hedged back into local currencies such as the euro and the yen through the derivatives market, and it involves shorting the dollar. When the contracts roll, investors have to pay up if the dollar moves higher. That means they may have to sell assets elsewhere to cover the loss.

“I get concerned that a much stronger dollar will create a lot of pressure, particularly in hedging US dollar assets back to local currencies,” Michele said in an interview. “When the central bank steps on the brakes, something goes through the windshield. The cost of financing has gone up and it will create tension in the system.”

The market probably saw some of that pressure already: as we noted at the time, investment-grade credit spreads spiked close to 20 basis points toward the end of September. That’s coincidental with a lot of currency hedges rolling over at the end of the third quarter, he said — and it may be just “the tip of an iceberg.”

So far so good: and where we agree especially with Michele is what he thinks happens next: as Bloomberg writes, “the central bank will be so committed to combating inflation that it will keep raising rates and won’t pause or reverse course unless something really bad happens to markets or the economy, or both. If policy makers pause in response to market functionality, there has to be such a shock to the system that it creates potential insolvencies. And a rising dollar might do just that.”

And the fact that the Fed is already quietly shuttling billions of dollars to various central banks to plug dollar overnight funding holes, confirms that the rising dollar has already done just that. One look at the meltup in FRA-OIS is enough confirmation.

As for what happens next, we suggest that you i) quietly panic if you are still short USD, which so many since at last check (which was March 2020) JPMorgan calculated that the global dollar short was $12 trillion, some 60% of US GDP, a number which has conservatively grown to about $20 trillion as of today…

… and ii) keep a very close eye on this particular hotel.