Authored by Lance Roberts via RealInvestmentAdvice.com,

Last week, we discussed why the more bullish technical formations were at odds with the many recession forecasts. Not surprisingly, that article generated substantial pushback from readers, pointing out various bearish fundamental measures.

As I discussed in our latest “Bull Bear Report,” the technical backdrop has improved markedly since the October lows.

“I previously discussed the inverse ‘head-and-shoulder’ pattern already suggests a market bottom has formed. A solid break above the downtrend line (with a successful retest) would confirm the completion of that pattern. Notably, the 50-DMA is rapidly closing in on a cross above the declining 200-DMA. Such is known as the ‘golden cross’ and historically signifies a more bullish setup for markets moving forward.“

“The market surge last week ran into resistance on Friday as markets pushed well into 3-standard deviations above the 50-DMA. However, while the weakness on Friday was not unexpected, it is also necessary to determine whether the current breakout is legitimate.“

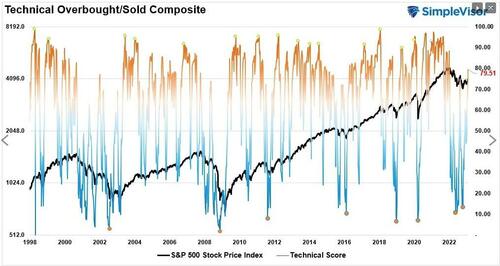

Furthermore, our weekly technical composite gauge is not back into bull market mode as it has risen above a reading of 70. Such is the first time that measure was reached in over a year.

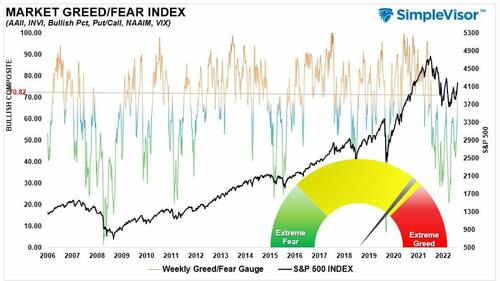

Also, investor sentiment has moved back into “bullish mode,” with our composite fear/greed gauge, which measures sentiment and positioning, pushing towards “greed” levels.

From a historical view, these technical measures have always preceded a continuation of a more bullish trend for the market. However, the critical point is that while the technical backdrop has improved, we must still acknowledge a risk to the technical bullish view. As I concluded:

“If the ‘bear market’ is ‘canceled,’ we will know relatively soon. To confirm whether the breakout is sustainable, thereby canceling the bear market, a pullback to the previous downtrend line that holds is crucial. Such a pullback would accomplish several things, from working off the overbought conditions, turning previous resistance into support, and reloading market shorts to support a move higher. The final piece of the puzzle, if the pullback to support holds, will be a break above the highs of this past week, confirming the next leg higher. Such would put 4300-4400 as a target in place.

A break BELOW the downtrend line, and the current intersection of the 50- and 200-DMA, will suggest the breakout was indeed a ‘head fake.’ Such will confirm the bear market remains, and a retest of last year’s lows is likely.

However, while the technicals are bullish near term, I can not disagree with the reader’s fundamental arguments.

Fundamental Problems

Greg Feirman made an interesting observation last week.

“Those of us who take a more fundamental approach are left scratching our heads because the price action does not match what we’re seeing from corporate earnings. Apple (AAPL) reported a 5.5% decline in revenue in its 4Q22 – and that quarter had 14 weeks compared to 13 in the year ago period. Net Income fell 13.4%. While Google’s (GOOG/GOOGL) overall revenue was +1%, if you dig a little deeper revenue in its core advertising business was actually -4%. And while Meta (META) had a huge relief rally, the fundamentals were far from stellar with revenue -4.5% and EPS -52% compared to a year ago.

And so it all sets up for a showdown in coming weeks. My contention is that “the market is a voting machine in the short term, and a weighing machine in the long term” (Ben Graham). That is, price will follow the crowd in the short term but the crowd will follow fundamentals in the long term. So while the market may continue to rally in the days and weeks ahead, eventually this rally will peter out and we will look back at it as just another bear market rally. If you’re interested in this debate between technicians and fundamentalists, pay attention because we’re all about to learn something one way or another.”

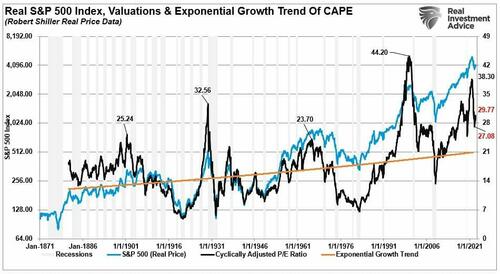

Greg is correct. Since the beginning of the year, the rise in the market has been purely a function of valuation expansion as both earnings, and earnings estimates, continue to deteriorate. As shown, valuations are rising to 29x, trailing real earnings, which is historically expensive.

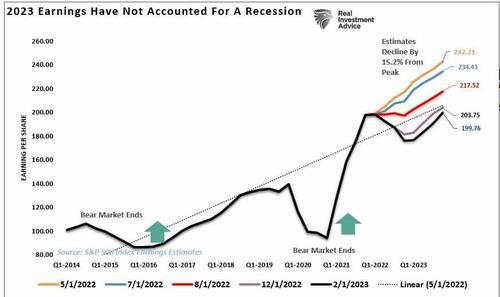

Such is occurring as earnings and estimates continue to deteriorate sharply, even though analysts remain optimistic about a recovery later in the year.

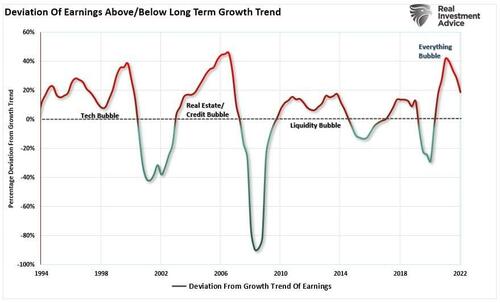

However, the hoped-for earnings recovery is contingent on a much stronger economic environment to support that growth in earnings. Given that earnings remain 20% above their long-term growth trend. The expected recovery seems overly optimistic due to the massive stimulus injections that pulled forward consumption.

With much economic data pointing to further weakness in the months ahead, market fundamentals remain challenging to the technical bullish narrative.

However, historically, the markets tend to price economic and fundamental recoveries 6-9 months in advance. Such would suggest that the more bullish optimistic views of a “soft landing” scenario in the economy could be possible.

The only issue with that view, again from the fundamental perspective, is that historically with inflation running well above 5% and the Federal Reserve continuing to hike rates, “goldilocks outcomes” did not previously come to fruition.

Bull Now, Bear Later?

So, what should an investor due with such a dichotomy?

The answer is more simple than it seems.

The market can defy economic and fundamental realities in the short term. Greg noted that the market is a “voting machine” in the short term. In other words, the market will respond to the “votes” of the herd in the market. However, the market will “weigh” the fundamental measures and price accordingly over the longer term.

For investors, relying heavily upon either the “votes” or the “weight” can lead to more disappointing outcomes over the long term. As I have noted previously, many investors missed out almost entirely on the market’s advance from 2009 to the present for various valid, fundamental reasons. Yes, they missed the crash in 2008 but lost far more in missed capital gains over the ensuing decade.

“Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” – Peter Lynch

Rules To Follow

For the moment, the market is back in a more bullish mode. As such, we need a set of rules to navigate that bullish trend until it eventually ends.

-

Cut losers short and let winners run. (Be a scale-up buyer into strength.)

-

Set goals and be actionable. (Without specific goals, trades become arbitrary and increase overall portfolio risk.)

-

Emotionally driven decisions void the investment process. (Buy high/sell low)

-

Follow the trend. (The long-term, monthly trend determines 80% of portfolio performance. While a “rising tide lifts all boats, ”the opposite is also true.)

-

Never let a “trading opportunity” turn into a long-term investment. (Refer to rule #1. All initial purchases are “trades” until your investment thesis is proved correct.)

-

An investment discipline does not work if it is not followed.

-

The odds of success improve significantly when the technical price action confirms the fundamental analysis. (This applies to both bull and bear markets)

-

Markets are either “bullish” or “bearish.” During a “bull market,” be only long or neutral. During a “bear market,” be only neutral or short. (Bull and Bear markets are determined by their long-term trend)

-

When markets are trading at, or near, extremes do the opposite of the “herd.”

-

Do more of what works and less of what doesn’t (Traditional rebalancing takes money from winners and adds it to losers. Rebalance by reducing losers and adding to winners.)

Don’t Pick A Side

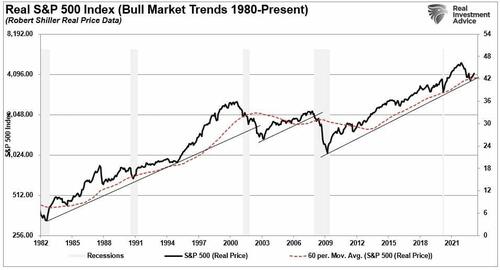

Note there are several references to the “long-term trend” of the market. That trend remains bullish as measured by both trend lines and the 60-month moving average. With the market recently bottoming at those trendline supports, such suggests the longer-term bull market remains intact.

Yes, the fundamentals will eventually matter, and they will matter much more than many currently think. However, for the now, the bulls remain in charge of the market.

Set aside the idea of being either “bullish” or “bearish.”

Once you pick a side, you lose objectivity to what is occurring within the market.

How long with the technical bull run last? I have no idea.

But when it ends, and the fundamentals begin to re-emerge, we will have plenty of warning to adjust accordingly.

Authored by Lance Roberts via RealInvestmentAdvice.com,

Last week, we discussed why the more bullish technical formations were at odds with the many recession forecasts. Not surprisingly, that article generated substantial pushback from readers, pointing out various bearish fundamental measures.

As I discussed in our latest “Bull Bear Report,” the technical backdrop has improved markedly since the October lows.

“I previously discussed the inverse ‘head-and-shoulder’ pattern already suggests a market bottom has formed. A solid break above the downtrend line (with a successful retest) would confirm the completion of that pattern. Notably, the 50-DMA is rapidly closing in on a cross above the declining 200-DMA. Such is known as the ‘golden cross’ and historically signifies a more bullish setup for markets moving forward.“

“The market surge last week ran into resistance on Friday as markets pushed well into 3-standard deviations above the 50-DMA. However, while the weakness on Friday was not unexpected, it is also necessary to determine whether the current breakout is legitimate.“

Furthermore, our weekly technical composite gauge is not back into bull market mode as it has risen above a reading of 70. Such is the first time that measure was reached in over a year.

Also, investor sentiment has moved back into “bullish mode,” with our composite fear/greed gauge, which measures sentiment and positioning, pushing towards “greed” levels.

From a historical view, these technical measures have always preceded a continuation of a more bullish trend for the market. However, the critical point is that while the technical backdrop has improved, we must still acknowledge a risk to the technical bullish view. As I concluded:

“If the ‘bear market’ is ‘canceled,’ we will know relatively soon. To confirm whether the breakout is sustainable, thereby canceling the bear market, a pullback to the previous downtrend line that holds is crucial. Such a pullback would accomplish several things, from working off the overbought conditions, turning previous resistance into support, and reloading market shorts to support a move higher. The final piece of the puzzle, if the pullback to support holds, will be a break above the highs of this past week, confirming the next leg higher. Such would put 4300-4400 as a target in place.

A break BELOW the downtrend line, and the current intersection of the 50- and 200-DMA, will suggest the breakout was indeed a ‘head fake.’ Such will confirm the bear market remains, and a retest of last year’s lows is likely.

However, while the technicals are bullish near term, I can not disagree with the reader’s fundamental arguments.

Fundamental Problems

Greg Feirman made an interesting observation last week.

“Those of us who take a more fundamental approach are left scratching our heads because the price action does not match what we’re seeing from corporate earnings. Apple (AAPL) reported a 5.5% decline in revenue in its 4Q22 – and that quarter had 14 weeks compared to 13 in the year ago period. Net Income fell 13.4%. While Google’s (GOOG/GOOGL) overall revenue was +1%, if you dig a little deeper revenue in its core advertising business was actually -4%. And while Meta (META) had a huge relief rally, the fundamentals were far from stellar with revenue -4.5% and EPS -52% compared to a year ago.

And so it all sets up for a showdown in coming weeks. My contention is that “the market is a voting machine in the short term, and a weighing machine in the long term” (Ben Graham). That is, price will follow the crowd in the short term but the crowd will follow fundamentals in the long term. So while the market may continue to rally in the days and weeks ahead, eventually this rally will peter out and we will look back at it as just another bear market rally. If you’re interested in this debate between technicians and fundamentalists, pay attention because we’re all about to learn something one way or another.”

Greg is correct. Since the beginning of the year, the rise in the market has been purely a function of valuation expansion as both earnings, and earnings estimates, continue to deteriorate. As shown, valuations are rising to 29x, trailing real earnings, which is historically expensive.

Such is occurring as earnings and estimates continue to deteriorate sharply, even though analysts remain optimistic about a recovery later in the year.

However, the hoped-for earnings recovery is contingent on a much stronger economic environment to support that growth in earnings. Given that earnings remain 20% above their long-term growth trend. The expected recovery seems overly optimistic due to the massive stimulus injections that pulled forward consumption.

With much economic data pointing to further weakness in the months ahead, market fundamentals remain challenging to the technical bullish narrative.

However, historically, the markets tend to price economic and fundamental recoveries 6-9 months in advance. Such would suggest that the more bullish optimistic views of a “soft landing” scenario in the economy could be possible.

The only issue with that view, again from the fundamental perspective, is that historically with inflation running well above 5% and the Federal Reserve continuing to hike rates, “goldilocks outcomes” did not previously come to fruition.

Bull Now, Bear Later?

So, what should an investor due with such a dichotomy?

The answer is more simple than it seems.

The market can defy economic and fundamental realities in the short term. Greg noted that the market is a “voting machine” in the short term. In other words, the market will respond to the “votes” of the herd in the market. However, the market will “weigh” the fundamental measures and price accordingly over the longer term.

For investors, relying heavily upon either the “votes” or the “weight” can lead to more disappointing outcomes over the long term. As I have noted previously, many investors missed out almost entirely on the market’s advance from 2009 to the present for various valid, fundamental reasons. Yes, they missed the crash in 2008 but lost far more in missed capital gains over the ensuing decade.

“Far more money has been lost by investors trying to anticipate corrections than lost in the corrections themselves.” – Peter Lynch

Rules To Follow

For the moment, the market is back in a more bullish mode. As such, we need a set of rules to navigate that bullish trend until it eventually ends.

-

Cut losers short and let winners run. (Be a scale-up buyer into strength.)

-

Set goals and be actionable. (Without specific goals, trades become arbitrary and increase overall portfolio risk.)

-

Emotionally driven decisions void the investment process. (Buy high/sell low)

-

Follow the trend. (The long-term, monthly trend determines 80% of portfolio performance. While a “rising tide lifts all boats, ”the opposite is also true.)

-

Never let a “trading opportunity” turn into a long-term investment. (Refer to rule #1. All initial purchases are “trades” until your investment thesis is proved correct.)

-

An investment discipline does not work if it is not followed.

-

The odds of success improve significantly when the technical price action confirms the fundamental analysis. (This applies to both bull and bear markets)

-

Markets are either “bullish” or “bearish.” During a “bull market,” be only long or neutral. During a “bear market,” be only neutral or short. (Bull and Bear markets are determined by their long-term trend)

-

When markets are trading at, or near, extremes do the opposite of the “herd.”

-

Do more of what works and less of what doesn’t (Traditional rebalancing takes money from winners and adds it to losers. Rebalance by reducing losers and adding to winners.)

Don’t Pick A Side

Note there are several references to the “long-term trend” of the market. That trend remains bullish as measured by both trend lines and the 60-month moving average. With the market recently bottoming at those trendline supports, such suggests the longer-term bull market remains intact.

Yes, the fundamentals will eventually matter, and they will matter much more than many currently think. However, for the now, the bulls remain in charge of the market.

Set aside the idea of being either “bullish” or “bearish.”

Once you pick a side, you lose objectivity to what is occurring within the market.

How long with the technical bull run last? I have no idea.

But when it ends, and the fundamentals begin to re-emerge, we will have plenty of warning to adjust accordingly.

Loading…