All of a sudden the stock market “geniuses” that were minted during the Covid stimulus days don’t look so brilliant. And all it took was for the free money to run out…imagine that.

That was the topic of a new Wall Street Journal article that explored the demise of the very same retail traders who were living the high life just months ago. The article includes examples like Omar Ghias, who “amassed roughly $1.5 million as stocks surged during the early part of the pandemic” but now works at a deli in Las Vegas making $14 per hour, plus tips, after blowing it all on bad bets and excessive spending.

“I’m starting from zero,” he told the Journal, after spending on things like sports betting, bars and luxury cars. He outlined the path of his now-deceased fortune to the Journal:

Once the pandemic began, he gravitated to stocks and funds tracking the performance of metals as well as options, which allow investors to buy or sell shares at a certain price. He used these to generate income or profit from stock volatility. He also borrowed from his brokerage firms to amplify his positions, a tactic known as leverage.

In 2021, he started increasing that leverage, his brokerage statements show. He often turned to trades tied to the Invesco QQQ Trust, a popular fund tracking the tech-heavy Nasdaq-100 index, while continuing to bet heavily on metals. At times, he dabbled in options tied to hot stocks such as Tesla Inc. and Apple.

At one point, his leverage amounted to more than $1 million, brokerage statements reviewed by The Wall Street Journal show. By around June 2021, according to those brokerage statements, his portfolio was worth roughly $1.5 million.

“I really started treating the market like a casino,” he said. He started betting thousands on football games – including a $35,000 losing bet on the Super Bowl – enjoying late nights at bars and drinking Don Julio 1942 tequila. He also took on Vegas, paying for friends to come stay with him and renting a black Lamborghini to race up and down the strip.

“I felt like I was indestructible. It was irrational,” he told WSJ.

One of his biggest bets in the market, betting on gold and silver to rally via a position in Hecla Mining, was swiftly carried out after the Fed announced it was going to pull back on its easy money policies in late 2021. He lost $300,000 in one account even as the S&P was up 27% that year. “That was my breaking point,” he said.

Omar isn’t alone. He is like many other retail traders who saw their heyday during the runups of names like GameStop, AMC and Bed Bath and Beyond – all spurred by the Fed’s money printer rattling off trillions of dollars to stimulate the economy in the midst of the pandemic.

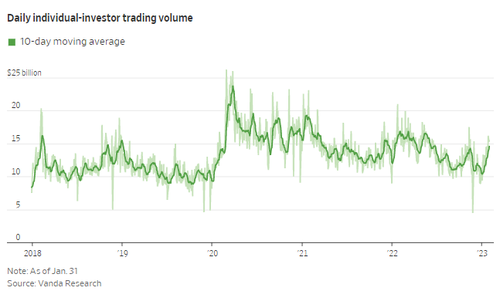

In fact, “The average individual investor’s portfolio has declined 27% since peaking in December 2021,” the Journal writes, citing Vanda Research. Monthly active users on Robinhood – the brokerage of choice for retail investors during the pandemic – fell to their lowest level since the company went public.

The Journal also interviewed Sumit Gupta, a 49-year-old ophthalmologist in Charlotte. He says he is now being more conservative with his bets and dollar cost averaging as markets move lower. “Now there’s yield on cash again. At this stage in my career, I don’t need to be aggressive,” he said.

Another trader interviewed by the Journal was 32 year old Navroop Sandhu, who started trading during the early days of the pandemic with eToro. “It was like a snowball effect, where I just got addicted,” she said, after making money from the onset. But she now places only 2 to 5 trades a week where she used to place up to 10 a week, she said. She’s trying to be patient in selecting her positions as the market falls.

Yet nother trader, 28 year old Jonathan Javier, watched his portfolio double through November 2021 – but by the middle of 2022, it was down about 8%. He has slowed down his regular investments but is buying some tech stock again this year.

He said: “Now I know the key to making a profit is buying when the stock is at a low price point instead of just buying and ‘hoping’ that I will make a gain from it.”

Story cited here.

Scroll down to leave a comment: