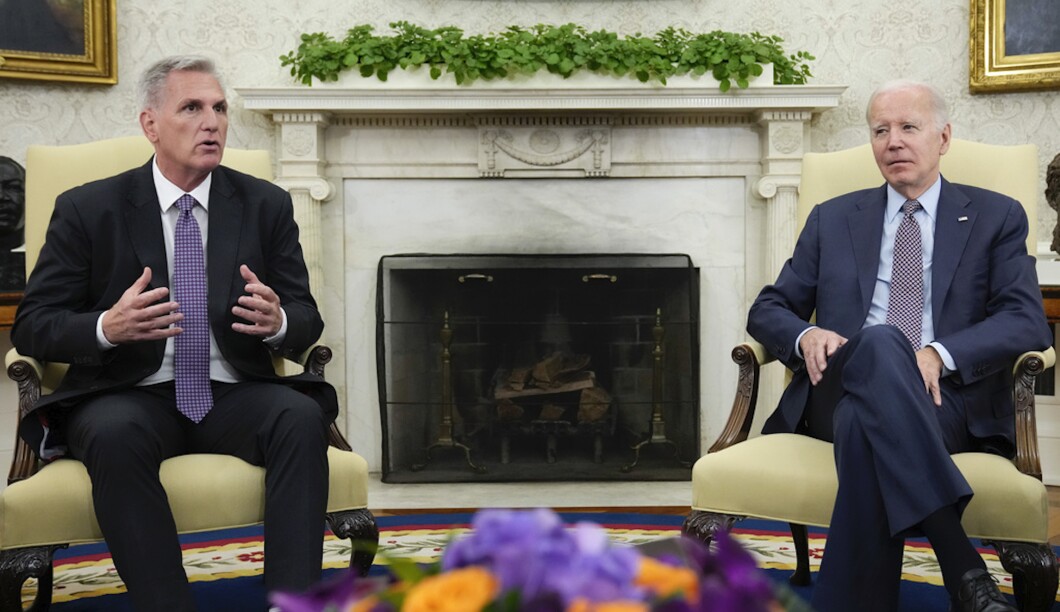

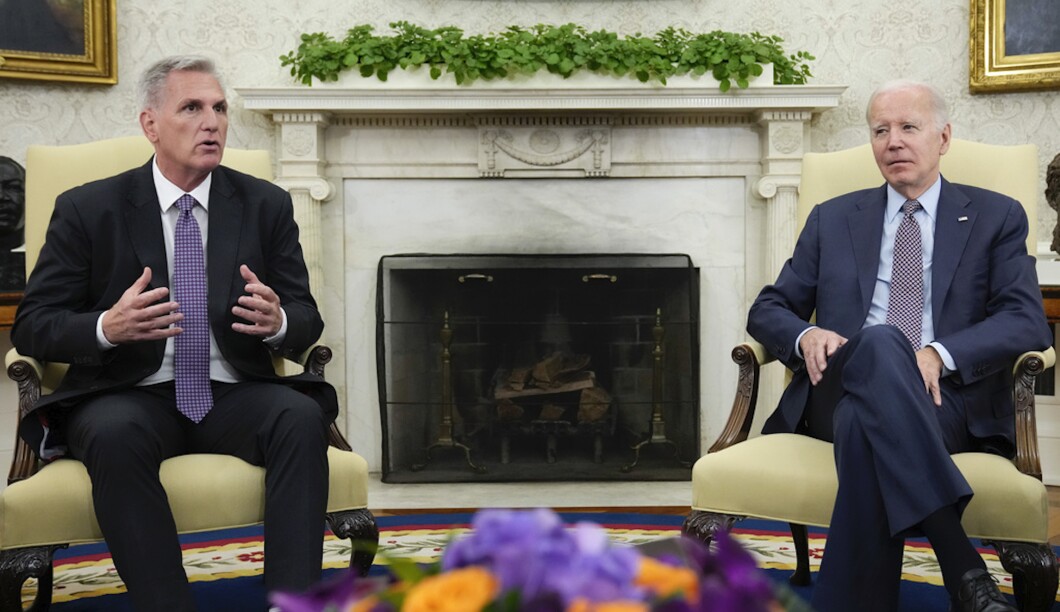

A deal to raise the debt ceiling through the end of next year and cut spending in the process has upset lawmakers from both parties, even as House Speaker Kevin McCarthy (R-CA) and President Joe Biden tout the agreement as a win.

Weeks of negotiations led to a deal that limited the growth of nondefense spending until the end of 2025, denying Biden the “clean” debt ceiling increase he wanted while making far more modest cuts to spending than Republicans set out to secure.

DEBT CEILING DEAL INCLUDES COMPLETION OF EMBATTLED MOUNTAIN VALLEY PIPELINE

Here are three key takeaways from the deal.

IRS SPENDING

House Republicans have been taking aim at $80 billion in extra funding for the IRS since the Democrats included it in last year’s Inflation Reduction Act. McCarthy started debt ceiling talks with the stated goal of canceling every dollar of that funding because Republicans feared the agency would use it to conduct more audits of middle-class people.

The final version of the deal cuts $10 billion of the new IRS funding in the next fiscal year and $10 billion in fiscal 2025.

It still leaves the IRS with a big boost of funding, and the money taken back from the agency’s budget isn’t actually savings for the federal government.

Instead, Democrats secured the ability to reuse the $20 billion for other nondefense programs.

However, Democrats had worked to protect all of the IRS funding, arguing the money was necessary to bring in more revenue through stronger enforcement of tax laws.

WORK REQUIREMENTS

House Republicans can count new welfare work requirements as perhaps their greatest victory in the deal, given that some Democrats had protested strongly against including them.

The reforms would extend existing work requirements, which presently mandate that able-bodied adults without dependents work 20 hours a week or submit to job training in order to receive food stamps for more than three months at a time, from the current cutoff age of 50 to 55.

Still, Republicans agreed to some loopholes that could make the work requirements less effective at reducing welfare dependence.

The deal includes exemptions for veterans, some homeless people, and people who were once part of the foster system.

And it doesn’t close every waiver available to states, which allowed some to skirt the existing work requirements on younger people. While the agreement will make it harder for states to exempt their residents from the requirements, some of the waivers remain in place.

SPENDING CAPS

Biden and McCarthy agreed to keep spending in the next fiscal year at roughly the same level as this year, excluding defense and veterans programs, which will be allowed to grow in fiscal 2024.

Nondefense spending can grow at 1% in fiscal 2025.

Conservatives in the House are likely most upset about this part of the agreement. They had demanded far deeper cuts to future spending, such as capping next year’s budget at the fiscal 2022 level.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Overall, in a House bill Republicans passed last month, the GOP conference had asked for $4.8 trillion in deficit reductions over the next decade.

Instead, the modest spending caps will expire after 2025 under the debt ceiling deal.