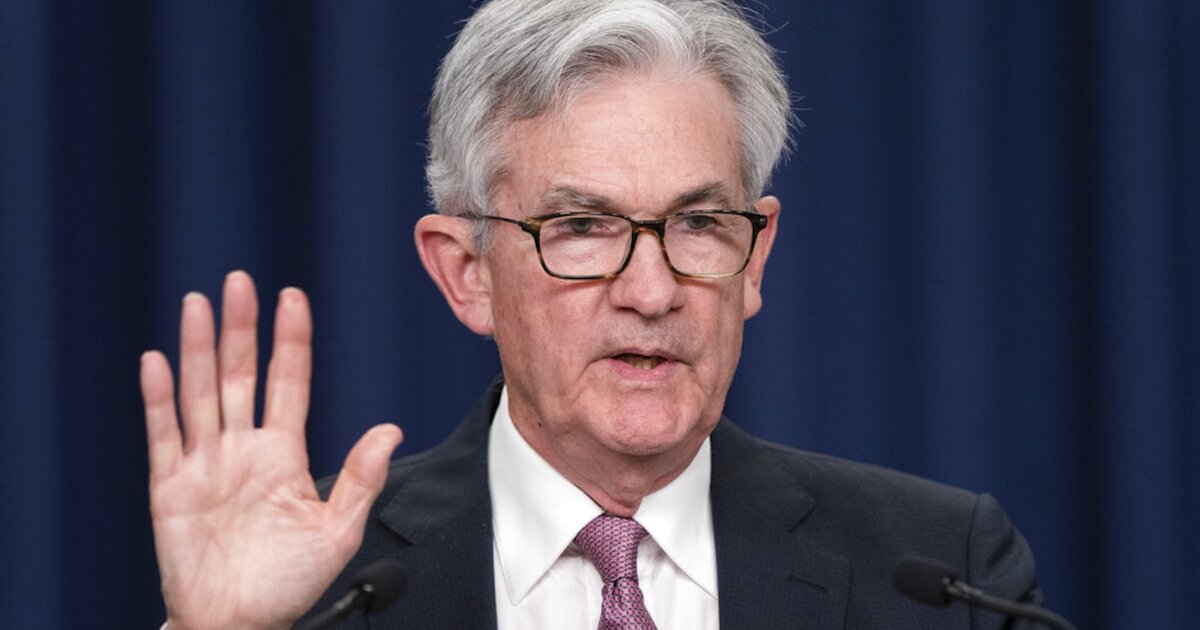

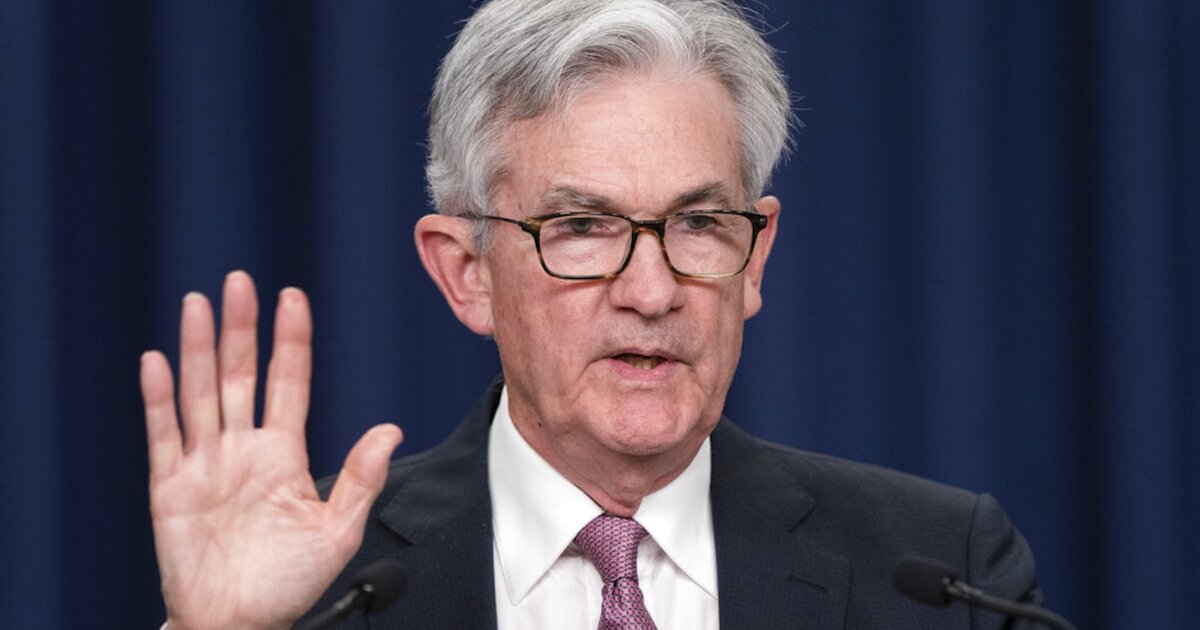

The Federal Reserve announced Wednesday that it is pausing its interest rate hikes, showing that officials believe they are having success in bringing down inflation.

Following a two-day meeting of its monetary policy committee in Washington, D.C., the central bank announced that it would not be increasing its interest rate target. The vast majority of economists and investors anticipated such a pause in rate hikes, which comes as inflation keeps slowing.

HOUSE PASSES FIRST BILL TO BLOCK FEDERAL GOVERNMENT’S GAS STOVE BAN

The central bank’s key overnight rate target will remain at 5% to 5.25%. Rates are still the highest they have been since 2007, at the outset of the global financial crisis.

The move comes against the backdrop of elevated recession odds. It also comes amid ongoing volatility in the financial sector following Silicon Valley Bank’s failure about three months ago and upheaval in the housing market.

The pause is a signal that the central bank is beginning to see an economic slowdown and threats to the economy as potentially larger threats to the economy than too-high inflation. It also indicates that the Fed is growing more confident in signs that inflation is meaningfully slowing, which has been the goal of the barrage of rate revisions over the past year or so.

This month’s Federal Open Market Committee meeting coincided with two major inflation reports, both of which bolstered confidence that the Fed would pause on Wednesday.

The consumer price index showed a 4% annual rate of inflation in May, down from 4.9% the previous month. The annual CPI inflation rate has been trending down since peaking last June and is now running at the lowest level since March 2021, right around when the country’s inflationary troubles first started bubbling up.

Additionally, inflation fell to a 1.1% annual rate in May, as measured by the producer price index, which gauges the wholesale prices of goods, which are eventually passed down to consumers.

While the labor market is still surprisingly strong, given the rate hikes, there are a few signs that it is softening — something that while bad for job seekers, does further ease inflationary pressure and is something that the Fed had hoped to see.

The economy once again beat expectations in May and added another 339,000 jobs. Still, the unemployment rate rose from 3.4% to 3.7%. Additionally, average hourly earnings growth decelerated in May.

Meanwhile, the banking sector is still under the microscope following the sudden failure of SVB in March. SVB’s downfall acted as a bit of a domino and led to a few other bank collapses, as well as some regional banks seeing their stock values plunge.

The federal government was able to step in and stymie the worst of the fallout, although economists are still closely watching the banking system, given the overall volatility of the economy amid the Fed’s rate hiking.

Also, while the broader economy is not in a recession, many experts contend that the housing market is. Home prices are falling, a sign of just how much the market has cooled since its red-hot zenith in 2020 when the Fed slashed rates to near-zero and mortgage rates fell in response.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

As of Wednesday, the average rate on a 30-year, fixed-rate mortgage was 6.71%, according to Freddie Mac. That number is up from a recent low of just under 6.1% registered in early February and up from about 3.1% at the start of last year.