Sam Bankman-Fried, the former crypto king found guilty last year of orchestrating one of the biggest frauds in U.S. history, will be sentenced this week in a New York courtroom.

Prosecutors have argued that the onetime Forbes billionaire should spend the next 40 to 50 years behind bars for a crime that had more than a million victims, losses totaling up to $10 billion, and led to the stunning collapse of his FTX crypto empire.

In a court filing, a Manhattan prosecutor argued that Bankman-Fried, who is scheduled to be sentenced on March 28, showed “unmatched greed and hubris” and broke the law based on a “pernicious megalomania guided by the defendant’s own values and sense of superiority.”

Bankman-Fried’s defense team has pushed back on the claim, arguing such a long sentence “distorts reality” and paints him not as the inexperienced businessman as he claims but as a “depraved super-villain.”

Under federal sentencing guidelines, Bankman-Fried could be sentenced to more than 100 years behind bars, though that is unlikely.

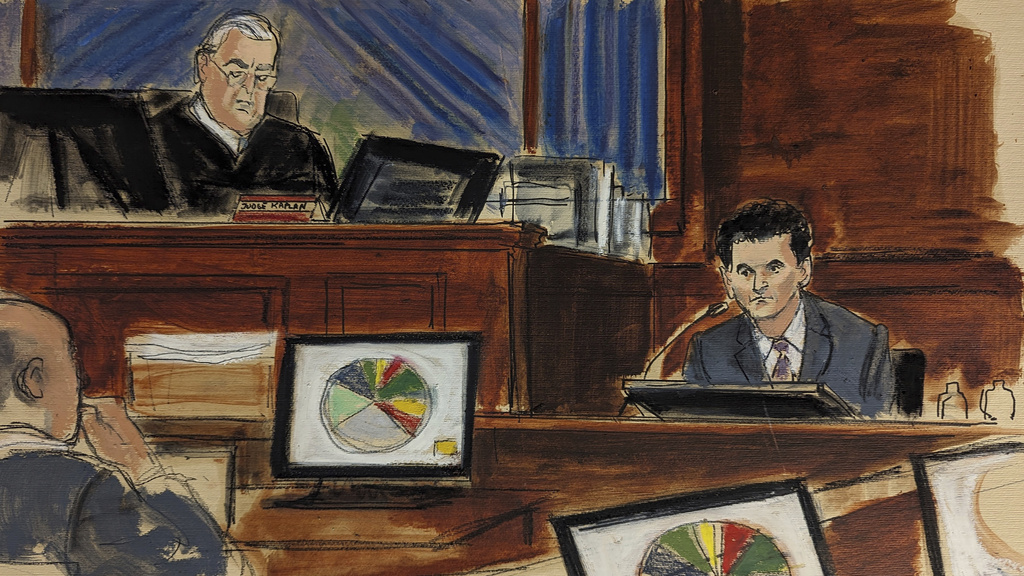

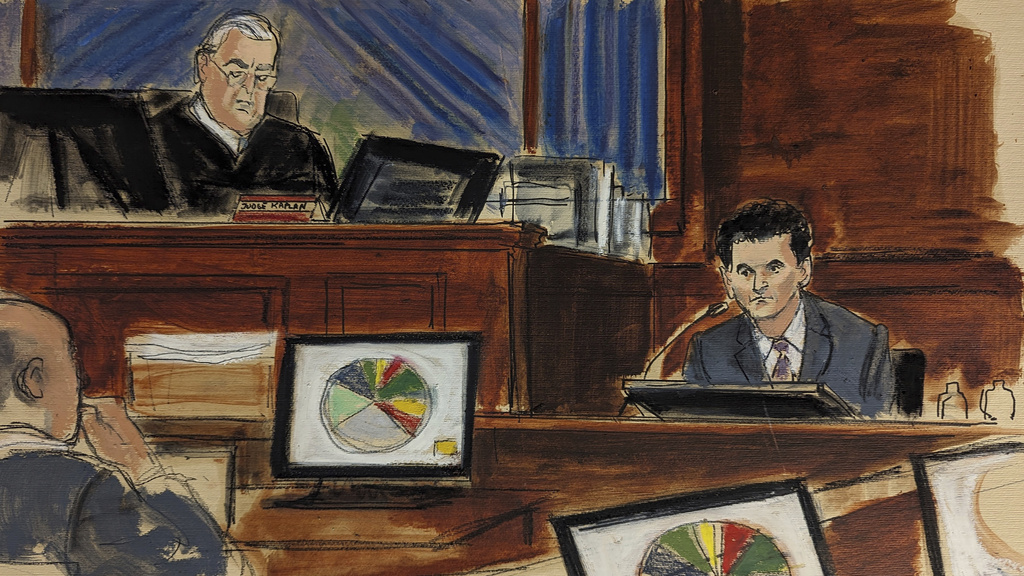

In November, a New York jury of nine women and three men found the now 32-year-old guilty of seven federal charges, including wire fraud, securities fraud, and money laundering connected to the implosion of his cryptocurrency exchange and related hedge fund Alameda Research.

Defense lawyer Marc Mukasey claimed that swindled FTX customers would be able to recoup their money in the bankruptcy process and that Bankman-Fried tried to stem some of the loss before he was arrested in 2022.

It’s an argument Bankman-Fried’s FTX successor, John Ray, pushed back on in a victim impact statement filed with the federal court.

Ray said FTX customers may be able to claw back some losses because of the bankruptcy estate’s efforts, not because Bankman-Fried did anything to help.

“Mr. Bankman-Fried continues to live a life of delusion,” Ray wrote. “There should be no delusion that because assets have increased in value or that the professionals have been able to recover funds and assets taken or stolen from the estate, that there was no need for the Chapter 11 cases.”

The government claimed Bankman-Fried stole billions in customer funds to live an extravagant lifestyle that included a sprawling penthouse in the Bahamas. He also used the money to buy himself “power and influence” on Capitol Hill and then lied to cover his tracks. After the exchange, which was once valued at $32 billion, failed in 2022, thousands of customers were unable to get their money back, and the government turned its case against Bankman-Fried and his top lieutenants into a referendum on the loosely regulated but highly volatile crypto industry.

The government’s case against Bankman-Fried was much stronger than anticipated and included a parade of his closest confidants who testified that he called the shots and demanded they break the rules, too, if they wanted to keep getting paid.

The prosecution called 16 witnesses over the course of two weeks. The defense called three witnesses, including Bankman-Fried, a decision that seemed to do him more harm than good in the long run.

CLICK HERE FOR MORE FROM THE WASHINGTON EXAMINER

Prosecutors chipped away at his credibility on the stand and cornered him into making multiple contradictions like claims he had no idea about the misappropriation of customer funds until just a few months before the exchange collapsed. He also pinned much of the day-to-day responsibilities on his co-founders Gary Wang and Nishad Singh and former Alameda CEO Caroline Ellison.

Wang, Singh, and Ellison, who used to be Bankman-Fried’s girlfriend, all pleaded guilty to similar charges and worked with prosecutors in their case against Bankman-Fried. Because of their cooperation, they are expected to receive little to no prison time.