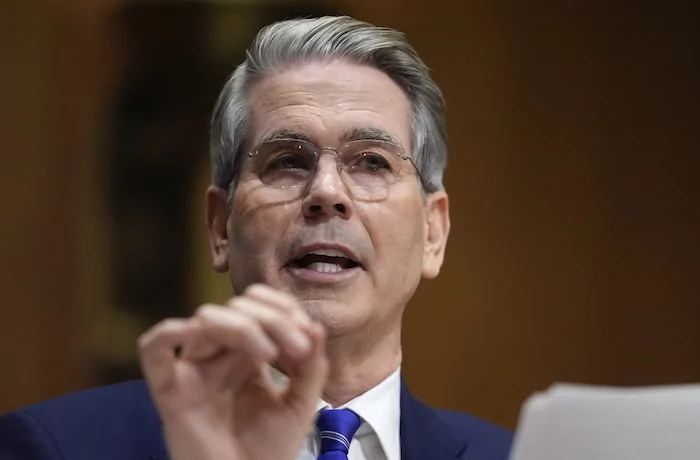

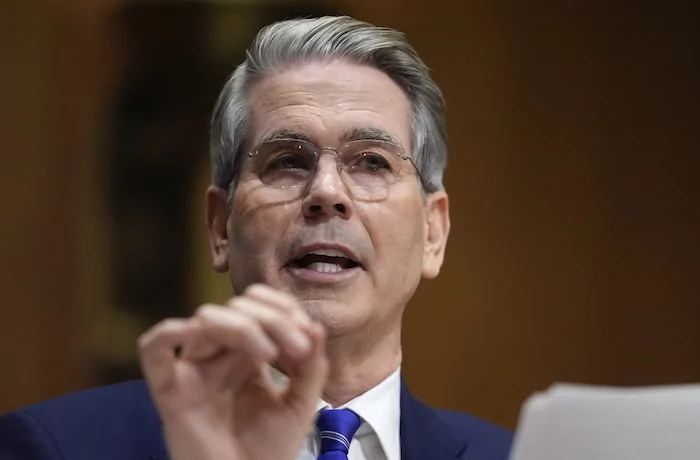

Treasury Secretary Scott Bessent laid out multiple factors President Donald Trump is considering in the decision to implement reciprocal tariffs.

Trump has pledged for months to implement reciprocal tariffs on other countries in response to import taxes and other trade policies on U.S. goods. The tariffs are set to go into effect on April 2.

“On April 2, each country will receive a number that we believe represents their tariffs,” Bessent told Fox Business. “For some countries, it could be quite low. For some countries, it could be quite high.”

“We are going to go to them and say, ‘Look, here is where we think the tariff levels are, nontariff barriers, currency manipulation, unfair funding, labor suppression, and if you will stop this, we will not put up the tariff wall,’” he said.

Bessent added that if the countries do not change those policies, the Trump administration “will put up the tariff wall to protect our economy, protect our workers, and protect our industries.”

Here is a breakdown of the four policies the Trump administration is considering:

Nontariff barriers

Nontariff barriers restrict trade via methods that are not tariffs, such as quotas, licenses, regulations, or embargoes.

During the interview, Bessent said the countries that fail to reduce their trade barriers would face steeper tariffs, which he suggested would protect the U.S. economy.

Currency manipulation

Currency manipulation occurs when a country intentionally weakens its currency for its exports to be cheaper and imports to be more expensive.

Under Section 3004 of the Omnibus Trade and Competitiveness Act of 1988, the treasury secretary must “consider whether countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustments or gaining unfair competitive advantage in international trade.”

During Trump’s first administration, then-Treasury Secretary Steven Mnuchin designated China as a currency manipulator for “devaluing its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past,” according to a press release. It was the first time the United States used that label on China since 1994.

A December 2024 report from Reuters found that China’s top lawmakers considered allowing the yuan to weaken as they braced for the effects of Trump’s tariffs.

Unfair funding

Unfair funding refers to governments or other large investors subsidizing or giving financial assistance to specific companies, sectors, or regions in a way that distorts the market. Such policies could hurt competition and consumers.

For example, the U.S. long accused the European Union of subsidizing Airbus, a French-based competitor to the Seattle-based Boeing. The EU also accused the U.S. of subsidizing Boeing, which had millions of dollars in government contracts.

In 2021, both parties settled the 17-year dispute and agreed to suspend tariffs for a five-year period.

“With the agreement on Boeing-Airbus, we have taken a major step in resolving the longest trade dispute in the history of the WTO. I am happy to see that after intensive work between the European Commission and the U.S. administration,” European Commission President Ursula von der Leyen said.

Labor suppression

There are multiple mechanisms to suppress labor, including union busting, offshoring work, and limiting workers’ rights. Many countries do not have similar labor practices as the U.S., which has a set minimum wage and allows for unions in certain professions.

WHITE HOUSE PROMOTES ‘POSITIVE NEWS OF THE ECONOMY’ AMID RECESSION FEARS

Labor suppression can make countries with fewer rights, such as Bangladesh and China, more attractive to companies due to their extremely low cost of operation.

Some countries allow “sweatshops” to be created, where employees are paid minimal wages and work extremely long hours. This allows those countries to produce goods for a cheaper price than countries with workers’ rights, and the practice hurts competition.