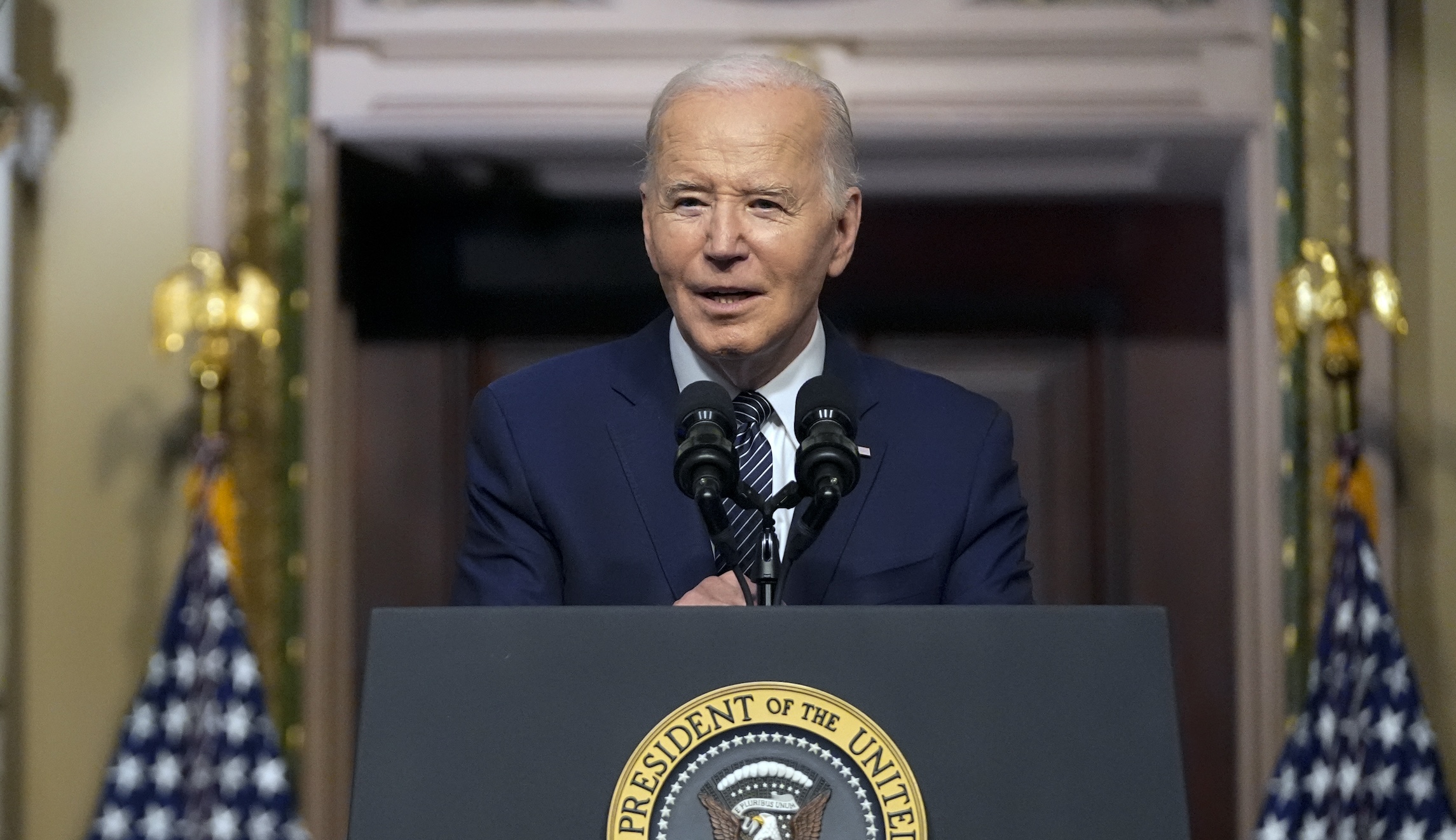

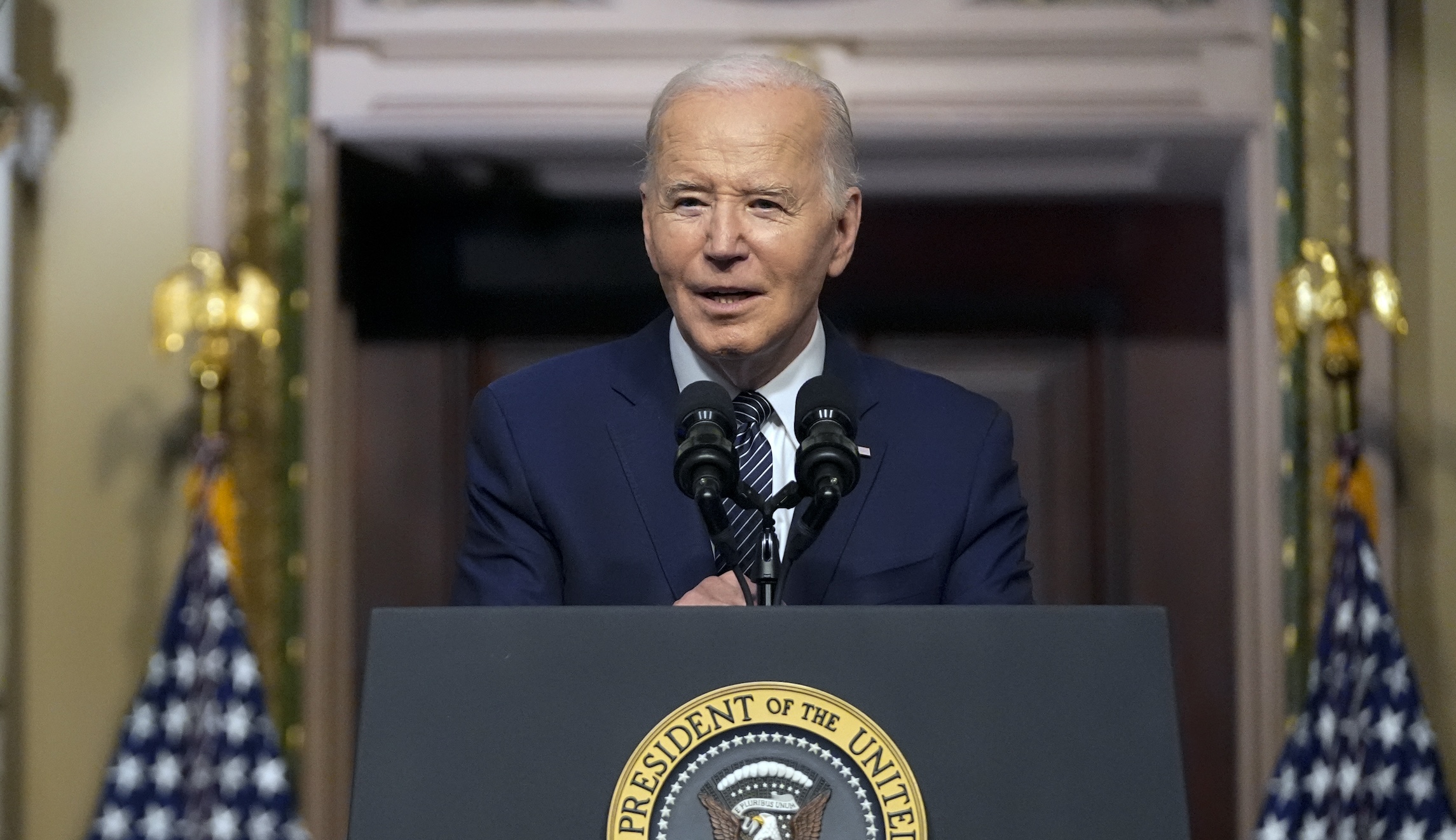

President Joe Biden is expected to announce a new attempt at mass student loan forgiveness, setting up another battle with Republicans as he looks to woo younger voters in the 2024 election.

It will be his second, and in some respects his third, try to make good on a 2020 campaign promise to cancel student loans, with high political and financial stakes.

“From day one of my administration, I promised to fix broken student loan programs and make sure higher education is a ticket to the middle class, not a barrier to opportunity,” Biden said on March 21. “I won’t back down from using every tool at my disposal to deliver student debt relief to more Americans and build an economy from the middle out and bottom up.”

The range and power of those tools will be fiercely debated between now and Election Day. Biden’s original student loans plan would have written off up to $20,000 in debt per borrower but was ruled illegal by the Supreme Court. He’s since announced another $144 billion in cancellation and a plan to lower future repayments, which is now also the subject of lawsuits.

Whatever Biden rolls out this time will probably wind up in court as well.

“We beat Joe Biden’s unlawful student loan plan in court last summer, so he quickly rolled out Plan B,” Missouri Attorney General Andrew Bailey said in a statement to the Washington Examiner. “Now that we’re challenging that, he’s panicked and is rolling out a Plan C. We will continue to watch the federal government closely and take action whenever they’ve overstepped their authority.”

The Wall Street Journal reported that Biden will outline the broad contours of his latest plan during a Monday speech in Madison, Wisconsin, home of that state’s flagship public university.

Biden promised in 2020 to forgive swaths of student loans, but he has been mostly unable to do so due to lawsuits and congressional opposition. Still, the moves are popular with younger voters and those holding student loan debt, both Democratic-leaning constituencies.

“He’s trying to come through on a campaign promise,” said Sasha Tirador, a Florida-based Democratic strategist. “The good thing is that younger folks actually read more about this subject than some others that don’t affect them as directly. They’re aware of the hurdles Biden has had to go through in order to get this accomplished.”

In that sense, the president could win either way — by successfully getting the debt canceled or by pointing angry loanees to the Republicans who blocked it.

The latest effort, per the Wall Street Journal, will be more targeted than the first one and has gone through a negotiated rulemaking process, which could give it stronger legal footing.

But that also means it could affect fewer people. The Department of Education previously indicated it is targeting five groups of borrowers: those whose balances are greater than what they originally borrowed, those with loans that were taken out decades ago, those whose college experience “did not provide sufficient financial value,” those who are eligible for relief programs but have not applied, and those who have “experienced financial hardship and need support.”

The White House did not respond to a request for comment from the Washington Examiner.

Bureaucratic hurdles remain, which could mean the president’s plans are finalized in the weeks before Election Day.

Tirador sees it as a winning message for Biden.

“It’s his duty to show those directly affected by student debt that he’s not giving up, that he’s still trying to come through and hold those people accountable who won’t let him complete this task,” Tirador said. “Which is obviously the Republican Party.”

Roughly 44 million people hold student loans, but the GOP focuses on the 290 million who don’t, arguing that blue-collar workers who never attended college and graduates who diligently paid loans back shouldn’t have to pay for others’ debt.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Forgiveness advocates, such as the Student Borrower Protection Center, say Biden’s goals are politically popular. SBPC released its own poll that found roughly 75% of voters support government action to address student loan debt, with 50% of registered voters supporting government action to cancel the debt.

Opponents point out that “forgiven” loans do not disappear but instead fall on the backs of taxpayers. The Penn Wharton Budget Model estimated that Biden’s Saving on a Valuable Education Plan alone could add $475 billion to the national debt over 10 years.