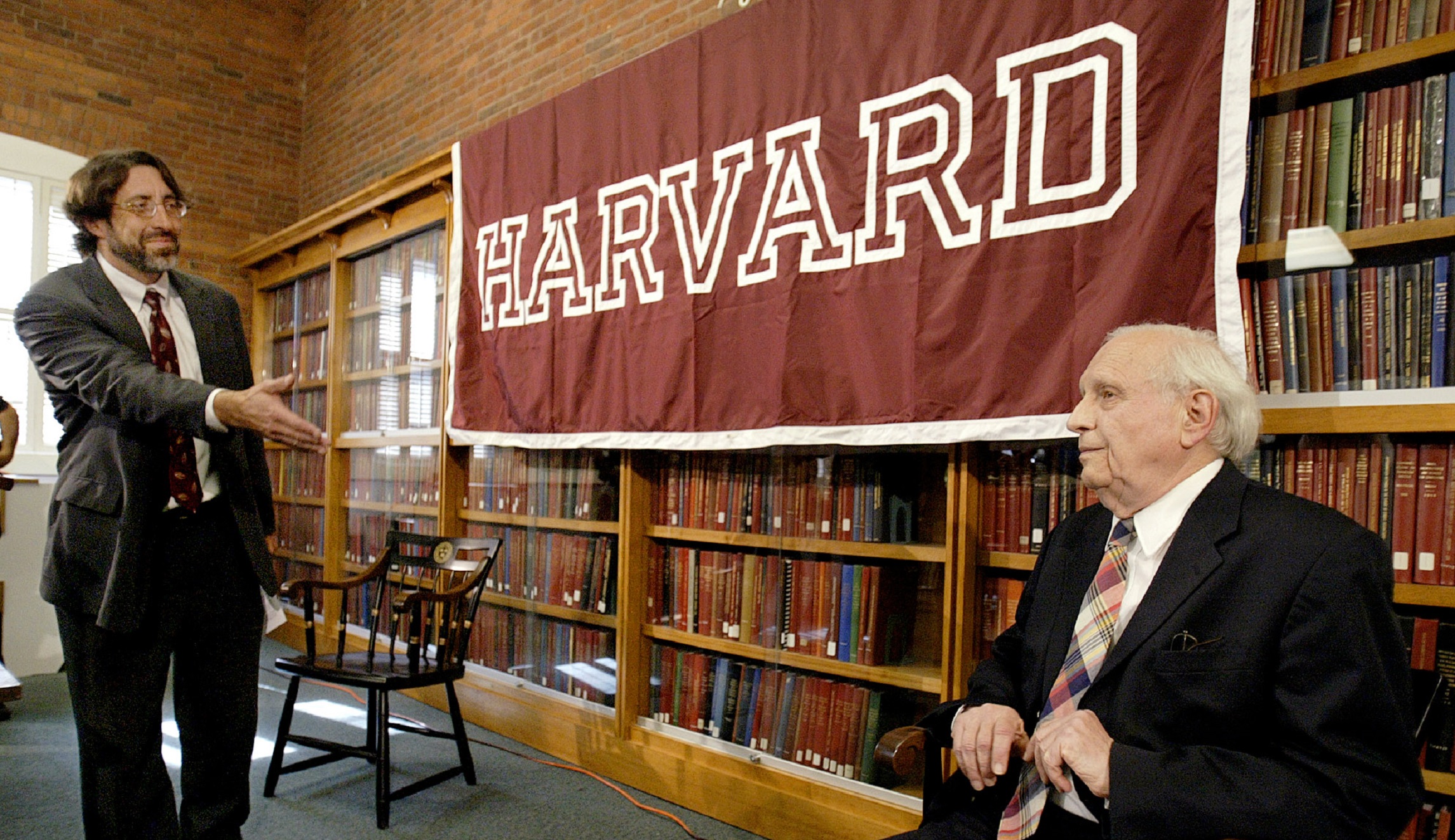

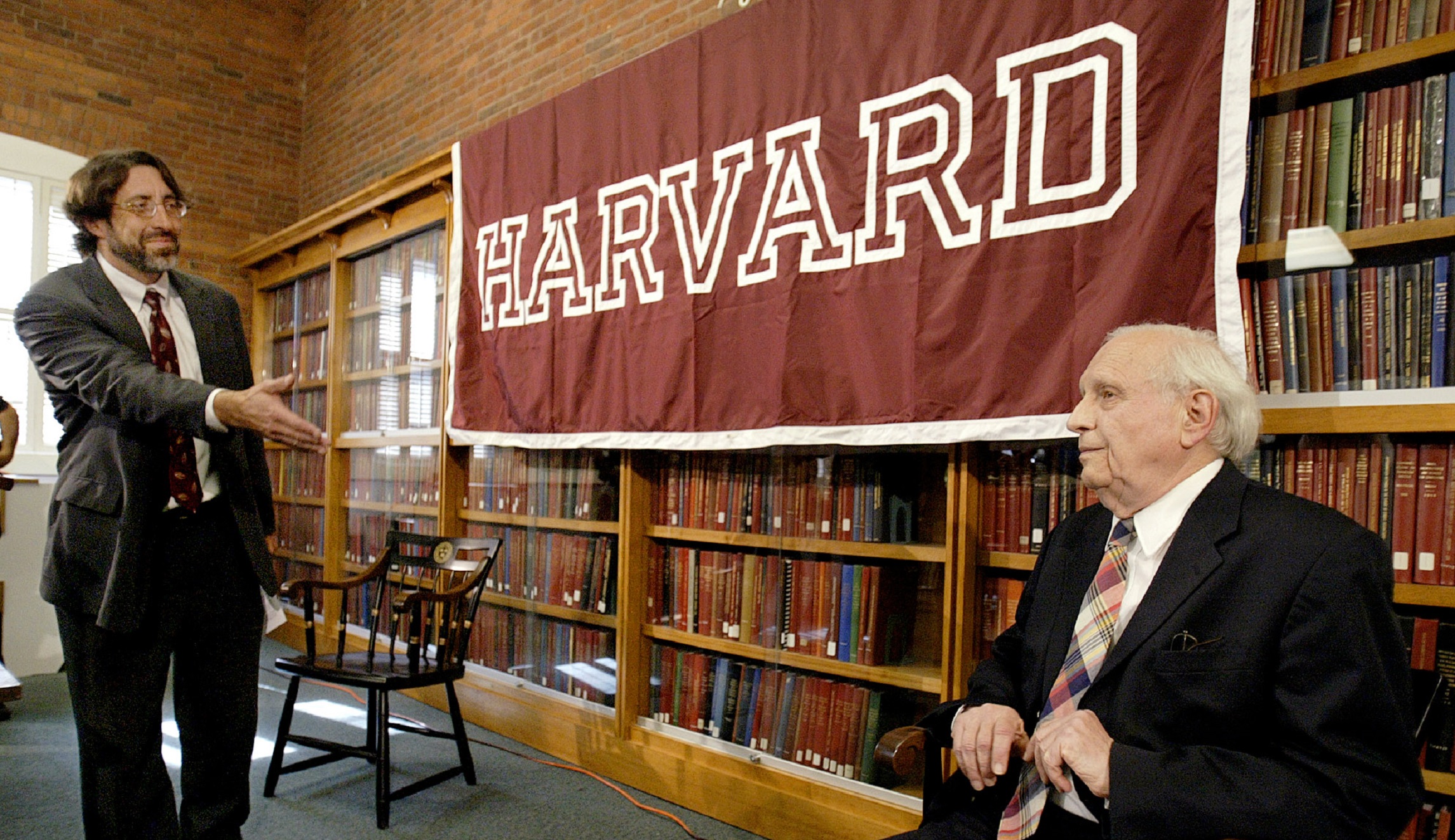

(The Center Square) – Massachusetts could soon reach into Harvard University’s $50 billion endowment and take over $1 billion in taxes if two legislators get their way.

The legislation proposed by Reps. Natalie Higgins, D-Leominster, and Christine Barber, D-Somerville, would impose a 2.5% excise tax on all private higher education institutions with over $1 billion in endowments.

Harvard’s endowment is the largest in the country, estimated to be worth nearly $50 billion. Thirteen other Massachusetts private schools would also be taxed under the bill.

Supporters of the legislation see an opportunity to increase economic growth by allowing more students to get degrees and removing barriers to working. “If we have more students being able to go and get a college degree and contribute to the Commonwealth, and if we have more families able to access childcare without worrying about how they’re going to make ends meet, it’s going to benefit the entire state,” Higgins told The Harvard Crimson.

Critics of the legislation see the proposal as an attack on higher education. “Colleges and universities increasingly rely on philanthropy and endowments to keep tuition down, provide financial aid, drive research and innovation, and support public and community service,” said Sonya Hagopian, vice president for communications at the Association of Independent Colleges and Universities in Massachusetts.

The “An Act to Support Educational Opportunity for All” bill would move any funds collected into the “Educational Opportunity for All Trust Fund.” It’s where the money would be directed instead of Harvard’s substantial endowment, motivated the bill’s sponsors.

“We’re not targeting these institutions because they are higher ed institutions,” said Higgins. “We are really redirecting this money just to make sure that every single person in the Commonwealth has the opportunity to get a college education.”

The commonwealth would be restricted from using the funds for anything besides increasing access to school. “The fund shall be used exclusively for the purposes of subsidizing the cost of higher education, early education and child care for lower-income and middle-class residents of the commonwealth,” the bill says.

The House recently extended the reporting date to April 30, pending concurrence by the Senate.