The Secret Sauce to Lowering Wages: Biden’s Loose Border Policy

Walmart is cutting wages for new employees stocking shelves and packing online orders.

This is a surprising turn of events given what appears to be a tight labor market. The ratio of job vacancies to unemployed people remains at an extremely high 1.5 to one. The unemployment rate is 3.8 percent nationwide, with the median among states as low as three percent. Consumer spending rose in July an astonishing 0.8 percent. Retail sales at general merchandise stores, the category that includes Walmart, rose by the same 0.8 percent.

How is Walmart able to reduce wages in an environment of low unemployment and rising demand?

It’s very likely that a hidden-in-plain sight program of Bidenonomics is putting downward pressure on wages: uncontrolled migration.

A new report from Fitch Ratings details that higher levels of migration into the U.S. in 2022 and 2023 has increased the labor supply, driven up labor force participation, eased labor shortages that were pushing wages higher, and allowed companies like Walmart to keep growing payrolls.

“Labor supply has increased, largely on the supply and participation of immigrants, and an uptick in the participation of prime aged workers between ages 25-54,” said Olu Sonola, Head of U.S. Regional Economics.

The border crossers not only add to the total number available to be hired, they tend to have a higher work force participation rate.

Erasing the Wage Gains of the Post-Pandemic Era

Fitch points out that year-over-year wage growth of all private industry employees is declining. Last year, wages rose around six percent, and now they are rising at a five percent annual rate, according to Fitch. Wage growth in the leisure and hospitality space—a prime employer for foreign workers—has declined significantly, Fitch writes.

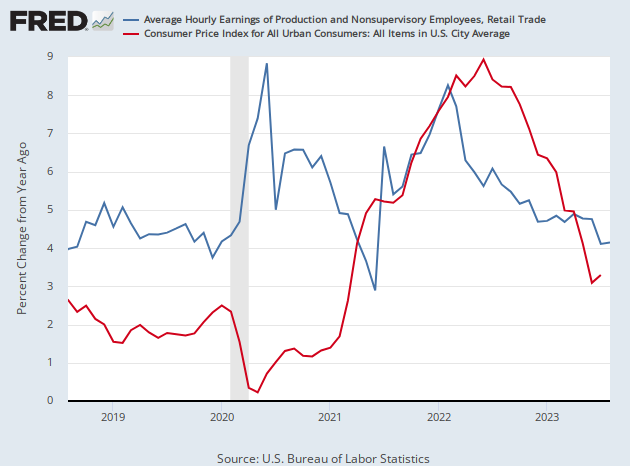

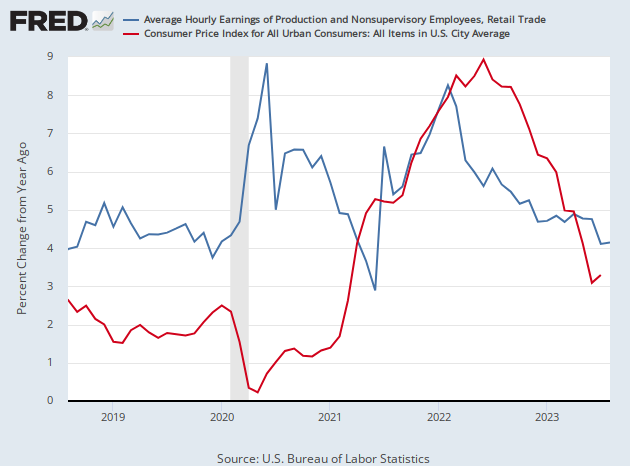

The average hourly wage of retail workers has generally risen this year—but at a slower pace than last year. Wages are up 4.2 percent from a year ago, a slowdown from the five percent increase last summer.

If we set aside managers and supervisors, the average hourly wage in retail is up 4.1 percent compared with last August. A year ago, these employees were sitting on a 5.7 percent wage gain.

As the chart below indicates, the average hourly earnings gain (blue line) is now running lower than it was for most of the last year of the Trump presidency. What’s more, these gains are worth far less to workers because inflation (red line) is so much higher.

Open Borders Does Not Provide Relief from Inflation

While this is being celebrated in some circles as evidence that inflation will continue to decline, there’s good reason to doubt that. Wage growth was not the primary driver of inflation in the post-pandemic period. So, reducing the pace of wage growth might not have all that big of an effect on inflation.

What’s more, if wages are falling because more workers are entering the country, this could have the opposite effect. When wages fall because demand for labor has cooled, this can put downward pressure on inflation, especially if the total income of the working population is shrinking because of this. But when wages fall because newcomers are added to the population, this does not diminish demand for goods and services. It increases it.

Border crossers do not just contribute to the supply of labor. They contribute to demand for goods, especially groceries and shelter. In July, one of the biggest increases in spending on goods came from the grocery category. For services, it was housing. The consumer price index for shelter was up 7.7 percent year over year in July, making it one of the worst inflation afflicted areas of the economy. Grocery prices were up 3.6 percent, which partly reflects the fact that grocery prices rose so fast last year.

In other words, Bidenomics may be accomplishing something many economists view as almost impossible: sustained inflation amid falling working-class wages.