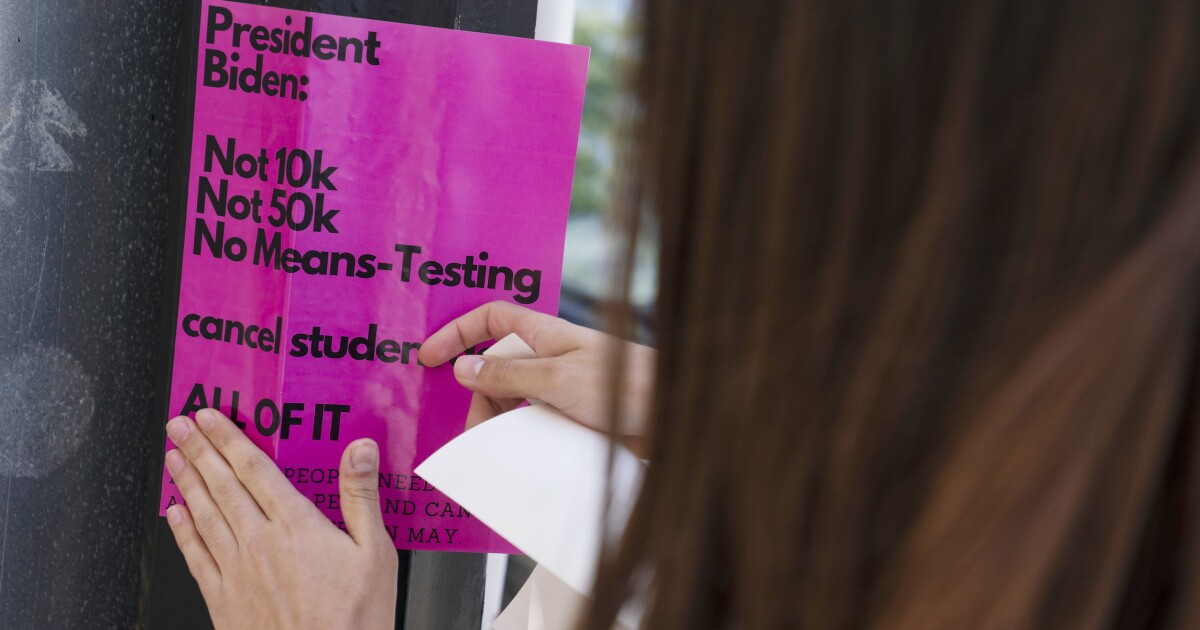

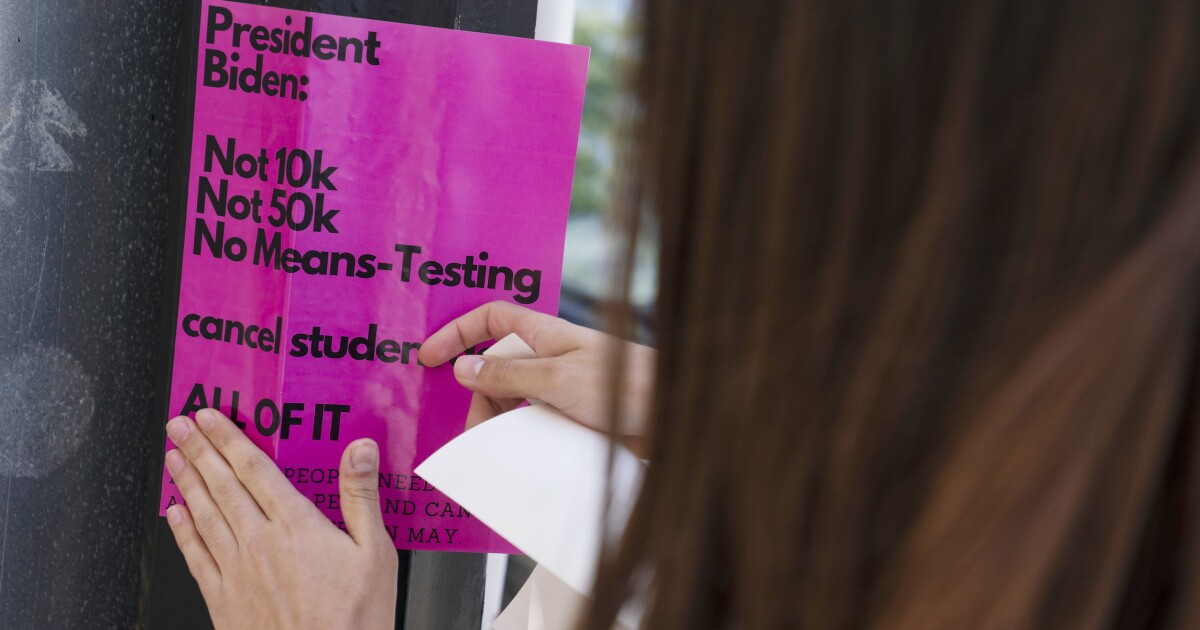

As the Biden administration drops hints that it may move to cancel student loan debt with or without Congress, questions about Biden’s legal authority to do so have arisen.

President Joe Biden promised to address student loan debt on the 2020 campaign trail, but in office, he has mostly said he’s waiting on Congress to act first. Though that stance seems to have shifted in recent weeks, experts are divided on whether or not Biden can legally shift student loan debt via executive order.

BIDEN STUDENT DEBT CANCELLATION PLAN AIMED AT FIRING UP LIBERAL VOTERS

“It’s a simple question, and the answer is no,” said GianCarlo Canaparo, a senior legal fellow at the conservative Heritage Foundation. “Congress hasn’t taken the first step, which is to give him the power to do this with respect to student loans generally.”

Persis Yu, policy director and managing counsel at the Student Borrower Protection Center, has a different take.

“Yes, absolutely, Biden has the legal authority under the Higher Education Act to grant widespread debt cancellation,” said Yu. “We don’t need to go through Congress. [Executive action] is the fastest and simplest way to get relief to the borrowers that need it.”

The background and laws concerning the question are complex, but both Yu and Canaparo cite language in the Higher Education Act of 1965 to back their arguments. Buried deep in the text of the act is language empowering the Secretary of Education to “enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”

Each interprets the wording as supporting their cause, with Yu pointing out that this text has been relied on to allow the current student loan pause, with full cancellation just a further extension of that authority. Canaparo argues the authority does not extend to canceling student loans generally.

The issue has come into focus as Biden increasingly teases executive action. After saying on the campaign trail he’d forgive all undergraduate tuition debt from public and historically black colleges for borrowers earning up to $125,000, Biden spent his first year in office pointing to Congress as a necessary first mover.

That stance seems to have shifted. On Monday, White House press secretary Jen Psaki made a move seem likely.

“He is continuing to consider and take a very hard look and close look at providing student debt relief,” she said. “And that’s something that, you know, hopefully we’ll have more on soon.”

Psaki also used the term “when” to describe a potential proposal or executive action that Biden could release publicly. More than 40 million borrowers hold a collective $1.6 trillion in federal student loan debt, and none have been required to make payments since March 2020.

Student debt cancellation is a popular issue with a segment of Democratic voters that could help the party in the midterm elections. But it has fierce critics, too, who point to the inflationary impact and the fact that debts are not truly “canceled” but absorbed by taxpayers and lumped into the national debt. There are also questions about the impact on future college costs and future borrowers, who may take on bigger loans expecting future rounds of cancellation.

Courts have tossed out several Biden policies already, enough that some call it a political strategy for his administration. There are now warnings that the same thing could happen with executive action on student loans.

Former Education Department General Counsel Charlie Rose wrote that Biden would be on shaky legal ground taking on mass forgiveness on his own.

Mark Kantrowitz, an expert on student financial aid, agrees.

“I’m pretty certain the courts would overturn such an attempt if someone decided to challenge it,” he said. “You really can’t justify erasing federal student loan debt through any kind of executive waiver authority.”

Congress has stalled on the issue, with even Democrats divided. Sens. Elizabeth Warren (D-MA) and Majority Leader Chuck Schumer (D-NY) have encouraged Biden to move on his own. Schumer says the president can do so with the “flick of a pen.”

House Speaker Nancy Pelosi (D-CA) takes the opposite view, saying last year that the president cannot address student loans and even suggesting she opposes the idea.

“Suppose … your child just decided they, at this time, [do] not want to go to college, but you’re paying taxes to forgive somebody else’s obligations,” Pelosi said last July. “You may not be happy about that.”

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

A final issue if Biden takes executive action is who would have standing to file a lawsuit as a harmed party. Canaparo floated loan servicing companies or congressional Republicans as entities who could sue, but acknowledged it could be a sticky question.

Former Trump DOE official Wayne Johnson has said he would sue, but it remains to be seen if such a lawsuit would be successful.

“It’s unclear what the basis for that would be,” said Yu. “There are not a lot of people who would potentially have standing, have the grounds to bring a lawsuit. Who would want to take that step in order to keep these borrowers in debt longer?”