By Alex Kimani of Oilprice.com

Demand for long-term LNG contracts has increased sharply in the current year, with suppliers taking advantage of robust demand thanks to a global effort to cut Russian imports by demanding much higher rates for new long-term contracts.

According to an Oil & Gas Journal report, 10-year LNG contracts are currently priced at ~75% above 2021’s rates, with tight supplies expected to persist as Europe aims to boost LNG imports.

Meanwhile, volatile spot prices and a worsening supply outlook have triggered a rush by importers to negotiate long-term deals as they attempt to lock in prices.

Last year, the volume of long-term LNG contracts signed to end-user markets climbed to a 5-year high, and the momentum is showing no signs of abating in the current year. So far this year, more than 10 million tonnes/year (tpy) of LNG has been signed to end-market users, according to a report by Wood Mackenzie.

For instance, Louisiana-based LNG company Sempra Infrastructure, a majority-owned subsidiary of Sempra Energy, has just inked its sixth long-term contract in five months. The deal calls for Sempra Infrastructure’s Cameron LNG in Hackberry to supply 2 million metric tons of LNG annually to the Polish Oil & Gas Co. Sempra Infrastructure struck another 2 million-ton deal with Polish for its upcoming Port Arthur LNG facility in Port Arthur, Texas.

Most new contracts are from U.S. supply as operators move projects forward. All these contracts are linked to North American prices. Meanwhile, Chinese buyers continue to dominate the market, signing more than 8 million tpy of new LNG sale and purchase agreements this year.

“The Russian invasion of Ukraine has had a dramatic impact on long-term LNG contracts. Many traditional LNG buyers will neither procure spot gas or LNG nor renew or sign additional LNG contracts with Russian sellers. Spot prices have also been high and volatile, pushing many buyers towards long-term contracts. Additionally, some buyers are returning to long-term contracting on behalf of governments to protect national energy security,” Wood Mackenzie principal analyst Daniel Toleman has said.

Pricey Deals

According to WoodMac, sellers are unwilling to agree to any deal below a 12% slope of current Brent crude oil futures prices, compared with the just over 10% slope in deals a year ago.

LNG contract prices are typically expressed as a slope, or percentage, of Brent prices.

For example, a 12% slope of the current front-month Brent price of $111.50 a barrel would translate to LNG price of roughly $13.38 per mmBtu, though the contracts may not be that straightforward on pricing. That level would be well below current spot prices.

Contracted LNG supply linked to the price of oil--a practice dating back to the 1970s--is currently much lower than the cost of buying a shipment from the spot market. But that discount is shrinking as available supplies dwindle.

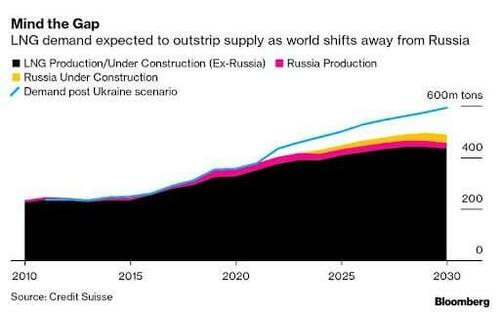

The Ukraine crisis, the energy transition, severe weather, and surging demand are creating a period of upheaval that is tightening supply like never before in the natural gas industry. Credit Suisse has estimated that the global LNG market could be short nearly 100 million tons per year by the middle of the decade if the world moves to cut Russian gas.

Middle East LNG sellers are currently demanding deals above 12%. According to Toleman, these deals have limited flexibility, seasonality, and are fixed to a market, so the slope of a ‘normal’ contract is actually higher at 12.5-14%.

“There has been news about sellers wanting 16% or 17% for 10 years, but we have not been able to substantiate this. Short-term deals can attract these rates. We believe that sellers can get 16% slopes for 2- or 3- year deals with volumes ending before the end of 2024. The range is slightly lower at 14-15% for 4- or 5-year deals with volumes that end in 2026,” Toleman says.

Chinese buyers have continued their strategy of procuring low-priced LNG. Since mid-2021, Chinese buyers have targeted Henry Hub deals with liquefaction tariffs below $2/MMbtu.

In Europe, French multinational utility Engie SA has signed up to 1.75 million tpy for 15 years from NextDecade’s Rio Grande project, a project that will use carbon capture and storage (CCS) to reduce its emission footprint.

“Recent brownfield Henry Hub-linked deals are rumored to have liquefaction tolling fees below $2/MMbtu. This follows deals signed last year in a similar range. We expect higher capacity fees for Henry Hub-linked deals under negotiation. This is reflective of two trends. First, more advanced projects capable of delivering LNG in the 2025-2026 timeframe will attract premiums. Second, rising raw material, labor and EPC costs are all driving up the cost of delivering projects on the US Gulf Coast, in turn resulting in higher capacity fees,” Toleman has said.

Resurgence In Long-Term Offtake Agreements

Not surprisingly, the strength in LNG markets has spurred a resurgence in long-term offtake agreements, which experts see as key to advancing LNG export projects towards Final Investment Decision (FID).

Indeed, potential FIDs in 2022 will support a more than two-fold increase in U.S. LNG export capacity, with FID in 2022 contributing to a ~15.1 billion cubic feet per day (Bcf/d) capacity expansion relative to the 13.8 Bcf/d of LNG export capacity operating in the U.S. today.

To wit, Venture Global has announced FID for its Plaquemines LNG project in May after securing $13.2 billion in financing. Plaquemines marks the first FID for a U.S. LNG export facility since Venture Global’s Calcasieu Pass in August 2019.

Other projects bounding towards FID announcements this year include Tellurian’s first phase of its Driftwood LNG project; Cheniere Energy’s Corpus Christi Stage 3 expansion this summer, as well as Energy Transfer’s and NextDecade, both of which are searching for customers for their LNG projects at Lake Charles in Louisiana and Rio Grande in Brownsville, Texas, respectively.

By Alex Kimani of Oilprice.com

Demand for long-term LNG contracts has increased sharply in the current year, with suppliers taking advantage of robust demand thanks to a global effort to cut Russian imports by demanding much higher rates for new long-term contracts.

According to an Oil & Gas Journal report, 10-year LNG contracts are currently priced at ~75% above 2021’s rates, with tight supplies expected to persist as Europe aims to boost LNG imports.

Meanwhile, volatile spot prices and a worsening supply outlook have triggered a rush by importers to negotiate long-term deals as they attempt to lock in prices.

Last year, the volume of long-term LNG contracts signed to end-user markets climbed to a 5-year high, and the momentum is showing no signs of abating in the current year. So far this year, more than 10 million tonnes/year (tpy) of LNG has been signed to end-market users, according to a report by Wood Mackenzie.

For instance, Louisiana-based LNG company Sempra Infrastructure, a majority-owned subsidiary of Sempra Energy, has just inked its sixth long-term contract in five months. The deal calls for Sempra Infrastructure’s Cameron LNG in Hackberry to supply 2 million metric tons of LNG annually to the Polish Oil & Gas Co. Sempra Infrastructure struck another 2 million-ton deal with Polish for its upcoming Port Arthur LNG facility in Port Arthur, Texas.

Most new contracts are from U.S. supply as operators move projects forward. All these contracts are linked to North American prices. Meanwhile, Chinese buyers continue to dominate the market, signing more than 8 million tpy of new LNG sale and purchase agreements this year.

“The Russian invasion of Ukraine has had a dramatic impact on long-term LNG contracts. Many traditional LNG buyers will neither procure spot gas or LNG nor renew or sign additional LNG contracts with Russian sellers. Spot prices have also been high and volatile, pushing many buyers towards long-term contracts. Additionally, some buyers are returning to long-term contracting on behalf of governments to protect national energy security,” Wood Mackenzie principal analyst Daniel Toleman has said.

Pricey Deals

According to WoodMac, sellers are unwilling to agree to any deal below a 12% slope of current Brent crude oil futures prices, compared with the just over 10% slope in deals a year ago.

LNG contract prices are typically expressed as a slope, or percentage, of Brent prices.

For example, a 12% slope of the current front-month Brent price of $111.50 a barrel would translate to LNG price of roughly $13.38 per mmBtu, though the contracts may not be that straightforward on pricing. That level would be well below current spot prices.

Contracted LNG supply linked to the price of oil–a practice dating back to the 1970s–is currently much lower than the cost of buying a shipment from the spot market. But that discount is shrinking as available supplies dwindle.

The Ukraine crisis, the energy transition, severe weather, and surging demand are creating a period of upheaval that is tightening supply like never before in the natural gas industry. Credit Suisse has estimated that the global LNG market could be short nearly 100 million tons per year by the middle of the decade if the world moves to cut Russian gas.

Middle East LNG sellers are currently demanding deals above 12%. According to Toleman, these deals have limited flexibility, seasonality, and are fixed to a market, so the slope of a ‘normal’ contract is actually higher at 12.5-14%.

“There has been news about sellers wanting 16% or 17% for 10 years, but we have not been able to substantiate this. Short-term deals can attract these rates. We believe that sellers can get 16% slopes for 2- or 3- year deals with volumes ending before the end of 2024. The range is slightly lower at 14-15% for 4- or 5-year deals with volumes that end in 2026,” Toleman says.

Chinese buyers have continued their strategy of procuring low-priced LNG. Since mid-2021, Chinese buyers have targeted Henry Hub deals with liquefaction tariffs below $2/MMbtu.

In Europe, French multinational utility Engie SA has signed up to 1.75 million tpy for 15 years from NextDecade’s Rio Grande project, a project that will use carbon capture and storage (CCS) to reduce its emission footprint.

“Recent brownfield Henry Hub-linked deals are rumored to have liquefaction tolling fees below $2/MMbtu. This follows deals signed last year in a similar range. We expect higher capacity fees for Henry Hub-linked deals under negotiation. This is reflective of two trends. First, more advanced projects capable of delivering LNG in the 2025-2026 timeframe will attract premiums. Second, rising raw material, labor and EPC costs are all driving up the cost of delivering projects on the US Gulf Coast, in turn resulting in higher capacity fees,” Toleman has said.

Resurgence In Long-Term Offtake Agreements

Not surprisingly, the strength in LNG markets has spurred a resurgence in long-term offtake agreements, which experts see as key to advancing LNG export projects towards Final Investment Decision (FID).

Indeed, potential FIDs in 2022 will support a more than two-fold increase in U.S. LNG export capacity, with FID in 2022 contributing to a ~15.1 billion cubic feet per day (Bcf/d) capacity expansion relative to the 13.8 Bcf/d of LNG export capacity operating in the U.S. today.

To wit, Venture Global has announced FID for its Plaquemines LNG project in May after securing $13.2 billion in financing. Plaquemines marks the first FID for a U.S. LNG export facility since Venture Global’s Calcasieu Pass in August 2019.

Other projects bounding towards FID announcements this year include Tellurian’s first phase of its Driftwood LNG project; Cheniere Energy’s Corpus Christi Stage 3 expansion this summer, as well as Energy Transfer’s and NextDecade, both of which are searching for customers for their LNG projects at Lake Charles in Louisiana and Rio Grande in Brownsville, Texas, respectively.