One of the notable features of the May FOMC statement is that unlike back in March, it came with no projection materials. But that doesn't mean that the Fed staff did not discuss - and revise - their economic and inflation forecasts.

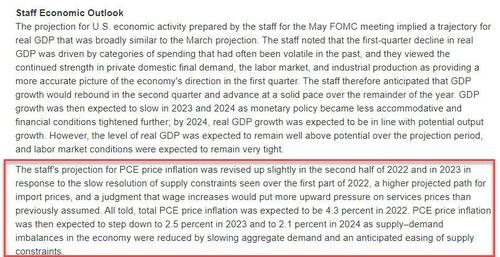

Indeed, as the "Staff Economic Outlook" section in today's Minutes reveals, "the staff's projection for PCE price inflation was revised up slightly in the second half of 2022 and in 2023 in response to the slow resolution of supply constraints seen over the first part of 2022, a higher projected path for import prices, and a judgment that wage increases would put more upward pressure on services prices than previously assumed." All told, the Minutes conclude, "total PCE price inflation was expected to be 4.3 percent in 2022. PCE price inflation was then expected to step down to 2.5 percent in 2023 and to 2.1 percent in 2024 as supply–demand imbalances in the economy were reduced by slowing aggregate demand and an anticipated easing of supply constraints."

This matters a lot, because as Bloomberg's Vincent Cignarella calculates, while most Fed officials agreed that the central bank would continue to tighten in 50bps increments over the next couple of meetings, continuing an aggressive set of moves that would leave policy makers with flexibility to shift gears later if needed, it may not last long at all.

And, as Cignarella concludes referring to the Fed's updated PCE forecast (which ends 2022 at 4.3% but then drops to 2.5% in 2023 and 2.1% in 2024), "if their forecast is accurate, it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022."

Incidentally, this aligns with JPMorgan's own estimates when the Fed will likely pause and/or pivot: as JPM's Andrew Tyler wrote overnight, while "financial conditions are already at the level in which we saw the Fed pivot in 2018/19; I think it is unlikely we see the Fed pivot at this stage in the tightening cycle." After all, Powell said that he and the Fed need to see material evidence of slowing inflation. So, with "the September Fed meeting one where we could see a pivot, that essentially leaves 3 more CPI prints to prove the case (the release date for August CPI is Sept 13 which falls within the Fed blackout period)." This may explain why earlier this week Bostic also hinted that the Fed could pause in September.

*BOSTIC: MAY MAKE SENSE TO PAUSE IN SEPT., DEPENDING ON ECONOMY

— zerohedge (@zerohedge) May 23, 2022

And there it is: the first "pause" hint

Expect many more, and then a hard stop

Translation: three more 50bps hike and then the Fed pauses... indefinitely, its next move a cut as the economic recession emerges from hiding.

One of the notable features of the May FOMC statement is that unlike back in March, it came with no projection materials. But that doesn’t mean that the Fed staff did not discuss – and revise – their economic and inflation forecasts.

Indeed, as the “Staff Economic Outlook” section in today’s Minutes reveals, “the staff’s projection for PCE price inflation was revised up slightly in the second half of 2022 and in 2023 in response to the slow resolution of supply constraints seen over the first part of 2022, a higher projected path for import prices, and a judgment that wage increases would put more upward pressure on services prices than previously assumed.” All told, the Minutes conclude, “total PCE price inflation was expected to be 4.3 percent in 2022. PCE price inflation was then expected to step down to 2.5 percent in 2023 and to 2.1 percent in 2024 as supply–demand imbalances in the economy were reduced by slowing aggregate demand and an anticipated easing of supply constraints.”

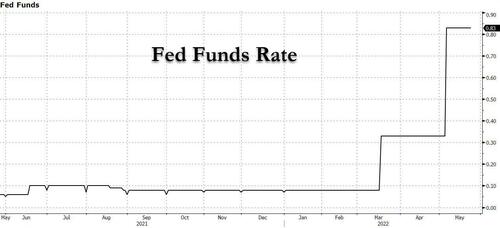

This matters a lot, because as Bloomberg’s Vincent Cignarella calculates, while most Fed officials agreed that the central bank would continue to tighten in 50bps increments over the next couple of meetings, continuing an aggressive set of moves that would leave policy makers with flexibility to shift gears later if needed, it may not last long at all.

And, as Cignarella concludes referring to the Fed’s updated PCE forecast (which ends 2022 at 4.3% but then drops to 2.5% in 2023 and 2.1% in 2024), “if their forecast is accurate, it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022.“

Incidentally, this aligns with JPMorgan’s own estimates when the Fed will likely pause and/or pivot: as JPM’s Andrew Tyler wrote overnight, while “financial conditions are already at the level in which we saw the Fed pivot in 2018/19; I think it is unlikely we see the Fed pivot at this stage in the tightening cycle.” After all, Powell said that he and the Fed need to see material evidence of slowing inflation. So, with “the September Fed meeting one where we could see a pivot, that essentially leaves 3 more CPI prints to prove the case (the release date for August CPI is Sept 13 which falls within the Fed blackout period).” This may explain why earlier this week Bostic also hinted that the Fed could pause in September.

*BOSTIC: MAY MAKE SENSE TO PAUSE IN SEPT., DEPENDING ON ECONOMY

And there it is: the first “pause” hint

Expect many more, and then a hard stop— zerohedge (@zerohedge) May 23, 2022

Translation: three more 50bps hike and then the Fed pauses… indefinitely, its next move a cut as the economic recession emerges from hiding.