After last week saw The Fed's balance sheet shrink significantly back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening to see if things have continued to 'improve' or re-worsened amid regional bank shares unable to bounce above post-SVB lows ahead of earnings.

This week's $30.27 billion inflow means that over the last five weeks, we have seen over $380 billion flow into money market funds which is the largest ever inflow outside of the COVID lockdown panic...

Source: Bloomberg

That pushed assets to a record $5.277 trillion, well above the $4.8 trillion pandemic peak, suggesting that US commercial bank deposits continued to fall...

Source: Bloomberg

The silver lining there is that the rate of flow into MM funds is slowing and thus, potentially, the pace of deposit outflows is also slowing.

Though not wanting to piss all over those hopeful fireworks, we note that reverse repo continues to rise...

Source: Bloomberg

The most anticipated financial update of the week - the infamous H.4.1. showed the world's most important balance sheet shrank for the 3rd straight week last week, by $17.59 billion, dramatically less than last week's $73.558 billion tumble - the biggest weekly decline in The Fed's balance sheet since July 2020...

Source: Bloomberg

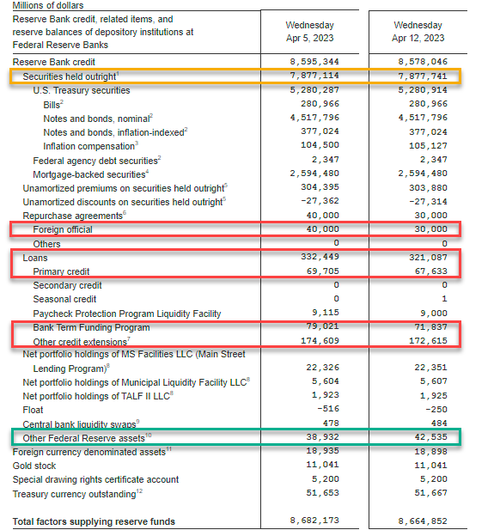

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings fell modestly from $149 billion to $139 billion (still massively higher than the $4.5 billion pre-SVB)...

Source: Bloomberg

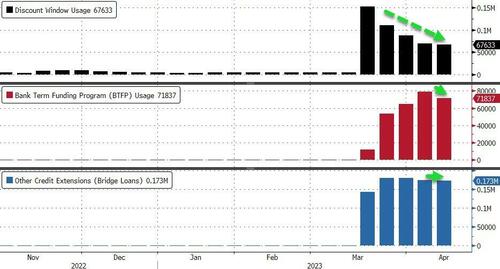

...but the composition shifted, as usage of the Discount Window dropped by $2.1 billion to $67.6 billion (upper pane below) along with a $8.2 billion decrease in usage of the Fed's brand new Bank Term Funding Program, or BTFP, to $71.8 billion (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions - consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank - fell very modestly from $175BN to $173BN (lower pane)...

Source: Bloomberg

There was zero QT this week (which was last week's big downside driver of the Fed balance sheet) but we do note that 'Other Fed Assets' rose by $3.6 billion...

The continued rise in MM inflows suggest bank deposit flight continues and the smaller shrink of The Fed's balance sheet suggests this is far from over yet. The silver lining is that emergency usage facilities eased modestly (but remain extremely high relative to pre-SVB).

After last week saw The Fed’s balance sheet shrink significantly back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening to see if things have continued to ‘improve’ or re-worsened amid regional bank shares unable to bounce above post-SVB lows ahead of earnings.

This week’s $30.27 billion inflow means that over the last five weeks, we have seen over $380 billion flow into money market funds which is the largest ever inflow outside of the COVID lockdown panic…

Source: Bloomberg

That pushed assets to a record $5.277 trillion, well above the $4.8 trillion pandemic peak, suggesting that US commercial bank deposits continued to fall…

Source: Bloomberg

The silver lining there is that the rate of flow into MM funds is slowing and thus, potentially, the pace of deposit outflows is also slowing.

Though not wanting to piss all over those hopeful fireworks, we note that reverse repo continues to rise…

Source: Bloomberg

The most anticipated financial update of the week – the infamous H.4.1. showed the world’s most important balance sheet shrank for the 3rd straight week last week, by $17.59 billion, dramatically less than last week’s $73.558 billion tumble – the biggest weekly decline in The Fed’s balance sheet since July 2020…

Source: Bloomberg

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings fell modestly from $149 billion to $139 billion (still massively higher than the $4.5 billion pre-SVB)…

Source: Bloomberg

…but the composition shifted, as usage of the Discount Window dropped by $2.1 billion to $67.6 billion (upper pane below) along with a $8.2 billion decrease in usage of the Fed’s brand new Bank Term Funding Program, or BTFP, to $71.8 billion (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions – consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank – fell very modestly from $175BN to $173BN (lower pane)…

Source: Bloomberg

While the reduction in banks’ usage of the BTFP bailout facility is positive, given the drop in yields (and thus rise in MTM value of banks’ HTM books), we would have expected a larger decline in the emergency facility’s usage.

There was zero QT this week (which was last week’s big downside driver of the Fed balance sheet) but we do note that ‘Other Fed Assets’ rose by $3.6 billion…

On the foreign (USD funding) side of the Fed balance sheet, reverse repo usage rose $20 billion and Fed custody holdings of Treasuries (for foreigners) also rose…

The continued rise in MM inflows suggest bank deposit flight continues and the smaller shrink of The Fed’s balance sheet suggests this is far from over yet. The silver lining is that emergency usage facilities eased modestly (but remain extremely high relative to pre-SVB).

Loading…