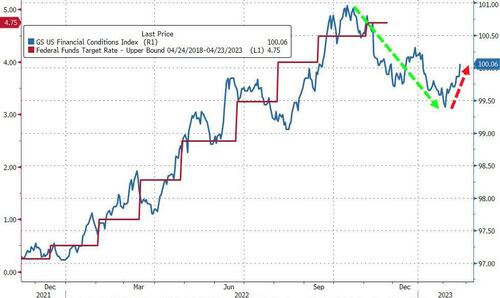

Tl:dr: Fed Minutes appear to argue against what Powell said during the presser on the decoupling of financial conditions from monetary policy:

Powell declined to try to talk down financial markets, pointedly noting that it wasn’t up to him to persuade people, saying:

“We’re just going to have to see.”

By contrast, it seems like there were others on the panel that were concerned.

“Participants noted that it was important that overall financial conditions be consistent with the degree of policy restraint that the Committee is putting into place in order to bring inflation back to the 2 percent goal.”

Additionally:

“several participants observed that some measures of financial conditions had eased over the past few months.”

While Powell said at the meeting

“Financial conditions didn’t really change much from the December meeting to now.”

And there's a long way to go to catch up...

Overall, Bloomberg's sentiment model suggests the Minutes were more dovish than the last...

That is the most dovish statement in at least two years.

But, David Wilcox of Bloomberg Economics noted on BTV, there is only a single mention of a "pause" in rates -- and that one is in reference to other central banks!

* * *

Since the last FOMC meeting (on Feb 1st) when Chair Powell dismissed any fears about loosening financial conditions, prompting a panic-bid in stocks, financial conditions have done nothing but tighten as the FedSpeak along with 'good' economic news has nuked the 'Fed pivot' narrative...

Source: Bloomberg

That is even more evident in the hawkish explosion higher in the market's expectation for The Fed's terminal rate and the collapse in hopes of a H2 2023 rate-cut...

Source: Bloomberg

With the odds of 25bp hikes in March, May, and June all rising rapidly...

Source: Bloomberg

All of which has prompted chaos across asset classes with gold and bonds down notably, bitcoin and the dollar stronger and stocks fading fast in the last few days...

Source: Bloomberg

And if there is one final thing to consider before The Minutes come out, it's the fact that US macro data has dramatically surprised to the upside (and sticky inflation expectations along with it):

-

the 517,000 surge in January payrolls that blew away estimates

-

the re-acceleration of month-on-month CPI inflation in January

-

the biggest jump in the ISM services gauge since mid-2020

-

the largest increase in retail sales in nearly two years

...making the Minutes very stale.

Source: Bloomberg

As a reminder, Fed Chair Powell actually told us during the press conference on Feb 1st that:

“The minutes will come out in three weeks and will give you a lot of detail. We spend a lot of time talking about the path ahead and the state of the economy. And I wouldn’t want to start to describe all the details there, but that was -- the sense of the discussion was really talking quite a bit about the path forward.”

While the biggest issue to watch for is just how dovish sentiment really is within The Fed, we already know that at least two Fed members pushed for 50bps (Mester and Bullard) at the last meeting, so what will The Minutes tell us (now that they are so stale)...

On 25 or 50 bps

In their consideration of appropriate monetary policy actions at this meeting, participants concurred that the Committee had made significant progress over the past year in moving toward a sufficiently restrictive stance of monetary policy. Even so, participants agreed that, while there were recent signs that the cumulative effect of the Committee’s tightening of the stance of monetary policy had begun to moderate inflationary pressures, inflation remained well above the Committee’s longer-run goal of 2 percent and the labor market remained very tight, contributing to continuing upward pressures on wages and prices.

Against this backdrop, and in consideration of the lags with which monetary policy affects economic activity and inflation, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points at this meeting. Many of these participants observed that a further slowing in the pace of rate increases would better allow them to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability as they determine the extent of future policy tightening that will be required to attain a stance that is sufficiently restrictive to achieve these goals.

A few participants stated that they favored raising the target range for the federal funds rate 50 basis points at this meeting or that they could have supported raising the target by that amount. The participants favoring a 50-basis point increase noted that a larger increase would more quickly bring the target range close to the levels they believed would achieve a sufficiently restrictive stance, taking into account their views of the risks to achieving price stability in a timely way.

All participants agreed that it was appropriate to continue the process of reducing the Federal Reserve’s securities holdings, as described in its previously announced Plans for Reducing the Size of the Federal Reserve’s Balance Sheet.

On Risk Management

"Almost all participants observed that slowing the pace of rate increases at the current juncture would allow for appropriate risk management."

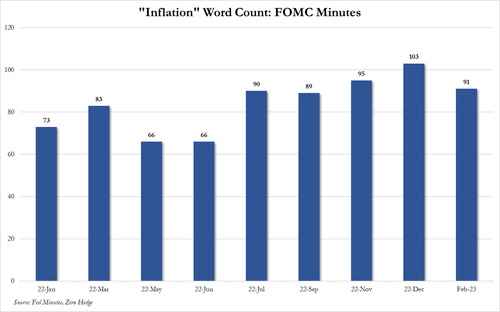

On Inflation

"A number of participants observed that a policy stance that proved to be insufficiently restrictive could halt recent progress in moderating inflationary pressures."

The Fed staff doesn’t see inflation moving back to 2% until 2025:

“With steep declines in consumer energy prices and a substantial moderation in food price inflation expected for this year, total inflation was projected to step down markedly this year and then to track core inflation over the following two years. In 2025, both total and core PCE price inflation were expected to be near 2 percent.”

On market valuations

“The staff judged that asset valuation pressures remained notable. In particular, the staff noted that measures of valuations in both residential and commercial property markets remained high, and that the potential for large declines in property prices remained greater than usual. In addition, the forward price-to-earnings ratio for S&P 500 firms remained above its median value despite the decline in equity prices over the past year.”

On Household Spending Slowdown

"In their discussion of the household sector, participants noted that growth in consumer spending had softened recently. Several participants remarked that there had been a reduction in discretionary expenditures, especially among lower- and middle-income households, whose purchases were shifting toward lower-cost options."

On Labor Hoarding

"A number of participants remarked that some businesses were keen to retain workers after their recent experiences of labor shortages and hiring challenges. These participants noted that this consideration had limited layoffs even as the broader economy had softened"

On The Debt Limit

“A number of participants stressed that a drawn-out period of negotiations to raise the federal debt limit could pose significant risks to the financial system and the broader economy.”

On financial conditions

...officials said it was important “that overall financial conditions be consistent with the degree of policy restraint that the Committee is putting into place in order to bring inflation back to the 2 percent goal.”

Additionally:

“several participants observed that some measures of financial conditions had eased over the past few months.”

While Powell said at the meeting

“Financial conditions didn’t really change much from the December meeting to now.”

Still a long way to go to normalize back to monetary policy...

But, David Wilcox of Bloomberg Economics noted on BTV, there is only a single mention of a "pause" in rates -- and that one is in reference to other central banks!

Read the full Minutes below:

Tl:dr: Fed Minutes appear to argue against what Powell said during the presser on the decoupling of financial conditions from monetary policy:

Powell declined to try to talk down financial markets, pointedly noting that it wasn’t up to him to persuade people, saying:

“We’re just going to have to see.”

By contrast, it seems like there were others on the panel that were concerned.

“Participants noted that it was important that overall financial conditions be consistent with the degree of policy restraint that the Committee is putting into place in order to bring inflation back to the 2 percent goal.”

Additionally:

“several participants observed that some measures of financial conditions had eased over the past few months.”

While Powell said at the meeting

“Financial conditions didn’t really change much from the December meeting to now.”

And there’s a long way to go to catch up…

Overall, Bloomberg’s sentiment model suggests the Minutes were more dovish than the last…

That is the most dovish statement in at least two years.

But, David Wilcox of Bloomberg Economics noted on BTV, there is only a single mention of a “pause” in rates — and that one is in reference to other central banks!

* * *

Since the last FOMC meeting (on Feb 1st) when Chair Powell dismissed any fears about loosening financial conditions, prompting a panic-bid in stocks, financial conditions have done nothing but tighten as the FedSpeak along with ‘good’ economic news has nuked the ‘Fed pivot’ narrative…

Source: Bloomberg

That is even more evident in the hawkish explosion higher in the market’s expectation for The Fed’s terminal rate and the collapse in hopes of a H2 2023 rate-cut…

Source: Bloomberg

With the odds of 25bp hikes in March, May, and June all rising rapidly…

Source: Bloomberg

All of which has prompted chaos across asset classes with gold and bonds down notably, bitcoin and the dollar stronger and stocks fading fast in the last few days…

Source: Bloomberg

And if there is one final thing to consider before The Minutes come out, it’s the fact that US macro data has dramatically surprised to the upside (and sticky inflation expectations along with it):

-

the 517,000 surge in January payrolls that blew away estimates

-

the re-acceleration of month-on-month CPI inflation in January

-

the biggest jump in the ISM services gauge since mid-2020

-

the largest increase in retail sales in nearly two years

…making the Minutes very stale.

Source: Bloomberg

As a reminder, Fed Chair Powell actually told us during the press conference on Feb 1st that:

“The minutes will come out in three weeks and will give you a lot of detail. We spend a lot of time talking about the path ahead and the state of the economy. And I wouldn’t want to start to describe all the details there, but that was — the sense of the discussion was really talking quite a bit about the path forward.”

While the biggest issue to watch for is just how dovish sentiment really is within The Fed, we already know that at least two Fed members pushed for 50bps (Mester and Bullard) at the last meeting, so what will The Minutes tell us (now that they are so stale)…

On 25 or 50 bps

In their consideration of appropriate monetary policy actions at this meeting, participants concurred that the Committee had made significant progress over the past year in moving toward a sufficiently restrictive stance of monetary policy. Even so, participants agreed that, while there were recent signs that the cumulative effect of the Committee’s tightening of the stance of monetary policy had begun to moderate inflationary pressures, inflation remained well above the Committee’s longer-run goal of 2 percent and the labor market remained very tight, contributing to continuing upward pressures on wages and prices.

Against this backdrop, and in consideration of the lags with which monetary policy affects economic activity and inflation, almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points at this meeting. Many of these participants observed that a further slowing in the pace of rate increases would better allow them to assess the economy’s progress toward the Committee’s goals of maximum employment and price stability as they determine the extent of future policy tightening that will be required to attain a stance that is sufficiently restrictive to achieve these goals.

A few participants stated that they favored raising the target range for the federal funds rate 50 basis points at this meeting or that they could have supported raising the target by that amount. The participants favoring a 50-basis point increase noted that a larger increase would more quickly bring the target range close to the levels they believed would achieve a sufficiently restrictive stance, taking into account their views of the risks to achieving price stability in a timely way.

All participants agreed that it was appropriate to continue the process of reducing the Federal Reserve’s securities holdings, as described in its previously announced Plans for Reducing the Size of the Federal Reserve’s Balance Sheet.

On Risk Management

“Almost all participants observed that slowing the pace of rate increases at the current juncture would allow for appropriate risk management.”

On Inflation

“A number of participants observed that a policy stance that proved to be insufficiently restrictive could halt recent progress in moderating inflationary pressures.”

The Fed staff doesn’t see inflation moving back to 2% until 2025:

“With steep declines in consumer energy prices and a substantial moderation in food price inflation expected for this year, total inflation was projected to step down markedly this year and then to track core inflation over the following two years. In 2025, both total and core PCE price inflation were expected to be near 2 percent.”

On market valuations

“The staff judged that asset valuation pressures remained notable. In particular, the staff noted that measures of valuations in both residential and commercial property markets remained high, and that the potential for large declines in property prices remained greater than usual. In addition, the forward price-to-earnings ratio for S&P 500 firms remained above its median value despite the decline in equity prices over the past year.”

On Household Spending Slowdown

“In their discussion of the household sector, participants noted that growth in consumer spending had softened recently. Several participants remarked that there had been a reduction in discretionary expenditures, especially among lower- and middle-income households, whose purchases were shifting toward lower-cost options.”

On Labor Hoarding

“A number of participants remarked that some businesses were keen to retain workers after their recent experiences of labor shortages and hiring challenges. These participants noted that this consideration had limited layoffs even as the broader economy had softened”

On The Debt Limit

“A number of participants stressed that a drawn-out period of negotiations to raise the federal debt limit could pose significant risks to the financial system and the broader economy.”

On financial conditions

…officials said it was important “that overall financial conditions be consistent with the degree of policy restraint that the Committee is putting into place in order to bring inflation back to the 2 percent goal.”

Additionally:

“several participants observed that some measures of financial conditions had eased over the past few months.”

While Powell said at the meeting

“Financial conditions didn’t really change much from the December meeting to now.”

Still a long way to go to normalize back to monetary policy…

But, David Wilcox of Bloomberg Economics noted on BTV, there is only a single mention of a “pause” in rates — and that one is in reference to other central banks!

Read the full Minutes below:

Loading…