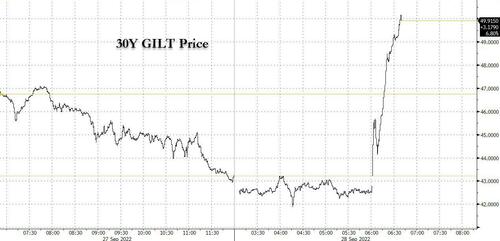

With everything biw breaking, including an explosive move in bond yields in the UK, 10Y yields rising above 4.00%, and Apple "suddenly" realizing there was not enough demand for the latest iteration of its iPhone 5, it was only a matter of time before some central bank somewhere capitulated and pivoted back to QE, and this morning that's precisely what happened when the BOE delayed the launch of QT and restarted QE "on whatever scale is necessary" on a "temporary and targeted" (lol) basis to restore order, which sent UK bond surging (and yields tumbling the most on record going back to 1996 erasing an earlier jump to the the highest since 1998)...

... the pound first surged before falling back as traders realized the UK now has both rate hikes and QE at the same time, the dollar sliding then spiking, the 10Y US TSY yield dipping from 4.00%, the highest level since 1998, and stock futures spiking from fresh 2022 lows, but then fizzling as traders now demand a similar end to QT/restart of QE from the Fed or else they will similarly break the market.

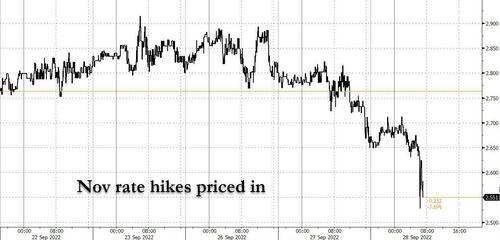

Needless to say, the BOE has opened up the tap on coming central bank pivots, and while the market may be slow to grasp it, risk is cheap here with a similar QE restarted by the Fed just weeks if not days away. Indeed, look no further than the tumbling odds of a November 75bps rate hike as confirmation.

As if the BOE's pivot wasn't enough, there was also a barrage of company specific news: in premarket trading, the world's biggest company, Apple tumbled 3.9% after a Bloomberg report said the company was likely to ditch its iPhone production boost, citing people familiar with the matter. Shares of suppliers to Apple also fell in premarket trading after the report, with Micron Technology (MU US) down -1.9%, Qualcomm (QCOM US) -1.8%, Skyworks Solutions (SWKS US) -1.6%. Other notable premarket movers:

- Biogen shares surged as much as 71% in US premarket trading, with the drugmaker on track for its biggest gain since its 1991 IPO if the move holds, as analysts lauded results of an Alzheimer’s drug study with partner Eisai.

- Lockheed drops as much as 2.3% in premarket trading as it was downgraded to underweight at Wells Fargo, which is taking a more cautious view on the defense sector on a likely difficult US budget environment into 2023.

- Mind Medicine slid 35% in premarket trading after an offering of shares priced at $4.25 apiece, representing a 31% discount to last close.

- Watch insurers, utilities and travel stocks as Hurricane Ian comes closer to making landfall on Florida’s Gulf coast.

- Keep an eye on southeastern US utilities including NextEra Energy (NEE US), Entergy (ETR US), Duke Energy (DUK US), insurers like AIG (AIG US), Chubb (CB US), as well as airline stocks

- Netflix (NFLX US) was raised to overweight from neutral at Atlantic Equities, the latest in a slew of brokers to turn bullish on the outlook for the streaming giant’s new ad- supported tier, though the stock was little changed in premarket trading

In other news, Hurricane Ian became a dangerous Category 4 storm as it roars toward Florida, threatening to batter the Gulf Coast with devastating wind gusts and floods.

European stocks dropped for a fifth day as Citigroup strategists said investors are abandoning the region at levels last seen during the euro area debt crisis. Miners underperformed as the strong dollar and concerns about demand for raw materials sent commodity prices to the lowest level since January. Retail stocks slumped, with the sector underperforming declines for the broader Stoxx 600, as concerns mount about a consumer spending crunch. UK retail stocks are particularly weak amid Britain’s market meltdown and after online clothing retailer Boohoo issued a profit warning. Boohoo cut its guidance for the year, with soaring energy and food bills stopping consumers from splashing out on clothes and shoes; peers including Asos (-7.5%) and Zalando (-3.5%) sank. Here are the biggest European movers:

- Roche gains as much as 6.5% in early trading, most since March 2020 after Eisai and partner Biogen said their drug significantly slowed Alzheimer’s disease. Roche partner MorphoSys rises as much as 22%. BioArctic jumps as much as 171% in Wednesday trading, its biggest intraday rise since 2018; the Swedish biopharma company is a partner of Eisai

- Sanofi shares rise as much as 2.2% after saying it sees currency impact of approximately 10%-11% on 3Q sales, according to statement.

- Burberry rises as much as 4.5% as analysts welcome the appointment of Daniel Lee, formerly of Bottega Veneta, to succeed Riccardo Tisci as creative director at the luxury designer.

- Retail stocks slide, with the sector underperforming declines for the broader Stoxx 600, as concerns mount about a consumer spending crunch. Boohoo slumped as much as 18% after cutting its guidance for the year, with soaring energy and food bills stopping consumers from splashing out on clothes and shoes; peers fell, with Asos down as much as 9.4% and Zalando -4.3%.

- Financial sectors including banks, real estate and insurance were the worst performers in Europe on Wednesday as hawkish comments from Fed officials stoked concerns over the economic outlook. HSBC fell as much as 5.3%, Barclays 6%, and insurer Aviva 7.9%

- Norway unveiled a plan to tap power and fish companies for 33 billion kroner ($3 billion) a year to cover ballooning budget expenditures, sending salmon farmers’ stocks falling. Salmar down as much as 30%, Leroy Seafood dropped as much as 26%, and Mowi slid as much as 21%

- Truecaller, which offers an app to block unwanted phone calls, falls as much as 23% in Stockholm after short seller Viceroy Research says it’s betting against the stock.

Adding to concerns, Deutsche Bank CEO Christian Sewing predicted a severe downturn in the lender’s home region and said the volatility whipsawing markets will continue for another year as central banks tighten rates to fight inflation, while ECB President Christine Lagarde said borrowing costs will be raised at the next “several meetings,” with several Governing Council members favoring a 75 basis point hike in October.

Meanwhile, natural gas prices in Europe surged after Russia said it may cut off supplies via Ukraine and the German Navy was deployed to investigate the suspected sabotage to the Nord Stream pipelines. Putin moved to annex a large chunk of Ukrainian territory amid a string of military setbacks in its seven-month-old invasion.

Asian shares also fell: Japanese equities slumped after the latest hawkish comments from Fed officials on raising interest rates in order to bring inflation down. The Topix fell 1% to close at 1,855.15, while the Nikkei declined 1.5% to 26,173.98. Toyota Motor Corp. contributed the most to the Topix decline, decreasing 1.6%. Out of 2,169 stocks in the index, 943 rose and 1,137 fell, while 89 were unchanged. “From here on, U.S. CPI inflation will be the most important factor,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management. “Now that the FOMC meeting is over, we will be getting a good amount of statements from Fed officials, and wondering what kind of statements will come out.”

Key equity gauges in India posted their longest stretch of declines in more than three months, as investors continued to sell stocks across global markets on worries over economic growth. The S&P BSE Sensex dropped 0.9% to 56,598.28 in Mumbai, while the NSE Nifty 50 Index fell by an equal measure. The indexes posted their sixth-consecutive decline, the worst losing streak since mid-June. Fourteen of the 19 sector sub-indexes compiled by BSE Ltd. declined. Metals and banking stocks were the worst performers. Healthcare and software firms gained. Reliance Industries and HDFC Bank contributed the most to the Sensex’s decline. Reliance Industries has erased its gain for the year and is headed for its lowest close since March. Out of 30 shares in the Sensex index, 12 rose, while 18 fell

In FX, the dollar’s rally brought losses to other currencies, including the euro and onshore yuan, which tumbled to its weakest level since 2008. A regulatory body guided by the People’s Bank of China urged banks to protect the authority of the yuan fixing after the onshore yuan fell to the weakest level against the dollar since the global financial crisis in 2008, amid an incessant advance in the greenback and speculation China is toning down its support for the local currency. The yen remained near the key 145 mark versus the dollar and within sight of levels that have drawn intervention from Japan. Speculation the sliding yen will compel Japan to intervene further, potentially funded by Treasuries sales, weighed on US debt.

“The fact we have such a strong increase in US yields is attracting flows into the US dollar,” said Nanette Hechler-Fayd’herbe, chief investment officer of international wealth management for Credit Suisse Group AG. “As long as monetary and fiscal policy worldwide are really not coming to strengthen their own currencies, we should be anticipating a very strong dollar.”

In rates, Treasury yields fell, following a more aggressive bull flattening move across the gilt curve, after Bank of England announced it would step into the market and buy long-dated government bonds, financed with new reserves. The Treasury curve remains steeper on the day however, with front-end yields richer by 7bp and long-end slightly cheaper. US session focus on 7-year note auction and a barrage of Fed speakers scheduled. Treasury 10-year yields around 3.93%, richer by 1.5bp on the day and underperforming gilts by around 25bp in the sector -- gilts curve richer by 3bp to 50bp on the day from front-end out to long-end following Bank of England announcement. US auctions conclude with $36b 7-year note sale at 1pm, follows soft 2- and 5-year auctions so far this week

In commodities, WTI trades within Tuesday’s range, falling 0.5% to around $78.14. Spot gold falls roughly $11 to trade near $1,618/oz.

Looking to the day ahead, there are an array of central bank speakers including Fed Chair Powell, the Fed’s Bostic, Bullard, Bowman, Barkin and Evans, ECB President Lagarde, the ECB’s Kazimir, Holzmann and Elderson, as well as BoE Deputy Governor Cunliffe and the BoE’s Dhingra. In the meantime, data releases include pending home sales for August.

Market Snapshot

- S&P 500 futures down 0.6% to 3,637

- MXAP down 1.9% to 139.41

- MXAPJ down 2.3% to 452.49

- Nikkei down 1.5% to 26,173.98

- Topix down 1.0% to 1,855.15

- Hang Seng Index down 3.4% to 17,250.88

- Shanghai Composite down 1.6% to 3,045.07

- Sensex down 0.3% to 56,939.09

- Australia S&P/ASX 200 down 0.5% to 6,462.03

- Kospi down 2.5% to 2,169.29

- STOXX Europe 600 down 1.4% to 382.97

- German 10Y yield little changed at 2.31%

- Euro down 0.3% to $0.9561

- Brent Futures down 0.4% to $85.94/bbl

- Brent Futures down 0.4% to $85.94/bbl

- Gold spot down 0.6% to $1,619.74

- U.S. Dollar Index up 0.36% to 114.52

Top Overnight News from Bloomberg

- ECB President Christine Lagarde said borrowing costs will be raised at the next “several meetings” to ensure inflation expectations remain anchored and price gains return to the 2% target over the medium term

- The ECB is on track to take interest rates to a level that no longer stimulates the economy by December, Governing Council member Olli Rehn told Reuters

- Germany’s federal government will increase debt sales by €22.5 billion ($21.5 billion) in the fourth quarter compared with an original plan to help fund generous spending to offset the impact of the energy crisis

- The cost of protection against European corporate debt has surpassed the pandemic peak as investors fret over the effect of central bank tightening at a time of mounting recession risk

- The Federal Reserve’s delicate balance between curbing demand enough to slow inflation without causing a recession is a “struggle,” said San Francisco Fed President Mary Daly

- This week a gauge of one-month volatility in the majors hit its strongest level since the pandemic mayhem of March 2020, as wide price swings in the pound lifted hedging costs across the G-10 space

- Moscow declared landslide victories in the hastily organized “referendums” it held in the territories currently occupied by its forces and prepared to absorb them within days. The United Nations has condemned the voting as illegal with people at times forced at gunpoint.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior 3.8%

- 08:30: Aug. Retail Inventories MoM, est. 1.0%, prior 1.1%

- Wholesale Inventories MoM, est. 0.4%, prior 0.6%

- 08:30: Aug. Advance Goods Trade Balance, est. -$89b, prior -$89.1b, revised - $90.2b

- 10:00: Aug. Pending Home Sales (MoM), est. -1.5%, prior -1.0%

- Pending Home Sales YoY, est. -24.5%, prior -22.5%

Central Bank Speakers

- 08:35: Fed’s Bostic Takes Part in Moderated Q&A

- 10:10: Fed’s Bullard Makes Welcome Remarks at Community Banking...

- 10:15: Powell Gives Welcoming Remarks at Community Banking Conference

- 11:00: Fed’s Bowman Speaks at Community Banking Conference

- 11:30: Fed’s Barkin Speaks at Chamber of Commerce Lunch

- 14:00: Fed’s Evans Speaks at the London School of Economics

DB's Jim Reid concludes the overnight wrap

I had my worst nightmare yesterday. One of my wife's friends, who vaguely knows I work in financial markets, urgently contacted me for mortgage advise. She needed to make a decision within hours on what mortgage to take out from a selection of unpalatable options here in the UK. I'll be honest, when I speak to you dear readers and give advice I know you're all big and brave enough to either ignore it or consider it. However it felt very dangerous to be giving my wife's friend my opinion. Hopefully they'll be no fall out at the end of the period I advised on!

After the tumultuous events of recent days, market volatility has remained very high over the last 24 hours, with plenty of negative headlines to keep investors alert. In Europe, we got a fresh reminder about the energy situation after leaks in the Nord Stream 1 and 2 pipelines, whilst Gazprom warned that sanctions on Ukraine’s Naftogaz could put flows from Russia at risk. In the meantime, investors’ jitters surrounding the UK showed few signs of abating, with 30yr gilt yields surpassing 5% in trading for the first time since 2002 and a level it hasn't consistently been above since 1998. And even though we got some better-than-expected data releases from the US, they were also seen as giving the Fed more space to keep hiking rates over months ahead, adding to fears that they still had plenty of hawkish medicine left to deliver.

We’ll start here in the UK, since it was gilts once again that were at the epicentre of the ongoing repricing in rates, with plenty of signs that investors remain very nervous about the current economic situation. Gilt yields rose to fresh highs across the curve, with the selloff accelerating late in the session to leave the 10yr yield up by +26.1bps at a post-2008 high of 4.50%. Furthermore, the 30yr yield surged +44.8bps to a post-2007 high of 4.97%, closing just beneath the 5% mark that it had exceeded at one point right before the close. This for me is a fascinating development as recently as last December we were at 0.83% and then 2.28% in early August. For many many years the demand for long end gilts were seen as one of the most price insensitive assets in the fixed income world with huge regulatory and asset/liability buying. So the fact that even this has cracked shows the deep trouble the UK market is in at the moment. The moves have been so drastic that even the IMF announced yesterday they were closely monitoring developments in Britain and were engaged with UK authorities. Their rebuke was quite scathing.

Staying in the UK, there was an even more significant repricing of real yields, with the 10yr real yield surging by another +52.9bps on the day to 0.77%, having been at -0.84% only a week earlier, so a massive turnaround. Sterling ended a run of 5 consecutive daily losses to strengthen by +0.41% against the US Dollar, taking it back up to $1.073. However it was higher before the IMF statement and is at $1.065 this morning with their rebuke reverberating around markets.

Whilst UK assets continued to struggle, we did hear from BoE Chief Economist Pill yesterday, who sits on the 9-member Monetary Policy Committee. The main headline from his remarks was the comment that “this will require a significant monetary policy response”. Investors are still pricing in over +155bps worth of hikes by the next meeting on November 3, as well as a terminal rate above 6% next year. However, investors also continued to lower the chances of an emergency inter-meeting hike, particularly after Pill said that it was better to take a “considered” and “low-frequency” approach to monetary policy.

Elsewhere in Europe, the question of energy remained top of the agenda yesterday, with a fresh surge in natural gas futures (+19.65%) that marked a reversal to the declines over the last month. That followed the news of leaks from the Nord Stream 1 and 2 pipelines, which officials across multiple countries said could be the result of sabotage. Danish PM Frederiksen said that it was” hard to imagine that these are coincidences” and the FT reported German officials who said there was concern that a “targeted attack” had caused the sudden loss of pressure. A real nightmare scenario is if the sabotage attempts extended to other pipelines. Indeed Bloomberg reported that Norway was looking to increase security around its own infrastructure. However these pipes are long so it would take a lot of effort to protect them all.

On top of the leaks, we also heard from Gazprom, who said that there was a risk that Moscow would sanction Ukraine’s Naftogaz. That would stop them from paying transit fees, which in turn would put gas flows to Europe at risk, and led to a significant jump in prices after the news came through later in the session.

Against that unfavourable backdrop, European assets continued to suffer over the last 24 hours across multiple asset classes. Sovereign bonds didn’t do quite as badly as gilts, but it was still a very poor performance by any normal day’s standards, with yields on 10yr bunds (+11.3bps) reaching a post-2010 high of 2.22%. Peripheral spreads continued to widen as well, with the gap between 10yr Italian yields over bunds closing above 250bps for the first time since April 2020. In the meantime, equities lost ground thanks to a late session reversal, leaving the STOXX 600 (-0.13%) at its lowest level since December 2020. And there was little respite for credit either, with the iTraxx Crossover widening +15.2bps to 670bps, which is a closing level we haven’t seen since March 2020.

On top of sour risk sentiment, results from Russia’s referendum in four Ukrainian territories unsurprisingly revealed lopsided votes in favour of Russian annexation, topping 85% in each of the regions. That stoked fears that Russia will move to officially annex the territories as soon as this week, thereby claiming any attack on those territories is an attack on sovereign Russia itself and enabling yet further escalation. President Putin is scheduled to address both houses of the Russian Parliament this Friday, which British intelligence reports may be used as a venue to push through an official annexation ratification.

Over in the US, there was some better news on the data side that helped to allay fears about an imminent slide into recession. First, the Conference Board’s consumer confidence reading for September rose to 108.0 (vs. 104.6 expected), which is its highest level since April. Second, new home sales in August unexpectedly rebounded to an annualised pace of 685k (vs. 500k expected), which is their highest level since March. Third, the preliminary durable goods orders for August were roughly in line with expectations at -0.2% (vs. -0.3% expected), and core capital goods orders exceeded them with +1.3% growth (vs. +0.2% expected) and a positive revision to the previous month. Finally, the Richmond Fed’s manufacturing index for September came in at 0 (vs. -10 expected), adding to that theme of stronger-than-expected releases. A word of caution, the housing data is typically noisy and subject to revision, so despite the bounce in sales, we don’t think this marks a sea-change in housing markets, which have been battered by tightening financial conditions to date.

In the end however, those data releases didn’t manage to stop the S&P 500 (-0.21%) losing ground for a 6th consecutive session, which takes the index back to its lowest closing level since November 2020. In fact for the Dow Jones (-0.43%), yesterday’s losses left it at its lowest closing level since 6 November 2020. That was the last trading session before the news on Monday 9 November from Pfizer that their late-stage vaccine trials had been successful, thus triggering a massive global surge as the way out of the pandemic became much clearer. All-in-all though, equities were a side show to fixed income yesterday.

When it came to Treasuries, there was a notable steepening in both the nominal and real yield curves yesterday, and 10yr yields ended the session up +2.1bps at 3.95%. This morning in Asia 10yr yields did trade at 4% for the first time since 2010 before dipping to around 3.98% as I type. In terms of Fed speak yesterday, we heard from Chicago Fed President Evans, who implied that the Fed might take stock of the impact of rate hikes in the spring, saying that “By spring of next year we are going to get to a funds rate that we can sort of sit and watch how things are behaving,” In the meantime, St Louis Fed President Bullard (one of the most hawkish members of the FOMC) said that inflation was a serious problem and that the credibility of the Fed’s inflation target was at risk.

This morning Asian equity markets are extending their downtrend. As I type, The Kospi (-3.01%) is sharply lower in early trade with the Hang Seng (-2.40%), the Nikkei (-2.21%), the CSI (-0.77%) and the Shanghai Composite (-0.75%) all trading in negative territory.

After a steady start, US stock futures got caught up in the bearish mood with contracts on the S&P 500 (-0.71%) and NASDAQ 100 (-0.98%) both moving lower.Apple reversing plans for an iPhone production boost on waning demand seemed to be a catalyst. The US dollar index (+0.43%) has hit a fresh two-decade high of 114.69 this morning.

Early morning data showed that Australia’s August retail sales advanced for the eighth consecutive month, rising +0.6% m/m, faster than the +0.4% increase expected although the pace of growth slowed from the +1.3% rise seen in July.

To the day ahead now, and there are an array of central bank speakers including Fed Chair Powell, the Fed’s Bostic, Bullard, Bowman, Barkin and Evans, ECB President Lagarde, the ECB’s Kazimir, Holzmann and Elderson, as well as BoE Deputy Governor Cunliffe and the BoE’s Dhingra. In the meantime, data releases include Germany’s GfK consumer confidence reading for October, and France and Italy’s consumer confidence reading for September. In the US, there’s also pending home sales data for August.

With everything biw breaking, including an explosive move in bond yields in the UK, 10Y yields rising above 4.00%, and Apple “suddenly” realizing there was not enough demand for the latest iteration of its iPhone 5, it was only a matter of time before some central bank somewhere capitulated and pivoted back to QE, and this morning that’s precisely what happened when the BOE delayed the launch of QT and restarted QE “on whatever scale is necessary” on a “temporary and targeted” (lol) basis to restore order, which sent UK bond surging (and yields tumbling the most on record going back to 1996 erasing an earlier jump to the the highest since 1998)…

… the pound first surged before falling back as traders realized the UK now has both rate hikes and QE at the same time, the dollar sliding then spiking, the 10Y US TSY yield dipping from 4.00%, the highest level since 1998, and stock futures spiking from fresh 2022 lows, but then fizzling as traders now demand a similar end to QT/restart of QE from the Fed or else they will similarly break the market.

Needless to say, the BOE has opened up the tap on coming central bank pivots, and while the market may be slow to grasp it, risk is cheap here with a similar QE restarted by the Fed just weeks if not days away. Indeed, look no further than the tumbling odds of a November 75bps rate hike as confirmation.

As if the BOE’s pivot wasn’t enough, there was also a barrage of company specific news: in premarket trading, the world’s biggest company, Apple tumbled 3.9% after a Bloomberg report said the company was likely to ditch its iPhone production boost, citing people familiar with the matter. Shares of suppliers to Apple also fell in premarket trading after the report, with Micron Technology (MU US) down -1.9%, Qualcomm (QCOM US) -1.8%, Skyworks Solutions (SWKS US) -1.6%. Other notable premarket movers:

- Biogen shares surged as much as 71% in US premarket trading, with the drugmaker on track for its biggest gain since its 1991 IPO if the move holds, as analysts lauded results of an Alzheimer’s drug study with partner Eisai.

- Lockheed drops as much as 2.3% in premarket trading as it was downgraded to underweight at Wells Fargo, which is taking a more cautious view on the defense sector on a likely difficult US budget environment into 2023.

- Mind Medicine slid 35% in premarket trading after an offering of shares priced at $4.25 apiece, representing a 31% discount to last close.

- Watch insurers, utilities and travel stocks as Hurricane Ian comes closer to making landfall on Florida’s Gulf coast.

- Keep an eye on southeastern US utilities including NextEra Energy (NEE US), Entergy (ETR US), Duke Energy (DUK US), insurers like AIG (AIG US), Chubb (CB US), as well as airline stocks

- Netflix (NFLX US) was raised to overweight from neutral at Atlantic Equities, the latest in a slew of brokers to turn bullish on the outlook for the streaming giant’s new ad- supported tier, though the stock was little changed in premarket trading

In other news, Hurricane Ian became a dangerous Category 4 storm as it roars toward Florida, threatening to batter the Gulf Coast with devastating wind gusts and floods.

European stocks dropped for a fifth day as Citigroup strategists said investors are abandoning the region at levels last seen during the euro area debt crisis. Miners underperformed as the strong dollar and concerns about demand for raw materials sent commodity prices to the lowest level since January. Retail stocks slumped, with the sector underperforming declines for the broader Stoxx 600, as concerns mount about a consumer spending crunch. UK retail stocks are particularly weak amid Britain’s market meltdown and after online clothing retailer Boohoo issued a profit warning. Boohoo cut its guidance for the year, with soaring energy and food bills stopping consumers from splashing out on clothes and shoes; peers including Asos (-7.5%) and Zalando (-3.5%) sank. Here are the biggest European movers:

- Roche gains as much as 6.5% in early trading, most since March 2020 after Eisai and partner Biogen said their drug significantly slowed Alzheimer’s disease. Roche partner MorphoSys rises as much as 22%. BioArctic jumps as much as 171% in Wednesday trading, its biggest intraday rise since 2018; the Swedish biopharma company is a partner of Eisai

- Sanofi shares rise as much as 2.2% after saying it sees currency impact of approximately 10%-11% on 3Q sales, according to statement.

- Burberry rises as much as 4.5% as analysts welcome the appointment of Daniel Lee, formerly of Bottega Veneta, to succeed Riccardo Tisci as creative director at the luxury designer.

- Retail stocks slide, with the sector underperforming declines for the broader Stoxx 600, as concerns mount about a consumer spending crunch. Boohoo slumped as much as 18% after cutting its guidance for the year, with soaring energy and food bills stopping consumers from splashing out on clothes and shoes; peers fell, with Asos down as much as 9.4% and Zalando -4.3%.

- Financial sectors including banks, real estate and insurance were the worst performers in Europe on Wednesday as hawkish comments from Fed officials stoked concerns over the economic outlook. HSBC fell as much as 5.3%, Barclays 6%, and insurer Aviva 7.9%

- Norway unveiled a plan to tap power and fish companies for 33 billion kroner ($3 billion) a year to cover ballooning budget expenditures, sending salmon farmers’ stocks falling. Salmar down as much as 30%, Leroy Seafood dropped as much as 26%, and Mowi slid as much as 21%

- Truecaller, which offers an app to block unwanted phone calls, falls as much as 23% in Stockholm after short seller Viceroy Research says it’s betting against the stock.

Adding to concerns, Deutsche Bank CEO Christian Sewing predicted a severe downturn in the lender’s home region and said the volatility whipsawing markets will continue for another year as central banks tighten rates to fight inflation, while ECB President Christine Lagarde said borrowing costs will be raised at the next “several meetings,” with several Governing Council members favoring a 75 basis point hike in October.

Meanwhile, natural gas prices in Europe surged after Russia said it may cut off supplies via Ukraine and the German Navy was deployed to investigate the suspected sabotage to the Nord Stream pipelines. Putin moved to annex a large chunk of Ukrainian territory amid a string of military setbacks in its seven-month-old invasion.

Asian shares also fell: Japanese equities slumped after the latest hawkish comments from Fed officials on raising interest rates in order to bring inflation down. The Topix fell 1% to close at 1,855.15, while the Nikkei declined 1.5% to 26,173.98. Toyota Motor Corp. contributed the most to the Topix decline, decreasing 1.6%. Out of 2,169 stocks in the index, 943 rose and 1,137 fell, while 89 were unchanged. “From here on, U.S. CPI inflation will be the most important factor,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management. “Now that the FOMC meeting is over, we will be getting a good amount of statements from Fed officials, and wondering what kind of statements will come out.”

Key equity gauges in India posted their longest stretch of declines in more than three months, as investors continued to sell stocks across global markets on worries over economic growth. The S&P BSE Sensex dropped 0.9% to 56,598.28 in Mumbai, while the NSE Nifty 50 Index fell by an equal measure. The indexes posted their sixth-consecutive decline, the worst losing streak since mid-June. Fourteen of the 19 sector sub-indexes compiled by BSE Ltd. declined. Metals and banking stocks were the worst performers. Healthcare and software firms gained. Reliance Industries and HDFC Bank contributed the most to the Sensex’s decline. Reliance Industries has erased its gain for the year and is headed for its lowest close since March. Out of 30 shares in the Sensex index, 12 rose, while 18 fell

In FX, the dollar’s rally brought losses to other currencies, including the euro and onshore yuan, which tumbled to its weakest level since 2008. A regulatory body guided by the People’s Bank of China urged banks to protect the authority of the yuan fixing after the onshore yuan fell to the weakest level against the dollar since the global financial crisis in 2008, amid an incessant advance in the greenback and speculation China is toning down its support for the local currency. The yen remained near the key 145 mark versus the dollar and within sight of levels that have drawn intervention from Japan. Speculation the sliding yen will compel Japan to intervene further, potentially funded by Treasuries sales, weighed on US debt.

“The fact we have such a strong increase in US yields is attracting flows into the US dollar,” said Nanette Hechler-Fayd’herbe, chief investment officer of international wealth management for Credit Suisse Group AG. “As long as monetary and fiscal policy worldwide are really not coming to strengthen their own currencies, we should be anticipating a very strong dollar.”

In rates, Treasury yields fell, following a more aggressive bull flattening move across the gilt curve, after Bank of England announced it would step into the market and buy long-dated government bonds, financed with new reserves. The Treasury curve remains steeper on the day however, with front-end yields richer by 7bp and long-end slightly cheaper. US session focus on 7-year note auction and a barrage of Fed speakers scheduled. Treasury 10-year yields around 3.93%, richer by 1.5bp on the day and underperforming gilts by around 25bp in the sector — gilts curve richer by 3bp to 50bp on the day from front-end out to long-end following Bank of England announcement. US auctions conclude with $36b 7-year note sale at 1pm, follows soft 2- and 5-year auctions so far this week

In commodities, WTI trades within Tuesday’s range, falling 0.5% to around $78.14. Spot gold falls roughly $11 to trade near $1,618/oz.

Looking to the day ahead, there are an array of central bank speakers including Fed Chair Powell, the Fed’s Bostic, Bullard, Bowman, Barkin and Evans, ECB President Lagarde, the ECB’s Kazimir, Holzmann and Elderson, as well as BoE Deputy Governor Cunliffe and the BoE’s Dhingra. In the meantime, data releases include pending home sales for August.

Market Snapshot

- S&P 500 futures down 0.6% to 3,637

- MXAP down 1.9% to 139.41

- MXAPJ down 2.3% to 452.49

- Nikkei down 1.5% to 26,173.98

- Topix down 1.0% to 1,855.15

- Hang Seng Index down 3.4% to 17,250.88

- Shanghai Composite down 1.6% to 3,045.07

- Sensex down 0.3% to 56,939.09

- Australia S&P/ASX 200 down 0.5% to 6,462.03

- Kospi down 2.5% to 2,169.29

- STOXX Europe 600 down 1.4% to 382.97

- German 10Y yield little changed at 2.31%

- Euro down 0.3% to $0.9561

- Brent Futures down 0.4% to $85.94/bbl

- Brent Futures down 0.4% to $85.94/bbl

- Gold spot down 0.6% to $1,619.74

- U.S. Dollar Index up 0.36% to 114.52

Top Overnight News from Bloomberg

- ECB President Christine Lagarde said borrowing costs will be raised at the next “several meetings” to ensure inflation expectations remain anchored and price gains return to the 2% target over the medium term

- The ECB is on track to take interest rates to a level that no longer stimulates the economy by December, Governing Council member Olli Rehn told Reuters

- Germany’s federal government will increase debt sales by €22.5 billion ($21.5 billion) in the fourth quarter compared with an original plan to help fund generous spending to offset the impact of the energy crisis

- The cost of protection against European corporate debt has surpassed the pandemic peak as investors fret over the effect of central bank tightening at a time of mounting recession risk

- The Federal Reserve’s delicate balance between curbing demand enough to slow inflation without causing a recession is a “struggle,” said San Francisco Fed President Mary Daly

- This week a gauge of one-month volatility in the majors hit its strongest level since the pandemic mayhem of March 2020, as wide price swings in the pound lifted hedging costs across the G-10 space

- Moscow declared landslide victories in the hastily organized “referendums” it held in the territories currently occupied by its forces and prepared to absorb them within days. The United Nations has condemned the voting as illegal with people at times forced at gunpoint.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior 3.8%

- 08:30: Aug. Retail Inventories MoM, est. 1.0%, prior 1.1%

- Wholesale Inventories MoM, est. 0.4%, prior 0.6%

- 08:30: Aug. Advance Goods Trade Balance, est. -$89b, prior -$89.1b, revised – $90.2b

- 10:00: Aug. Pending Home Sales (MoM), est. -1.5%, prior -1.0%

- Pending Home Sales YoY, est. -24.5%, prior -22.5%

Central Bank Speakers

- 08:35: Fed’s Bostic Takes Part in Moderated Q&A

- 10:10: Fed’s Bullard Makes Welcome Remarks at Community Banking…

- 10:15: Powell Gives Welcoming Remarks at Community Banking Conference

- 11:00: Fed’s Bowman Speaks at Community Banking Conference

- 11:30: Fed’s Barkin Speaks at Chamber of Commerce Lunch

- 14:00: Fed’s Evans Speaks at the London School of Economics

DB’s Jim Reid concludes the overnight wrap

I had my worst nightmare yesterday. One of my wife’s friends, who vaguely knows I work in financial markets, urgently contacted me for mortgage advise. She needed to make a decision within hours on what mortgage to take out from a selection of unpalatable options here in the UK. I’ll be honest, when I speak to you dear readers and give advice I know you’re all big and brave enough to either ignore it or consider it. However it felt very dangerous to be giving my wife’s friend my opinion. Hopefully they’ll be no fall out at the end of the period I advised on!

After the tumultuous events of recent days, market volatility has remained very high over the last 24 hours, with plenty of negative headlines to keep investors alert. In Europe, we got a fresh reminder about the energy situation after leaks in the Nord Stream 1 and 2 pipelines, whilst Gazprom warned that sanctions on Ukraine’s Naftogaz could put flows from Russia at risk. In the meantime, investors’ jitters surrounding the UK showed few signs of abating, with 30yr gilt yields surpassing 5% in trading for the first time since 2002 and a level it hasn’t consistently been above since 1998. And even though we got some better-than-expected data releases from the US, they were also seen as giving the Fed more space to keep hiking rates over months ahead, adding to fears that they still had plenty of hawkish medicine left to deliver.

We’ll start here in the UK, since it was gilts once again that were at the epicentre of the ongoing repricing in rates, with plenty of signs that investors remain very nervous about the current economic situation. Gilt yields rose to fresh highs across the curve, with the selloff accelerating late in the session to leave the 10yr yield up by +26.1bps at a post-2008 high of 4.50%. Furthermore, the 30yr yield surged +44.8bps to a post-2007 high of 4.97%, closing just beneath the 5% mark that it had exceeded at one point right before the close. This for me is a fascinating development as recently as last December we were at 0.83% and then 2.28% in early August. For many many years the demand for long end gilts were seen as one of the most price insensitive assets in the fixed income world with huge regulatory and asset/liability buying. So the fact that even this has cracked shows the deep trouble the UK market is in at the moment. The moves have been so drastic that even the IMF announced yesterday they were closely monitoring developments in Britain and were engaged with UK authorities. Their rebuke was quite scathing.

Staying in the UK, there was an even more significant repricing of real yields, with the 10yr real yield surging by another +52.9bps on the day to 0.77%, having been at -0.84% only a week earlier, so a massive turnaround. Sterling ended a run of 5 consecutive daily losses to strengthen by +0.41% against the US Dollar, taking it back up to $1.073. However it was higher before the IMF statement and is at $1.065 this morning with their rebuke reverberating around markets.

Whilst UK assets continued to struggle, we did hear from BoE Chief Economist Pill yesterday, who sits on the 9-member Monetary Policy Committee. The main headline from his remarks was the comment that “this will require a significant monetary policy response”. Investors are still pricing in over +155bps worth of hikes by the next meeting on November 3, as well as a terminal rate above 6% next year. However, investors also continued to lower the chances of an emergency inter-meeting hike, particularly after Pill said that it was better to take a “considered” and “low-frequency” approach to monetary policy.

Elsewhere in Europe, the question of energy remained top of the agenda yesterday, with a fresh surge in natural gas futures (+19.65%) that marked a reversal to the declines over the last month. That followed the news of leaks from the Nord Stream 1 and 2 pipelines, which officials across multiple countries said could be the result of sabotage. Danish PM Frederiksen said that it was” hard to imagine that these are coincidences” and the FT reported German officials who said there was concern that a “targeted attack” had caused the sudden loss of pressure. A real nightmare scenario is if the sabotage attempts extended to other pipelines. Indeed Bloomberg reported that Norway was looking to increase security around its own infrastructure. However these pipes are long so it would take a lot of effort to protect them all.

On top of the leaks, we also heard from Gazprom, who said that there was a risk that Moscow would sanction Ukraine’s Naftogaz. That would stop them from paying transit fees, which in turn would put gas flows to Europe at risk, and led to a significant jump in prices after the news came through later in the session.

Against that unfavourable backdrop, European assets continued to suffer over the last 24 hours across multiple asset classes. Sovereign bonds didn’t do quite as badly as gilts, but it was still a very poor performance by any normal day’s standards, with yields on 10yr bunds (+11.3bps) reaching a post-2010 high of 2.22%. Peripheral spreads continued to widen as well, with the gap between 10yr Italian yields over bunds closing above 250bps for the first time since April 2020. In the meantime, equities lost ground thanks to a late session reversal, leaving the STOXX 600 (-0.13%) at its lowest level since December 2020. And there was little respite for credit either, with the iTraxx Crossover widening +15.2bps to 670bps, which is a closing level we haven’t seen since March 2020.

On top of sour risk sentiment, results from Russia’s referendum in four Ukrainian territories unsurprisingly revealed lopsided votes in favour of Russian annexation, topping 85% in each of the regions. That stoked fears that Russia will move to officially annex the territories as soon as this week, thereby claiming any attack on those territories is an attack on sovereign Russia itself and enabling yet further escalation. President Putin is scheduled to address both houses of the Russian Parliament this Friday, which British intelligence reports may be used as a venue to push through an official annexation ratification.

Over in the US, there was some better news on the data side that helped to allay fears about an imminent slide into recession. First, the Conference Board’s consumer confidence reading for September rose to 108.0 (vs. 104.6 expected), which is its highest level since April. Second, new home sales in August unexpectedly rebounded to an annualised pace of 685k (vs. 500k expected), which is their highest level since March. Third, the preliminary durable goods orders for August were roughly in line with expectations at -0.2% (vs. -0.3% expected), and core capital goods orders exceeded them with +1.3% growth (vs. +0.2% expected) and a positive revision to the previous month. Finally, the Richmond Fed’s manufacturing index for September came in at 0 (vs. -10 expected), adding to that theme of stronger-than-expected releases. A word of caution, the housing data is typically noisy and subject to revision, so despite the bounce in sales, we don’t think this marks a sea-change in housing markets, which have been battered by tightening financial conditions to date.

In the end however, those data releases didn’t manage to stop the S&P 500 (-0.21%) losing ground for a 6th consecutive session, which takes the index back to its lowest closing level since November 2020. In fact for the Dow Jones (-0.43%), yesterday’s losses left it at its lowest closing level since 6 November 2020. That was the last trading session before the news on Monday 9 November from Pfizer that their late-stage vaccine trials had been successful, thus triggering a massive global surge as the way out of the pandemic became much clearer. All-in-all though, equities were a side show to fixed income yesterday.

When it came to Treasuries, there was a notable steepening in both the nominal and real yield curves yesterday, and 10yr yields ended the session up +2.1bps at 3.95%. This morning in Asia 10yr yields did trade at 4% for the first time since 2010 before dipping to around 3.98% as I type. In terms of Fed speak yesterday, we heard from Chicago Fed President Evans, who implied that the Fed might take stock of the impact of rate hikes in the spring, saying that “By spring of next year we are going to get to a funds rate that we can sort of sit and watch how things are behaving,” In the meantime, St Louis Fed President Bullard (one of the most hawkish members of the FOMC) said that inflation was a serious problem and that the credibility of the Fed’s inflation target was at risk.

This morning Asian equity markets are extending their downtrend. As I type, The Kospi (-3.01%) is sharply lower in early trade with the Hang Seng (-2.40%), the Nikkei (-2.21%), the CSI (-0.77%) and the Shanghai Composite (-0.75%) all trading in negative territory.

After a steady start, US stock futures got caught up in the bearish mood with contracts on the S&P 500 (-0.71%) and NASDAQ 100 (-0.98%) both moving lower.Apple reversing plans for an iPhone production boost on waning demand seemed to be a catalyst. The US dollar index (+0.43%) has hit a fresh two-decade high of 114.69 this morning.

Early morning data showed that Australia’s August retail sales advanced for the eighth consecutive month, rising +0.6% m/m, faster than the +0.4% increase expected although the pace of growth slowed from the +1.3% rise seen in July.

To the day ahead now, and there are an array of central bank speakers including Fed Chair Powell, the Fed’s Bostic, Bullard, Bowman, Barkin and Evans, ECB President Lagarde, the ECB’s Kazimir, Holzmann and Elderson, as well as BoE Deputy Governor Cunliffe and the BoE’s Dhingra. In the meantime, data releases include Germany’s GfK consumer confidence reading for October, and France and Italy’s consumer confidence reading for September. In the US, there’s also pending home sales data for August.