A new study by Lending Tree found Generation Z (ages 18 to 24) are purchasing homes in America's least expensive "flyover" cities while barely entertaining homeownership in pricey coastal cities.

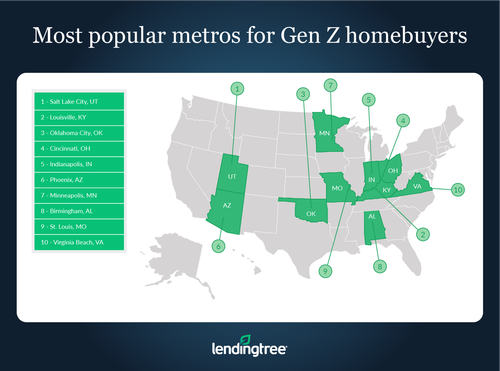

The study analyzed new mortgages across the country's 50 top largest metros in 2021. Salt Lake City topped the list for Gen Z homebuyers, with 16.60% of mortgages. The second was Louisville, Kentucky, with 15.86% of mortgages, and Oklahoma City was third, with 15.34% of mortgages. These areas are relatively inexpensive in terms of homeownership and cost of living.

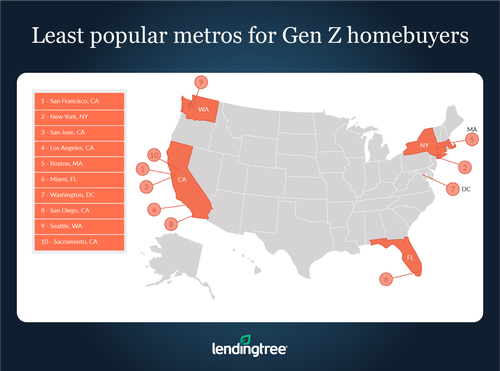

Metro areas with the lowest Gen Z homebuyers were San Francisco, New York, and San Jose. Homes in these areas are pricey, and the cost of living is expensive.

Behaviors of this emerging young generation reveal they're flocking to metro areas where they can afford, possibly due to affordability constraints. The typical Gen Z homebuyer had an average credit score of around 700. They made up almost 10% of all home purchases in 2021.

Since the study was only for the 2021 year, it remains to be seen how soaring mortgage rates in 2022 have changed their buying patterns. Perhaps, this generation has an even greater motivation to seek lower-cost metro areas, partly because of affordability and remote work.

A new study by Lending Tree found Generation Z (ages 18 to 24) are purchasing homes in America’s least expensive “flyover” cities while barely entertaining homeownership in pricey coastal cities.

The study analyzed new mortgages across the country’s 50 top largest metros in 2021. Salt Lake City topped the list for Gen Z homebuyers, with 16.60% of mortgages. The second was Louisville, Kentucky, with 15.86% of mortgages, and Oklahoma City was third, with 15.34% of mortgages. These areas are relatively inexpensive in terms of homeownership and cost of living.

Metro areas with the lowest Gen Z homebuyers were San Francisco, New York, and San Jose. Homes in these areas are pricey, and the cost of living is expensive.

Behaviors of this emerging young generation reveal they’re flocking to metro areas where they can afford, possibly due to affordability constraints. The typical Gen Z homebuyer had an average credit score of around 700. They made up almost 10% of all home purchases in 2021.

Since the study was only for the 2021 year, it remains to be seen how soaring mortgage rates in 2022 have changed their buying patterns. Perhaps, this generation has an even greater motivation to seek lower-cost metro areas, partly because of affordability and remote work.