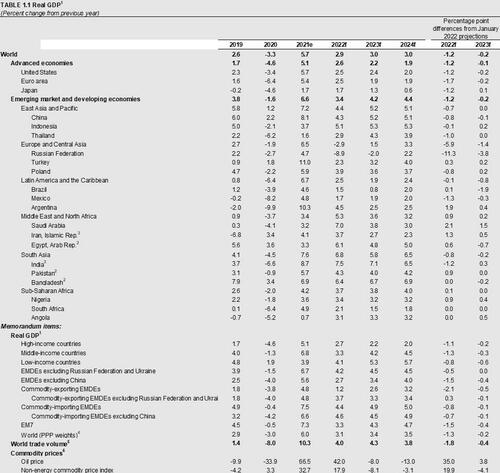

Less than a month after The IMF cut global growth forecasts, blaming Putin, The World Bank has just slashed its 2022 global growth forecast to +2.9% (1.2 percentage points below January's forecast) and also blamed Putin.

"The world economy is expected to experience its sharpest deceleration following an initial recovery from global recession in more than 80 years," the bank said Tuesday in its Global Economic Prospects report.

“The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,” said World Bank President David Malpass.

“Markets look forward, so it is urgent to encourage production and avoid trade restrictions. Changes in fiscal, monetary, climate and debt policy are needed to counter capital misallocation and inequality.”

This continued degradation on growth forecasts amid ongoing soaring inflation points to just one word...

Stagflation. Global central planners are panicking as their nemesis grows stronger.

Ayhan Kose, Director of the World Bank’s Prospects Group says:

“Communicating monetary policy decisions clearly, leveraging credible monetary policy frameworks, and protecting central bank independence can effectively anchor inflation expectations and reduce the amount of policy tightening required to achieve the desired effects on inflation and activity.”

Yeah, good luck with that amid the collapse in credibility.

The World Bank has more advice:

Policymakers, moreover, should refrain from distortionary policies such as price controls, subsidies, and export bans, which could worsen the recent increase in commodity prices. Against the challenging backdrop of higher inflation, weaker growth, tighter financial conditions, and limited fiscal policy space, governments will need to reprioritize spending toward targeted relief for vulnerable populations.

All of which will do nothing to bring about the demand destruction that is necessary to clear this. But hey, doing the same thing again and expecting different results is the sign of true elite status.

Less than a month after The IMF cut global growth forecasts, blaming Putin, The World Bank has just slashed its 2022 global growth forecast to +2.9% (1.2 percentage points below January’s forecast) and also blamed Putin.

“The world economy is expected to experience its sharpest deceleration following an initial recovery from global recession in more than 80 years,” the bank said Tuesday in its Global Economic Prospects report.

“The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,” said World Bank President David Malpass.

“Markets look forward, so it is urgent to encourage production and avoid trade restrictions. Changes in fiscal, monetary, climate and debt policy are needed to counter capital misallocation and inequality.”

This continued degradation on growth forecasts amid ongoing soaring inflation points to just one word…

Stagflation. Global central planners are panicking as their nemesis grows stronger.

Ayhan Kose, Director of the World Bank’s Prospects Group says:

“Communicating monetary policy decisions clearly, leveraging credible monetary policy frameworks, and protecting central bank independence can effectively anchor inflation expectations and reduce the amount of policy tightening required to achieve the desired effects on inflation and activity.”

Yeah, good luck with that amid the collapse in credibility.

The World Bank has more advice:

Policymakers, moreover, should refrain from distortionary policies such as price controls, subsidies, and export bans, which could worsen the recent increase in commodity prices. Against the challenging backdrop of higher inflation, weaker growth, tighter financial conditions, and limited fiscal policy space, governments will need to reprioritize spending toward targeted relief for vulnerable populations.

All of which will do nothing to bring about the demand destruction that is necessary to clear this. But hey, doing the same thing again and expecting different results is the sign of true elite status.