Earlier today we reported that the biggest oil bears among the big banks, Citi and Barclays, just capitulated on their downbeat forecasts - having seen crude steamroll any and every downside catalyst thrown at it and hitting 3 month highs - and were forced to hike their price targets. Of course, their views don't matter since anyone who had traded based on their reco to short oil is now looking for a new career; but with them out of the way, the big boys are now coming out with a new round of aggressive price hikes. To wit, late on Monday, Goldman published a report in which it again revised its price outlook (higher), saying that structural shortages remain unresolved to this day (despite a brief period in which the oil market enjoyed its first surplus since June 2020), and the bank is raising its peak summer oil price target from $125 to $140, while also hiking it oil prices targets for the rest of 2022 and 2022 by $10 higher than before.

We excerpt some more details below.

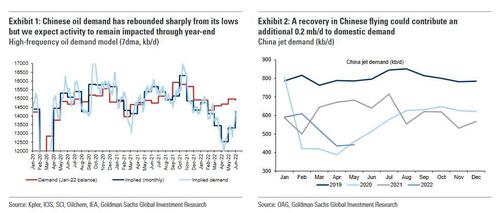

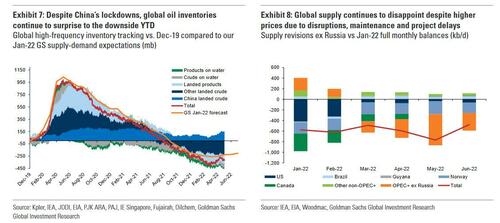

As Goldman's Damien Courvalin writes in the note (available to professional subs), with fundamentals weakening in April-May, due to modest declines in Russian exports, record large SPR sales and severe Chinese lockdowns, the oil market to saw its first surplus since June 2020. However, this politically created surplus is already ending (even with the SPR still pumping a cool million every single day until the Democrats are swept out of Congress this November), driven by the ongoing recovery in Chinese demand...

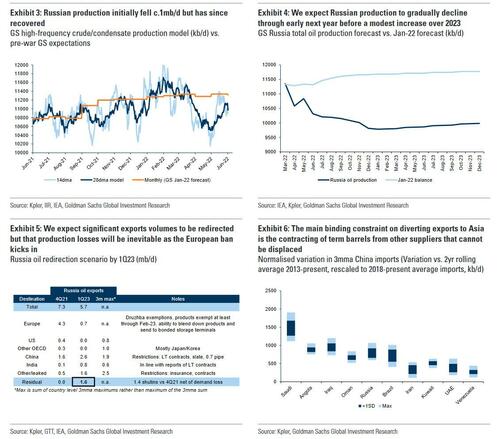

... with an 0.5 mb/d expected further decline in Russian production following the European ban.

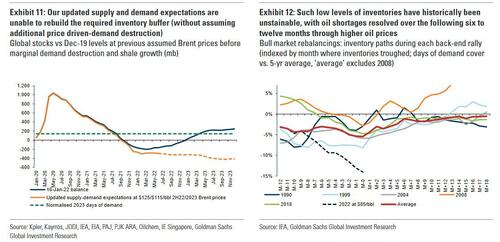

As such, oil’s structural deficit remains unresolved, with in fact an even tighter oil market through April than the Goldman analyst had expected. Supply remains inelastic to higher prices with core-OPEC (higher) and exempt countries (lower) production shifts broadly offsetting.

On the demand side, the negative global growth impulse remains insufficient to rebalance inventories at current prices.

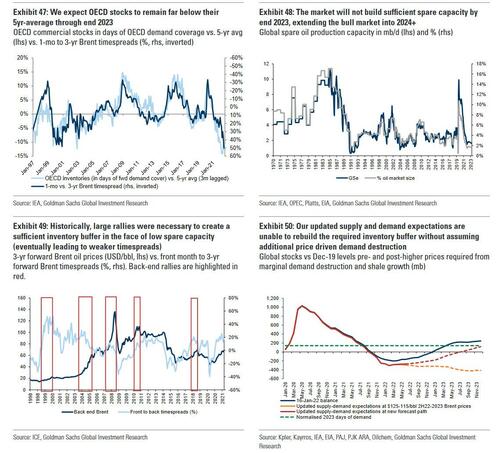

As a result, Goldman believes that oil prices need to rally further to normalize the unsustainably low levels of global oil inventories, as well as OPEC and refining spare capacities.

Warning that with structural shortages unresolved, Courvalin writes that the rising long-term shortages will require near-term surpluses, and that given both record low inventories and OPEC spare capacity, "the market will solve to balance in the short-term and recreate the necessary buffers in the coming year."

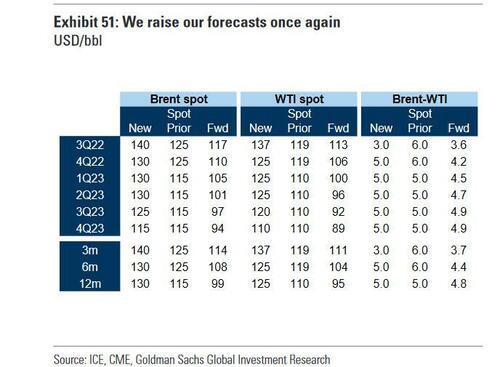

Forcing the market to balance in the short-run and create excess inventories next year therefore requires a higher oil price forecast over both periods. Based on Goldman's estimated 3% demand elasticity and bottom-up estimated shale elasticity, as well as accounting for the retail vs. Brent price disconnect, the bank forecasts that oil prices will need to average $135/bbl in 2H22 and $125/bbl in 2023, $10/bbl higher than previously. On a monthly basis, this points to a peak summer Brent price of $140/bbl with Goldman's consumer Brent price expected to reach over $160/bbl.

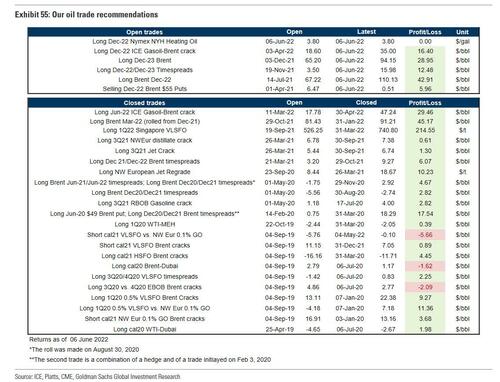

Finally, how is Goldman trading this upside? The bank has identified three opportunities to express this bullish view and overcome then near-term fundamental uncertainties.

- First, long Dec-22 Gasoil, a trade that will perform even if US foreign policy leads to higher OPEC crude supply and that positions for a potential surge in prices this summer.

- Second, Goldman reiterates its long Dec-23 Brent Top Trade recommendation (and its corollary that energy equities continue to outperform the broader market), as the multi-year supply response has yet to be triggered.

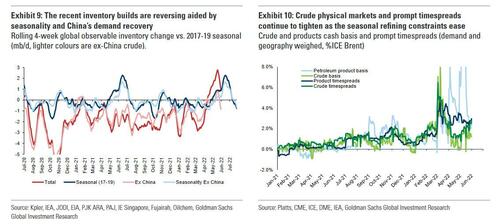

- Third, the bank reiterates its bullish crude timespread near-term view as refinery runs ramp-up by more than the risks to Russian production and Chinese demand.

More in the full note available only to pro subs.

Earlier today we reported that the biggest oil bears among the big banks, Citi and Barclays, just capitulated on their downbeat forecasts – having seen crude steamroll any and every downside catalyst thrown at it and hitting 3 month highs – and were forced to hike their price targets. Of course, their views don’t matter since anyone who had traded based on their reco to short oil is now looking for a new career; but with them out of the way, the big boys are now coming out with a new round of aggressive price hikes. To wit, late on Monday, Goldman published a report in which it again revised its price outlook (higher), saying that structural shortages remain unresolved to this day (despite a brief period in which the oil market enjoyed its first surplus since June 2020), and the bank is raising its peak summer oil price target from $125 to $140, while also hiking it oil prices targets for the rest of 2022 and 2022 by $10 higher than before.

We excerpt some more details below.

As Goldman’s Damien Courvalin writes in the note (available to professional subs), with fundamentals weakening in April-May, due to modest declines in Russian exports, record large SPR sales and severe Chinese lockdowns, the oil market to saw its first surplus since June 2020. However, this politically created surplus is already ending (even with the SPR still pumping a cool million every single day until the Democrats are swept out of Congress this November), driven by the ongoing recovery in Chinese demand…

… with an 0.5 mb/d expected further decline in Russian production following the European ban.

As such, oil’s structural deficit remains unresolved, with in fact an even tighter oil market through April than the Goldman analyst had expected. Supply remains inelastic to higher prices with core-OPEC (higher) and exempt countries (lower) production shifts broadly offsetting.

On the demand side, the negative global growth impulse remains insufficient to rebalance inventories at current prices.

As a result, Goldman believes that oil prices need to rally further to normalize the unsustainably low levels of global oil inventories, as well as OPEC and refining spare capacities.

Warning that with structural shortages unresolved, Courvalin writes that the rising long-term shortages will require near-term surpluses, and that given both record low inventories and OPEC spare capacity, “the market will solve to balance in the short-term and recreate the necessary buffers in the coming year.”

Forcing the market to balance in the short-run and create excess inventories next year therefore requires a higher oil price forecast over both periods. Based on Goldman’s estimated 3% demand elasticity and bottom-up estimated shale elasticity, as well as accounting for the retail vs. Brent price disconnect, the bank forecasts that oil prices will need to average $135/bbl in 2H22 and $125/bbl in 2023, $10/bbl higher than previously. On a monthly basis, this points to a peak summer Brent price of $140/bbl with Goldman’s consumer Brent price expected to reach over $160/bbl.

Finally, how is Goldman trading this upside? The bank has identified three opportunities to express this bullish view and overcome then near-term fundamental uncertainties.

- First, long Dec-22 Gasoil, a trade that will perform even if US foreign policy leads to higher OPEC crude supply and that positions for a potential surge in prices this summer.

- Second, Goldman reiterates its long Dec-23 Brent Top Trade recommendation (and its corollary that energy equities continue to outperform the broader market), as the multi-year supply response has yet to be triggered.

- Third, the bank reiterates its bullish crude timespread near-term view as refinery runs ramp-up by more than the risks to Russian production and Chinese demand.

More in the full note available only to pro subs.