By Eric Peters, CIO of One River Asset Management

“Wanna know what would make Biggie’s job easy?” barked Biggie Too, slipping into 3rd person like a warm bath. “On Valentine’s Day, non-farm payrolls is -250k, unemployment is above 4%, Powell says enough is enough, the S&P 500 troughs at 3300, and up we go,” bellowed Biggie, Chief Global Strategist for one of Wall Street’s Too-Big-To-Fail affairs. “The end of the bear market gets given to Biggie, wrapped up in a red bow.” Then Biggie went quiet. Agitating himself. “But Biggie doesn’t get gifts. Not for Valentine’s Day. Not for Christmas. Biggie doesn’t even get damn birthday cards.”

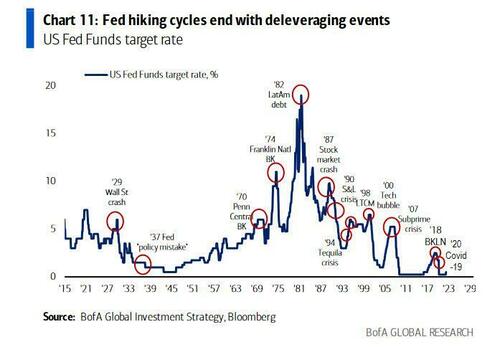

“Biggie is not going to get a signal we got a big low,” said Too. “Biggie is going to get a continuation of a series of lows next year, and it’s going be horrible, just horrible,” he said, not sounding terribly upset about it if I’m being honest. “And somewhere in the middle of it, something is going to break. It always does. Always.” We’ve seen the warning signs bubbling up. The UK pension LDI debacle. “You don’t hike rates this fast and not break something big. It’s coming,” said Biggie. “And listen, you’ll know when to trade the Fed pivot. It’ll be after everyone has given up on the Fed pivot.”

MMT

“The Fed and almost everyone else misunderstands how interest rates affect the economy,” said Warren Mosler, father of MMT. “Higher rates increase interest payments on gov’t debt, and these dollars get pumped into the economy,” he said. US GDP is roughly $25trln. US national debt held by the public is currently $24trln. If the average interest rate on this debt is 1%, the gov’t will pay $240bln in interest. If overnight rates stay high and the average rate on our debt stock rises to 4%, the government will pay $1trln per year. That’s ~4% of GDP.

“The gov’t currently increases the deficit to pay interest on its debt, so higher interest rates increase the deficit and money in the system, and this lifts inflation,” continued Mossler. “If a gov’t wants to reduce demand, which I’m not saying is the problem, it should cut interest rates to 0% (keep them there forever), raise taxes, and/or cut federal spending. Lifting interest rates is the opposite of what it should do,” he said. “And raising rates pays interest only to the people in society who already have assets. It is the equivalent of Universal Basic Income for rich people.”

“The rate hikes have sustained earnings but shifted them from the high multiple stocks into low multiple names,” explained Mosler. “The effect is a one-time decline in overall market capitalization for stocks as a whole, but once we adjust to this shift, the market heads higher to reflect the rising inflation brought on by the Fed,” he said. “Stocks will then be a good inflation hedge until something breaks.” In each cycle, something snaps. "You never know what it will be, but my best guess is that something like $300/barrel oil eventually ends this cycle."

“As for policy rates, it looks like the Fed will get rates to 5% or so,” said Mosler. “Inflation bumps around between 3%-6%,” he said. “The federal deficit moves up toward 8%. Interest costs are quickly going to 3% of that and then headed higher still. Nominal GDP is probably in the range of 5%-6%,” said Mosler. “The rising amounts of money flowing into the economy from deficit spending, including things like student loan forgiveness, 8%-9% social security inflation adjustments, and infrastructure spending keeps inflation and nominal growth high. And stocks like nominal growth.”

By Eric Peters, CIO of One River Asset Management

“Wanna know what would make Biggie’s job easy?” barked Biggie Too, slipping into 3rd person like a warm bath. “On Valentine’s Day, non-farm payrolls is -250k, unemployment is above 4%, Powell says enough is enough, the S&P 500 troughs at 3300, and up we go,” bellowed Biggie, Chief Global Strategist for one of Wall Street’s Too-Big-To-Fail affairs. “The end of the bear market gets given to Biggie, wrapped up in a red bow.” Then Biggie went quiet. Agitating himself. “But Biggie doesn’t get gifts. Not for Valentine’s Day. Not for Christmas. Biggie doesn’t even get damn birthday cards.”

“Biggie is not going to get a signal we got a big low,” said Too. “Biggie is going to get a continuation of a series of lows next year, and it’s going be horrible, just horrible,” he said, not sounding terribly upset about it if I’m being honest. “And somewhere in the middle of it, something is going to break. It always does. Always.” We’ve seen the warning signs bubbling up. The UK pension LDI debacle. “You don’t hike rates this fast and not break something big. It’s coming,” said Biggie. “And listen, you’ll know when to trade the Fed pivot. It’ll be after everyone has given up on the Fed pivot.”

MMT

“The Fed and almost everyone else misunderstands how interest rates affect the economy,” said Warren Mosler, father of MMT. “Higher rates increase interest payments on gov’t debt, and these dollars get pumped into the economy,” he said. US GDP is roughly $25trln. US national debt held by the public is currently $24trln. If the average interest rate on this debt is 1%, the gov’t will pay $240bln in interest. If overnight rates stay high and the average rate on our debt stock rises to 4%, the government will pay $1trln per year. That’s ~4% of GDP.

“The gov’t currently increases the deficit to pay interest on its debt, so higher interest rates increase the deficit and money in the system, and this lifts inflation,” continued Mossler. “If a gov’t wants to reduce demand, which I’m not saying is the problem, it should cut interest rates to 0% (keep them there forever), raise taxes, and/or cut federal spending. Lifting interest rates is the opposite of what it should do,” he said. “And raising rates pays interest only to the people in society who already have assets. It is the equivalent of Universal Basic Income for rich people.”

“The rate hikes have sustained earnings but shifted them from the high multiple stocks into low multiple names,” explained Mosler. “The effect is a one-time decline in overall market capitalization for stocks as a whole, but once we adjust to this shift, the market heads higher to reflect the rising inflation brought on by the Fed,” he said. “Stocks will then be a good inflation hedge until something breaks.” In each cycle, something snaps. “You never know what it will be, but my best guess is that something like $300/barrel oil eventually ends this cycle.”

“As for policy rates, it looks like the Fed will get rates to 5% or so,” said Mosler. “Inflation bumps around between 3%-6%,” he said. “The federal deficit moves up toward 8%. Interest costs are quickly going to 3% of that and then headed higher still. Nominal GDP is probably in the range of 5%-6%,” said Mosler. “The rising amounts of money flowing into the economy from deficit spending, including things like student loan forgiveness, 8%-9% social security inflation adjustments, and infrastructure spending keeps inflation and nominal growth high. And stocks like nominal growth.”