–>

December 7, 2022

The big problem with debt is that it is addictive. Once a person starts down this ramp, it is hard to stop before insolvency. Addictions give way to irrational action. Sometimes the only way to stop is to crash into something hard.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); }

The debt problem is compounded exponentially when the addict is not an individual but a government. It is so much easier to spend someone else’s money and borrow more when it runs out.

Governments trying to be all things to all people soon find themselves funding expensive projects that never seem to die or end. As governments barrel down the irrational road of debt, they must also crash into something, although in a much more spectacular way.

No one likes to talk about the eventuality of these crashes. Instead, the addicted debtor is always obsessed with postponing the day of reckoning. The higher the debt, the more desperate become the measures to kick the can down the road.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); }

Thus, America faces a debt crisis that is running out of options. The facts are evident. It is not a complicated scenario. There is no need to be a conspiracy theorist or alarmist to point out the signs. The crisis consists of massive debt and irrational official policies coming together to increase the speed and likelihood of a crash.

Destroying the Modern Economy

It is not easy to destroy a modern economy because it is a complex, interconnected system with many safeguards to deal with crises. A robust economy can deal with some debt crises involving large amounts of money. Indeed, this has been the case in America for decades. Financial wizards work their magic to mitigate the absurdity of living beyond one’s means. America is aided by the fact that the rest of the world always wanted to buy its debt (seeing it as more creditworthy), allowing the nation to live with a false sense of security.

Thus, the global financial system can absorb the normal headwinds that disrupt the world economy. However, solutions increasingly patched up crises with ever more debt.

Turkish-born Iranian-American economist Nouriel Roubini, professor emeritus of New York University’s Stern School of Business, believes that the world economy is heading toward a perfect storm of economic, financial and debt crises threatening the whole system. The cause is an orgy of deficits, borrowing, and leveraging that puts even the most resistant systems to the test. Outside factors like war and the pandemic add more stress to already overloaded structures.

Roubini does not give dates or present doomsday forecasts. His assessment is a calm statement of facts that indicate where the economy went wrong.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); } if (publir_show_ads) { document.write(“

Mountains of Debt

Key components of his assessment are the two main categories of debt exploding in America and the world.

The first is private debt based on individual addiction to debt mechanisms now considered normal. A $16.51 trillion mountain of American household debt, for example, includes mortgages, credit card debt, auto loans, student loans, and personal loans. Personal debt everywhere is approaching pre-COVID levels.

Another category of private debt is that of the corporate world. Due to the chaotic COVID climate, much of the business world is weighed down by bank loans, bond debt, and other investment instruments. The American portion of the $87.52 trillion global non-financial debt is $23.7 trillion. The American financial sector also carries significant liabilities of bank and non-bank institutions ($18.9 trillion).

All this global private debt alone should be a matter of concern. However, there is more.

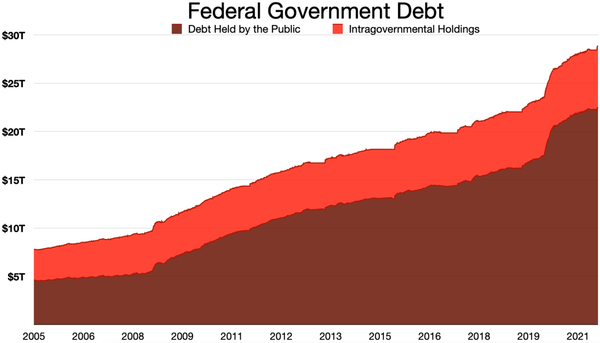

Massive Public Debt and Liabilities

The frenetic intemperance of governments has dramatically increased the amount of debt via a massive array of public debt instruments. These include the national U.S. debt of $31.3 trillion (and growing). State and local bonds and other formal liabilities are also at high levels. There are also the implicit unfunded liabilities found in pension and healthcare schemes that grow as people age and the payoffs come due.

American private debt addiction is mirrored in other advanced and developed countries worldwide.

Double-Whammy Debt Ratios

Dr. Roubini presents staggering figures for the two debt categories. He reports, “Globally, total private- and public-sector debt as a share of GDP rose from 200% in 1999 to 350% in 2021. The ratio is now 420% across advanced economies, and 330% in China. In the United States, it is 420%, which is higher than during the Great Depression and after World War II.”

T his debt is dangerous because it often does not involve capital investments that tend to boost wealth. Much personal borrowing consists of consumer spending that does not have a return on investment. Corporate debt is spent on rapid expansion projects that often do not render significant returns. Government pork barrel projects invest in useless pet projects and extravagant infrastructure schemes. None of this helps the economy.

his debt is dangerous because it often does not involve capital investments that tend to boost wealth. Much personal borrowing consists of consumer spending that does not have a return on investment. Corporate debt is spent on rapid expansion projects that often do not render significant returns. Government pork barrel projects invest in useless pet projects and extravagant infrastructure schemes. None of this helps the economy.

Reckless Policies Lead to Crisis

This crisis did not happen overnight. Banking and government colluded to make borrowing easy and seemingly without consequence. Reckless spending policies have been in place for years and, like addictions, tend to grow exponentially.

Dr. Roubini cites the “democratization of finance” as a cause of over-borrowing. Low-income households suddenly invested in assets they could not afford. Ultra-loose monetary and credit policies favoring extremely low interest rates provided an incentive to buy without concern for the future.

Adding to the problem is the pumping of money into the economy through years of quantitative easing (QE) programs. Central bank planning also created “free money” by keeping borrowing costs near zero or even a negative interest rate. There was so much money around that some government bonds charged negative interest from investors to park their cash safely in public debt ($17 trillion in 2020).

The Demise of the Zombies

The flood of easy credit worldwide created a class of debtors that economists call zombies. Borrowers of all types, from individuals to corporations to governments, found themselves steeped in so much debt that they should have been dead in a normal economy. However, they were rescued, like zombies, by near-zero, negative interest rates and other bailout schemes that raised them from the financially dead.

As central banks start to increase interest rates to fight inflation, the zombies are now feeling the pressure of being outside the artificial climate that allowed them to thrive. They are hit with eroding income, devalued assets, and increased borrowing costs as they attempt to service or roll over their loans. This time their deaths might be for real.

Zombie governments are also learning that the age of free money is over. Soon, debt servicing will take out a significant chunk of the budget.

Massive Disruptions

Finally, adding to the economic problems are all sorts of disruptions rocking the markets. Many of these are outside the control of financial institutions and involve political decisions, ecological swindles, and natural disasters. These influences are battering markets with problems that would challenge healthy economies.

On top of unwieldy debt, the world faces the war in Ukraine that is wreaking havoc on commodity, energy, and grain prices. Europe and other nations are scrambling to find other sources of vital supplies. The zero-COVID policies of Communist China are disrupting supply chains. ESG investment policies and climate-change regulations threaten the stability of vital industries like agriculture, oil, and energy.

Roubini lists many “megathreats” that include cyberwarfare, new protectionism, the possibility of nuclear war, a Taiwan invasion and “other medium-term shocks.” All these factors create pressures upon an already staggering world economy. Worse, they are contributing to the return of stagflation, a combination of high inflation with stagnation or weak growth, last seen in the seventies.

Empty Toolkit

There are no more tools in the toolkit used during the 2008 subprime mortgage and COVID-19 crises. Massive stimulus bills that inject even more money into the economy only exacerbate inflation, not real growth. The Fed’s “free money” giveaway have a similar effect.

Recent government proposals to continue these programs seem to destroy the economy, not fix it.

Roubini does not see governments having the political will to cut spending, reduce deficits, or raise taxes. Thus, he foresees a hard landing coming “as asset bubbles burst, debt-servicing ratios spike, and inflation-adjusted incomes fall across households, corporations, and governments.”

Some tricks might still be used to postpone the debt crisis, but there is no way to avoid it. Too many factors are piling up and bringing together the perfect storm.

Image: Wikideas 1

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to helpdesk@americanthinker.com

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>