(function(d, s, id) { var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) return; js = d.createElement(s); js.id = id; js.src = “https://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v3.0”; fjs.parentNode.insertBefore(js, fjs); }(document, ‘script’, ‘facebook-jssdk’)); –>

–>

September 27, 2023

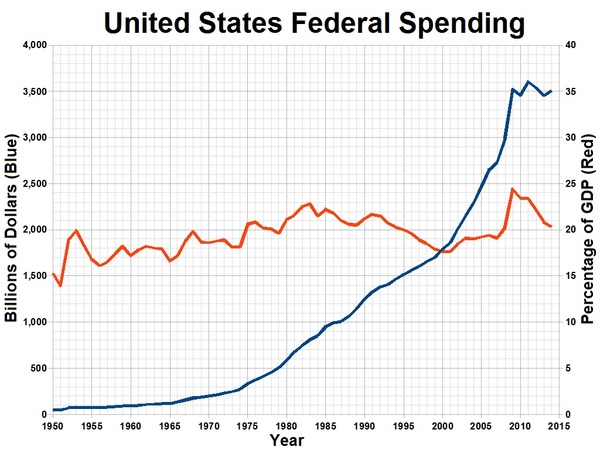

The federal government, under both parties, has printed trillions of dollars to fund its “stimulus” packages and other projects. This spending greatly increased during the COVID era. Basic economics teaches that the government printing press is not only the cause, but the very definition of inflation. Over the past 30 + months, prices of all consumer goods have risen dramatically. Real estate has achieved similar highs. Prices have appeared to stabilize only after action by the Federal Reserve system to restrict the money supply. The supply of money has been the key both to inflation and to its temporary taming.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); document.write(”); googletag.cmd.push(function() { googletag.pubads().addEventListener(‘slotRenderEnded’, function(event) { if (event.slot.getSlotElementId() == “div-hre-Americanthinker—New-3028”) { googletag.display(“div-hre-Americanthinker—New-3028”); } }); }); }

Of course, raising interest rates is not the real solution. Only the end of government printing would stop inflation.

Government and its media operatives have, as usual, attempted to confuse the issue. The administration and its corporate media sponsors have blamed Russia, COVID, the “supply chain” and other irrelevant targets. They even passed the Inflation Reduction Act, which promises to reduce inflation by providing, among other items, even more government spending. The administration refuses to credit the Federal Reserve for the monetary restrictive measures, preferring to credit the counterproductive measures in the Inflation Reduction Act. But those spending measures in the Inflation Reduction Act appear to be rekindling inflation again.

Throughout history, governments both small and large have addressed inflation with irrelevant and counterproductive measures. Price controls have been imposed by everyone from Roman Emperor Diocletian to President Nixon to modern Venezuela. Weimar Germany’s hyperinflation led to the collapse of that government and aided the rise of Hitler. Hyperinflation was replaced by war and destruction. Argentina’s inflation rate reached 1,000 or more percent in the 1980s — as that once-thriving democracy became a military dictatorship with a devastated economy. President Gerald Ford attempted to rally the public with “WIN” (“Whip Inflation Now”) buttons. This tactic was ridiculed — usually for the wrong reasons. All in the Family’s “Meathead” quipped that “nobody’s going to wear those things” — blaming the failure of WIN buttons on the lack of participation by inflation’s victims. As Ronald Reagan used to say about inflation, “We are the victim of language.”

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); document.write(”); googletag.cmd.push(function() { googletag.pubads().addEventListener(‘slotRenderEnded’, function(event) { if (event.slot.getSlotElementId() == “div-hre-Americanthinker—New-3035”) { googletag.display(“div-hre-Americanthinker—New-3035”); } }); }); }

Every nation that imposed price controls saw the same result — shortages. Historian Will Durant described the failure of Diocletian’s price controls as “rapid and complete.” Nixon’s price controls caused chaos without managing to stop price increases. All attempts at price controls have failed due to black markets, shortages, or the flight of capital.

Price controls cause shortages. Even conservatives fail to learn that lesson. We attribute shortages in Venezuela to vague labels like “socialism” or “corruption.”

Governments fail to learn the lessons of past inflation and price controls. They repeat the same mistakes over and over. Today, municipal governments in California enact rent control even though the national trend sees rental rates dropping. These controls will limit the availability of housing as they limit the  availability of every other product whose price is controlled. New York City has endured rent controls for decades, with resulting shortages of housing. Even though rent control causes housing shortages, numerous cities and states, including California, now contemplate increased rent control. Increased homelessness would surely result from such measures. Investor advocates hope to stem the tide of such measures with a legal challenge currently before the U.S. Supreme Court. But one lawsuit, whatever the outcome, will not undo decades of economic ignorance.

availability of every other product whose price is controlled. New York City has endured rent controls for decades, with resulting shortages of housing. Even though rent control causes housing shortages, numerous cities and states, including California, now contemplate increased rent control. Increased homelessness would surely result from such measures. Investor advocates hope to stem the tide of such measures with a legal challenge currently before the U.S. Supreme Court. But one lawsuit, whatever the outcome, will not undo decades of economic ignorance.

Rent control advocates argue that rent control somehow fights homelessness. One would expect this claim from someone who (1) never saw the intersection of a supply and demand curve (2) never ran a business and (3) does not read books. The market sets rental rates where supply meets demand. Interfering with that process means that the lines don’t meet. The gap between the lines is the shortage in rental properties. Shortages are bad — in this case resulting in homelessness.

Conservatives must go beyond the idea that federal spending merely hurts taxpayers. We accuse politicians of wasting “tax dollars” with each new federal program. We cite staggering dollar amounts that voters cannot directly relate to their own pocketbooks. The federal government spends large dollar amounts without “raising taxes,” thus creating a disconnect between the spending and the harm in the minds of the voters. Tax time comes once a year for most Americans. We easily forget the pain of April 15 when politicians are promising goodies during the rest of the year.

Federal spending directly affects (creates) inflation more than that spending affects taxes. Every penny that the federal government spends places upward pressure on prices. When the government spends billions (or trillions) of dollars, that pressure becomes enormous. Those consequences become easy to demonstrate in today’s inflationary climate. For each new spending proposal, we must remind the public that such proposal will affect not only their taxes, but more directly and immediately their groceries, gas, and rent.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); document.write(”); googletag.cmd.push(function() { googletag.pubads().addEventListener(‘slotRenderEnded’, function(event) { if (event.slot.getSlotElementId() == “div-hre-Americanthinker—New-3027”) { googletag.display(“div-hre-Americanthinker—New-3027”); } }); }); } if (publir_show_ads) { document.write(“

When the government sends money to Ukraine, your grocery, housing, and gas prices will increase.

When the government provides relief to those displaced by COVID lockdowns, your grocery, housing, and gas prices increase.

When the government provides disaster relief, your grocery, housing, and gas prices increase.

When the government subsidizes medicine and drug costs, your grocery, housing, and gas prices increase. So do your medicine prices.

When the government funds alternative energy boondoggles, grocery, housing, and gas prices increase. In simpler terms, government funding of “alternative energy” (or anything) causes you to pay more at the pump.

When the government provides “relief” to those indebted for student loans, your grocery, housing, and gas prices increase. So does the price of college tuition.

When the government subsidizes rent or “first time home buyers,” your grocery, housing and gas prices increase. That includes rent, real estate prices, and construction costs.

Most conservatives have done a poor job of connecting government spending with increased cost of living. Many voters have no idea that the two things are even related. But this connection is vital to understanding what created the current economic situation. We must do better than saying only that the government “spends too much.” We cannot be content to say only that inflation is bad and a Democrat is President so “vote Republican.” We must remind the voters that if the government does what the leftists propose in any situation (always involving spending) the voters will pay more solely because of that spending. We can tell them to imagine another dollar per gallon at the pump or another fifty dollars a month in rent. We should ask if the government program of the moment is worth it. Those are predictions that have always come true and will come true again.

Had we expressed the issue in those terms instead of vague references to “taxpayer dollars,” maybe the corporate media propagandists would have a harder time advocating “rent control” as a means of cleaning up their own mess. The only way to prevent “rent control” and other counterproductive crackdowns is for us to point out the connection between government spending and inflation at every opportunity.

Image: Delphi234

<!–

–>

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to [email protected]

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>