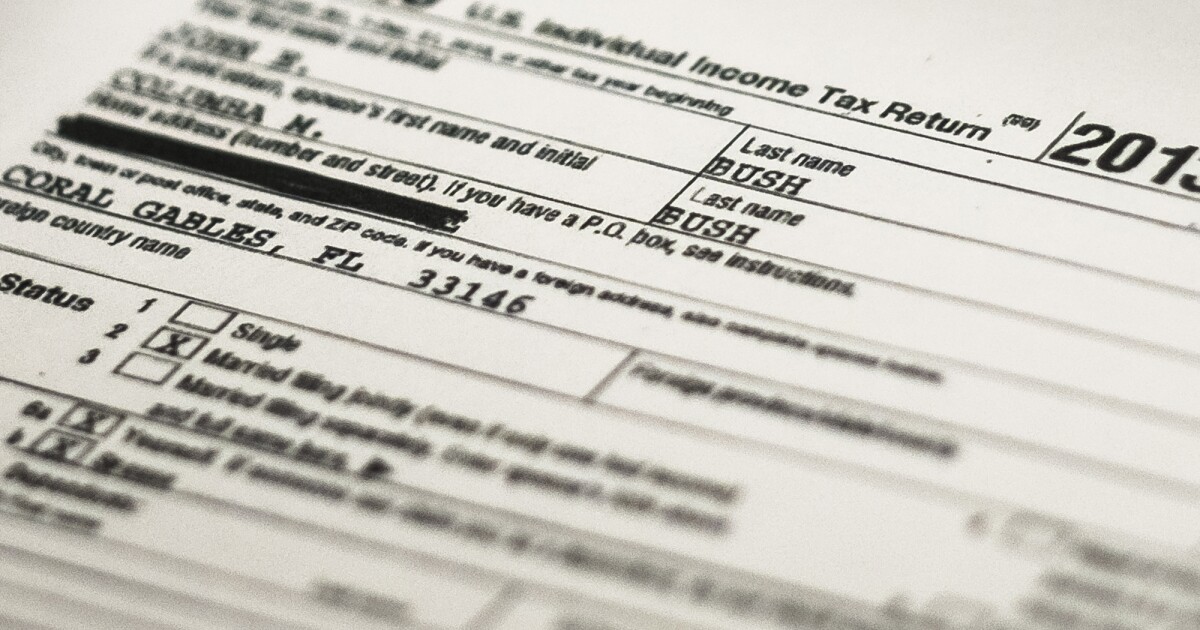

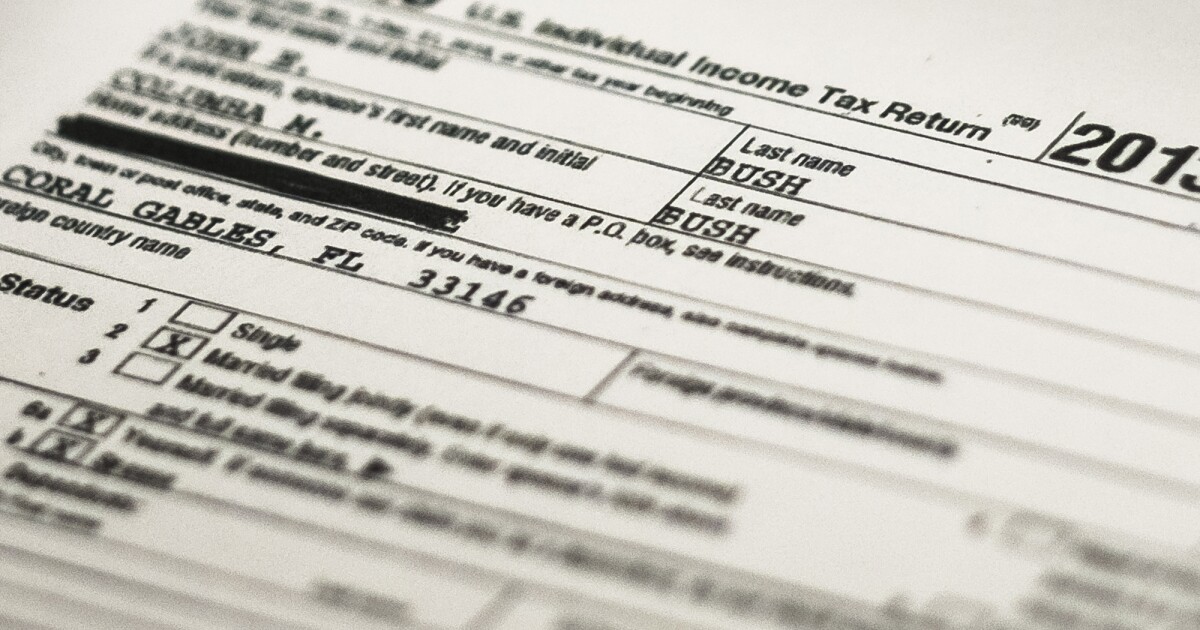

The Internal Revenue Service has issued more refunds in the first three weeks of this year’s tax season than it had last year, but the refunds are not nearly as big.

The IRS has accepted tax returns since Jan. 23, the start of the 2023 tax season, and since Feb. 10, has issued 13.3 million federal income tax refunds, up by 48.4% compared to last year, according to data released by the agency on Friday. The agency has also received 28.8 million returns so far, up 9.1% from the same time period last year, according to Detroit Free Press.

2023 TAX BRACKETS: HERE ARE THE NEW INCOME THRESHOLDS FOR TAXPAYERS

This year’s returns are looking smaller than what recipients received last year, however, as the average tax refund was $1,997 for early returns processed through Feb. 10. The amount is 14% less than the 2022 average of $2,323 from the same time last year, according to the data.

The smaller refunds reported from the data come after several financial experts warned that the amount recipients will receive from this year’s refund may not be as large as in previous years. Part of the decrease in this year’s refund is from the lack of a recovery rebate, which was given to taxpayers in response to the COVID-19 pandemic and gave taxpayers $1,400 per person when filing their 2021 taxes.

An additional change made to filing taxes this year was made to the child tax credit, which granted families either $3,000 in credits for children under 18 or $3,600 in credits for children under 6. This credit has now reverted to its original amount of $2,000 per child.

All tax returns for the 2022 tax year are due by April 18. Employers were required to issue Form W-2s to all of their employees by Jan. 31; the IRS recommends any employee who has not yet received this form should contact their employer to receive it.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The IRS has advised taxpayers to avoid calling the agency over Presidents Day weekend, as the agency has historically received a peak number of calls during this time. To help avoid the wait times that would come with so many callers calling the agency, the IRS recommends using several self-help tools available on its website.

“The IRS continues to see improvements this tax season compared to previous years, including better phone service,” said IRS acting commissioner Doug O’Donnell. “But we always see a significant surge in phone traffic around Presidents Day. With the calendar advancing, millions of people turn their attention to taxes during this period. To avoid potential delays, we encourage people to check IRS.gov first, which can provide much of the same information instantly to taxpayers.”