On Jan 24th, we posted a recommendation on our Premium-Subscriber twitter feed, suggesting subscribers: "Get Long FXI here..."

Like many of the reccs on this exclusive feed, it has done rather well...

(Subscribe to Premium ZeroHedge here)

The question is, after gaining 30%, do we stay with the trade - or as Goldman Sachs flow of funds guru asks (and answers) today: "Is This China Rally for Real?"

His answer is simple:

"Yes. TCT (The China Trade) is back."

We have seen our most China activity on the desk this week in 2024 via a mix of investor types. We think is more than just short covering as there are green shoots developing. We have had notable Long Only demand, this is new. I will be spending time on this over the weekend, so sharing the trade thesis more broadly.

The Chinese equity market is breaking out on high volume, including when southbound connect is on holiday. Why? Catalysts in the coming weeks/months include the long-delayed Third Plenum and more specific policies related to the overall guidance of the Nine measures.

Full Checklist of catalysts, flows, and macro ideas below for TCT:

I. GS Research presents several possible catalysts that could potentially turn the entrenched negative expectation and sentiment around.

1. a comprehensive and forceful easing package

2. demand-side-focused stimulus

3. confidence boosting policy targeting the private economy

4. government backstop in the housing and stock markets

5. improvements and predictability in US-China relations

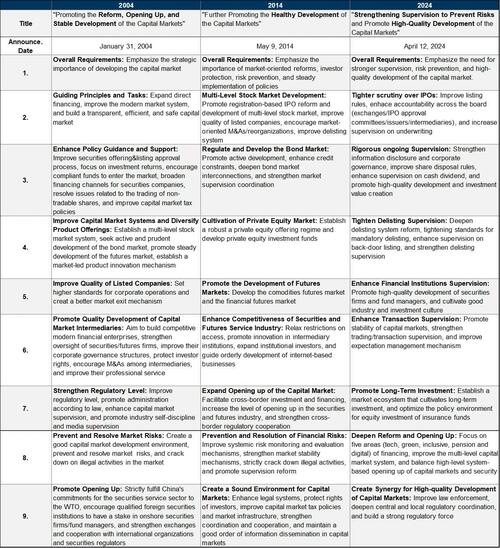

II. The new “Nine Measures”

a. GS Research triangulates the potential policy-driven upside through the lens of shareholder returns, corporate governance standards, and institutional investor ownership.

b. GS Research analysis suggests that A-shares could rise ~20% if they could narrow the gaps with international averages along these dimensions, and could re-rate as much as 40% if they catch up with global leaders in our blue-sky scenario.

III. Positioning is currently short and underweight and FOMO is on the rise.

1. Hedge Fund Positioning:

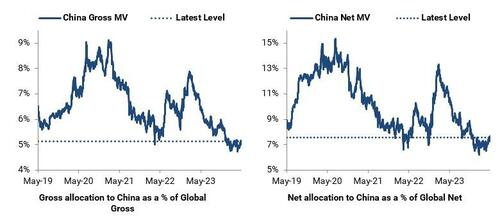

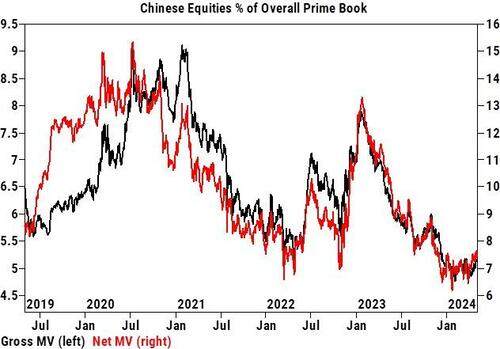

a. Both Gross and Net allocations to China increased in April, but continue to stay close to 5-year lows. Gross allocation to China increased to 5.1% (7th percentile five-year), while Net allocation increased to 7.5% (10th percentile five-year).

b. The 5 year low of gross exposure was 4.7% on March 27th and low net exposure in January of 6.2%. (for context the 5 year high gross was 9.1% in Jan 2021 and net of 15.3% in July 2020).

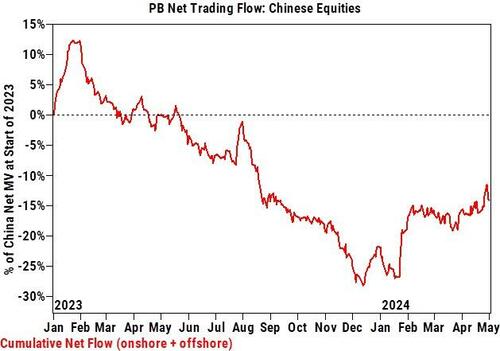

c. Chinese equities were moderately net bought (+0.5 SD) in April and are now net bought in four of the past five months.

d. Chinese domiciled equities (onshore and offshore combined) were net bought with long buys exceeding short covers in a ratio of 5 to 1. Flows were risk

Trading Flows: China (Onshore + Offshore)

Source: Goldman Sachs

Positioning: China (Onshore + Offshore):

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

2. Global Mutual Funds (as of Mar-end):

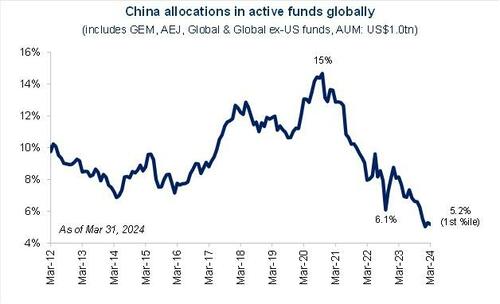

Based on EPFR data, mutual funds globally in aggregate have 5.2% allocation in Chinese equities as of end-March, which represents 1st percentile over the past decade .

Source: Goldman Sachs

On asset-weighted basis, active mutual fund mandates remain underweight Chinese equities by 320bps vs. benchmark.

Source: Goldman Sachs

Global, EM, and AEJ long-only mandates modestly increased their allocations in Chinese equities in March.

Source: Goldman Sachs

3. Southbound/Northbound Trading Flows:

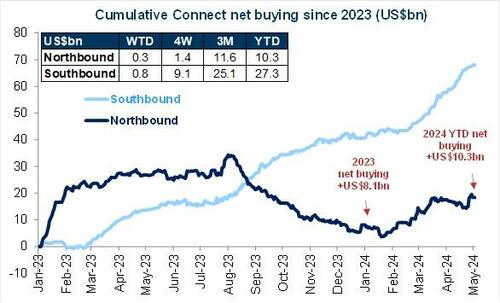

A-shares have seen US$10.3bn Northbound inflows ytd, surpassing the US$8.1bn for full-year 2023.

Southbound saw strong buying of US$27bn ytd.

Source: Goldman Sachs

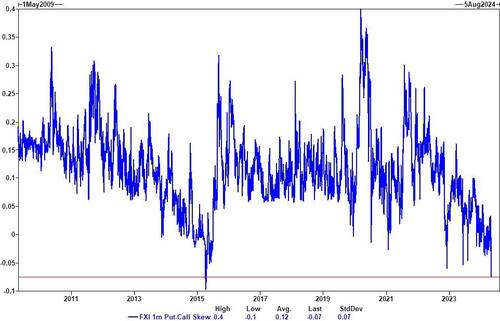

4. Options - During NYC Macro trading, we are seeing hedge fund buyers of call options and ETF’s.

We’re now witnessing a strong chase for HK/China upside (outsized call option volumes yesterday in both FXI and KWEB).

Source: Lee Coppersmith, Goldman Sachs

FXI 1month put-call skew is now back near all-time lows following this week’s rally, signaling increased demand for upside exposure.

On Jan 24th, we posted a recommendation on our Premium-Subscriber twitter feed, suggesting subscribers: “Get Long FXI here…”

Like many of the reccs on this exclusive feed, it has done rather well…

(Subscribe to Premium ZeroHedge here)

The question is, after gaining 30%, do we stay with the trade – or as Goldman Sachs flow of funds guru asks (and answers) today: “Is This China Rally for Real?”

His answer is simple:

“Yes. TCT (The China Trade) is back.”

We have seen our most China activity on the desk this week in 2024 via a mix of investor types. We think is more than just short covering as there are green shoots developing. We have had notable Long Only demand, this is new. I will be spending time on this over the weekend, so sharing the trade thesis more broadly.

The Chinese equity market is breaking out on high volume, including when southbound connect is on holiday. Why? Catalysts in the coming weeks/months include the long-delayed Third Plenum and more specific policies related to the overall guidance of the Nine measures.

Full Checklist of catalysts, flows, and macro ideas below for TCT:

I. GS Research presents several possible catalysts that could potentially turn the entrenched negative expectation and sentiment around.

1. a comprehensive and forceful easing package

2. demand-side-focused stimulus

3. confidence boosting policy targeting the private economy

4. government backstop in the housing and stock markets

5. improvements and predictability in US-China relations

II. The new “Nine Measures”

a. GS Research triangulates the potential policy-driven upside through the lens of shareholder returns, corporate governance standards, and institutional investor ownership.

b. GS Research analysis suggests that A-shares could rise ~20% if they could narrow the gaps with international averages along these dimensions, and could re-rate as much as 40% if they catch up with global leaders in our blue-sky scenario.

III. Positioning is currently short and underweight and FOMO is on the rise.

1. Hedge Fund Positioning:

a. Both Gross and Net allocations to China increased in April, but continue to stay close to 5-year lows. Gross allocation to China increased to 5.1% (7th percentile five-year), while Net allocation increased to 7.5% (10th percentile five-year).

b. The 5 year low of gross exposure was 4.7% on March 27th and low net exposure in January of 6.2%. (for context the 5 year high gross was 9.1% in Jan 2021 and net of 15.3% in July 2020).

c. Chinese equities were moderately net bought (+0.5 SD) in April and are now net bought in four of the past five months.

d. Chinese domiciled equities (onshore and offshore combined) were net bought with long buys exceeding short covers in a ratio of 5 to 1. Flows were risk

Trading Flows: China (Onshore + Offshore)

Source: Goldman Sachs

Positioning: China (Onshore + Offshore):

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

2. Global Mutual Funds (as of Mar-end):

Based on EPFR data, mutual funds globally in aggregate have 5.2% allocation in Chinese equities as of end-March, which represents 1st percentile over the past decade .

Source: Goldman Sachs

On asset-weighted basis, active mutual fund mandates remain underweight Chinese equities by 320bps vs. benchmark.

Source: Goldman Sachs

Global, EM, and AEJ long-only mandates modestly increased their allocations in Chinese equities in March.

Source: Goldman Sachs

3. Southbound/Northbound Trading Flows:

A-shares have seen US$10.3bn Northbound inflows ytd, surpassing the US$8.1bn for full-year 2023.

Southbound saw strong buying of US$27bn ytd.

Source: Goldman Sachs

4. Options – During NYC Macro trading, we are seeing hedge fund buyers of call options and ETF’s.

We’re now witnessing a strong chase for HK/China upside (outsized call option volumes yesterday in both FXI and KWEB).

Source: Lee Coppersmith, Goldman Sachs

FXI 1month put-call skew is now back near all-time lows following this week’s rally, signaling increased demand for upside exposure.

Loading…