Authored by Simon White, Bloomberg macro strategist,

The US manufacturing ISM is one of the main explanatory factors of global stock markets over the medium term.

While the ISM should see some upside in the very short term, any gains are likely to be short lived, with stocks soon facing more resistance.

There’s a reason why the market pays so much attention to the ISM. It’s one of the first data points released each month about the state of the economy. It’s forward-looking as it asks participants about their expectations of future business conditions. It’s not therefore unexpected it would have an impact on stock markets.

But its influence is greater perhaps than it has any business being. Indeed, the manufacturing ISM has a high correlation to the factor that explains over 60% over global stock-market returns. This is a compelling result, as it’s not the usual suspects of global earnings, revenues or profit margins you might expect.

The ISM remains in the sub-50 contraction zone, but there is some short-term (~1-3 months) optimism ahead as the new orders-to-inventory ratio, which leads the headline, has turned up.

Further out though (~3-9 months), the picture for the ISM and therefore for stocks is less rosy.

Rises in global rates have yet to fully feed through.

My Global Financial Tightness Indicator, a diffusion index of global policy rates, leads the ISM by 3-9 months, and points to a weaker ISM over that timeframe.

That points to downside for stocks too.

This begs the question (using the expression non-formally) why is manufacturing, which is only ~11% of US GDP, so pivotal for US and global stock markets?

That stems from the sector’s disproportionate impact on jobs, patents, exports and revenues. In gross output terms it accounts for over a third of economic activity, despite only being a little over a tenth of GDP.

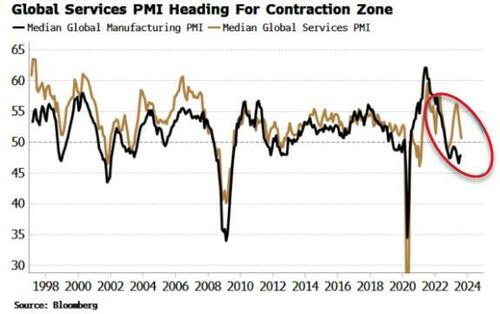

Manufacturing also typically leads the rest of the economy due to its high sensitivity to interest rates. Currently, the global services PMI is in the process of catching down to the global manufacturing PMI.

Earnings and margins are still important for stocks in the longer term, but for timescales under a year, the old economy - increasingly dismissed as obsolescent – still has plenty of influence on the outlook for equity markets.

Authored by Simon White, Bloomberg macro strategist,

The US manufacturing ISM is one of the main explanatory factors of global stock markets over the medium term.

While the ISM should see some upside in the very short term, any gains are likely to be short lived, with stocks soon facing more resistance.

There’s a reason why the market pays so much attention to the ISM. It’s one of the first data points released each month about the state of the economy. It’s forward-looking as it asks participants about their expectations of future business conditions. It’s not therefore unexpected it would have an impact on stock markets.

But its influence is greater perhaps than it has any business being. Indeed, the manufacturing ISM has a high correlation to the factor that explains over 60% over global stock-market returns. This is a compelling result, as it’s not the usual suspects of global earnings, revenues or profit margins you might expect.

The ISM remains in the sub-50 contraction zone, but there is some short-term (~1-3 months) optimism ahead as the new orders-to-inventory ratio, which leads the headline, has turned up.

Further out though (~3-9 months), the picture for the ISM and therefore for stocks is less rosy.

Rises in global rates have yet to fully feed through.

My Global Financial Tightness Indicator, a diffusion index of global policy rates, leads the ISM by 3-9 months, and points to a weaker ISM over that timeframe.

That points to downside for stocks too.

This begs the question (using the expression non-formally) why is manufacturing, which is only ~11% of US GDP, so pivotal for US and global stock markets?

That stems from the sector’s disproportionate impact on jobs, patents, exports and revenues. In gross output terms it accounts for over a third of economic activity, despite only being a little over a tenth of GDP.

Manufacturing also typically leads the rest of the economy due to its high sensitivity to interest rates. Currently, the global services PMI is in the process of catching down to the global manufacturing PMI.

Earnings and margins are still important for stocks in the longer term, but for timescales under a year, the old economy – increasingly dismissed as obsolescent – still has plenty of influence on the outlook for equity markets.

Loading…