One week ago we said that every market period has a distinct bogeyman for when a trade doesn't go your way: "8 years ago, every most hated rally was "explained" with HFTs; 4 years ago it was gamma. Now it's 0DTE."

8 years every most hated rally was "explained" with HFTs; 4 years ago it was gamma. Now it's 0DTE

— zerohedge (@zerohedge) February 5, 2023

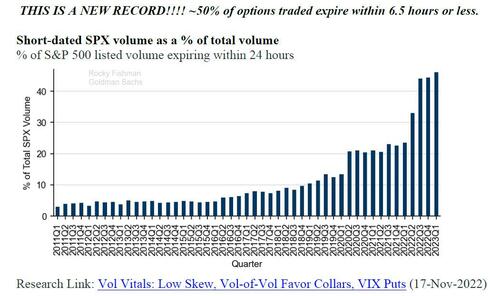

Fast forward to today when JPMorgan's former permabull-turned-ultrabear Marko Kolanovic, who earlier this week one again reiterated his bearish case alongside Michael Wilson only to see stocks rip higher, did just that when he not only blamed Zero-Days to Expiration options (which we profiled first in "What's Behind The Explosion In 0DTE Option Trading", and followed up here "Why 0DTE Is So Important, And Why The VIX Is Now Meaningless") for why stocks refuse to go down and finally prove him right (as a reminder Marko erroneously spent most of 2022 urging clients to buy the dip, then turned bearish just before the January meltup), but warned that 0DTE itself is emerging as one of the potential ticking time bombs embedded within the market's microstructure.

Marko starts off by lamenting the continued melt up, which he did not anticipate (as otherwise he clearly would have told his clients to go along for the ride), and instead he explains (after the fact of course( why it occurred, and why those investors who chase the risk wave higher are begging for punishment from none other than the Fed itself, because who in their right minds would fight the Fed... although actually the answer is pretty much everyone as we explained a few weeks ago.

Since the last Fed meeting, the 2-year bond yield is up ~60bp. After all, it is the bond market moving toward the Fed, rather than the Fed to the bond market. However, equity markets are rallying, and the prevailing sentiment is of exuberance and greed. For instance, AAII % bulls is the highest since 2021 and AAII % bears is the lowest since 2021, the CNN fear-greed index is at extreme greed, and financial conditions (e.g., as measured by BFCIUS) are the least restrictive in a year. This divergence between equity and bond markets is odd – as the main premise of the recent equity rally was not just the Fed cutting interest rates in the second half but also a soft landing. Leadership of equity markets has also been upside-down given the yields moving higher. In fact, it is the lower quality, long-duration segments such as unprofitable and speculative tech that has been at the forefront of the rally (while short-duration segments lagged). There is an old adage ”don’t fight the Fed,” but this behavior is not just fighting but also taunting the Fed with crypto, meme stocks, and unprofitable companies responding best to Fed communications. Retail activity (volumes) are near record high with over 20% of all market volume coming from retail orders.

Here, Marko is simply recapping what we said more than two weeks ago when we first pointed out that it was once again retail that is leading the charge higher, and as we followed up today in 'Here They Come: Hedge Funds "Start To Rerisk", Buy Tech For 11 Straight Days", it was indeed retail - like in early 2021 - that woke the hedge fund fast money out of hibernation and back into buying, with just the Long Only crowd still waiting on the sidelines, but not for long.

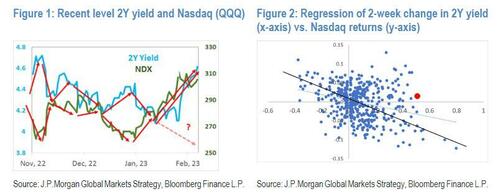

Of course, Marko can't concede that we may have seen a low in the market now that there is a panicked pursuit of risk higher, and instead he presents - as he has done for the past two months - several arguments why buying here is a bad idea even though stocks are now about 400 points higher than where he first said to sell and/or short. He starts off by pointing out the correlation between 2Y yields and stocks and asserts that "the move in 2y interest rates since the Fed meeting should result in a ~5- 10% sell-off in Nasdaq (Figures 1 and 2), which is actually up ~3% since, and for high-beta tech the divergence is much larger. However, this divergence cannot go much further, in our view, and may revert."

The Croat then shifts to macro challenges facing risk - all of which are well known and have been largely pried in by now - although not according to the JPM strategist who claims that "over the last three months, complacency set in with investors when it comes to geopolitical risks. There is a perception that the energy crisis is over and that the war in Ukraine is not an issue any more – supporting the record rally in European stocks – and recent geopolitical tensions related to China do not resonate with short-term financial inflows into the asset class." Of course, since Kolanovic remains bearish - for at least another 100 points in the S&P - he believes that "geopolitical risks may re-escalate in the near future... which would negatively impact European FX and equities." Among the potential geopolitical powderkegs, is that Europe still remains beholden to Russia for its energy needs, to wit:

Recently, a number of media outlets and politicians have claimed that Europe won the energy war due to warm weather, increased LNG shipments, and reduced consumption. However, this might only amount to a short-term Band-Aid at an unsustainable annual cost of 5% of EU GDP along with shutdowns of industrial and residential consumption. Furthermore, the situation remains quite fragile, for instance, if Russia were to disrupt some of the Norway gas pipelines or LNG shipping, e.g., as a response to recently published allegations (e.g., see here), the energy crisis would rapidly escalate. Also it has been broadly reported that a new Russian offensive could start in the near future, and that would most likely reduce risk appetite globally and negatively impact European assets. The relationship of the West with China has also been deteriorating recently, and as China regains economic momentum, one should expect more rather than less geopolitical tensions.

While it remains to be seen if a new geopolitical crisis will dent risk assets - in a world where the elusive bear case increasingly needs a fresh global war - Kolanovic actually makes an interesting point next, arguing that it is the 0DTE phenomenon discussed above (and earlier) that could potentially destabilize stocks and lead to a painful flush lower.

Here, the Croat reminds readers of the infamous Volmageddon episode in Feb 2018, which was basically a historic VIX spike triggered by a collapse in inverse VIX products and fueled by further systematic selling.

For Kolanovic, it's deja vu all over again, and the JPM strategist claims that we may get a similar market event, only instead of inverse VIX ETN, this time he blames 0DTE option activity as the source of vol suppression and selling which is destabilizing markets and could lead to a furious selloff. Here is his explanation:

The rise of inverse volatility products prior to Volmageddon started as a virtuous feedback loop of volatility selling. Selling the VIX directly suppressed the level of implied volatility (boosting performance of short volatility products), as well as indirect suppression of realized volatility (via gamma hedging of underlying options). The decline of volatility and intraday hedging also manifested as buying the dip behavior. As the strong performance of volatility selling became self-fulfilling, leverage and tail risk in these products increased. On February 5, 2018, leverage was such that an increase of the VIX resulted in daily rebalance (closing of short VIXpositions) that overwhelmed the market liquidity and led to an uncontrolled increase of volatility. This in turn triggered further selling from various other systematic investors such as volatility targeters, gamma hedgers, and CTAs.

Remember what we said above: 4 years ago traders blamed gamma when a trade didn't go their way, and now they blame 0DTE? Well, here is Marko capturing perfectly what we said, by pointing out that "while history doesn’t repeat, it often rhymes, and current selling of 0DTE (zero day to expiry), daily and weekly options is having a similar impact on markets." The impact he is referring to is an analogue to the VIX suppression by inverse vol ETNs in 2018, not that it is 0DTE's fault for keeping his bearish scenario from materializing.

But we digress: going back to 0DTE, the JPM strategist notes that the volumes in these short-term options are "very large" which of course is correct as we showed earlier today.

Marko picks up on this, and in the chart below he shows the daily notional volumes in these short-term options is ~$1 trillion; the Croat claims that "these options are net sold by directional investors, and supply of gamma is likely causing a suppression of realized intraday volatility." These are typically low delta options that rarely get in the money, and their impact is mostly through volatility suppression and an intraday buy-the-dip pattern that results from hedging. However, Kolanovic warns, "if there is a big move when these options get in the money, and sellers cannot support these positions, forced covering would result in very large directional flows."

These flows could "particularly impact markets given the current low liquidity environment" (or, inversely, the lack of a 0DTE crash particularly impacts markets by pushing them higher every day in the current low liquidity environment).

Marko then takes his thought experiment in 0DTE precrime to the final level, and says that by estimating how much of these short-term options are net sold by directional investors (and hedged by dealers), if there is a large market move, he calculates that "covering of short-term option delta could result in intraday selling on a large down move (or buying on a large up move) on the order of ~$30bn."

And since 0DTE is just the tip of the derivative iceberg, Kolanovic warns that "one should also take into account that these flows would trigger further one-way flows from monthly option hedging as well as volatility control strategies and CTAs (particularly in a case of a large down move)."

Couple of points here: of course the market is unstable: that's hardly news; in fact the market has been fragile and illiquid since the start of QE1, and has only gotten worse the more central bank intervention it benefited from over the years. But that fragility was a double edged sword since any resulting selloff would prompt the Fed to intervene. In fact, some bulls should hope that Kolanovic is right because a market crash would only precipitate a faster end to tightening and QT and lead to a far more powerful and sustainable rally. Another point is that we have seen 0DTE aggressively expand its presence for the past 3 years, so far without any dramatic consequences; and while it is certain that one day we will have Volmageddon 2.0 (whether due to 0DTE or something else), it could be tomorrow or it could be in one year, and by then the S&P could be at 4,500... or 5,000... or 6,000. One thing is certain: now that he is in full-blown bear mode again, don't expect Marko to tell you when stocks will rise, only that they will fall (eventually), and if one week, or one month, or one year from today stocks are (much) higher, the Croat will have a detailed and convincing explanation for why the rally simply refuses to end (as it has so far). If only he also had a just as convincing way to make his clients some money...

One week ago we said that every market period has a distinct bogeyman for when a trade doesn’t go your way: “8 years ago, every most hated rally was “explained” with HFTs; 4 years ago it was gamma. Now it’s 0DTE.”

8 years every most hated rally was “explained” with HFTs; 4 years ago it was gamma. Now it’s 0DTE

— zerohedge (@zerohedge) February 5, 2023

Fast forward to today when JPMorgan’s former permabull-turned-ultrabear Marko Kolanovic, who earlier this week one again reiterated his bearish case alongside Michael Wilson only to see stocks rip higher, did just that when he not only blamed Zero-Days to Expiration options (which we profiled first in “What’s Behind The Explosion In 0DTE Option Trading“, and followed up here “Why 0DTE Is So Important, And Why The VIX Is Now Meaningless“) for why stocks refuse to go down and finally prove him right (as a reminder Marko erroneously spent most of 2022 urging clients to buy the dip, then turned bearish just before the January meltup), but warned that 0DTE itself is emerging as one of the potential ticking time bombs embedded within the market’s microstructure.

Marko starts off by lamenting the continued melt up, which he did not anticipate (as otherwise he clearly would have told his clients to go along for the ride), and instead he explains (after the fact of course( why it occurred, and why those investors who chase the risk wave higher are begging for punishment from none other than the Fed itself, because who in their right minds would fight the Fed… although actually the answer is pretty much everyone as we explained a few weeks ago.

Since the last Fed meeting, the 2-year bond yield is up ~60bp. After all, it is the bond market moving toward the Fed, rather than the Fed to the bond market. However, equity markets are rallying, and the prevailing sentiment is of exuberance and greed. For instance, AAII % bulls is the highest since 2021 and AAII % bears is the lowest since 2021, the CNN fear-greed index is at extreme greed, and financial conditions (e.g., as measured by BFCIUS) are the least restrictive in a year. This divergence between equity and bond markets is odd – as the main premise of the recent equity rally was not just the Fed cutting interest rates in the second half but also a soft landing. Leadership of equity markets has also been upside-down given the yields moving higher. In fact, it is the lower quality, long-duration segments such as unprofitable and speculative tech that has been at the forefront of the rally (while short-duration segments lagged). There is an old adage ”don’t fight the Fed,” but this behavior is not just fighting but also taunting the Fed with crypto, meme stocks, and unprofitable companies responding best to Fed communications. Retail activity (volumes) are near record high with over 20% of all market volume coming from retail orders.

Here, Marko is simply recapping what we said more than two weeks ago when we first pointed out that it was once again retail that is leading the charge higher, and as we followed up today in ‘Here They Come: Hedge Funds “Start To Rerisk”, Buy Tech For 11 Straight Days“, it was indeed retail – like in early 2021 – that woke the hedge fund fast money out of hibernation and back into buying, with just the Long Only crowd still waiting on the sidelines, but not for long.

Of course, Marko can’t concede that we may have seen a low in the market now that there is a panicked pursuit of risk higher, and instead he presents – as he has done for the past two months – several arguments why buying here is a bad idea even though stocks are now about 400 points higher than where he first said to sell and/or short. He starts off by pointing out the correlation between 2Y yields and stocks and asserts that “the move in 2y interest rates since the Fed meeting should result in a ~5- 10% sell-off in Nasdaq (Figures 1 and 2), which is actually up ~3% since, and for high-beta tech the divergence is much larger. However, this divergence cannot go much further, in our view, and may revert.“

The Croat then shifts to macro challenges facing risk – all of which are well known and have been largely pried in by now – although not according to the JPM strategist who claims that “over the last three months, complacency set in with investors when it comes to geopolitical risks. There is a perception that the energy crisis is over and that the war in Ukraine is not an issue any more – supporting the record rally in European stocks – and recent geopolitical tensions related to China do not resonate with short-term financial inflows into the asset class.” Of course, since Kolanovic remains bearish – for at least another 100 points in the S&P – he believes that “geopolitical risks may re-escalate in the near future… which would negatively impact European FX and equities.” Among the potential geopolitical powderkegs, is that Europe still remains beholden to Russia for its energy needs, to wit:

Recently, a number of media outlets and politicians have claimed that Europe won the energy war due to warm weather, increased LNG shipments, and reduced consumption. However, this might only amount to a short-term Band-Aid at an unsustainable annual cost of 5% of EU GDP along with shutdowns of industrial and residential consumption. Furthermore, the situation remains quite fragile, for instance, if Russia were to disrupt some of the Norway gas pipelines or LNG shipping, e.g., as a response to recently published allegations (e.g., see here), the energy crisis would rapidly escalate. Also it has been broadly reported that a new Russian offensive could start in the near future, and that would most likely reduce risk appetite globally and negatively impact European assets. The relationship of the West with China has also been deteriorating recently, and as China regains economic momentum, one should expect more rather than less geopolitical tensions.

While it remains to be seen if a new geopolitical crisis will dent risk assets – in a world where the elusive bear case increasingly needs a fresh global war – Kolanovic actually makes an interesting point next, arguing that it is the 0DTE phenomenon discussed above (and earlier) that could potentially destabilize stocks and lead to a painful flush lower.

Here, the Croat reminds readers of the infamous Volmageddon episode in Feb 2018, which was basically a historic VIX spike triggered by a collapse in inverse VIX products and fueled by further systematic selling.

For Kolanovic, it’s deja vu all over again, and the JPM strategist claims that we may get a similar market event, only instead of inverse VIX ETN, this time he blames 0DTE option activity as the source of vol suppression and selling which is destabilizing markets and could lead to a furious selloff. Here is his explanation:

The rise of inverse volatility products prior to Volmageddon started as a virtuous feedback loop of volatility selling. Selling the VIX directly suppressed the level of implied volatility (boosting performance of short volatility products), as well as indirect suppression of realized volatility (via gamma hedging of underlying options). The decline of volatility and intraday hedging also manifested as buying the dip behavior. As the strong performance of volatility selling became self-fulfilling, leverage and tail risk in these products increased. On February 5, 2018, leverage was such that an increase of the VIX resulted in daily rebalance (closing of short VIXpositions) that overwhelmed the market liquidity and led to an uncontrolled increase of volatility. This in turn triggered further selling from various other systematic investors such as volatility targeters, gamma hedgers, and CTAs.

Remember what we said above: 4 years ago traders blamed gamma when a trade didn’t go their way, and now they blame 0DTE? Well, here is Marko capturing perfectly what we said, by pointing out that “while history doesn’t repeat, it often rhymes, and current selling of 0DTE (zero day to expiry), daily and weekly options is having a similar impact on markets.” The impact he is referring to is an analogue to the VIX suppression by inverse vol ETNs in 2018, not that it is 0DTE’s fault for keeping his bearish scenario from materializing.

But we digress: going back to 0DTE, the JPM strategist notes that the volumes in these short-term options are “very large” which of course is correct as we showed earlier today.

Marko picks up on this, and in the chart below he shows the daily notional volumes in these short-term options is ~$1 trillion; the Croat claims that “these options are net sold by directional investors, and supply of gamma is likely causing a suppression of realized intraday volatility.” These are typically low delta options that rarely get in the money, and their impact is mostly through volatility suppression and an intraday buy-the-dip pattern that results from hedging. However, Kolanovic warns, “if there is a big move when these options get in the money, and sellers cannot support these positions, forced covering would result in very large directional flows.”

These flows could “particularly impact markets given the current low liquidity environment” (or, inversely, the lack of a 0DTE crash particularly impacts markets by pushing them higher every day in the current low liquidity environment).

Marko then takes his thought experiment in 0DTE precrime to the final level, and says that by estimating how much of these short-term options are net sold by directional investors (and hedged by dealers), if there is a large market move, he calculates that “covering of short-term option delta could result in intraday selling on a large down move (or buying on a large up move) on the order of ~$30bn.”

And since 0DTE is just the tip of the derivative iceberg, Kolanovic warns that “one should also take into account that these flows would trigger further one-way flows from monthly option hedging as well as volatility control strategies and CTAs (particularly in a case of a large down move).”

Couple of points here: of course the market is unstable: that’s hardly news; in fact the market has been fragile and illiquid since the start of QE1, and has only gotten worse the more central bank intervention it benefited from over the years. But that fragility was a double edged sword since any resulting selloff would prompt the Fed to intervene. In fact, some bulls should hope that Kolanovic is right because a market crash would only precipitate a faster end to tightening and QT and lead to a far more powerful and sustainable rally. Another point is that we have seen 0DTE aggressively expand its presence for the past 3 years, so far without any dramatic consequences; and while it is certain that one day we will have Volmageddon 2.0 (whether due to 0DTE or something else), it could be tomorrow or it could be in one year, and by then the S&P could be at 4,500… or 5,000… or 6,000. One thing is certain: now that he is in full-blown bear mode again, don’t expect Marko to tell you when stocks will rise, only that they will fall (eventually), and if one week, or one month, or one year from today stocks are (much) higher, the Croat will have a detailed and convincing explanation for why the rally simply refuses to end (as it has so far). If only he also had a just as convincing way to make his clients some money…

Loading…