The Fed is in an incredibly uncomfortable position, Warns Nomura chief strategist Charlie McElligott in a note this morning.

The Fed's problem is simple - the market has reflexively built-in a message that not just 'Peak Fed Tightening' is behind us already - but that we're about to cut Rates in early '23, as evidenced by US 10Y Real Yields collapsing 70bps in two weeks—which has then dictated a wholesale risk-asset explosion higher from Equities to Credit to Long Duration, as US financial conditions then impulse ease in an extremely counter-productive dynamic for the Fed's "inflation fighting" mandate.

Financial conditions have eased in the same proportion as the last four mini-easings - all of which have seen lower highs (tighter 'peak easing') and lower lows (tighter)...

Source: Bloomberg

Why is The Fed's position a problem?

Simple, McElligott explains, pulling the bullish blinkers back from the bull crowd's eyes:

...with the remarkable US Labor market strength (U-Rate at 53 year lows) alongside structurally imbalanced Commodities / Energy / Housing, Inflation is simply in no position to return to the “old world” of 2% target without a further escalation of FCI hawkishness from the Fed...

...but all while the market is already EASING policy preemptively on nobody’s behalf, now seeing “just” a Terminal Rate at 3.26% achieved btwn Dec ’22 / Feb ’23 before implied Fed cutting soon thereafter.

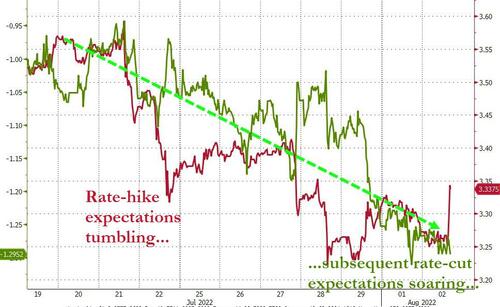

Rate-hike expectations have plunged and subsequent rate-cut expectations have soared...

But, rather than see this as the market knowing all and accepting the bullish narrative that the worst is behind us, McElligott warns that this recent spastic EASING in FCI most notably via the meltdown in Real Yields will only further build “animal spirits” impulses back into these key inflation inputs and risk-markets, because you simply have not caused enough of a slowdown to crimp the “demand” input which the Fed can control.

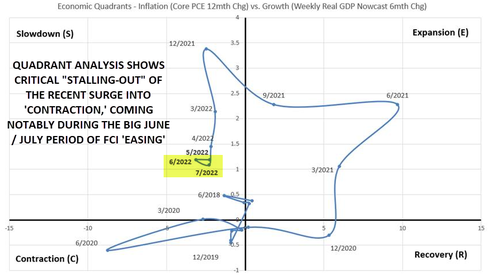

Critically, this EASING of US financial conditions - incredibly occurring over the same period that the Fed hiked 150bps in a ~ month month span (!!!) - is actually seeing the hotly anticipated “Recession” trade stall-out a touch in our high-frequency quadrant monitor, chopping our feet and actually now avoiding any further move lower into “Contraction” territory - and that is actually then a problem for the huge swing back into “all things Duration” as the whole world’s base-case shifted to said “Recession” outlook.

For that reason, the Nomura MD sees Fed Funds sitting “higher for longer” than the market is currently anticipating, with a “re- tightening” in policy rhetoric from FOMC members in coming-weeks (a bunch of speakers next few days) - which will then begin to “push back” against the market pricing that the Fed will somehow be EASING in early 2023.

As we noted earlier, Academy Securities' Peter Tchir summed-up the market's apparent delusion well as he points out that, while traders desperately hope to look through the weakness to a brave new world of QE, recession risk is worse than inflation for markets.

I’m not sure the Fed has done enough to avoid a recession (inventories keep popping up as a major warning sing).

I doubt the Fed messaging is going to help much this week, as they seem to want to beat down on the idea that they’ve made a dovish shift.

And in case you were hoping for some 'technical' assistance from options-land or vol-control strategies, McElligott warns we are actually seeing Vol “try” to firm again here in recent days, and even prior to this Pelosi / Taiwan / CCP clownshow fiasco to an extent - which I’d imagine is a function of:

1) funds adding back small hedges as they take Nets back up (cover shorts, add longs);

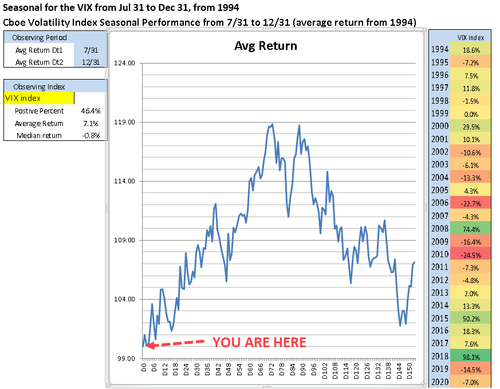

2) VIX seasonality btwn July 31 into year-end since ‘94

3) the “speed” of the rally off the lows feeling increasingly unstable, particularly as more people get comfortable with the idea that the Fed is going to struggle with this recent impulse EASING of FCI.

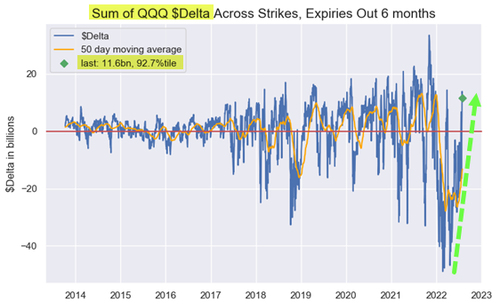

As the Nomura strategist concludes, we are now too back into an increasingly stable “Long Gamma” regime, which will act to help suppress intraday swings via Dealer hedging, and allow more fundamental direction to re-assert itself.

The “all clear” signal that everybody wants from a Fed “dovish pivot” of the prior QE era remains further away than realized.

The Fed is in an incredibly uncomfortable position, Warns Nomura chief strategist Charlie McElligott in a note this morning.

The Fed’s problem is simple – the market has reflexively built-in a message that not just ‘Peak Fed Tightening’ is behind us already – but that we’re about to cut Rates in early ’23, as evidenced by US 10Y Real Yields collapsing 70bps in two weeks—which has then dictated a wholesale risk-asset explosion higher from Equities to Credit to Long Duration, as US financial conditions then impulse ease in an extremely counter-productive dynamic for the Fed’s “inflation fighting” mandate.

Financial conditions have eased in the same proportion as the last four mini-easings – all of which have seen lower highs (tighter ‘peak easing’) and lower lows (tighter)…

Source: Bloomberg

Why is The Fed’s position a problem?

Simple, McElligott explains, pulling the bullish blinkers back from the bull crowd’s eyes:

…with the remarkable US Labor market strength (U-Rate at 53 year lows) alongside structurally imbalanced Commodities / Energy / Housing, Inflation is simply in no position to return to the “old world” of 2% target without a further escalation of FCI hawkishness from the Fed…

…but all while the market is already EASING policy preemptively on nobody’s behalf, now seeing “just” a Terminal Rate at 3.26% achieved btwn Dec ’22 / Feb ’23 before implied Fed cutting soon thereafter.

Rate-hike expectations have plunged and subsequent rate-cut expectations have soared…

But, rather than see this as the market knowing all and accepting the bullish narrative that the worst is behind us, McElligott warns that this recent spastic EASING in FCI most notably via the meltdown in Real Yields will only further build “animal spirits” impulses back into these key inflation inputs and risk-markets, because you simply have not caused enough of a slowdown to crimp the “demand” input which the Fed can control.

Critically, this EASING of US financial conditions – incredibly occurring over the same period that the Fed hiked 150bps in a ~ month month span (!!!) – is actually seeing the hotly anticipated “Recession” trade stall-out a touch in our high-frequency quadrant monitor, chopping our feet and actually now avoiding any further move lower into “Contraction” territory – and that is actually then a problem for the huge swing back into “all things Duration” as the whole world’s base-case shifted to said “Recession” outlook.

For that reason, the Nomura MD sees Fed Funds sitting “higher for longer” than the market is currently anticipating, with a “re- tightening” in policy rhetoric from FOMC members in coming-weeks (a bunch of speakers next few days) – which will then begin to “push back” against the market pricing that the Fed will somehow be EASING in early 2023.

As we noted earlier, Academy Securities’ Peter Tchir summed-up the market’s apparent delusion well as he points out that, while traders desperately hope to look through the weakness to a brave new world of QE, recession risk is worse than inflation for markets.

I’m not sure the Fed has done enough to avoid a recession (inventories keep popping up as a major warning sing).

I doubt the Fed messaging is going to help much this week, as they seem to want to beat down on the idea that they’ve made a dovish shift.

And in case you were hoping for some ‘technical’ assistance from options-land or vol-control strategies, McElligott warns we are actually seeing Vol “try” to firm again here in recent days, and even prior to this Pelosi / Taiwan / CCP clownshow fiasco to an extent – which I’d imagine is a function of:

1) funds adding back small hedges as they take Nets back up (cover shorts, add longs);

2) VIX seasonality btwn July 31 into year-end since ‘94

3) the “speed” of the rally off the lows feeling increasingly unstable, particularly as more people get comfortable with the idea that the Fed is going to struggle with this recent impulse EASING of FCI.

As the Nomura strategist concludes, we are now too back into an increasingly stable “Long Gamma” regime, which will act to help suppress intraday swings via Dealer hedging, and allow more fundamental direction to re-assert itself.

The “all clear” signal that everybody wants from a Fed “dovish pivot” of the prior QE era remains further away than realized.