New Mexico residents may be able to receive some extra cash for their pockets sometime this year should recently proposed state legislation get passed.

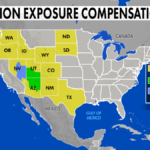

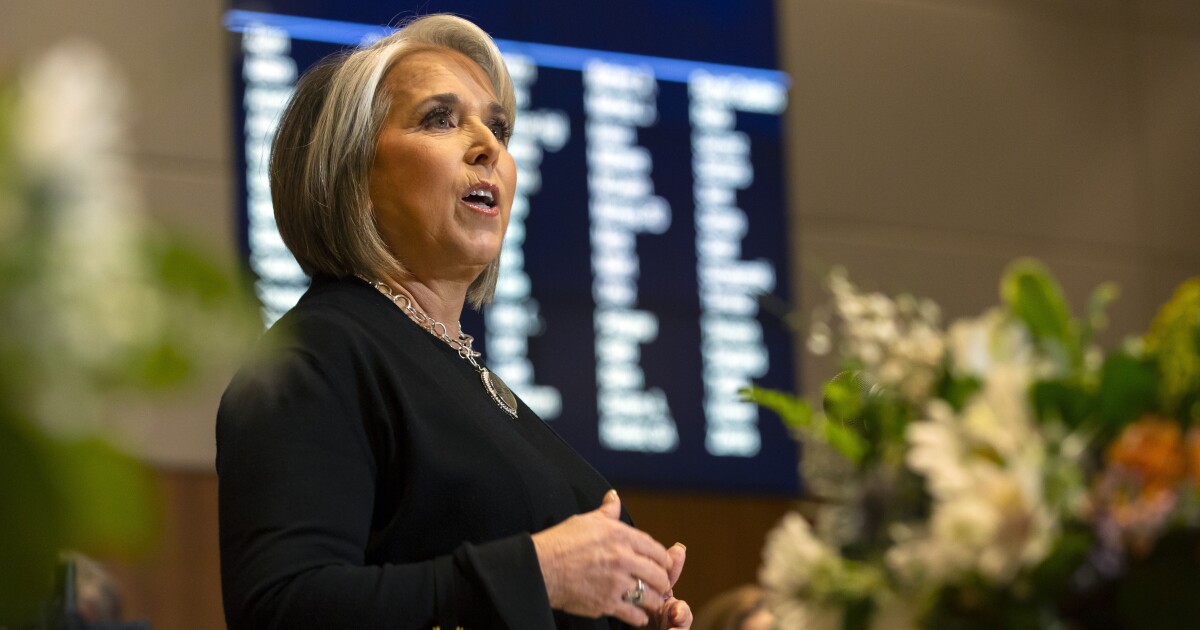

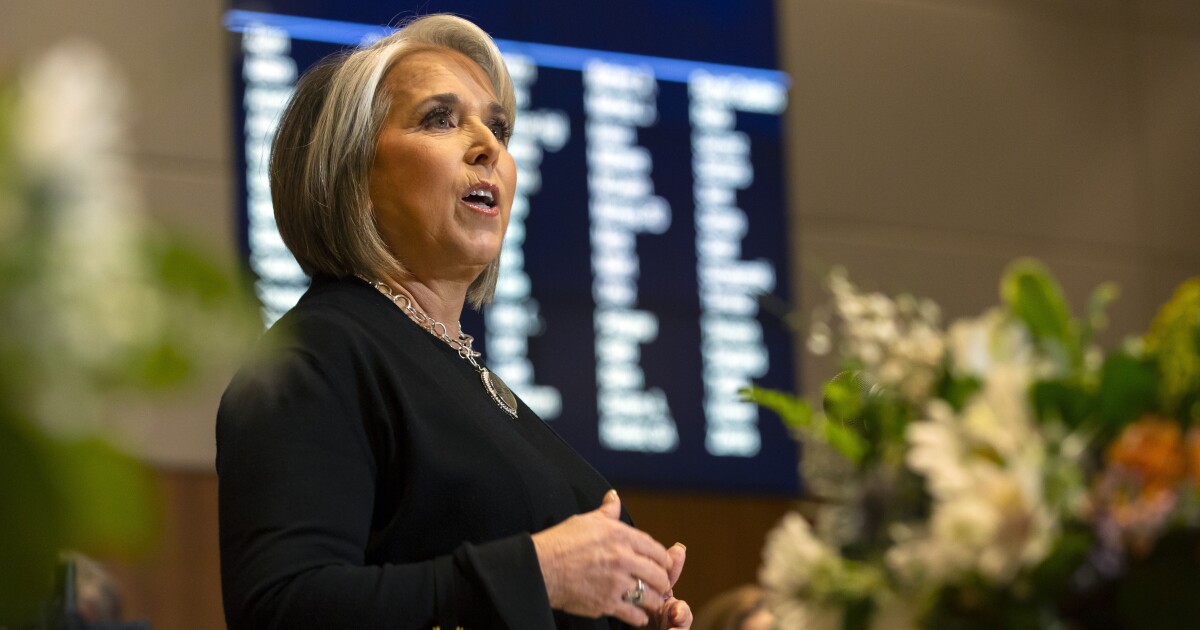

Senate Bill 10, the legislation introduced by Gov. Michelle Lujan Grisham (D) on Wednesday, would provide $1 billion in household relief to around 875,000 New Mexico taxpayers with one-time rebate payments. These payments would be worth $750 for single taxpayers and $1,500 for joint filers, with the intent to distribute them sometime this summer, according to a press release from the governor’s office.

NEW MEXICO ATTORNEY GENERAL MOVES TO GET LOCAL ABORTION RESTRICTIONS THROWN OUT

“As prices remain high across the country, we can and we should take action to help more New Mexicans afford the things they need right now,” said Lujan Grisham. “As our state continues to see the results of our continued and targeted investments that have resulted in an unprecedented financial windfall, I look forward to working with the legislature to put more money back in the pockets of New Mexico families.”

State Sen. Benny Shendo (D), who has sponsored the legislation, has also spoken in favor of these rebate payments, saying it would help “thousands of families across the state.”

The payments would likely be welcomed by state residents, as many living in the United States are still struggling to keep up with rising prices of everyday items, such as eggs.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The state of New Mexico is also still offering a tax rebate of up to $500, giving residents who did not yet file a 2021 New Mexico personal income tax return through May 31 to receive this rebate. A resident must also not be claimed as a dependent on another person’s tax return if they wish to partake in this rebate, according to the New Mexico Tax and Revenue Department.

The Washington Examiner has contacted Lujan Grisham’s office for comment.