Authored by David Stockman via LewRockwell.com,

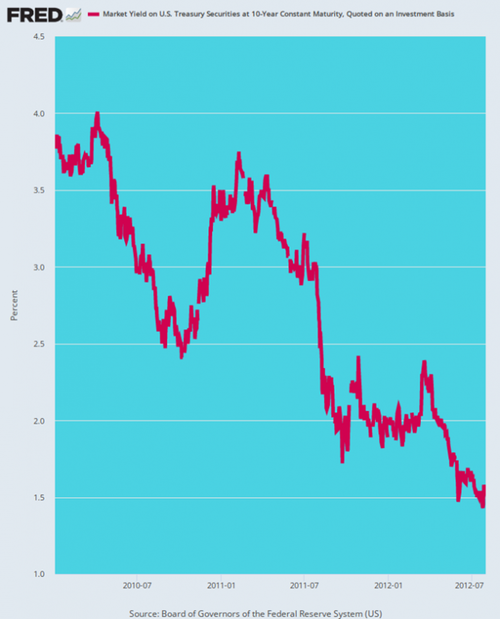

Let’s first reprise the great 2011 debt ceiling showdown. On July 28, just a few days prior to when the Treasury’s borrowing authority would have been exhausted, the yield on the benchmark 10-year UST note stood at 2.98%. And despite months of heated warnings to the freshly elected GOP House majority about its duty to promptly pass a “clean” debt ceiling increase that figure was actually down considerably from the 3.36% yield of early January 2011.

That’s right. As shown below, the whole seven month ordeal on Capitol Hill about the expiring borrowing authority resulted in, well, an irregular but marked decline of the benchmark bond yield.

Yield On 10-Year UST, January 2011 to August 2012

On July 31st the House GOP famously capitulated, agreeing to a big debt ceiling increase in return for what was advertised to be $2.1 trillion of deficit reductions over the next decade. At that point the yield dropped further to 2.58% on August 5th, the day S&P dramatically cut the UST credit rating from AAA to AA+ after the market closed.

The folks at S&P were apparently not amused by the banana republic “brinkmanship” that had prevailed on Capitol Hill for the better part of the year. So they sternly admonished Washington that—

The downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenge,” the company said in a statement.

Did the yield soar the next week in response to America’s loss of its purported pristine credit rating, as had been warned ad nauseam by the Wall Street and Washington powers that be in the run-up to the crisis?

Why, no, it did not. By year-end 2011 the yield had further fallen to 1.89% and, as shown above, by the first anniversary of the downgrade in early August 2012 it had plummeted to just 1.50%.

Moreover, by the latter point the Y/Y inflation rate was running at 2.0% on our trusty 16% trimmed mean CPI. In effect, one-year after all the debt ceiling strum and drang of 2011 the real yield on the benchmark government security was negative 50 basis points. That is to say, the US government lost its pristine credit rating and was rewarded with tens of billions of annual debt service savings!

It might be argued, of course, that the $2.1 trillion deficit reduction plan which accompanied the GOP debt ceiling capitulation was what caused yields to go down, not up. But that doesn’t wash, either.

These deficit reductions were to be achieved by—

-

A defense and nondefense discretionary appropriations freeze that was to save $900 billion over ten years;

-

A further $1.2 trillion of savings from entitlements based on permanent reforms to Social Security, Medicare, Medicaid and Food Stamps etc. via the recommendations of a Joint Select Committee on Deficit Reduction.

As it happened, the latter “study committee” approach to sweeping entitlement reform was not meant to be the usual duck and dodge airball. The debt ceiling deal also established a backup procedure to increase the incentive on the Joint Committee to reach a compromise. This was to occur in the form of automatic cuts called “sequestration” that would trigger if the committee failed to make and implement the $1.2 trillion of additional savings.

Broadly speaking, for 2013 and future years these automatic across-the-board cuts would have meant about an 8.4% reduction in most affected non-defense discretionary programs, a 7.5% cut in affected defense programs, an 8.0% savings in affected mandatory programs other than Medicare, and a 2.0% cut in Medicare provider payments. For 2014 through 2021, the Medicare cut were to remain at 2 percent while the percentage cuts in other programs would gradually shrink.

As it happened, the Select Committee produced a big fat goose egg in terms of actual budget savings. So then, piling gimmick upon gimmick, the above described sequestration process was triggered for FY 2014 to FY 2021.

Alas, on the entitlement side of the budget ledger it is hard so see where the sequester “cuts” drew any fiscal blood. Federal transfer payment spending, in fact, rose from $1.8 trillion in 2011 to $2.9 trillion by FY 2021, representing a gain of 64%.

Federal Transfer Payments, 2011 to 2021

Likewise, in the case of nondefense appropriations the eight-year total of outlays (FY 2014-2021) was to be capped at $4.11 trillion. In fact, outlays for the period totaled $5.49 trillion or 34% more.

Moreover, by the last year of the House GOP plan (2021) the results were nothing short of a joke. The capped annual level of spending was supposed to be $558 billion, but it actually clocked in a $895 billion or 60% more.

Similarly, the eight-year defense cap was supposed to total $4.342 billion, but actually came in at $5.109 trillion or 18% more. Again, the FY 2021 cap was $589 billion under the House GOP plan, but actual outlays came in at $742 billion.

Overall, the Rube Goldberg budget device that then GOP Speaker John Boehner had crafted in return for the debt ceiling increase was supposed to limit appropriated defense and nondefense spending to $8.45 trillion over the next 10-years in the absence of entitlement reforms from the Joint Select Committee. The actual level, as it turned out, was $10.60 trillion. That is to say, these fakers missed their targets by $2.15 trillion over the period!

Moreover, since the Boehner gimmicks left entitlements largely unaddressed, the overall deficit outcome after FY 2011 made a pure mockery of the plan. At the time, CBO estimated that during the 10-year budget window impacted by the Boehner plan (FY 2012 to FY 2021) the cumulative Federal deficit would total $3.49 trillion.

Alas, the actual figure turned out to be 3.3X higher at $11.60 trillion!

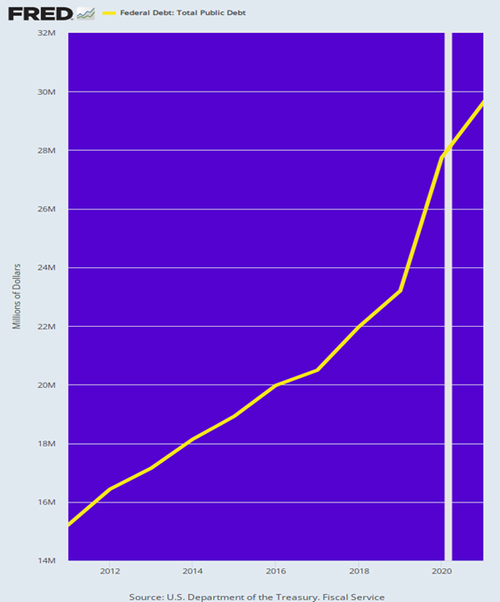

As a result, the public debt actually doubled during the decade after the July 2011 debt ceiling showdown. The $15.2 trillion public debt of 2011 became $29.6 trillion by 2021, and has continued to climb from there into still another so-called debt-ceiling crisis.

Total Public Debt, 2010 to 2021

So here we are again—allegedly three weeks away from Fiscal Armageddon. But what actually lies ahead is not a rendezvous with the ballyhooed “national default” event, but something actually far more important: Namely, the hour when Grandma Yellen must be forced to use the Treasury’s authority to allocate receipts on a priority basis among spending accounts.

For crying out loud. The US Treasury is still being gorged with hard-earned tribute from the taxpayers—so there is more than enough inflow to pay the debt service, as well as other priorities that the Treasury might establish.

During the just completed month of April, for instance, the interest payment was a hefty $62 billion, but that was just 9.5% of the $639 Federal receipt collection for the month. So by every form of math we are aware of, there was not a remote chance of failing to pay Uncle Sam’s interest obligations—even without borrowing another dime.

And, yes, April is a big collection month with April 15 tax payments and all, but even on a average monthly basis for the first six months of FY 2023, there has been plenty of current inflow to cover interest payments and several other priorities that are likely to float to the top of the heap when push-comes-to-shove.

Average Per Month, FY 2023 To Date:

-

Federal receipts: $448 billion;

-

Net interest payments: $61 billion;

-

Social Security Payments: $128 billion;

-

Veterans Services & Compensation: $26 billion;

-

Military Pay and O&M: $47 billion;

-

Food Stamps, Welfare & SSI: $22 billion

-

Total Big Five Spending Accounts: $285 billion;

-

Receipts left for all other spending accounts: $163 billion.

As it happened, during the first six months of this year the average monthly outlay for all spending accounts outside of the Big Five was $318 billion. So in theory, if the debt ceiling stand-off were to go on for a full month, only 51% of pending bills could be paid to defense contractors, medicare providers, state medicaid agencies, Federal civilian bureaucrats and retirees, highway builders, student aid recipients, farm subsidies, public works projects, community development grants, etc.

Then again, it would never come to a whole month. The mere act of shoving what would amount to $318 billion of non-prioritized due bills into a drawer at the US treasury would bring down the wrath of the impacted constituencies on the White House like never before.

In a word, Sleepy Joe would negotiate and negotiate fast and flexibly on real spending cuts, not just the usual budgetary flim-flammery.

Accordingly, the make or break matter which now stands before Speaker McCarthy and the House GOP is to force Grandma Yellen to prioritize spending. Once the Big Lie about debt “default” is broken wide-open in this manner, the fiscal equation would be changed forever.

Instead of the entitlements and the uniparty pork barrel spenders taking the nation’s fiscal accounts hostage, the taxpayers and their representatives would finally have the leverage to stop the fiscal doomsday machine in its tracks.

Stated differently, what is really at stake in the current standoff is the urgent need to refute the endlessly repeated notion that the president must helplessly sit on his hands, making debt payment default unavoidable and instantaneous.

To the contrary, no less a scholar than Harvard Law School’s Laurence Tribe, the dean of liberal constitutional experts, has forthrightly debunked that hoary notion—among many others. Several weeks prior to the great August 2011 debt crisis professor Tribe declared as follows:

All of this brings me to my second point: what is the government to do if, come August 3, it does not have enough money to make all of the expenditures that Congress has required by law? The answer, I think, is that it must prioritize expenditures: some payments simply have to be postponed until the Treasury has enough money to make them.

So what are the House Republicans waiting for?

The nation’s foremost liberal scholar has given them the green light to stand their ground. And in the first instance that means forcing Grandma Yellen to prioritize the incoming revenue to debt service payments and other key items, while leaving the rest of the unpaid bills to pile-up in the great hall of invoices at the US Treasury.

And it is well to remember that when an accrued military contractor bill or Medicaid reimbursement payment to state governments is paid 5,15, 30 or even 60 days late that is not an earth-shattering default; it’s merely a case of “slow pay” by Uncle Sam just like financially pinched private companies do from time to time, and in this case the tardiness would be for good and substantial reasons.

Stated differently, the great army of sucklers on the public teat need to understand that while Uncle Sam will always make his bond payments on time, what amount to his trade “payables” might get stretched occasionally when his checkbook is overdrawn.

Needless to say, prioritizing debt service and the above illustrated set of priorities—or any other plausible set– would be blessed in a heartbeat by the Roberts Court. That is, even if it got litigated, should some lobby group be foolish enough to bring suit against the President’s prioritizing of available receipts.

It’s hard to be more unequivocal than that—a truth that your editor well understands because we confronted exactly that question more than once during Ronald Reagan’s short-lived rebuke to Leviathan. As a later budget director and then Member of Congress, Mick Mulvaney, noted in October 2013 on the occasional of another feigned default:

We’re not going to default; there is no default. There’s an [Office of Management and Budget] directive from the 1980s, the last time we got fairly close to not raising the debt ceiling, that clearly lays out the process by which the Treasury secretary prioritizes interest payments.

Needless to say, the Imperial City fears these three bolded words more than Dracula feared a glittering crucifix. Yet what hangs in the balance is whether even a semblance of fiscal sanity can be recouped based on this primal and only remaining source of budgetary leverage.

This time, however, there may actually be a chance for sanity. That because the Fed is in no position to monetize the debt, as it was in 2011 and thereafter. In the great scheme of history, that was one of the most foolish financial undertakings of the state ever recorded.

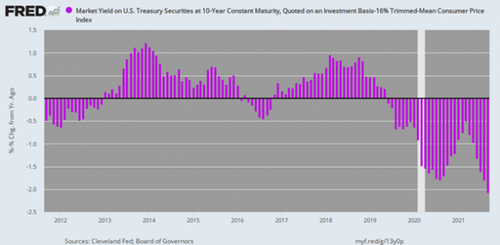

As shown below, it meant that for the 10-years of the 2011 debt ceiling deal, the inflation-adjusted interest rate on the benchmark UST was negative nearly 50% of the time. And when it was positive it registered well below 1.0% in all months except five. Altogether, therefore, the weighted average real interest rate during the period was well below the zero bound.

And it was the resulting massive distortion of the economic signalling system that led to the the Brobdingnagian financial bubbles and debts which now hang over the American economy like the Sword of Damocles.

Inflation-Adjusted Yield On 10-Year UST, September 2011 to September 2021

To repeat, interest rates did not soar when first the Congress dallied by not promptly enacting a “clean” debt ceiling increase in the spring of 2011; and they did not rise, either, when S&P downgraded the nation’s credit in August, nor did they increase thereafter when the big deficit reduction agreement solemnly entered into by the Washington uniparty was torn to shreds and made a mockery of by these same politicians during the following decade.

But that was not because deficits and debts don’t matter. It was because the day of reckoning was postponed by the Fed’s money-printing spree during the period in question.

To wit, at the time of the S&P downgrade the Fed’s balance sheet stood at $2.8 trillion, which had taken 98 years to accumulate from the Fed’s launch in 1914. Ten year latter and deficit reduction agreements notwithstanding, it stood at $8.5 trillion or triple what had previously taken a century to accumulate.

That is, the Fed monetized $5.7 trillion of the public debt during that 10-year period or well more than 40% of the new US Treasury issuance, while a large share of the remaining issuance was taken down by other fellow-traveling central banks.

No more. The Fed has decisively “pivoted” but not in the good way the Wall Street gamblers are pining for. The fact is, even our Keynesian money-printers know they have let the inflation-genie out of the bottle and will have no choice except to keep the printing presses not just on idle, but operating in reverse for a considerable period ahead.

That is, even as the US Treasury contemplates issuing upwards of $2 trillion of new debt per year as far as the eye can see, the Fed will be shrinking its balance sheet via what is its actual anti-inflation program. By that we mean, of course, QT (quantitative tightening) which has the effect of dumping existing Federal debt back into the bond pits at a $1.14 trillion annual rate.

That’s right. The net US Treasury call on funds in the bond pits will run at a $3 trillion+ annual rate for a considerable period of time. And we do mean “considerable” when it comes to the shutdown of the Fed’s printing press.

Here is the latest inflation data based on the 16% trimmed mean CPI. The brown lines represents the Y/Y rate of increase, while the yellow line is the annualized rate for the current month. As is evident from the chart, the brown line is bending lower, albeit at a snail’s pace.

At the peak last June, the Y/Y rate peaked at 7.3%, but as of April 2023 the gain was still 6.1%. More importantly, the average monthly annualized gain (yellow line) since November has posted at 5.0% and was still running above 4.0% in April.

So do we expect the inflation rate to descent rapidly toward the Fed’s dubious 2.00% target during the balance of this year or even 2024—the likely onset of recession notwithstanding?

We do not. The US economy is heading into the worst stagflation—high inflation and weak growth—since the early 1980s. Yet the Fed has backed itself into such a deep corner after years of flooding the system with excess liquidity and cheap central bank credit that it will have no choice except to keep shrinking its balance sheet until it has drained a substantial portion of these excesses from the bond pits.

16% Trimmed Mean CPI, Y/Y Gain Versus Annualized Monthly Gain, May 2020 to April 2023

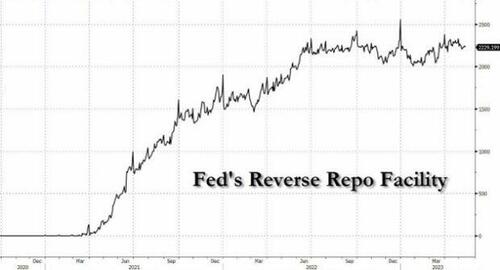

For want of doubt, the chart below needs be gazed upon intently. The Fed’s reverse repo facility now stands at $2.23 trillion, and that, folks, is utterly absurd. It amounts to overnight Fed borrowings at a current rate of 5.05%.

The “bringing-coals-to-Newcastle” metaphor has long been overworked. But pray tell, why in the world does the most prodigious legal printing press on the planet need to borrow $2.23 trillion each and every night at rates better than 5%?

Outstanding Balance On Fed Reverse Repo Facility, December 2020 to May 2023

Actually, there is no mystery as to the above absurdity. Over the last decade or longer the Fed and other central banks have so water-logged the financial markets with excess liquidity that interest rates on the free market would be far lower than the Fed’s current 5.25% target.

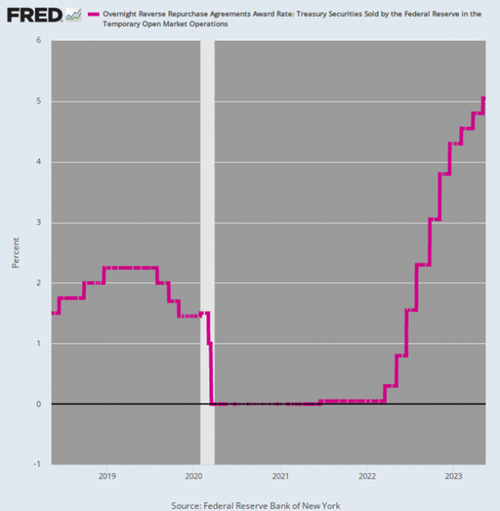

Interest Rate On the Fed’s O/N RRP, 2018 to 2023

So the geniuses in the Eccles Building are borrowing trillions to show that like some monetary King Canute, they can still command the financial waters to rise or fall.

Then again, the stair-step line in the chart below shows how desperate the Fed’s belated battle against inflation actually is. There can be no abatement of inflation until real interest rates in the open market turn decisively positive. Paul Volcker proved that four decades ago when he pushed the real Fed funds rate north of 8.0% before he finally broke the inflationary momentum.

Of course, the rising red line in the chart below is wrecking havoc with the banking sector, especially smaller and mid-sized banks. Owing to the Fed’s generous 5.05% standing offer at the O/N RRP, it is now draining massive amounts of deposits out of the banking system and into money-market funds, which, in turn, are pouring these new deposits back into the RRP!

Perhaps, therefore, geniuses at work in not the most apt metaphor. But it does remind that the destructive Washington chain of spending, borrowing and printing has to finally stop, and soon.

And making Grandma Yellen shatter the “default” myth is the only practical place to start.

* * *

Reprinted with permission from David Stockman’s Contra Corner.

Authored by David Stockman via LewRockwell.com,

Let’s first reprise the great 2011 debt ceiling showdown. On July 28, just a few days prior to when the Treasury’s borrowing authority would have been exhausted, the yield on the benchmark 10-year UST note stood at 2.98%. And despite months of heated warnings to the freshly elected GOP House majority about its duty to promptly pass a “clean” debt ceiling increase that figure was actually down considerably from the 3.36% yield of early January 2011.

That’s right. As shown below, the whole seven month ordeal on Capitol Hill about the expiring borrowing authority resulted in, well, an irregular but marked decline of the benchmark bond yield.

Yield On 10-Year UST, January 2011 to August 2012

On July 31st the House GOP famously capitulated, agreeing to a big debt ceiling increase in return for what was advertised to be $2.1 trillion of deficit reductions over the next decade. At that point the yield dropped further to 2.58% on August 5th, the day S&P dramatically cut the UST credit rating from AAA to AA+ after the market closed.

The folks at S&P were apparently not amused by the banana republic “brinkmanship” that had prevailed on Capitol Hill for the better part of the year. So they sternly admonished Washington that—

The downgrade reflects our view that the effectiveness, stability, and predictability of American policymaking and political institutions have weakened at a time of ongoing fiscal and economic challenge,” the company said in a statement.

Did the yield soar the next week in response to America’s loss of its purported pristine credit rating, as had been warned ad nauseam by the Wall Street and Washington powers that be in the run-up to the crisis?

Why, no, it did not. By year-end 2011 the yield had further fallen to 1.89% and, as shown above, by the first anniversary of the downgrade in early August 2012 it had plummeted to just 1.50%.

Moreover, by the latter point the Y/Y inflation rate was running at 2.0% on our trusty 16% trimmed mean CPI. In effect, one-year after all the debt ceiling strum and drang of 2011 the real yield on the benchmark government security was negative 50 basis points. That is to say, the US government lost its pristine credit rating and was rewarded with tens of billions of annual debt service savings!

It might be argued, of course, that the $2.1 trillion deficit reduction plan which accompanied the GOP debt ceiling capitulation was what caused yields to go down, not up. But that doesn’t wash, either.

These deficit reductions were to be achieved by—

-

A defense and nondefense discretionary appropriations freeze that was to save $900 billion over ten years;

-

A further $1.2 trillion of savings from entitlements based on permanent reforms to Social Security, Medicare, Medicaid and Food Stamps etc. via the recommendations of a Joint Select Committee on Deficit Reduction.

As it happened, the latter “study committee” approach to sweeping entitlement reform was not meant to be the usual duck and dodge airball. The debt ceiling deal also established a backup procedure to increase the incentive on the Joint Committee to reach a compromise. This was to occur in the form of automatic cuts called “sequestration” that would trigger if the committee failed to make and implement the $1.2 trillion of additional savings.

Broadly speaking, for 2013 and future years these automatic across-the-board cuts would have meant about an 8.4% reduction in most affected non-defense discretionary programs, a 7.5% cut in affected defense programs, an 8.0% savings in affected mandatory programs other than Medicare, and a 2.0% cut in Medicare provider payments. For 2014 through 2021, the Medicare cut were to remain at 2 percent while the percentage cuts in other programs would gradually shrink.

As it happened, the Select Committee produced a big fat goose egg in terms of actual budget savings. So then, piling gimmick upon gimmick, the above described sequestration process was triggered for FY 2014 to FY 2021.

Alas, on the entitlement side of the budget ledger it is hard so see where the sequester “cuts” drew any fiscal blood. Federal transfer payment spending, in fact, rose from $1.8 trillion in 2011 to $2.9 trillion by FY 2021, representing a gain of 64%.

Federal Transfer Payments, 2011 to 2021

Likewise, in the case of nondefense appropriations the eight-year total of outlays (FY 2014-2021) was to be capped at $4.11 trillion. In fact, outlays for the period totaled $5.49 trillion or 34% more.

Moreover, by the last year of the House GOP plan (2021) the results were nothing short of a joke. The capped annual level of spending was supposed to be $558 billion, but it actually clocked in a $895 billion or 60% more.

Similarly, the eight-year defense cap was supposed to total $4.342 billion, but actually came in at $5.109 trillion or 18% more. Again, the FY 2021 cap was $589 billion under the House GOP plan, but actual outlays came in at $742 billion.

Overall, the Rube Goldberg budget device that then GOP Speaker John Boehner had crafted in return for the debt ceiling increase was supposed to limit appropriated defense and nondefense spending to $8.45 trillion over the next 10-years in the absence of entitlement reforms from the Joint Select Committee. The actual level, as it turned out, was $10.60 trillion. That is to say, these fakers missed their targets by $2.15 trillion over the period!

Moreover, since the Boehner gimmicks left entitlements largely unaddressed, the overall deficit outcome after FY 2011 made a pure mockery of the plan. At the time, CBO estimated that during the 10-year budget window impacted by the Boehner plan (FY 2012 to FY 2021) the cumulative Federal deficit would total $3.49 trillion.

Alas, the actual figure turned out to be 3.3X higher at $11.60 trillion!

As a result, the public debt actually doubled during the decade after the July 2011 debt ceiling showdown. The $15.2 trillion public debt of 2011 became $29.6 trillion by 2021, and has continued to climb from there into still another so-called debt-ceiling crisis.

Total Public Debt, 2010 to 2021

So here we are again—allegedly three weeks away from Fiscal Armageddon. But what actually lies ahead is not a rendezvous with the ballyhooed “national default” event, but something actually far more important: Namely, the hour when Grandma Yellen must be forced to use the Treasury’s authority to allocate receipts on a priority basis among spending accounts.

For crying out loud. The US Treasury is still being gorged with hard-earned tribute from the taxpayers—so there is more than enough inflow to pay the debt service, as well as other priorities that the Treasury might establish.

During the just completed month of April, for instance, the interest payment was a hefty $62 billion, but that was just 9.5% of the $639 Federal receipt collection for the month. So by every form of math we are aware of, there was not a remote chance of failing to pay Uncle Sam’s interest obligations—even without borrowing another dime.

And, yes, April is a big collection month with April 15 tax payments and all, but even on a average monthly basis for the first six months of FY 2023, there has been plenty of current inflow to cover interest payments and several other priorities that are likely to float to the top of the heap when push-comes-to-shove.

Average Per Month, FY 2023 To Date:

-

Federal receipts: $448 billion;

-

Net interest payments: $61 billion;

-

Social Security Payments: $128 billion;

-

Veterans Services & Compensation: $26 billion;

-

Military Pay and O&M: $47 billion;

-

Food Stamps, Welfare & SSI: $22 billion

-

Total Big Five Spending Accounts: $285 billion;

-

Receipts left for all other spending accounts: $163 billion.

As it happened, during the first six months of this year the average monthly outlay for all spending accounts outside of the Big Five was $318 billion. So in theory, if the debt ceiling stand-off were to go on for a full month, only 51% of pending bills could be paid to defense contractors, medicare providers, state medicaid agencies, Federal civilian bureaucrats and retirees, highway builders, student aid recipients, farm subsidies, public works projects, community development grants, etc.

Then again, it would never come to a whole month. The mere act of shoving what would amount to $318 billion of non-prioritized due bills into a drawer at the US treasury would bring down the wrath of the impacted constituencies on the White House like never before.

In a word, Sleepy Joe would negotiate and negotiate fast and flexibly on real spending cuts, not just the usual budgetary flim-flammery.

Accordingly, the make or break matter which now stands before Speaker McCarthy and the House GOP is to force Grandma Yellen to prioritize spending. Once the Big Lie about debt “default” is broken wide-open in this manner, the fiscal equation would be changed forever.

Instead of the entitlements and the uniparty pork barrel spenders taking the nation’s fiscal accounts hostage, the taxpayers and their representatives would finally have the leverage to stop the fiscal doomsday machine in its tracks.

Stated differently, what is really at stake in the current standoff is the urgent need to refute the endlessly repeated notion that the president must helplessly sit on his hands, making debt payment default unavoidable and instantaneous.

To the contrary, no less a scholar than Harvard Law School’s Laurence Tribe, the dean of liberal constitutional experts, has forthrightly debunked that hoary notion—among many others. Several weeks prior to the great August 2011 debt crisis professor Tribe declared as follows:

All of this brings me to my second point: what is the government to do if, come August 3, it does not have enough money to make all of the expenditures that Congress has required by law? The answer, I think, is that it must prioritize expenditures: some payments simply have to be postponed until the Treasury has enough money to make them.

So what are the House Republicans waiting for?

The nation’s foremost liberal scholar has given them the green light to stand their ground. And in the first instance that means forcing Grandma Yellen to prioritize the incoming revenue to debt service payments and other key items, while leaving the rest of the unpaid bills to pile-up in the great hall of invoices at the US Treasury.

And it is well to remember that when an accrued military contractor bill or Medicaid reimbursement payment to state governments is paid 5,15, 30 or even 60 days late that is not an earth-shattering default; it’s merely a case of “slow pay” by Uncle Sam just like financially pinched private companies do from time to time, and in this case the tardiness would be for good and substantial reasons.

Stated differently, the great army of sucklers on the public teat need to understand that while Uncle Sam will always make his bond payments on time, what amount to his trade “payables” might get stretched occasionally when his checkbook is overdrawn.

Needless to say, prioritizing debt service and the above illustrated set of priorities—or any other plausible set– would be blessed in a heartbeat by the Roberts Court. That is, even if it got litigated, should some lobby group be foolish enough to bring suit against the President’s prioritizing of available receipts.

It’s hard to be more unequivocal than that—a truth that your editor well understands because we confronted exactly that question more than once during Ronald Reagan’s short-lived rebuke to Leviathan. As a later budget director and then Member of Congress, Mick Mulvaney, noted in October 2013 on the occasional of another feigned default:

We’re not going to default; there is no default. There’s an [Office of Management and Budget] directive from the 1980s, the last time we got fairly close to not raising the debt ceiling, that clearly lays out the process by which the Treasury secretary prioritizes interest payments.

Needless to say, the Imperial City fears these three bolded words more than Dracula feared a glittering crucifix. Yet what hangs in the balance is whether even a semblance of fiscal sanity can be recouped based on this primal and only remaining source of budgetary leverage.

This time, however, there may actually be a chance for sanity. That because the Fed is in no position to monetize the debt, as it was in 2011 and thereafter. In the great scheme of history, that was one of the most foolish financial undertakings of the state ever recorded.

As shown below, it meant that for the 10-years of the 2011 debt ceiling deal, the inflation-adjusted interest rate on the benchmark UST was negative nearly 50% of the time. And when it was positive it registered well below 1.0% in all months except five. Altogether, therefore, the weighted average real interest rate during the period was well below the zero bound.

And it was the resulting massive distortion of the economic signalling system that led to the the Brobdingnagian financial bubbles and debts which now hang over the American economy like the Sword of Damocles.

Inflation-Adjusted Yield On 10-Year UST, September 2011 to September 2021

To repeat, interest rates did not soar when first the Congress dallied by not promptly enacting a “clean” debt ceiling increase in the spring of 2011; and they did not rise, either, when S&P downgraded the nation’s credit in August, nor did they increase thereafter when the big deficit reduction agreement solemnly entered into by the Washington uniparty was torn to shreds and made a mockery of by these same politicians during the following decade.

But that was not because deficits and debts don’t matter. It was because the day of reckoning was postponed by the Fed’s money-printing spree during the period in question.

To wit, at the time of the S&P downgrade the Fed’s balance sheet stood at $2.8 trillion, which had taken 98 years to accumulate from the Fed’s launch in 1914. Ten year latter and deficit reduction agreements notwithstanding, it stood at $8.5 trillion or triple what had previously taken a century to accumulate.

That is, the Fed monetized $5.7 trillion of the public debt during that 10-year period or well more than 40% of the new US Treasury issuance, while a large share of the remaining issuance was taken down by other fellow-traveling central banks.

No more. The Fed has decisively “pivoted” but not in the good way the Wall Street gamblers are pining for. The fact is, even our Keynesian money-printers know they have let the inflation-genie out of the bottle and will have no choice except to keep the printing presses not just on idle, but operating in reverse for a considerable period ahead.

That is, even as the US Treasury contemplates issuing upwards of $2 trillion of new debt per year as far as the eye can see, the Fed will be shrinking its balance sheet via what is its actual anti-inflation program. By that we mean, of course, QT (quantitative tightening) which has the effect of dumping existing Federal debt back into the bond pits at a $1.14 trillion annual rate.

That’s right. The net US Treasury call on funds in the bond pits will run at a $3 trillion+ annual rate for a considerable period of time. And we do mean “considerable” when it comes to the shutdown of the Fed’s printing press.

Here is the latest inflation data based on the 16% trimmed mean CPI. The brown lines represents the Y/Y rate of increase, while the yellow line is the annualized rate for the current month. As is evident from the chart, the brown line is bending lower, albeit at a snail’s pace.

At the peak last June, the Y/Y rate peaked at 7.3%, but as of April 2023 the gain was still 6.1%. More importantly, the average monthly annualized gain (yellow line) since November has posted at 5.0% and was still running above 4.0% in April.

So do we expect the inflation rate to descent rapidly toward the Fed’s dubious 2.00% target during the balance of this year or even 2024—the likely onset of recession notwithstanding?

We do not. The US economy is heading into the worst stagflation—high inflation and weak growth—since the early 1980s. Yet the Fed has backed itself into such a deep corner after years of flooding the system with excess liquidity and cheap central bank credit that it will have no choice except to keep shrinking its balance sheet until it has drained a substantial portion of these excesses from the bond pits.

16% Trimmed Mean CPI, Y/Y Gain Versus Annualized Monthly Gain, May 2020 to April 2023

For want of doubt, the chart below needs be gazed upon intently. The Fed’s reverse repo facility now stands at $2.23 trillion, and that, folks, is utterly absurd. It amounts to overnight Fed borrowings at a current rate of 5.05%.

The “bringing-coals-to-Newcastle” metaphor has long been overworked. But pray tell, why in the world does the most prodigious legal printing press on the planet need to borrow $2.23 trillion each and every night at rates better than 5%?

Outstanding Balance On Fed Reverse Repo Facility, December 2020 to May 2023

Actually, there is no mystery as to the above absurdity. Over the last decade or longer the Fed and other central banks have so water-logged the financial markets with excess liquidity that interest rates on the free market would be far lower than the Fed’s current 5.25% target.

Interest Rate On the Fed’s O/N RRP, 2018 to 2023

So the geniuses in the Eccles Building are borrowing trillions to show that like some monetary King Canute, they can still command the financial waters to rise or fall.

Then again, the stair-step line in the chart below shows how desperate the Fed’s belated battle against inflation actually is. There can be no abatement of inflation until real interest rates in the open market turn decisively positive. Paul Volcker proved that four decades ago when he pushed the real Fed funds rate north of 8.0% before he finally broke the inflationary momentum.

Of course, the rising red line in the chart below is wrecking havoc with the banking sector, especially smaller and mid-sized banks. Owing to the Fed’s generous 5.05% standing offer at the O/N RRP, it is now draining massive amounts of deposits out of the banking system and into money-market funds, which, in turn, are pouring these new deposits back into the RRP!

Perhaps, therefore, geniuses at work in not the most apt metaphor. But it does remind that the destructive Washington chain of spending, borrowing and printing has to finally stop, and soon.

And making Grandma Yellen shatter the “default” myth is the only practical place to start.

* * *

Reprinted with permission from David Stockman’s Contra Corner.

Loading…