Target was trounced on its inventory "glut" debacle as the bullwhip effect is in full effect... but dip-buyers stepped in (or share-buyback-ers) and put some lipstick on that pig (a pig that is the canary in the coalmine - to mix metaphors - for the rest of the US economy, over-stuffed and under-consumed)

0930ET - the US equity market cash open - was once again an incredibly bullish event as the slow drip of overnight weakness was immediately flipped into a buying-panic that paused briefly around the European close and then re-acclerated to drag the S&P and Nasdaq up 1%, Small Caps +1.5%...

Today's ramp dragged the S&P and Dow back to unchanged from the pre-payrolls level right before Friday's plunge

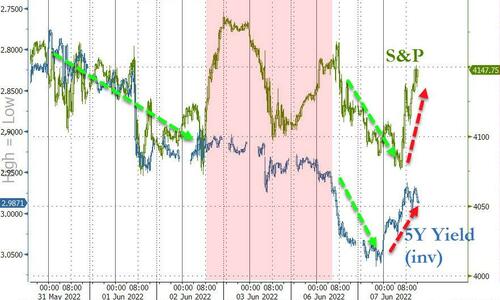

The correlation regime between stocks and bonds has flipped once again with bond and stock prices rising together today as the impact of rate-locks (due to a heavy IG calendar) are shrugged off)...

Source: Bloomberg

Treasuries were bid across the curve today (except the short-end), erasing much of yesterday's rate-lock surge in yields (2Y +1.5bps, 30Y -7bps)...

Source: Bloomberg

10Y rallied back below 3.00% today, finding support (in yields) at th epeak of the post-payrolls spike from Friday...

Source: Bloomberg

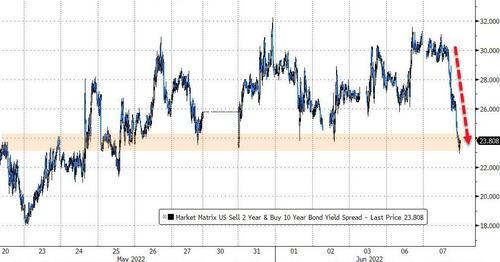

Today's moves in bond-land flattened the yield curve dramatically...

Source: Bloomberg

Rate-hike expectations were very modestly lower today

Source: Bloomberg

The dollar reversed overnight gains as the US equity market opened and ended the day lower against its fiat peers...

Source: Bloomberg

It's been a wild ride from crypto this week. Bitcoin ended the day only modestly lower but managed to scramble back from its death-free-fall overnight in Asia trading, back up near $31,500...

Source: Bloomberg

Gold rallied back above $1850 today...

Oil prices surged again with WTI topping $120 ahead of tonight's API inventory data...

Are we near the end of this epic rally? With a blow-off-top sparking real demand destruction next?

CHART OF THE DAY: Play long enough with a left-and-right y-axis double scale, and one can fit two charts and show a strong correlation. In this case, however, there's a single scale (right), and the correlation is scary: Brent market in 2007-to-2009, and in 2021-to-date | #OOTT pic.twitter.com/IgjEe3Exy8

— Javier Blas (@JavierBlas) June 7, 2022

Finally, today was a great day for buying stocks - The World Bank downgraded global economic growth and warned of staglfationary pressures building.. (ya think!)...

Source: Bloomberg

And The Atlanta Fed downgraded US economic growth to 0.9% and stagflationary threats are screaming...

Source: Bloomberg

As US financial conditions have eased in the last two weeks, we wonder - like Nomura's Charlie McElligott - if The Fed will once again jawbone the aggressive inflation-fighting hawkishness and tighten conditions once again...

Get back to work Mr.Powell (though we are not exactly sure wtf you're gonna do now!)

Target was trounced on its inventory “glut” debacle as the bullwhip effect is in full effect… but dip-buyers stepped in (or share-buyback-ers) and put some lipstick on that pig (a pig that is the canary in the coalmine – to mix metaphors – for the rest of the US economy, over-stuffed and under-consumed)

0930ET – the US equity market cash open – was once again an incredibly bullish event as the slow drip of overnight weakness was immediately flipped into a buying-panic that paused briefly around the European close and then re-acclerated to drag the S&P and Nasdaq up 1%, Small Caps +1.5%…

Today’s ramp dragged the S&P and Dow back to unchanged from the pre-payrolls level right before Friday’s plunge

The correlation regime between stocks and bonds has flipped once again with bond and stock prices rising together today as the impact of rate-locks (due to a heavy IG calendar) are shrugged off)…

Source: Bloomberg

Treasuries were bid across the curve today (except the short-end), erasing much of yesterday’s rate-lock surge in yields (2Y +1.5bps, 30Y -7bps)…

Source: Bloomberg

10Y rallied back below 3.00% today, finding support (in yields) at th epeak of the post-payrolls spike from Friday…

Source: Bloomberg

Today’s moves in bond-land flattened the yield curve dramatically…

Source: Bloomberg

Rate-hike expectations were very modestly lower today

Source: Bloomberg

The dollar reversed overnight gains as the US equity market opened and ended the day lower against its fiat peers…

Source: Bloomberg

It’s been a wild ride from crypto this week. Bitcoin ended the day only modestly lower but managed to scramble back from its death-free-fall overnight in Asia trading, back up near $31,500…

Source: Bloomberg

Gold rallied back above $1850 today…

Oil prices surged again with WTI topping $120 ahead of tonight’s API inventory data…

Are we near the end of this epic rally? With a blow-off-top sparking real demand destruction next?

CHART OF THE DAY: Play long enough with a left-and-right y-axis double scale, and one can fit two charts and show a strong correlation. In this case, however, there’s a single scale (right), and the correlation is scary: Brent market in 2007-to-2009, and in 2021-to-date | #OOTT pic.twitter.com/IgjEe3Exy8

— Javier Blas (@JavierBlas) June 7, 2022

Finally, today was a great day for buying stocks – The World Bank downgraded global economic growth and warned of staglfationary pressures building.. (ya think!)…

Source: Bloomberg

And The Atlanta Fed downgraded US economic growth to 0.9% and stagflationary threats are screaming…

Source: Bloomberg

As US financial conditions have eased in the last two weeks, we wonder – like Nomura’s Charlie McElligott – if The Fed will once again jawbone the aggressive inflation-fighting hawkishness and tighten conditions once again…

Get back to work Mr.Powell (though we are not exactly sure wtf you’re gonna do now!)