Via The Consciousness of Sheep blog,

Let’s talk about “value.” Value, at its simplest, is merely the consequences of acting upon the world in a manner which “improves” (some might say despoils) some part of it. If, for example, someone takes a pile of timber, a saw and some glue and nails, and then turns it into a table, they have added value. The same is true of goods and services across the economy. Wherever people act to improve the goods and services that we collectively consume, value is added… governments even attempt to tax that additional value via, well, Value Added Tax.

Value also has a clear relationship to another key factor in the way an economy works – productivity. We have all been brought up to understand that the simplest way of growing an economy is to improve productivity. In effect, to do more for less, or to put it another way, to make the addition of value more efficient.

In the coming months, as the western economies crater as a consequence of the follies of their elites, we are going to hear a great many siren voices urging us to improve our collective productivity in order to pull our stagnating economies out of the doldrums and to put an end to the cost-of-living crisis. And yet, among the biggest mistakes made by almost all of us is the false attribution of value and productivity.

For many on the political left, and at least some on the right, labour is the source of value – a view which can be traced back to classical liberal economists such as Adam Smith and David Ricardo. In classic Marxist thinking, capitalism uses the payment of wages for workers’ time as a means of converting the surplus value they create into profit. Politics in a capitalist economy then becomes an ongoing struggle over the respective shares of surplus value divided into the wages of workers and the profits of capitalists. According to Ricardo:

“The value of a commodity, or the quantity of any other commodity for which it will exchange, depends on the relative quantity of labour which is necessary for its production…”

Smith qualified this by arguing it was labour time rather than quantity which mattered:

“If among a nation of hunters, for example, it usually costs twice the labour to kill a beaver which it does to kill a deer, one beaver should naturally exchange for, or be worth two deer. It is natural that what is usually the produce of two days’ or two hours’ labour, should be worth double of what is usually the produce of one day’s or one hour’s labour.”

This line of thinking was flawed, since it allowed that the product of a bad or slow worker would have more value than the product of a good and fast worker. Marx was to tidy the thinking up by insisting that it was “socially necessary labour time” which mattered. The value of our wooden table was not the time our worker took to construct it, but rather the average time that a skilled carpenter would take to construct a wooden table. The other useful line of thought offered by Marx was that there is a difference between exchange and use value. This, for example, helps us understand why a Chippendale table might sell for a much higher amount than a plain utilitarian table. In monetary terms, the value of an item is merely whatever someone is prepared to pay for it. Nevertheless, there was something about socially necessary labour time which set a minimum value below which an item is neither worth selling nor even constructing.

Labour, in its naked form, however, is an incredibly weak source of value. And as Marx began to see later in his life – when Britain’s industrialisation had matured significantly – industrial machinery clearly added far more value than labour alone. (Although Marx refused to take this observation to its logical conclusion since it contradicted his class-based politics). In any case, Marx was wrong. It was not the machines themselves which were the source of value, but the coal-power which drove them. Nobel Prize-winning chemist and contrarian economist Frederick Soddy arrived at the real source of value in the early 1930s:

“Still one point seemed lacking to account for the phenomenal outburst of activity that followed in the Western world the invention of the steam engine, for it could not be ascribed simply to the substitution of inanimate energy for animal labour. The ancients used the wind in navigation and drew upon water-power in rudimentary ways. The profound change that then occurred seemed to be rather due to the fact that, for the first time in history, men began to tap a large capital store of energy and ceased to be entirely dependent on the revenue of sunshine. All the requirements of pre-scientific men were met out of the solar energy of their own times. The food they ate, the clothes they wore, and the wood they burnt could be envisaged, as regards the energy content which gives them use-value, as stores of sunlight. But in burning coal one releases a store of sunshine that reached the earth millions of years ago. In so far as it can be used for the purposes of life, the scale of living may be, to almost any necessary extent, augmented, devotion to the primitive ideas of the peoples of Kirkcaldy [i.e., Adam Smith and his followers] and Judea notwithstanding [i.e., economics is more religion than science].

“Then came the odd thought about fuel considered as a capital store, out of the consumption of which our whole civilisation, in so far as it is modern, has been built. You cannot burn it and still have it, and once burnt there is no way, thermodynamically, of extracting perennial interest from it. Such mysteries are among the inexorable laws of economics rather than of physics. With the doctrine of evolution, the real Adam turns out to have been an animal, and with the doctrine of energy the real capitalist proves to be a plant. The flamboyant era through which we have been passing is due not to our own merits, but to our having inherited accumulations of solar energy from the carboniferous era, so that life for once has been able to live beyond its income. Had it but known it, it might have been a merrier age!”

Insofar as the physiocrats, living during the heyday of pre-industrial landed estates, saw the land as the source of value it is because of the way the plants which grow on the land are able to photosynthesize solar energy and convert it into hydrocarbons which can feed humans directly or feed the animals which humans consume for fat and protein. In the same way, it was not so much the industrial machinery – still less the mass army of industrial workers – which provided the eighteenth and nineteenth century economy with massive quantities of surplus value so much as the fossilised solar energy locked up in the form of the coal which provided the energy behind the industrial economy.

Soddy also pointed to what was then the future predicament of fossil fuel depletion. Not only did we burn our way through the once-and-done “capital store” of accessible coal, but from the early twentieth century we set about the rapid depletion of oil and gas too. It is the surplus useful energy (sometimes referred to as exergy) – the amount left over after we have obtained the energy to begin with – which is the source of the surplus value generated in the industrial economy. And the huge quantities involved explain why a large part of the population of western states have enjoyed a standard of living which would be the envy of kings, and, indeed, why we are ruled over by a handful of godzillionaires whose wealth is so vast as to make the Gods of Olympus jealous… which is something of a problem because the world recently passed peak exergy.

That is, while there may be roughly as much fossil fuel in the ground as we have consumed in the course of three centuries of industrialisation, we also burned our way through the cheap and easy deposits first. Consider this an issue of “socially necessary exergy” – nobody was going to buy or even extract oil from deep beneath the North Sea or from hydraulically fractured shale deposits while it was still possible to obtain all the oil you needed by knocking a pipe into the ground. We will, of course, continue to extract ever more difficult and expensive fossil fuels, but their extraction will remorselessly consume an ever-greater part of the exergy previously available to the wider economy. Which, in turn, means that the wider economy is going to shrink… and we have no economic theory to explain how we are going to handle this.

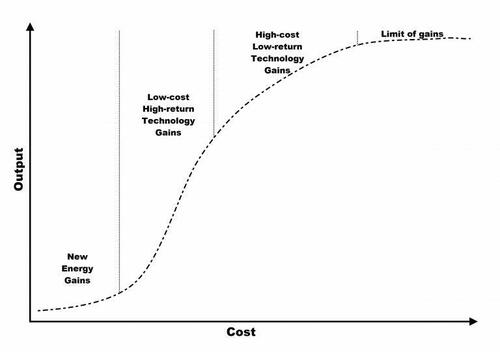

What of productivity? Surely – and visibly – technology adds value. After all, we now have automated production processes which can manufacture goods with barely a human finger laid upon them. But as with labour back in Adam Smith’s day, what the technology is achieving is the efficient conversion of exergy into value. And while this can have massive results – there is a big difference, for example, between Trevithick’s 1804 steam locomotive trundling down the Taff valley at walking pace (and later having to be towed back up by horses) and Gresley’s Mallard achieving the world record for a steam locomotive of 126 mph in 1938 – there are both physical (thermodynamic) and economic limits to what can be achieved. As with fossil fuels themselves, technological improvement – aka productivity gains, i.e., optimising the conversion of exergy into value – is cheap and easy to begin with but hard and expensive later on:

There is a reason why Mallard still holds the speed record for a steam locomotive, and it is the same reason why nobody has replaced Concorde in providing supersonic commercial flight – it costs too much! Indeed, Mallard and Concorde both turned out to be state-subsidised luxury passenger transport for the wealthy. And in both cases, electorates – most of whom could not afford the ticket price – eventually refused to vote for any more corporate welfare.

Although we like to pretend that the technology which surrounds us is novel and world-changing, as physicist Tom Murphy has shown, much of it would be recognisable to someone in the USA of the 1950s:

“Look around your environment and imagine your life as seen through the eyes of a mid-century dweller. What’s new? Most things our eyes land on will be pretty well understood. The big differences are cell phones (which they will understand to be a sort of telephone, albeit with no cord and capable of sending telegram-like communications, but still figuring that it works via radio waves rather than magic), computers (which they will see as interactive televisions), and GPS navigation (okay: that one’s thought to be magic even by today’s folk). They will no doubt be impressed with miniaturization as an evolutionary spectacle, but will tend to have a context for the functional capabilities of our gizmos.

“Telling ourselves that the pace of technological transformation is ever-increasing is just a fun story we like to believe is true. For many of us, I suspect, our whole world order is built on this premise.”

The point is that most of these technologies have already reaped the cheap and easy, and, indeed, almost all of the hard and expensive improvements that are ever going to be made. In this respect, we are entering a period similar to the early twentieth century when we hit the limits to coal-powered technologies. The big difference today being that there is no even more energy-dense and easily available new energy source available to us to usher in a new suite of technologies in the way that oil-based technologies rapidly replaced coal in the years after World War Two.

From this viewpoint, the smart thing to do today would be to simplify our way of life – and write-off a large part of the monetary claims on future exergy growth which will not be arriving – in order to bring our economies into line with the declining surplus energy available to us. The paradox though, is that – even at today’s higher prices – energy does not appear to be the biggest problem before us. For all of the complaints about the rapid and steep rise in fuel and electricity prices, they remain low in comparison to the benefits that we derive from them.

In the monetary economy, on the other hand, it is the cost of labour which looks like our biggest headache. In almost every business, the wage bill is far and away the biggest cost. And with the price of energy rising as a direct consequence of depleting exergy (and with few more productivity gains to be won) the greatest fear on the part of central bankers and policy-makers is that wage demands will begin to exceed price increases – a process compounded by labour shortages caused by two years of lockdown policies.

Labour shortages in Britain in the aftermath of the Napoleonic Wars, were an essential part of why we had an industrial revolution to begin with. The use of machinery to harness water and steam power rapidly out-produced craft workers, soon enough turning skilled artisans into mere machine-minders. And with labour shortages appearing again, the complexity trap is that corporations turn to technological automation to fill the gap. From supermarkets installing ever more self-service tills and automated farming to the end of High Street banking and the move to digital currencies, the trend toward technological fixes for our growing predicament is irresistible. But without the exergy to make it all work, something – very likely something big – is going to break.

The counter trend to technological automation can already be seen in less profitable sectors of the economy, where cheap labour has been used to replace increasingly unaffordable technologies such as the once ubiquitous automated car wash. Add these to a growing list of things that ordinary people used to be able to afford but no longer can. As the cost of necessities like food and temperature control continue to increase, the list will grow. And this will cause huge problems for the corporations which are pursuing the automation route… and, indeed, those of us who rely upon them as the customer base shrinks.

This loss of critical mass is one jaw of the complexity trap. Much of the automation that corporations are pursuing is only cheaper if a mass of the population uses it. As Netflix and Facebook have discovered recently, things go badly awry when people begin to unsubscribe. The same is true for the energy companies themselves since they rely on our collective willingness to continue using electricity and gas even as the price spirals upward. The problem, of course, is that we are not prepared to do this. Instead, we seek ways of cutting our use, with those at the bottom disconnecting themselves entirely. So much so that even that bastion of neoliberal austerity, the IMF, is now calling on states to subsidise energy and food… Not, as establishment media outlets may pretend, out of some sudden desire to alleviate the plight of the poor, but because when we stop buying, their system gets flushed around the U-bend.

Declining surplus energy is the other jaw of the trap. The immanent, and partially self-inflicted, loss of firm – 24/7/365 – electricity, along with periodic shortages of diesel, gas and food, are going to render hi-tech automated processes unworkable in practice. Your driverless tractor may plough the straightest furrows possible. But without diesel to fill the tank, it is no more than an expensive art installation. Digital currency is of little use when the servers are down and/or when the users have no electricity with which to transact. Try shopping during a power cut – something that is happening more often in the UK these days. You might want to pay, and the supermarket would be delighted to take your money. But if the tills aren’t working, it can’t be done… not even if you still use notes and coins, because without electricity, the system can’t process them. Oh, and as an aside, when the power goes off, the supermarket is legally bound to dump its frozen and chilled foods… even during a food shortage.

Several decades ago, sociologist Joseph Tainter observed that collapsing civilisations have a habit of unconsciously entering into complexity traps, adding energy-intensive complexity in a desperate attempt to sustain themselves. Our turn to energy-intensive automation in an attempt to overcome our growing woes and to maintain economic growth is likely repeating the same folly. The difference – at least for those who see the economy as primarily an energy rather than a monetary system – is that we have the necessary knowledge to avoid our complexity trap if only we are prepared to actively simplify away from an economy based on mass consumption in favour of one based around material simplicity… I’m not holding my breath though.

* * *

As you made it to the end…you might consider supporting The Consciousness of Sheep. There are five ways in which you could help me continue my work. First – and easiest by far – please share and like this article on social media. Second follow my page on Facebook. Third, sign up for my monthly e-mail digest to ensure you do not miss my posts, and to stay up to date with news about Energy, Environment and Economy more broadly. Fourth, if you enjoy reading my work and feel able, please leave a tip. Fifth, buy one or more of my publications

Via The Consciousness of Sheep blog,

Let’s talk about “value.” Value, at its simplest, is merely the consequences of acting upon the world in a manner which “improves” (some might say despoils) some part of it. If, for example, someone takes a pile of timber, a saw and some glue and nails, and then turns it into a table, they have added value. The same is true of goods and services across the economy. Wherever people act to improve the goods and services that we collectively consume, value is added… governments even attempt to tax that additional value via, well, Value Added Tax.

Value also has a clear relationship to another key factor in the way an economy works – productivity. We have all been brought up to understand that the simplest way of growing an economy is to improve productivity. In effect, to do more for less, or to put it another way, to make the addition of value more efficient.

In the coming months, as the western economies crater as a consequence of the follies of their elites, we are going to hear a great many siren voices urging us to improve our collective productivity in order to pull our stagnating economies out of the doldrums and to put an end to the cost-of-living crisis. And yet, among the biggest mistakes made by almost all of us is the false attribution of value and productivity.

For many on the political left, and at least some on the right, labour is the source of value – a view which can be traced back to classical liberal economists such as Adam Smith and David Ricardo. In classic Marxist thinking, capitalism uses the payment of wages for workers’ time as a means of converting the surplus value they create into profit. Politics in a capitalist economy then becomes an ongoing struggle over the respective shares of surplus value divided into the wages of workers and the profits of capitalists. According to Ricardo:

“The value of a commodity, or the quantity of any other commodity for which it will exchange, depends on the relative quantity of labour which is necessary for its production…”

Smith qualified this by arguing it was labour time rather than quantity which mattered:

“If among a nation of hunters, for example, it usually costs twice the labour to kill a beaver which it does to kill a deer, one beaver should naturally exchange for, or be worth two deer. It is natural that what is usually the produce of two days’ or two hours’ labour, should be worth double of what is usually the produce of one day’s or one hour’s labour.”

This line of thinking was flawed, since it allowed that the product of a bad or slow worker would have more value than the product of a good and fast worker. Marx was to tidy the thinking up by insisting that it was “socially necessary labour time” which mattered. The value of our wooden table was not the time our worker took to construct it, but rather the average time that a skilled carpenter would take to construct a wooden table. The other useful line of thought offered by Marx was that there is a difference between exchange and use value. This, for example, helps us understand why a Chippendale table might sell for a much higher amount than a plain utilitarian table. In monetary terms, the value of an item is merely whatever someone is prepared to pay for it. Nevertheless, there was something about socially necessary labour time which set a minimum value below which an item is neither worth selling nor even constructing.

Labour, in its naked form, however, is an incredibly weak source of value. And as Marx began to see later in his life – when Britain’s industrialisation had matured significantly – industrial machinery clearly added far more value than labour alone. (Although Marx refused to take this observation to its logical conclusion since it contradicted his class-based politics). In any case, Marx was wrong. It was not the machines themselves which were the source of value, but the coal-power which drove them. Nobel Prize-winning chemist and contrarian economist Frederick Soddy arrived at the real source of value in the early 1930s:

“Still one point seemed lacking to account for the phenomenal outburst of activity that followed in the Western world the invention of the steam engine, for it could not be ascribed simply to the substitution of inanimate energy for animal labour. The ancients used the wind in navigation and drew upon water-power in rudimentary ways. The profound change that then occurred seemed to be rather due to the fact that, for the first time in history, men began to tap a large capital store of energy and ceased to be entirely dependent on the revenue of sunshine. All the requirements of pre-scientific men were met out of the solar energy of their own times. The food they ate, the clothes they wore, and the wood they burnt could be envisaged, as regards the energy content which gives them use-value, as stores of sunlight. But in burning coal one releases a store of sunshine that reached the earth millions of years ago. In so far as it can be used for the purposes of life, the scale of living may be, to almost any necessary extent, augmented, devotion to the primitive ideas of the peoples of Kirkcaldy [i.e., Adam Smith and his followers] and Judea notwithstanding [i.e., economics is more religion than science].

“Then came the odd thought about fuel considered as a capital store, out of the consumption of which our whole civilisation, in so far as it is modern, has been built. You cannot burn it and still have it, and once burnt there is no way, thermodynamically, of extracting perennial interest from it. Such mysteries are among the inexorable laws of economics rather than of physics. With the doctrine of evolution, the real Adam turns out to have been an animal, and with the doctrine of energy the real capitalist proves to be a plant. The flamboyant era through which we have been passing is due not to our own merits, but to our having inherited accumulations of solar energy from the carboniferous era, so that life for once has been able to live beyond its income. Had it but known it, it might have been a merrier age!”

Insofar as the physiocrats, living during the heyday of pre-industrial landed estates, saw the land as the source of value it is because of the way the plants which grow on the land are able to photosynthesize solar energy and convert it into hydrocarbons which can feed humans directly or feed the animals which humans consume for fat and protein. In the same way, it was not so much the industrial machinery – still less the mass army of industrial workers – which provided the eighteenth and nineteenth century economy with massive quantities of surplus value so much as the fossilised solar energy locked up in the form of the coal which provided the energy behind the industrial economy.

Soddy also pointed to what was then the future predicament of fossil fuel depletion. Not only did we burn our way through the once-and-done “capital store” of accessible coal, but from the early twentieth century we set about the rapid depletion of oil and gas too. It is the surplus useful energy (sometimes referred to as exergy) – the amount left over after we have obtained the energy to begin with – which is the source of the surplus value generated in the industrial economy. And the huge quantities involved explain why a large part of the population of western states have enjoyed a standard of living which would be the envy of kings, and, indeed, why we are ruled over by a handful of godzillionaires whose wealth is so vast as to make the Gods of Olympus jealous… which is something of a problem because the world recently passed peak exergy.

That is, while there may be roughly as much fossil fuel in the ground as we have consumed in the course of three centuries of industrialisation, we also burned our way through the cheap and easy deposits first. Consider this an issue of “socially necessary exergy” – nobody was going to buy or even extract oil from deep beneath the North Sea or from hydraulically fractured shale deposits while it was still possible to obtain all the oil you needed by knocking a pipe into the ground. We will, of course, continue to extract ever more difficult and expensive fossil fuels, but their extraction will remorselessly consume an ever-greater part of the exergy previously available to the wider economy. Which, in turn, means that the wider economy is going to shrink… and we have no economic theory to explain how we are going to handle this.

What of productivity? Surely – and visibly – technology adds value. After all, we now have automated production processes which can manufacture goods with barely a human finger laid upon them. But as with labour back in Adam Smith’s day, what the technology is achieving is the efficient conversion of exergy into value. And while this can have massive results – there is a big difference, for example, between Trevithick’s 1804 steam locomotive trundling down the Taff valley at walking pace (and later having to be towed back up by horses) and Gresley’s Mallard achieving the world record for a steam locomotive of 126 mph in 1938 – there are both physical (thermodynamic) and economic limits to what can be achieved. As with fossil fuels themselves, technological improvement – aka productivity gains, i.e., optimising the conversion of exergy into value – is cheap and easy to begin with but hard and expensive later on:

There is a reason why Mallard still holds the speed record for a steam locomotive, and it is the same reason why nobody has replaced Concorde in providing supersonic commercial flight – it costs too much! Indeed, Mallard and Concorde both turned out to be state-subsidised luxury passenger transport for the wealthy. And in both cases, electorates – most of whom could not afford the ticket price – eventually refused to vote for any more corporate welfare.

Although we like to pretend that the technology which surrounds us is novel and world-changing, as physicist Tom Murphy has shown, much of it would be recognisable to someone in the USA of the 1950s:

“Look around your environment and imagine your life as seen through the eyes of a mid-century dweller. What’s new? Most things our eyes land on will be pretty well understood. The big differences are cell phones (which they will understand to be a sort of telephone, albeit with no cord and capable of sending telegram-like communications, but still figuring that it works via radio waves rather than magic), computers (which they will see as interactive televisions), and GPS navigation (okay: that one’s thought to be magic even by today’s folk). They will no doubt be impressed with miniaturization as an evolutionary spectacle, but will tend to have a context for the functional capabilities of our gizmos.

“Telling ourselves that the pace of technological transformation is ever-increasing is just a fun story we like to believe is true. For many of us, I suspect, our whole world order is built on this premise.”

The point is that most of these technologies have already reaped the cheap and easy, and, indeed, almost all of the hard and expensive improvements that are ever going to be made. In this respect, we are entering a period similar to the early twentieth century when we hit the limits to coal-powered technologies. The big difference today being that there is no even more energy-dense and easily available new energy source available to us to usher in a new suite of technologies in the way that oil-based technologies rapidly replaced coal in the years after World War Two.

From this viewpoint, the smart thing to do today would be to simplify our way of life – and write-off a large part of the monetary claims on future exergy growth which will not be arriving – in order to bring our economies into line with the declining surplus energy available to us. The paradox though, is that – even at today’s higher prices – energy does not appear to be the biggest problem before us. For all of the complaints about the rapid and steep rise in fuel and electricity prices, they remain low in comparison to the benefits that we derive from them.

In the monetary economy, on the other hand, it is the cost of labour which looks like our biggest headache. In almost every business, the wage bill is far and away the biggest cost. And with the price of energy rising as a direct consequence of depleting exergy (and with few more productivity gains to be won) the greatest fear on the part of central bankers and policy-makers is that wage demands will begin to exceed price increases – a process compounded by labour shortages caused by two years of lockdown policies.

Labour shortages in Britain in the aftermath of the Napoleonic Wars, were an essential part of why we had an industrial revolution to begin with. The use of machinery to harness water and steam power rapidly out-produced craft workers, soon enough turning skilled artisans into mere machine-minders. And with labour shortages appearing again, the complexity trap is that corporations turn to technological automation to fill the gap. From supermarkets installing ever more self-service tills and automated farming to the end of High Street banking and the move to digital currencies, the trend toward technological fixes for our growing predicament is irresistible. But without the exergy to make it all work, something – very likely something big – is going to break.

The counter trend to technological automation can already be seen in less profitable sectors of the economy, where cheap labour has been used to replace increasingly unaffordable technologies such as the once ubiquitous automated car wash. Add these to a growing list of things that ordinary people used to be able to afford but no longer can. As the cost of necessities like food and temperature control continue to increase, the list will grow. And this will cause huge problems for the corporations which are pursuing the automation route… and, indeed, those of us who rely upon them as the customer base shrinks.

This loss of critical mass is one jaw of the complexity trap. Much of the automation that corporations are pursuing is only cheaper if a mass of the population uses it. As Netflix and Facebook have discovered recently, things go badly awry when people begin to unsubscribe. The same is true for the energy companies themselves since they rely on our collective willingness to continue using electricity and gas even as the price spirals upward. The problem, of course, is that we are not prepared to do this. Instead, we seek ways of cutting our use, with those at the bottom disconnecting themselves entirely. So much so that even that bastion of neoliberal austerity, the IMF, is now calling on states to subsidise energy and food… Not, as establishment media outlets may pretend, out of some sudden desire to alleviate the plight of the poor, but because when we stop buying, their system gets flushed around the U-bend.

Declining surplus energy is the other jaw of the trap. The immanent, and partially self-inflicted, loss of firm – 24/7/365 – electricity, along with periodic shortages of diesel, gas and food, are going to render hi-tech automated processes unworkable in practice. Your driverless tractor may plough the straightest furrows possible. But without diesel to fill the tank, it is no more than an expensive art installation. Digital currency is of little use when the servers are down and/or when the users have no electricity with which to transact. Try shopping during a power cut – something that is happening more often in the UK these days. You might want to pay, and the supermarket would be delighted to take your money. But if the tills aren’t working, it can’t be done… not even if you still use notes and coins, because without electricity, the system can’t process them. Oh, and as an aside, when the power goes off, the supermarket is legally bound to dump its frozen and chilled foods… even during a food shortage.

Several decades ago, sociologist Joseph Tainter observed that collapsing civilisations have a habit of unconsciously entering into complexity traps, adding energy-intensive complexity in a desperate attempt to sustain themselves. Our turn to energy-intensive automation in an attempt to overcome our growing woes and to maintain economic growth is likely repeating the same folly. The difference – at least for those who see the economy as primarily an energy rather than a monetary system – is that we have the necessary knowledge to avoid our complexity trap if only we are prepared to actively simplify away from an economy based on mass consumption in favour of one based around material simplicity… I’m not holding my breath though.

* * *

As you made it to the end…you might consider supporting The Consciousness of Sheep. There are five ways in which you could help me continue my work. First – and easiest by far – please share and like this article on social media. Second follow my page on Facebook. Third, sign up for my monthly e-mail digest to ensure you do not miss my posts, and to stay up to date with news about Energy, Environment and Economy more broadly. Fourth, if you enjoy reading my work and feel able, please leave a tip. Fifth, buy one or more of my publications